How big data and analytics are transforming the audit?

How Big Data and Analytics transform the Audit? Auditing presents significant challenges to the safety, data protection, ethics, and honesty of data, especially if data are not standardized. Big data has shown a dramatic influence on profitability, efficiency, and risk management of the entire audit process.

What every IT auditor should know about data analytics?

- Testing complete sets of data, rather than just testing samples.

- Aiding risk assessment through identification of anomalies and trends, perhaps even through comparison to industry data, pointing auditors toward items they need to investigate further.

- Providing audit evidence through comprehensive analysis of organizations’ general ledger systems.

What is an audit analysis?

Audit data analytics involves the analysis of complete sets of data to identify anomalies and trends for further investigation, as well as to provide audit evidence. This process usually involves an analysis of entire populations of data, rather than the much more common audit approach of only examining a small sample of the data.

How much is ACL software?

How much does ACL software cost? On an annual subscription basis, prices range from less than $10,000/year to $1 million or more a year. What is the success rate of ACL surgery? ACL reconstruction surgery has a success rate of 80-90%. However, that leaves an unacceptable number of patients that have unsatisfactory results.

Why is analytics important in audit?

For auditors, the main driver of using data analytics is to improve audit quality. It allows auditors to more effectively audit the large amounts of data held and processed in IT systems in larger clients. Auditors can extract and manipulate client data and analyse it.

What are 3 types of audits?

Key Takeaways. There are three main types of audits: external audits, internal audits, and Internal Revenue Service (IRS) audits.

How do you audit using data analytics?

Determine your data collection method, set the priorities. Communicate with the client, learn about their data standardisation. Collect and analyse the data and implement your findings. Review the various data analytics procedures available to the audit teams and establish what would be beneficial to the audit.

What are the 4 types of audit?

Types of Audit Reports Opinions. There are four different types of audit report opinions that can be issued by the company's auditor based on the analysis of the company's financial statements. It includes Unqualified Audit Report, Qualified Audit Report, Adverse Audit Report, and Disclaimer Audit Report.

What is the most common type of audit?

The first of the four types of tax audits are correspondence audits are the most common type of IRS audits. In fact, they comprise roughly 75% of all IRS audits.

What are different types of audit tools?

Three main types of auditing tools are there. They are, External audits, Internal audits, and Internal Revenue Service audits.

What are the 5 steps of an audit?

Internal audit conducts assurance audits through a five-phase process which includes selection, planning, conducting fieldwork, reporting results, and following up on corrective action plans.

What is data analytics for internal audit?

Data analytics is the process by which insights are extracted from operational, finance and other forms of electronic data, internal or external to the organisation. The insights can be historical, real-time or predictive and also be risk-focused.

What is planning analytics in auditing?

Planning analytics are created for the purpose of identifying risks of material misstatement. Develop your expectations before creating your planning analytics (learn about the entity's operations and objectives; review past changes in numbers for context--assuming you've performed the audit in prior years)

What are the 7 principles of auditing?

The ISO 19011:2018 Standard includes seven auditing principles:Integrity.Fair presentation.Due professional care.Confidentiality.Independence.Evidence-based approach.Risk-based approach.

What is audit in simple words?

Definition: Audit is the examination or inspection of various books of accounts by an auditor followed by physical checking of inventory to make sure that all departments are following documented system of recording transactions. It is done to ascertain the accuracy of financial statements provided by the organisation.

What are key reports in audit?

The financial auditor might use a key report from the information system (i.e., computer) as the key information or an important audit procedure. In this case, the reliance upon the information is critical to the conclusions about the assertion of the account balance, class of transactions or disclosure being tested.

What are different types of audits?

Different types of auditInternal audit. Internal audits take place within your business. ... External audit. An external audit is conducted by a third party, such as an accountant, the IRS, or a tax agency. ... IRS tax audit. ... Financial audit. ... Operational audit. ... Compliance audit. ... Information system audit. ... Payroll audit.More items...•

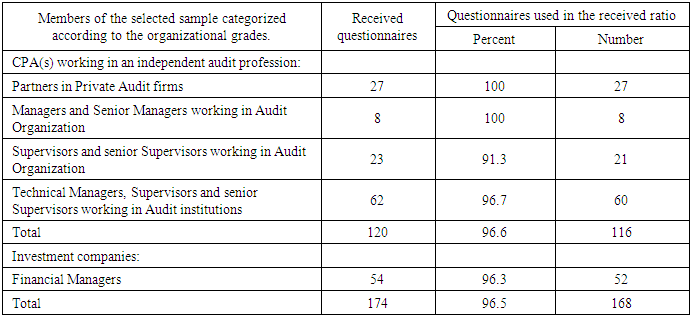

What are types of audit in Ethiopia?

Auditing in Ethiopia could be viewed in five main areas.The office of the auditor general (OAG) ... The audit service corporation. ... Private audit firms.Ministry of finance audit and inspection. ... 'Corporations' and enterprises' auditors.

What are the 5 types of auditors and their functions?

Some of the functions performed by the Government Auditors are:Readiness for Audit.Examination of the report.Financial statement audits.Compliance audits.Performance audits.Internal control testing.Information system control audits.

What is audit and explain types of audit?

Auditing is the process of reviewing and confirming your financial reports. Audits verify that you've created accurate and reliable financial reports and that no fraudulent activities are happening within the business. There are three main types of audits: internal, external, and government or IRS audits.

What is data analytics?

Data analytics is using data to solve problems. Internal audit is identifying risks within the company and evaluating controls (i.e. processes) to figure out how risky they actually are, then designing controls to decrease the risk (i.e. mitigating the risk). Essentially, internal audit data analytics is the process of using data to identify ...

Is "internal audit analytics" abstract?

Even with the less academic definition, it’s still pretty abstract. So what’s one of the best ways to make something concrete? Not to mention, what’s the content most of you are actually looking for when you searched for ‘internal audit analytics’?

What is Audit Data Analytics?

Audit data analytics involves the analysis of complete sets of data to identify anomalies and trends for further investigation, as well as to provide audit evidence. This process usually involves an analysis of entire populations of data, rather than the much more common audit approach of only examining a small sample of the data.

Advantages of Audit Data Analytics

With the more thorough analysis offered by data analytics, an auditor can benefit in several ways. For example, the auditor has better advance planning, since analytics can be used early in an audit to identify problem areas. It also results in better risk assessments, based on any anomalies and trends uncovered.

Disadvantages of Audit Data Analytics

Despite the preceding benefits, the use of audit data analytics can be restricted by the inaccessibility or poor quality of client data, or of data that cannot be converted into the format used by the auditor’s data analytics software.

Market need

As new and emerging technologies continue to flood the marketplace, auditors face a variety of techniques that could potentially transform the traditional financial statement audit, making it more efficient and adding more value.

Audit data analytics

This guide defines ADAs as: “The science and art of discovering and analyzing patterns, identifying anomalies and extracting other useful information in data underlying or related to the subject matter of an audit through analysis, modeling and visualization for the purpose of planning or performing the audit.” Simply put, ADAs are techniques that can be used to perform a number of audit procedures (i.e., risk assessment, tests of details, substantive analytical procedures and in forming an overall conclusion) to gather audit evidence..

The benefits of using ADAs can include

Improved understanding of entity’s operations and associated risks, including the risk of fraud

Guide overview

Guide to Audit Data Analytics will help auditors decide whether — and, if so, how — to use ADAs throughout the financial statement audit. The following chapters are included in the guide:

Conclusion

We believe that Guide to Audit Data Analytics is a critical first step to understanding what ADAs are and how they can be applied to the audit under the current auditing standards. It is crucial for the profession to move forward and stay abreast of these new techniques.

Acknowledgments

The AICPA’s Guide to Audit Data Analytics was developed by its Assurance Services Executive Committee (ASEC) and Auditing Standards Board’s (ASB) Audit Data Analytics Guide Working Group.

About

Serving more than 450 institutions and thousands of professionals globally, Audit Analytics provides corporate gatekeepers and stakeholders with unique data and insights.

History

Audit Analytics was created in the wake of the accounting scandals of the early 2000s.

Mission

Data, when classified and analyzed, increases transparency, enriches debate and makes better, more informed decisions possible.

Why is audit analytics important?

Audit analytics helps mine massive data sets to deliver smaller subsets of high-value data for the auditor to evaluate, improving both audit quality as well as the value of business insights an auditor is able to deliver.

Do human auditors have to be automated?

Even as audits become more automated, human auditors will continue to play an important, if substantially different, role. Some will engage closely with advanced audit analytics and automation systems. Others will assess high-level outcomes of automated and semi-automated audit processes.

What is audit analytics?

Audit analytics tools are ready for your firm. Audit analytics tools are a mature set of software that automate existing audit procedures— they are ready for your firm to adopt today. Take the summer to check out some of the tools and figure out which tool is right for your firm.

What are the two audit analytics tools?

There are two additional audit analytics tools that are also available, ACL and IDEA. These are not included above, as they are more complex to use and require extensive training and some programming knowledge to use effectively. They also are generally more costly than the tools above, so they are usually provided to “specialists” within an audit department, rather than to every auditor. (The rest of the tools mentioned above would usually be provided to every auditor.)

How to gain efficiency in audits?

One of the easier ways to do this is to look at data analytic tools that are designed to help automate the auditor’s work or audit analytics tools.

Is there a right or wrong tool for auditing?

I’ve found that there is no right or wrong tool for a given firm, and just because you’re using a particular vendor doesn’t mean that you should by default select their audit analytics tool. Before you begin to consider these tools, look at your audit engagements and determine which types of tests are performed most often. Then look at which tools perform those tests and whether those tests would be easy for your staff to learn.

Why is the performance of analytical procedures essential in an audit?

Performance of analytical procedures is considered essential from the planning stage to the execution and finalization of the audit. Following are some of the crucial aspects of auditing that are assisted by the performance of the analytical procedures.

Why is it important to have an auditor perform an analytical procedure?

In simple words, if the auditor plans to perform analytical procedures at the execution stage, the sample size for the Test of details can be reduced.

What is performance of analytical procedures?

Performance of analytical procedures is one of the essential procedures used by auditors to assess the risk of material misstatement in the overall engagement and test accuracy of the account balances. An auditor uses these procedures at the following stages of the audit.

Why is performance important in audit?

Further, the performance of the analytical procedures enables auditors to get more insights into their audit client; it enables an auditor to understand their market, industry, external economic conditions, and several other factors to plan, conduct and finalized the audit.

Why is it important to use analytical procedures in planning?

The use of analytical procedures at the planning stage helps to understand the nature of the business, comparative financial performance, the position of an audit client in comparison to industry, and overall risk in the engagement.

What is analytical procedure?

Analytical procedures help an auditor to critically assess if presented financial information has a plausible/logical relationship with other financial and non-financial information.

What is the basic theme of performing the analytical procedure?

The basic theme of performing the analytical procedure is to assess if the fluctuation of the account balance is in line with the reasonably expected spectrum developed based on external and internal factors impacting the business performance.

What is data analytics?

The term Data Analytics is a generic term that means quite obviously, the analysis of data. Hence the term gets used within the world of auditing in many ways. At TeamMate we refer to data analytics, or Audit Analytics, to mean the analysis of data related to the audit.

How does data analytics improve value?

Data Analytics can dramatically increase the value delivered through 100% coverage highlighting every potential issue or anomaly and the ability to get to the root of issues quickly. Join us to see how TeamMate Analytics can change the way you think about audit analytics.

Is it feasible to increase the size of the data analytics team?

Increasing the size of the data analytics team by 3x isn’t feasible. However, raising the bar for other members of the Audit team to perform some analytics is feasible, if they have easy to use tools that they know how to use. At TeamMate we know this to be true because have data to back this up!

Is data a strong support for audit findings?

Similarly, data provides justifiable support for our audit findings. Our findings are so much stronger when we can say that we looked at 100% of the data and found X, Y, and Z. This is so much stronger than sampling, which is why we generally don’t point out in our reports that we sampled, and certainly stronger than other work such as interviewing alone.

Can an audit go without data analytics?

Organizations with this thinking tend to be able to do very deep analysis, but they lack capacity so they can’t go very broad, resulting in most audits going without any data analytics at all.

Does Teammate Analytics do audits?

More than just a generic BI or visualization tool, TeamMate Analytics is specifically designed for Audit Analytics for all auditors.