What are the criteria for a capital lease?

Top 4 Criteria for a Capital Lease

- Ownership. Ownership of a leased asset is transferred to the lessee at the end of the lease agreement. ...

- Bargain Purchase Option (BPO) If the lease agreement contains a bargain purchase option, the lease is called Capital Lease. ...

- Lease Term. ...

- Present Value. ...

What does it mean to capitalize a lease?

When a lease is capitalized, the lessee creates an asset account for the leased item, and the asset value on the balance sheet is the lesser of the fair market value or the present value of the lease payments. The lessee automatically gains ownership of the asset at the end of the lease.

Are capitalized leases intangible assets?

enhancement of an intangible asset.5 Under these regulations, taxpayers must capitalize amounts paid to another party to acquire any intangible from that party in a purchase or similar transactions.6 A “lease” is specifically listed as an intangible within the scope of the rule.7 CCA Application of Law to Fact

What are the major types of leases?

- Gross Lease

- Modified Gross Lease (also referred to as Double Net)

- Net Lease (also referred to as NNN)

What is an example of a capital lease?

A capital lease can be used for a property as well as an asset. For example, a manufacturing company can obtain a piece of production machinery for their operations through a capital lease. Companies use capital leases for land, buildings, ships, aircraft, engines and very heavy machinery.

Which leases are required to be capitalized?

FASB 13 (Topic 840) requires capitalizing lease payments today only if one of the following four conditions exists: The title changes hand at the end of the lease; There is a bargain purchase option (like $1) at the end of the lease; The lease term is > 75% of useful life of the leased assets; or.

What does it mean to capitalize an operating lease?

By capitalizing an operating lease, a financial analyst is essentially treating the lease as debt. Both the lease and the asset acquired under the lease will appear on the balance sheet. The firm must adjust depreciation expenses to account for the asset and interest expenses to account for the debt.

What is the difference between a lease and a capital lease?

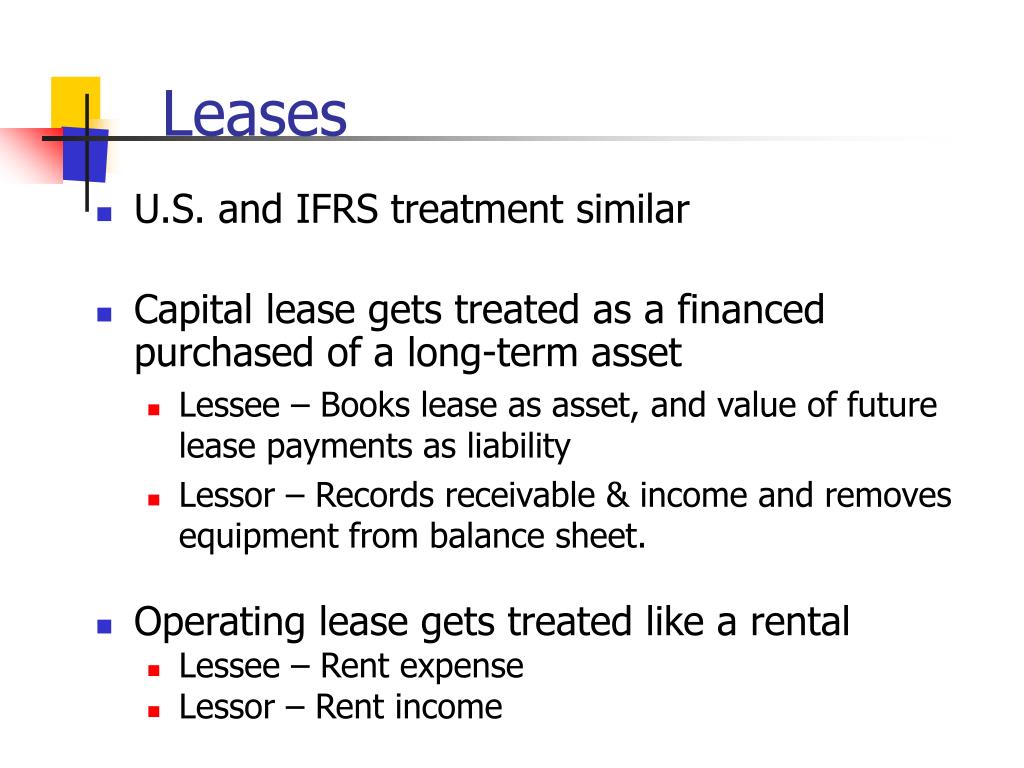

The capital lease requires a renter to book assets and liabilities associated with the lease if the rental contract meets specific requirements. In essence, a capital lease is considered a purchase of an asset, while an operating lease is handled as a true lease under generally accepted accounting principles (GAAP).

What does it mean to capitalize an asset?

Capitalization is an accounting method in which a cost is included in the value of an asset and expensed over the useful life of that asset, rather than being expensed in the period the cost was originally incurred.

How do you convert an operating lease to a capital lease?

How to Convert an Operating Lease To a Capital LeaseDetermine if the life of the lease exceeds 75 percent of the life of the asset. ... Check to see if you will own the asset at the end of the lease. ... Ask if you have the option to purchase the asset at a discount at the end of the lease.More items...•

Should all leases be capitalized?

The first prevalent myth is that all leases must be capitalized, or recorded on the balance sheet with an asset and a liability. While it is true that the vast majority of leases require capitalization under the proposed lease accounting rules, there are some exceptions.

What is the benefit of a capital lease?

Leasing capital equipment: Lowers upfront costs, compared to buying equipment outright. Reduces the chance that your company gets stuck with obsolete equipment, if your contract specifies upgrades. