What accounts go on a closing entry?

The four closing entries are, generally speaking, revenue accounts to income summary, expense accounts to income summary, income summary to retained earnings, and dividend accounts to retained earnings.

What type of accounts are closed?

A closed account is any account that has been deactivated or otherwise terminated, either by the customer, custodian or counterparty. The term is often applied to a checking or savings account, or derivative trading, credit card, auto loan or brokerage account.

What are the three closing entries?

Thus, three entries usually occur during the closing process. The first entry closes revenue accounts to the retained earnings account. The second entry closes expense accounts to the retained earnings account. The third entry closes the dividend account to the retained earnings account.

How do you identify accounts for closing?

0:337:33Closing Entries: Identify Temporary Accounts - Slides 1-10 - YouTubeYouTubeStart of suggested clipEnd of suggested clipThose temporary accounts revenues expenses and dividends analyze how to close them. Record theMoreThose temporary accounts revenues expenses and dividends analyze how to close them. Record the closing entries which will close them down to zero. And transfer their balances into a permanent.

Which accounts are not closed?

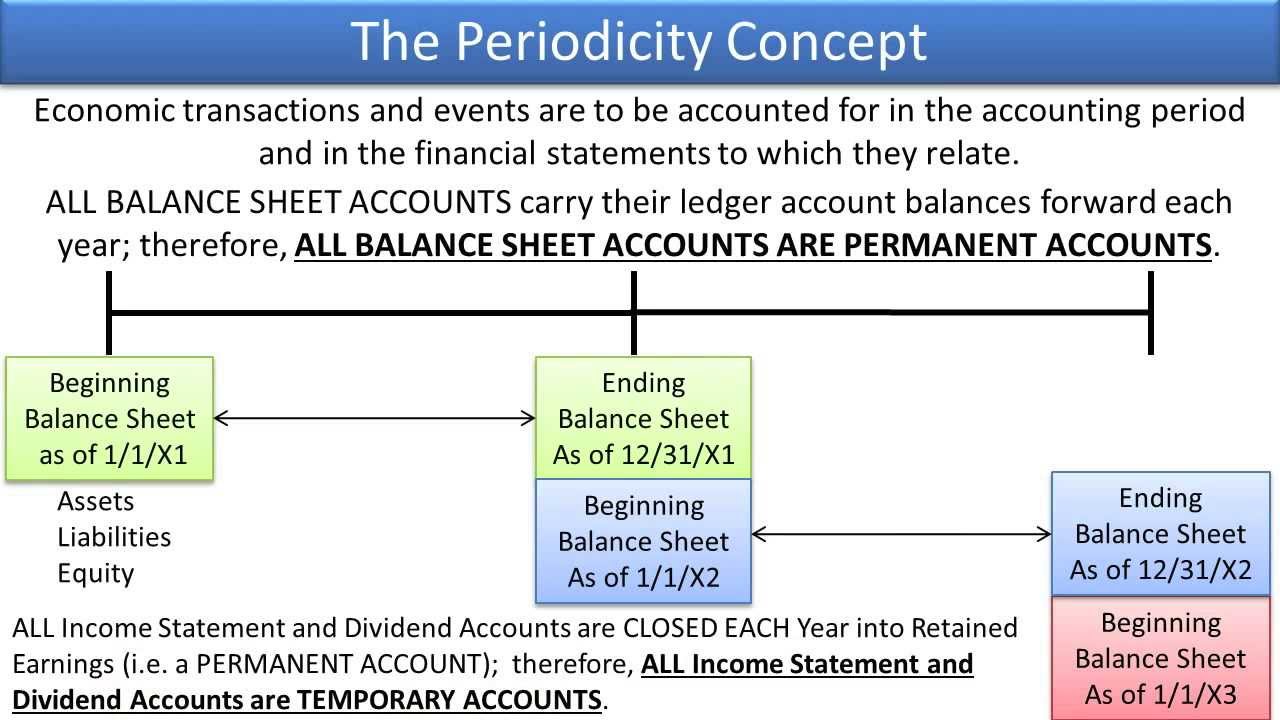

Permanent accounts are accounts that you don't close at the end of your accounting period. Instead of closing entries, you carry over your permanent account balances from period to period....Permanent accountsAccounts receivable.Inventory.Accounts payable.Loans payable.Retained earnings.Owner's equity.

Which account is not closed in accounting?

The accounts that do not get closed (their balances are carried forward to the next accounting year) are referred to as permanent accounts. The balance sheet accounts are permanent accounts.

What is closing entry give example?

Here are some examples of closing entries. (i) Opening stock account, Purchase account, Wages account, Carriage inwards account and Direct expenses account are closed by transferring to the debit side of the Trading and Profit and Loss account.

How do you write 4 closing entries?

Step 1: Closing the revenue account. When closing the revenue account, you will take the revenue listed in the trial balance and debit it, to reduce it to zero. ... Step 2: Closing the expense accounts. ... Step 3: Closing the income summary account. ... Step 4: Closing the drawing/dividends account. ... Step 5: Running reports.

What are the 4 steps to closing entries?

More specifically, making closing entries through the income summary is a four-step process that includes:Closing revenue accounts to income summary.Closing expense accounts to income summary.Closing income summary to retained earnings.Closing dividends to retained earnings.

Which accounts is not closed during the closing process?

Permanent accounts are never closed. Permanent accounts are those that keep continuous balances in them, even when the new year starts. All Asset Liability and equity accounts, except drawing, are permanent accounts and never get closed out.

What do you close in closing entries?

You can create a closing entry by closing your revenue and expense accounts and transferring the balances into an account called “income summary account.” The income summary account is only used in closing process accounting. Basically, the income summary account is the amount of your revenues minus expenses.

What accounts do you close at month end?

Check revenue and expense accounts At month-end close, review your revenue and expense accounts to confirm they are accurate. Check to see if you recorded your expenses in the correct accounts for the period. Be sure that accruals and prepaid expenses are recorded accurately in your books.

Are nominal accounts closed?

In accounting, nominal accounts are the general ledger accounts that are closed at the end of each accounting year. The closing process transfers their end-of-year balances from the nominal accounts to a permanent or real general ledger account.

Why accounts are closed?

A bank generally can close your account at any time and for any reason—and sometimes without notifying you in advance. Reasons a bank may shut down your account include using your account very little or not at all, or bouncing too many checks.

What is closed in accounting?

In an accounting context, a closed account or a closed entry means the annual process of shifting data from temporary accounts on the income statement to the permanent accounts on the balance sheet to begin the new financial year with a zero balance.

What are Closing Entries?

Closing entries, also called closing journal entries, are entries made at the end of an accounting period to zero out all temporary accounts and transfer their balances to permanent accounts. In other words, the temporary accounts are closed or reset at the end of the year. This is commonly referred to as closing the books.

How are expense accounts closed?

All expense accounts are then closed to the income summary account by crediting the expense accounts and debiting income summary.

What happens when you close all temporary accounts?

Closing all temporary accounts to the income summary account leaves an audit trail for accountants to follow. The total of the income summary account after the all temporary accounts have been close should be equal to the net income for the period.

What is a permanent account?

Permanent accounts are balance sheet accounts that track the activities that last longer than an accounting period. For example, a vehicle account is a fixed asset account that is recorded on the balance. The vehicle will provide benefits for the company in future years, so it is considered a permanent account.

Why do temporary accounts have zero balance?

In other words, revenue, expense, and withdrawal accounts always have a zero balance at the start of the year because they are always closed at the end of the previous year.

Can a temporary account be closed?

Temporary accounts can either be closed directly to the retained earnings account or to an intermediate account called the income summary account. The income summary account is then closed to the retained earnings account. Both ways have their advantages. Closing all temporary accounts to the income summary account leaves an audit trail ...

Do you have to close a temporary account?

There is no need to close temporary accounts to another temporary account (income summary account) in order to then close that again. Both closing entries are acceptable and both result in the same outcome. All temporary accounts eventually get closed to retained earnings and are presented on the balance sheet.

What is closing entries?

Closing Entries, With Examples. At the end of an accounting period when the books of accounts are at finalization stage, some special journal entries are required to be passed. In accounting terms, these journal entries are termed as closing entries. The main purpose of these closing entries is to bring the temporary journal account balances ...

What is permanent account?

The permanent accounts in which balances are transferred depend upon the nature of business of the entity. For example, in the case of a company permanent accounts are retained earnings account, and in case of a firm or a sole proprietorship, owner’s capital account absorbs the balances of temporary accounts.

What happens after you close both income and revenue accounts?

After closing both income and revenue accounts, the income summary account is also closed. All generated revenue of a period is transferred to retained earnings so that it is stored there for business use whenever needed.

What is the objective of total revenue?

The objective is to get the account balance to nil.

