What is Form 5695 residential energy credit?

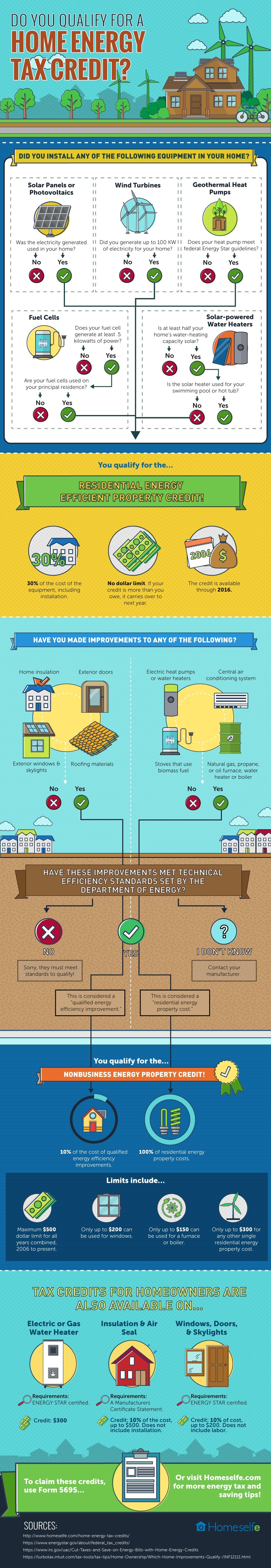

The residential energy-efficient property credit, best known as the residential energy credit and most commonly claimed by homeowners, is claimed in Part I of Form 5695. The nonbusiness energy property credit is claimed in Part II. The residential energy credit is based on a percentage of the cost paid for eligible energy-saving home improvements.

Can I carry forward residential energy credit?

With the Residential Energy Efficient Property Credit, taxpayers can carry forward the unused portion of the credit from the current year’s tax return to the next year’s tax return. For the Non-Business Energy Property Credit, the carryforward period is 20 years. Bottom line

What is residential energy credit limit?

There is no income limit for the Residential Energy Credit. The maximum credit for an eligible HVAC system is $300 if installed on your main home in 2021. This credit is limited as follows. • A total combined credit limit of $500 for all tax years after 2005. • A combined credit limit of $200 for windows for all tax years after 2005.

What is residential energy efficient property credit?

This Residential Energy Credit allows homeowners to claim a tax credit as a reward for using qualified energy-efficient property including appliances and systems that use solar, wind, geothermal and fuel cell technology in home building and improvement projects.

Did Congress extend the residential energy credit for 2018?

Basics of residential energy credits “Several renewable energy tax credits have been extended under the Bipartisan Budget Act of 2018,” explains Jacob Dayan, CEO and co-founder of Community Tax. “They'll be in effect until 2021, with a gradual step-down in credit value each year.”

How long can you carry forward residential energy credit?

Credits for energy efficiency With the Residential Energy Efficient Property Credit, taxpayers can carry forward the unused portion of the credit from the current year's tax return to the next year's tax return. For the Non-Business Energy Property Credit, the carryforward period is 20 years.

What is a residential energy credit?

What Is The Residential Energy Credit? The Residential Energy Efficient Property Credit provides an incentive for taxpayers to purchase alternative energy products and equipment for their home, such as solar hot water heaters and wind turbines.

How is residential energy credit calculated?

You may be able to take a credit equal to the sum of:10% of the amount paid or incurred for qualified energy efficiency improvements installed during 2020, and.Any residential energy property costs paid or incurred in 2020.

How many years can you claim the energy tax credit?

You may be able to take these credits if you made energy saving improvements to your principal residence during the taxable year. In 2018, 2019 2020, and 2021 the residential energy property credit is limited to an overall lifetime credit limit of $500 ($200 lifetime limit for windows).

Can you carry back residential energy credit?

If you can't use all of the credit because of the tax liability limit (that is, line 14 is less than line 13), you can carry the unused portion of the credit to 2022. File this form even if you can't use any of your credit in 2021.

What HVAC system qualifies for tax credit 2022?

The credit covers 10% of the cost of the equipment, including items such as home insulation, exterior doors, electric heat pumps, and central air conditioning systems. Just as you would with residential credits, this would also be filed on an IRS form 5695.

What is Form 5695 Residential energy credit?

Form 5695 calculates tax credits for a variety of qualified residential energy improvements, including geothermal heat pumps, solar panels, solar water heating, small wind turbines, and fuel cells.

How do I claim energy tax credit?

Claim the credits by filing Form 5695 with your tax return....Of that combined $500 limit,A maximum of $200 can be for windows.The maximum tax credit for a furnace circulating fan is $50.The maximum credit for a furnace or boiler is $150.The maximum credit for any other single residential energy property cost is $300.

How does the federal energy tax credit work?

An energy tax credit is a government incentive that reduces the cost for people and businesses to use alternative energy resources. Those who meet the criteria are reimbursed when paying income taxes, with the credit amount either reducing the total sum owed to the IRS or being added to your refund if you are due one.

Can you write off a new HVAC system on your taxes?

Here's some good news for a change from Washington, DC: You can get up to $500 in tax credits when you install an energy-efficient air conditioner, mini split, heater, boiler, or other HVAC appliance, thanks to a federal rebate incentive.

Does 16 SEER AC qualify for tax credit?

The following American Standard residential products qualify for a federal tax credit: Split system air conditioning - must meet 25C requirements of 16 SEER/13 EER (both efficiency levels must be met to qualify for the tax credit) Manufacturer's Certificate.

Can I carry forward energy tax credit?

The basics: You can carry forward the energy efficiency tax credit to future years if you use a geothermal pump, solar panels, solar water heater, small wind energy system, or fuel cells. Energy Incentives will be updated when the IRS issues further guidance.

Why is my home energy credit being carried forward?

There are times when you can't take the credit in the current year: Your income is at a level that's not taxed at all. You're getting other tax credits that have reduced your tax owed to zero.

Can you carry over unused solar tax credit?

To put it simply, yes, you can carry forward the Solar Tax Credit if your tax bill is smaller than your tax credit! A carry forward is a provision in the tax law that allows taxpayers to apply some of their unused credits, deductions, or losses to a future tax year.

How many times can I claim solar tax credit?

one timeHow Many Times Can You Claim The Solar Tax Credit? You can only claim the solar tax credit one time for your solar power installation. If you have any unused amount remaining on your tax credit that you are unable to claim in a single tax year, you may be able to carry over that tax credit value for up to five years.

How much is the residential energy property credit?

In 2018, 2019 2020, and 2021 the residential energy property credit is limited to an overall lifetime credit limit of $500 ($200 lifetime limit for windows). There are also other individual credit limitations: The residential energy property credit is nonrefundable.

What is energy efficient heating and air conditioning?

Energy-efficient heating and air conditioning systems. Water heaters (natural gas, propane or oil) Biomass stoves (qualified biomass fuel property expenditures paid or incurred in taxable years beginning after December 31, 2020, are now part of the residential energy efficient property credit for alternative energy equipment.)

Is there a residential energy efficient property credit?

Are there incentives for making your home energy efficient by installing alternative energy equipment? (updated April 27, 2021) A. Yes, the residential energy efficient property credit allows for a credit equal to the applicable percent of the cost of qualified property.

Is the residential energy property credit refundable?

The residential energy property credit is nonrefundable. A nonrefundable tax credit allows taxpayers to lower their tax liability to zero, but not below zero.

Can you get a credit for solar roof?

A. In general, traditional roofing materials and structural components do not qualify for the credit. However, some solar roofing tiles and solar roofing shingles serve as solar electric collectors while also performing the function of traditional roofing, serving both the functions of solar electric generation and structural support and such items may qualify for the credit. Components such as a roof's decking or rafters that serve only a roofing or structural function do not qualify for the credit.

How to apply for residential energy property credit?

To apply for the Residential Energy Property Credit, complete Form 5695 and attach it to your Form 1040.

How does having an energy efficient home help you?

By having an energy efficient home, you will save money on your bills and pay less money in taxes. Learn how you claim home energy tax credits if you qualify.

How many deductions does H&R Block have?

When you file with H&R Block Online they will search over 350 tax deductions and credits to find every tax break you qualify for so you get your maximum refund, guaranteed.

Residential Renewable-Energy Tax Credits

- What improvements qualify?

Residential renewable-energy tax credits may provide a credit valued at up to 30% of the cost of … 1. Solar panels that generate electricity in a home used as a residence 2. Solar-powered water heaters that perform at least half the home’s water heating in a U.S. home used as a residence …

Nonbusiness Energy Property Credits

- What improvements qualify?

The nonbusiness energy credit has expired, and will not be available for your 2018 taxes unless Congress acts to renew it. If nonbusiness energy property credits are renewed for 2018 and unchanged from 2017, they could be available for certain improvements to energy efficiency. Th… - Claiming nonbusiness energy property credits

If Congress renews the nonbusiness energy property credit for 2018, it would be claimed by completing IRS Form 5695. To claim the credits, you must meet all qualifying criteria. This means your home must be your main, or primary, home and the improvements to energy efficiency mus…

Other Advantages to Improving The Energy Efficiency of Your Home

- Earning tax credits is a good reason to improve the energy efficiency of your home, but reducing your federal taxes isn’t the only reason to act. Better energy efficiency can lower your ongoing costs and make your home more valuable to would-be buyers. In fact, the U.S. Department of Energy estimates your property value rises $20 for each $1 in utility-bill savings when you install …

Bottom Line

- Residential energy efficient property credit is available through 2021, and Congress looks ready to extend some energy credits that expired in 2017. So if you’re thinking about installing solar power, a solar water heater, a geothermal unit or fuel cells, now is probably a good time to act. For residential energy-efficient properties, you could get tax credits valued at up to 30% of your cost…