Factors Affecting Capital Structure

- Size of Company -Small companies may have to rely on the founder’s money but as they grow they will be eligible for long-term financing because larger companies are considered less risky by investors.

- Nature of Business -If your business is a monopoly you can go for debentures because your sales can give you adequate profits to pay your debts easily or pay dividends.

What factors affect the capital structure of a company?

The use of fixed cost in the production process also affects the capital structure. The high operating leverage; use of a higher proportion of fixed cost in the total cost over a period of time; can magnify the variability in future earnings.

What is the relationship between cost of capital and capital structure?

Cost of Capital and Capital Structure. Cost of capital is an important factor in determining the company’s capital structure. Determining a company’s optimal capital structure Capital Structure Capital structure refers to the amount of debt and/or equity employed by a firm to fund its operations and finance its assets.

What are the implications of capital structure theory?

One of the simplest implications of capital structure theory is the so-called traditional approach to capital structure. To sum up, when reviewing factors affecting capital structure decision of a firm it’s important to remember that equity is characterized by the following: simplicity in raising (no approval needed, only owner’s decision)

Which is not the most important factor in capital structure decisions?

But flotation costs are not the most important factor in capital structure decisions. If the amount of issue is increased, the percentage of flotation costs can decrease. Factor # 16. Control: In present times, management wants to maintain its existence continuously and does not want any outside interference.

What factors affect capital structure?

Factors determining capital structure are given below −Trading on equity.Degree of control.Flexibility of financial plan.Choice of investors.Capital market condition.Period of financing.Cost of financing.Stability of sales.More items...•

What is the effect of capital structure?

The effect that capital structure decisions have on profitability and firm value is that, it increases value through the present value of tax savings from the use of debt. Intuitively, this may imply that firms should use 100% debt to maximise their value.

How does capital structure affect a business?

A company's capital structure — essentially, its blend of equity and debt financing — is a significant factor in valuing the business. The relative levels of equity and debt affect risk and cash flow and, therefore, the amount an investor would be willing to pay for the company or for an interest in it.

How profitability affects capital structure?

Basically, profitability reflects corporate financial condition. The higher the profitability, the higher is the amount of intern fund from the retained earning, decreasing the proportion of debt in the capital structure. It is clear that profitability has a positive correlation with corporate value.

How does capital structure affect firm performance?

Several studies have found that capital structure has a positive impact on firm performance in financially or economically developed countries. However, in developing countries, evidence has shown that the relationship between leverage and performance is significantly negative.

How does capital structure affect profitability and financial risk?

Capital structure of a company affects both the profitability and the financial risk. A capital structure will be said to be optimal when the proportion of debt and equity is such that it results in an increase in the value of the equity share.

What is the meaning of capital structure?

Capital structure refers to the specific mix of debt and equity used to finance a company's assets and operations. From a corporate perspective, equity represents a more expensive, permanent source of capital with greater financial flexibility.

What is capital structure with example?

1 This mix of debts and equities make up the finances used for a business's operations and growth. For example, the capital structure of a company might be 40% long-term debt (bonds), 10% preferred stock, and 50% common stock.

How does a firm reduce equity?

In the second approach, the firm will borrow money (i.e., issue debt) and use that money to pay a one-time special dividend, which has the effect of reducing the value of equity by the value of the divided. This is another method of increasing debt and reducing equity.

Why do debt investors take less risk?

Debt investors take less risk because they have the first claim on the assets of the business in the event of bankruptcy. Bankruptcy Bankruptcy is the legal status of a human or a non-human entity (a firm or a government agency) that is unable to repay its outstanding debts. .

How to recapitalize a business?

Methods of recapitalization include: Issue debt and repurchase equity. Issue debt and pay a large dividend to equity investors. Issue equity and repay debt. Each of these three methods can be an effective way of recapitalizing the business.

What are the pros and cons of equity?

Pros and cons of equity: 1 No interest payments 2 No mandatory fixed payments (dividends are discretionary) 3 No maturity dates (no capital repayment) 4 Has ownership and control over the business 5 Has voting rights (typically) 6 Has a high implied cost of capital 7 Expects a high rate of return (dividends and capital appreciation) 8 Has last claim on the firm’s assets in the event of liquidation 9 Provides maximum operational flexibility

How does a firm borrow money?

