What happens if you don't do a title search?

What happens if you buy a home with outstanding liens?

Do you need a title search before closing?

What do they check before closing?

Lenders typically do last-minute checks of their borrowers' financial information in the week before the loan closing date, including pulling a credit report and reverifying employment.

What is the order of the closing process?

To close the deal on your home, you need a closing agent (also called a settlement or escrow agent). They'll coordinate document signing for all the parties, verify that both you and the seller have met the terms of the purchase agreement, and finally pay out all funds, transfer the title, and record the deed.

What happens the week before closing on a house?

Your lender will provide you with an estimated report of the closing costs when you apply for the loan. A week before closing, these costs are finalized and presented to you for review. This is the actual total you will need to bring to closing in the form of a cashier's check.

How long does a title search Take in Alabama?

Processing times may vary. Titles are normally issued within 10 – 15 days from the date the application and supporting documents are received by the Department and all required documentation is correct.

What are the 4 steps in the closing process?

What are the 4 steps in the closing process?Close revenue accounts to Income Summary. Income Summary is a temporary account used during the closing process. ... Close expense accounts to Income Summary. ... Close Income Summary to Retained Earnings. ... Close dividends to Retained Earnings.

What should you not do before closing on a house?

Do not:Buy a big-ticket item: a car, a boat, an expensive piece of furniture.Quit or switch your job.Open or close any lines of credit.Pay bills late.Ignore questions from your lender or broker.Let someone run a credit check on you.Make large deposits to your accounts outside of your paycheck.Cosign a loan with anyone.More items...

What happens 2 days before closing on a house?

A few days before closing, you'll be notified of the final closing cost with an itemized list of all fees and charges – thinks like appraisal costs, legal fees, etc. This is the actual amount you'll need to bring in the form of a certified or cashier's check — not a personal check.

How soon is your first house payment due after closing?

Your first payment date is set during closing. You can find it on your First Payment Letter along with payment instructions. The payment date is generally on the first of the month after a full month past the closing date. So, whether you close on September 2 or September 15, your payment would be due on November 1.

What to expect 2 weeks before closing?

Two Weeks Before Closing: Contact your insurance company to purchase a homeowner's insurance policy for your new home. Your lender will need an insurance binder from your insurance company 10 days before closing. Check in with your lender to determine if they need any additional information from you.

Who orders the title search?

Who Does The Title Search? A title company or attorney will typically take care of the title search. In some cases, the lender or the individual home buyer may take over this process instead.

How much is a title search in Alabama?

Title search and recording fees Title searches typically cost around $75 to $100; sellers and buyers customarily split this fee in Alabama.

Who pays closing costs in Alabama?

What are you typically paying for? Both buyers and sellers have to pay a portion of closing costs. Certain costs are traditionally paid by one party or the other. However, during negotiation buyers and sellers can agree to whatever they like.

What is the closing process in accounting?

A closing entry is a journal entry made at the end of the accounting period. It involves shifting data from temporary accounts on the income statement to permanent accounts on the balance sheet. All income statement balances are eventually transferred to retained earnings.

How many steps are in the closing process?

House Closing Process: The 12 Steps of Closing.

How many steps are in the closing process accounting?

The four closing entries are, generally speaking, revenue accounts to income summary, expense accounts to income summary, income summary to retained earnings, and dividend accounts to retained earnings.

What is the closing phase of a project?

The purpose of the closing phase in the project management lifecycle is to confirm completion of project deliverables to the satisfaction of the project sponsor, and to communicate final project disposition and status to all participants and stakeholders.

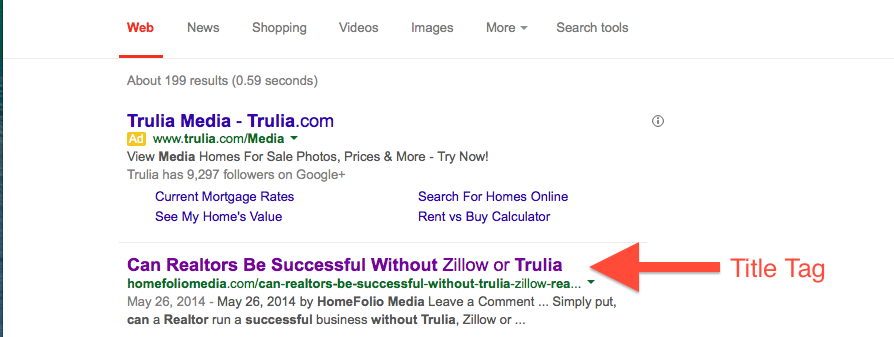

What Is A Title Search?

When you’re buying a home from a seller, you’d likely assume that the seller is entitled to sell the home in question. However, that assumption can lead to heartbreaking consequences if someone else with a claim or lien on the property shows up on the doorstep.

How Do Title Searches Identify Who Owns A Property?

A title search digs into the public records available for the property in question. Typically, an attorney or title company will use a variety of legal documents to confirm that the seller is truly the rightful owner. Beyond that, the title search will root out any other financial and/or legal claims on the property.

What is the process of searching for a title?

The Process. The person conducting the title search can be called an abstractor. The abstractor works to pull together all the relevant information and legal documents that they can find about the property to create an abstract of the title. The abstract of title will include a recorded chronology of all available documents ...

What is included in an abstract?

The abstract could include the current owner and previous owners. It could also include past surveys of the property, any easements that cross the property and any relevant wills and lawsuits that involve the property.

How long does it take to get a title search?

Once the documents are in the hands of the title company examiner, it could take a few hours or a few weeks to pore over the documents for any outstanding claims.

Why do debts come back to haunt me?

Second, the debts of any of the previous owners can come back to haunt you because they follow the property. Things like unpaid property taxes, homeowner’s association fees and bills for home improvements might become your responsibility if you were to skip a title search, or the title search failed to find it.

Where does Andrew Dehan live?

He is also a published poet, musician and nature-lover. He lives in metro Detroit with his wife, daughter and dogs.

What documents are needed to purchase a home?

Affidavits and miscellaneous documents necessary to purchase the property

What is closer in closing?

After the title search has been completed and all title matters are resolved, your closing coordinator – AKA closer – will finalize the closing process including preparation of all documents for signing. The closer will ensure that all documents required by Florida law and the lender (if applicable) are available before the closing date. Buyer documents include:

What is a title insurance closing?

A title insurance company closing process includes all the necessary steps to make the home you’ve decided to purchase legally yours, including signing title and loan documents (if applicable) and providing you with free and clear title. Many homebuyers are interested in learning more about the closing process to understand what they should expect. At Title Partners of South Florida, we pride ourselves on having a title company closing process that’s simple and transparent.

What does a title search do?

Having a title search completed and obtaining title insurance will give you the assurance that no one can make a claim to the property after you purchase it. A title agent will clarify any issues with the title, so no one will contest your ownership of the property once you own it. 5. Clarification of Title Matters.

When you reach an agreement with the seller, do you need to sign a contract?

When you reach an agreement with the seller, you’ll need to sign a real estate contract to begin the closing process. It’s important to complete preliminary research on the home and surrounding area, so you can offer a fair price for the home. This is where a real estate agent is extremely valuable.

Where are all transfer documents recorded?

All transfer documents are recorded in the public records in the correct county where the home is located . This completes the final transfer of the title to the buyer.

Do you need an appraisal for a home without a loan?

You may be able to negotiate with the seller to have them complete any necessary repairs if the real estate contract included a clause for a home-inspection contingency. An appraisal is only optional if you are purchasing a property without a loan. Otherwise, a lender will require a property appraisal. 4.

How does a title company work?

Once the issues with the title are identified, the title company works with necessary people to get them removed. Some issues -- like a utility easement -- usually can't be removed, and you'll have to buy the property subject to them. Others, like old mortgages or an improper transfer after a divorce, require tracking down old owners or lenders and having them sign documents to clear the title. Finally, some title issues, such as unpaid property taxes or the current mortgage, will go away at the closing when the money that comes in pays them off.

What is preliminary title report?

While the two parties in the sale of a piece of property are working through their inspections and getting a loan, the title company is working, too, searching title reports to produce a document, called a preliminary title report, that lists all of the items that impact a property's ownership. The report will list things such as existing mortgages, the right of the local government to collect property taxes, easements that let utility meter readers walk on your property and defects like an old mortgage that never got taken off from three owners ago.

What is a title report?

The report is part of the insurance that it grants, but it's also a tool that lets the buyer see the condition of the property's ownership. The title report is usually done well before the closing, since it's a necessity for most banks to underwrite the mortgage. You're entitled to get a copy of it at the closing or before -- you just have to ask for it.

Can a utility easement be removed?

Once the issues with the title are identified, the title company works with necessary people to get them removed. Some issues -- like a utility easement -- usually can't be removed , and you'll have to buy the property subject to them. Others, like old mortgages or an improper transfer after a divorce, require tracking down old owners or lenders and having them sign documents to clear the title. Finally, some title issues, such as unpaid property taxes or the current mortgage, will go away at the closing when the money that comes in pays them off.

Who is Steve Lander?

Steve Lander has been a writer since 1996, with experience in the fields of financial services, real estate and technology. His work has appeared in trade publications such as the "Minnesota Real Estate Journal" and "Minnesota Multi-Housing Association Advocate." Lander holds a Bachelor of Arts in political science from Columbia University.

What is a property title search?

A title search looks at public records to make sure there are no ownership issues or hidden debts that could interfere with the sale of a home. A home needs to have a clean title for a sale to go through.

What does a title search show?

A title search can uncover a wide spectrum of potential issues. Let’s go over some of the most common.

What happens if the title search discovers problems?

Any problems the title search reveals have to be solved before the deal can move forward.

How to do a title search on a property?

To do a property title search, get the title and deed from your county courthouse to check for a broken chain of ownership or other claims on the property. You might also look for tax documents from your county assessor's office. Finally, see if there is any pending legal action against the owner by searching your county court dockets.

What do buyers look for in a title search?

They look for claims like unpaid taxes, unpaid contractor debts, and various property restrictions.

What happens when a property owner in financial distress offers a property to an investor at a price that seems too?

For example, if a property owner in severe financial distress offers a property to an investor at a price that seems too good to be true, that investor might reasonably suspect that there may be unsolved debts associated with the property.

What does a title company do?

In a property title search, a title company or lawyer will look over all legal documents for the property to check for claims or liens. If the property owner owes a debt, for example, someone else may have legal rights to the property until that debt is paid. If the title is clear, the sale can go through. But if not, the seller will need to take care of their debts first.

When is a title search done?

A property title search is typically ordered during escrow when a lender financing a home purchase requests a preliminary report from a title company. However, a search can be done anytime, by anyone, such as a buyer (who might not need a lender’s money) or a homeowner who’s looking to refinance their home.

What is a property title search and how is it done?

The property title search is generally done after an offer to purchase real estate has been accepted, says David Zawadzki, senior account executive at Proper Title. Multiple sources are searched, including deeds, county land records, tax liens on the federal or state level, divorce cases, bankruptcy court records, and other financial judgments against an owner that could potentially attach to a property.

What happens if liens aren't discovered?

If liens or judgments aren’t discovered prior to closing, the buy er can face messy and expensive issues down the road.

What is a clean title search?

A clean property title search means the buyer—and lender—agree there are no claims on the property that could become an issue after ownership is transferred.

What is a title when buying a house?

When you buy or sell a home, a property title is essentially a fancy way of saying who has the right to own the property—and thus, to sell it . While it may seem straightforward that a home seller owns his house, there could be hidden claims or liens on the property the homeowners themselves may be unaware of, making a title search essential ...

What happens if a seller has a judgment against them?

For example, if the seller has a $10,000 judgment against them and the property was purchased without the judgment being paid off, it becomes the obligation of the new owner , says Jeffrey A. Hensel, broker associate at North Coast Financial in San Diego.

What is a defect on a title?

Defects could be someone else claiming title to the property, a claim that the seller never owned it or a wild deed (where someone buys the property but doesn’t officially record the title). Many properties have defects on a title. For buyers: Property title searches are a vital step in the home-buying process.

What Is A Property Title?

A property title is a document that names the rightful owner of a property. Only the person on the title has the right to sell the property. As an investor, you need this information to ensure that the person selling you a property is, in fact, within their rights to do so. This can get a little complicated if there are any liens on the property. The property owner has to settle any liens or claims before they can rightfully make a sale.

What Is A Title Search?

A title search is simply the process of examining public records to determine a property’s ownership. The search can uncover whether or not there are any liens on the property. Other unexpected legal issues can also come up, which we’ll go over next.

Can You Do A Title Search Yourself?

First, you’ll spend hours calling county offices and researching websites to pull public records, which can be a painstaking process in itself.

What is the purpose of title search?

The purpose is to uncover as much available information as possible so that the buyer can make an educated purchase decision. Other than real estate investors, mortgage lenders and other creditors also initiate title searches.

How much does a title search cost?

A title search costs as little as $150 but as much as $1,000. This cost is dependent on whether or not you’re doing a basic land report or a full report of ownership and encumbrances. It can also vary by state and by how much information you’re looking for. The cost of title searches is typically included in closing fees.

What are covenants in real estate?

Covenants: Covenants are legal restrictions that put a limit on what you can build on the land upon which the property sits. As an investor, this might kill your deal if you were planning on making expansions or are building an additional unit on the property.

What to do if title search misses anything?

The second strategy is to purchase title insurance. In case the title search misses anything or any past issues resurface, this insurance will protect you . Luckily, you won’t have to make monthly payments as you would with other types of insurance. Title insurance is paid for at closing, with a one-time premium.

What is closing of a house?

Closing is the phase in the home selling process when money and documents are transferred in order to transfer ownership of the property to the buyer.

What should you bring on the closing date?

You don’t need to bring much to the closing: usually just a government-issued photo ID, the keys to the property, and any outstanding documents and paperwork your attorney or escrow agent instructs you to bring. These may include documents showing you’ve completed all repairs requested by the buyer.

How long does the closing process take?

The full closing process, from the initial offer acceptance to the closing date, takes an average of 50 days, according to Realtor.com. If you sell to Opendoor, you can close on your timeline, whether it’s 14 days or 60 days.

How much are closing costs – and who pays them?

Closing costs range between 1 percent to 7 percent of the sale price of the home, split between both parties. Home sellers usually pay between 1 percent to 3 percent of the final sale price, according to Realtor.com.

What is appraisal based on?

The appraisal is based on the estimated value of the home’s individual features, as well as comparable homes that have sold recently nearby. If your home appraises below the sale price, lenders are unlikely to approve a loan to the buyer for that amount.

What happens if a buyer borrows money for a house?

If the buyer is borrowing money for the purchase, the mortgage lender will arrange for a professional appraisal. This is done so the lender can be confident that the amount of money it’s lending to the buyer is in line with the market value of the home in case the lender needs to repossess the house.

How long does it take to close a home?

There can be a lot of steps to the closing process, which may take an average of 50 days. Selling to Opendoor gives you control over the timeline.

What does a mortgage processor do?

The processor works as a liaison, coordinating with you and your real estate agent, your mortgage lender and other parties involved in the real estate transaction. She will confirm the date and time or your closing and help you through the rest of the settlement process leading up to your closing date.

What happens when you sign a deed to a home?

Once the documents are signed and closing funds are received , the homebuyer will receive a copy of the deed to the property and the keys. Congratulations! The property is yours.

What is a title cloud?

A cloud could be any number of things ranging from liens on the property to an outstanding loan or home equity line of credit, to outstanding real estate taxes or utilities. Judgments, unreleased deeds of trust and ownership claims can also create title clouds.

What is a title search?

(You can place the order online or have your real estate agent help you.) A title search is a review of the chain of title to your property done by a title examiner at the local courthouse.

What happens if you don't do a title search?

If one of these siblings attempted to sell the house without the others’ knowledge, a title search would bring this to light and put an end to the sale until the matter could be resolved . Without a title search, you might move forward with the purchase of the home only to be later burdened with lawsuits against the seller. You might even end up losing the house you worked so hard to get.

What happens if you buy a home with outstanding liens?

Another example: if you purchase a home that has outstanding liens, mortgages or back taxes due on the property – but you were not aware of this – you could be held accountable for those payments (unless you purchased title insurance). Again, a comprehensive title search should identify these issues and get them resolved by the current owner before the title is transferred to you.

Do you need a title search before closing?

Yes, a title search is done before you finalize the closing process and purchase a property. This process is done to protect you as the buyer – to ensure that the property can be legally sold and that there are no hidden issues/problems that could affect your home ownership.