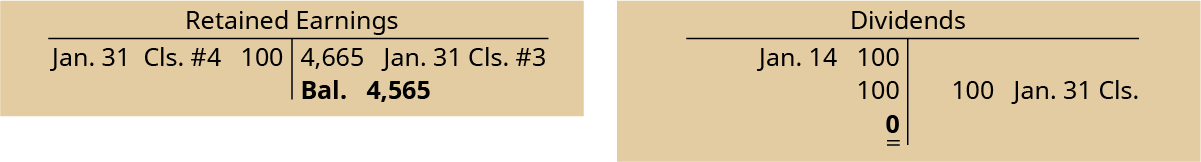

When is dividend paid journal entry required?

This entry is required in case if a company pays dividends during an accounting period which results in a reduction of capital. Dividend (paid) account is then closed with the help of the below journal entry:

Where are closing entries posted?

As similar to all other journal entries, closing entries are posted in the general ledger. Once all closing entries have been passed, only the permanent balance sheet and income statement accounts will have balances that are not zeroed.

When is expense account closed?

Just like revenue, expense account is also closed at the end of an accounting period so that it can once again begin with nil balance. Below is the journal entry that will assist in this process:

What are Temporary Accounts?

Temporary accounts include all revenue and expense accounts, and also withdrawal accounts of owner/s in the case of sole proprietorships and partnerships (dividends for corporations).

How are dividends recorded?

When dividends are declared by corporations, they are usually recorded by debiting Dividends Payable and crediting Retained Earnings. Note that by doing this, it is already deducted from Retained Earnings (a capital account), hence will not require a closing entry.

What does it mean when income summary has a debit balance?

What if Income Summary had a debit balance? It means that the company had a net loss. This is closed by doing the opposite – debit the capital account (decreasing the capital balance) and credit Income Summary.

What is income summary?

The Income Summary account is temporary. It is used to close income and expenses. As you will see later, Income Summary is eventually closed to capital.

What is the purpose of closing entries?

The purpose of closing entries is to prepare the temporary accounts for the next accounting period. In other words, the income and expense accounts are "restarted". After preparing the closing entries above, Service Revenue will now be zero. The expense accounts and withdrawal account will now also be zero. Effectively, the balances of these ...

What is a drawing account in a sole proprietorship?

In a sole proprietorship, a drawing account is maintained to record all withdrawals made by the owner. In a partnership, a drawing account is maintained for each partner. All drawing accounts are closed to the respective capital accounts at the end of the accounting period.

Why should the amounts in one accounting period be closed?

And so, the amounts in one accounting period should be closed so that they won't get mixed with those in the next period. Income and expenses are closed to a temporary clearing account, usually Income Summary. Then, Income Summary is closed to the capital account. Afterwards, withdrawal or dividend accounts are also closed to the capital account.

How to transfer expense balances to income summary?

Transfer the balances of various expense accounts to income summary account. It is done by debiting income summary account and crediting various expense accounts. This step closes all expense accounts.

What is closing entry?

Closing entries may be defined as journal entries made at the end of an accounting period to transfer the balances of various temporary ledger accounts to some permanent ledger account.

What is the step 4 of dividends?

Step 4 – closing the dividends account: Transfer the balance of dividends account directly to retained earnings account. Dividends paid to stockholders is not a business expense and is therefore not used while determining net income or net loss.

What does it mean when an income summary account has a credit balance?

If income summary account has a credit balance, it means the business has earned a profit during the period which causes an increase in retained earnings. Therefore, the income summary account is closed by debiting income summary account and crediting retained earnings account.

What is permanent account?

Permanent accounts (also known as real accounts) are ledger accounts the balances of which continue to exist beyond the current accounting period (i.e., these accounts are not closed at the end of the period). In the next accounting period, these accounts usually (but not always) start with a non-zero balance.

Which permanent account to which the balances of all temporary accounts are closed?

The permanent account to which the balances of all temporary accounts are closed is the retained earnings account in case of a company and owner’s capital account in case of a sole proprietorship.

What is temporary account?

Temporary accounts (also known as nominal accounts) are ledger accounts used to record transactions for only a single accounting period and are closed at the end of the period by making appropriate closing entries. In next accounting period, these accounts are opened again and normally start with a zero balance.

What is a temporary account?

The temporary accounts include the income statement accounts (revenue, expense, gain, loss, income summary) and also the drawing account of a sole proprietorship. The balances in these accounts will ultimately end up in the sole proprietor's capital account or the corporation's retained earnings account.

What accounts are debited in closing entries?

The following temporary accounts normally have credit balances that require a debit as part of the closing entries: Revenue accounts. Gain accounts. Contra expense accounts.

When do closing entries occur?

Closing entries occur at the end of an accounting year to transfer the balances in the temporary accounts to a permanent or real account. The intended result is for each temporary account to begin the next accounting year with a zero balance.