In the first approach, the firm borrows money by issuing debt and then uses all of the capital to repurchase shares from its equity investors. This has the effect of increasing the amount of debt and decreasing the amount of equity on the balance sheet.

What is capital structure?

Capital structure is a blend of company’s sources of finance and consists of several types of funding. To be more specific, capital structure is a ratio of short-term, long-term liabilities and equity. Depending on the sources of financing, we can distinguish borrowed (or debt) capital and equity (owner’s capital).

How does change in capital structure affect free cash flow?

Change in capital structure can also affect free cash flow, therefore influencing CapEx decisions. To add more, many companies pay dividends which decrease retained earnings and increase the amount ...

What proportion of equity should a company have in its capital structure?

For example, banks are heavily regulated by central banks and under the Basel III capital framework should have no less than 8% of their risk-weighted assets funded by equity capital and subordinated debt. Raising debt also usually imposes various debt covenants that restrict the proportion of debt a company is allowed to have.

Why do companies attract only equity capital?

Companies usually attract only equity capital when they start doing business because lack of collateral and credit history gives few options to attract investors.

What happens during a crisis?

In the period of crisis, companies usually develop business continuity plans and return on capital decreases. At this point company attracts more borrowed funds to fulfill its short-term obligations and equity share in capital structure shrinks (which evidenced a crisis in the company).

What are the advantages of borrowing capital?

First, interest paid is exempt when calculating profit for tax. Second, lenders receive only fixed income on provided funds and shareholder doesn’t have to share profit with them. Borrowed funds have disadvantages too.

Why do companies pay dividends?

To add more, many companies pay dividends which decrease retained earnings and increase the amount of funding company must have to finance its business. So factors affecting capital structure decision of a firm are interrelated with dividend policy.

How does capital structure affect the economy?

Capital structure significantly responds to changing tax incentives, lower taxes have affects the capital structure of firms, resulting in increased equity levels and decreased long-term debt levels. The smaller and more profitable firms are more likely to reduce their debt levels and therefore the trade-off by lowering taxes decrease the incentive to hold debt due to decreasing interest and tax deductibility.

What are the factors that affect a firm's capital structure?

The following factors must be kept in mind while taking capital structure decisions are:-. 1. Size of Business 2. Form of Business Organisations 3.

Why is leverage important in capital structure?

The income will also increase by the use of preference share capital but it will increase more by the use of debt funds because interest is allowed as an expense from the taxable income. Because of its effect on the earnings per share, financial leverage is an important factor in planning the capital structure.

Why should companies not use debt?

The companies whose sales are decreasing, should not use debt or preference share capital because they can face difficulty in the payment of interest and preference dividend, as a result of which the company could be liquidated.

What does it mean when the degree of competition is high?

If in an industry, the degree for competition is high, such companies in that industry should use greater degree of share capital as compared to the debt capital. On the other hand, the industries in which the degree of competition is not so high, have a tendency of stable income and, therefore, they can use more debt.

How does the sale of income affect the quantum of leverage?

The companies which have stability in income and sales, can use more amount of debt in their capital structure. They can easily pay their fixed financial charges. The industries producing consumer goods face more fluctuations in their sales and, therefore, use lesser amount of debt.

How does attitude affect capital structure?

The attitude of management towards the factors affecting the capital structure also affects the capital structure. The attitude of management towards risk and control should be analysed. Some managers do not want to bear much risk. In such case, ordinary share capital should be used in place of debt funds. The manager who wants to take much risk, can make use of more and more loans.

Important Marketing Concepts to Know

Read on to learn more about the marketing concepts that can help marketers appeal to their desired consumer.

What is business management?

Earning a degree in business management opens the door to vast career possibilities.

How to Become a Market Disruptor

Discover what a market disruptor is and what skills you need to become one.

What are the factors that affect the capital structure of a company?

It is made up of debt and equity securities and refers to the permanent financing of a firm. Capital structure is how a firm finances its overall operations and growth by using different sources of funds. Debt comes in the form of bond issues or long-term notes payable, while equity is classified as common stock, preferred stock or retained earnings. Every company needs capital to support its operations. Capital structure is a blend of the company’s sources of finance and consists of several types of funding. Some of the key factors that affect the capital structure of the firm are as follows:

What is capital structure?

Capital structure is how a firm finances its overall operations and growth by using different sources of funds. Debt comes in the form of bond issues or long-term notes payable, while equity is classified as common stock, preferred stock or retained earnings. Every company needs capital to support its operations.

What is anticipated growth rate?

The anticipated growth rate in sales provides a measure of the extent to which earning per share (EPS) of a firm are likely to be magnified by leverage. The firm is likely to use debt financing with a limited fixed charge only when the return on equity is likely to be magnified. However, the firms with significant growth in sales would have a high market price per share as a result of which they might prefer equity financing. The firm should make a relative cost-benefit analysis against debt and equity financing in anticipation to growth in sales to determine the appropriate capital structure.

How does the source of financing affect the firm?

The sources of financing to be used are affected in several ways by the maturity structure of assets to be used by the firm. If a firm has relatively longer-term assets with assured demand of its products, the firm attempts to use more long term debt. In contrast to this, the firms with relatively greater investment in receivables and inventory rather than fixed assets rely heavily on short-term financing.

What is the management style of a company?

Management styles range from aggressive to conservative. The more conservative a management’s approach is, the less inclined it is to use debt to increase profits. Aggressive management may try to grow the firm quickly, using significant amounts of debt to ramp up the growth of the company’s earnings per share (EPS).

What would happen if there were no barriers in the industry for the entry of new competitors?

If there were no barriers in the industry for the entry of new competing firms, the profit margin of existing firms in the industry would be adversely affected. As a result, the firm may find a riskier to use fixed charge bearing securities.

How does fixed cost affect capital structure?

The high operating leverage; use of a higher proportion of fixed cost in the total cost over a period of time ; can magnify the variability in future earnings. There is a negative relation between operating leverage and debt level in the capital structure.

What is a Capital Structure?

A capital structure can be referred to as the number of funds in the control of a business that can be used to fund the day-to-day operations of the business. there are two ways to acquire capital for the business. These are Debt Capital or Equity Capital. A business can use either one of them or a combination of both of them to acquire capital in the long run.

Is equity based business better for investors?

An equity-based company will be more preferred by potential investors, not that it will have its own drawbacks. A company that has a large amount of debt capital needs to understand that it needs to return the money with interest. Thus the risk in debt capital is also high. This is why a business should plan ahead and decide the optimum capital structure of the business.

What is capital structure?

Capital Structure Capital structure refers to the amount of debt and/or equity employed by a firm to fund its operations and finance its assets. A firm's capital structure. can be a tricky endeavor because both debt financing and equity financing carry respective advantages and disadvantages.

Why is equity financing attractive?

Despite its higher cost (equity investors demand a higher risk premium than lenders), equity financing is attractive because it does not create a default risk to the company. Also, equity financing may offer an easier way to raise a large amount of capital, especially if the company does not have extensive credit established with lenders. However, for some companies, equity financing may not be a good option, as it will reduce the control of current shareholders over the business.

Why is debt a good source of financing?

Companies can benefit from their debt instruments by expensing the interest payments made on existing debt and thereby reducing the company’s taxable income. These reductions in tax liability are known as tax shields. Tax shields are crucial to companies because they help to preserve the company’s cash flows and the total value of the company.

What is debt capacity?

Debt Capacity Debt capacity refers to the total amount of debt a business can incur and repay according to the terms of the debt agreement.

What is compound annual rate of return?

In other words, it is the expected compound annual rate of return that will be earned on a project or investment. that a business must earn before generating value. Before a business can turn a profit, it must at least generate sufficient income to cover the cost of the capital it uses to fund its operations.

Does adding debt increase risk of default?

For a company with a lot of debt, adding new debt will increase its risk of default, the inability to meet its financial obligations.

What is capital structure?

Capital structure is a permanent type of funding that supports a company's growth and related assets. Expressed as a formula, capital structure equals debt obligations plus total shareholders' equity:

What is a firm's judicious use of debt and equity?

A firm's judicious use of debt and equity is a key indicator of a strong balance sheet. A healthy capital structure that reflects a low level of debt and a high amount of equity is a positive sign of investment quality. This article focuses on analyzing the balance sheet based on a company's capital structure.

What are the three capitalization ratios?

The first two are popular metrics: the debt ratio (total debt to total assets) and the debt-to-equity (D/E) ratio (total debt to total shareholders' equity). However, it is a third ratio, the capitalization ratio — (long-term debt divided by (long-term debt plus shareholders' equity))—that delivers key insights into a company's capital position.

What is equity in debt?

In a capital structure, equity consists of a company's common and preferred stock plus retained earnings. This is considered invested capital and it appears in the shareholders' equity section of the balance sheet. Invested capital plus debt comprises capital structure.

What is equity in finance?

Equity consists of a company's common and preferred stock plus retained earnings. What constitutes debt varies, but typically includes short-term borrowing, long-term debt, and a portion of the principal amount of operating leases and redeemable preferred stock. Important ratios to analyze capital structure include the debt ratio, ...

Why is a balance sheet important?

If you are a stock investor who likes companies with good fundamentals, then a strong balance sheet is important to consider when seeking investment opportunities. By using three broad types of measurements—working capital, asset performance, and capital structure —you may evaluate the strength of a company's balance sheet, and thus its investment quality.

Why do we use financial ratios?

Various financial ratios help analyze the capital structure of a firm that makes it easy for investors and analysts to see how a company compares with its peers and therefore its financial standing in its industry. The ratings provided by credit agencies also help in shedding light on the capital structure of a firm.

Optimal Capital Structure

Dynamics of Debt and Equity

Cost of Capital

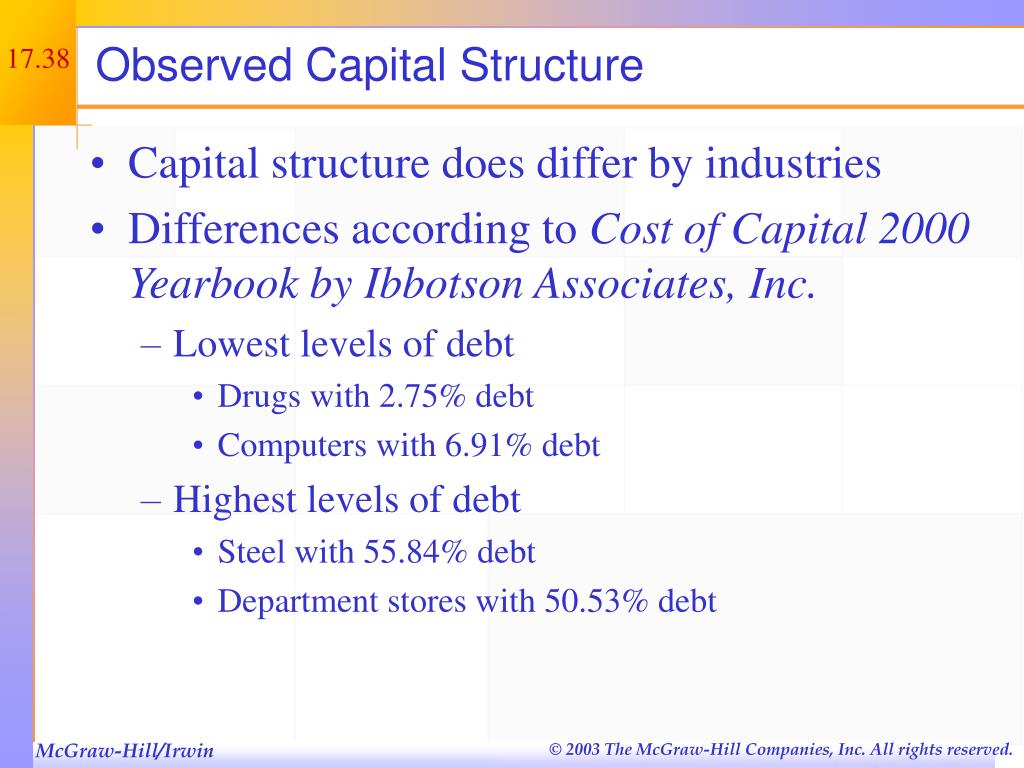

Capital Structure by Industry

How to Recapitalize A Business

Tradeoffs Between Debt and Equity

- There are many tradeoffs that owners and managers of firms have to consider when determining their capital structure. Below are some of the tradeoffs that should be considered. 1. No interest payments 2. No mandatory fixed payments (dividends are discretionary) 3. No maturity dates (no capital repayment) 4. Has ownership and control over the busine...

Video Explanation of Capital Structure

Capital Structure in Mergers and Acquisitions

Leveraged Buyouts

Additional Capital Structure Resources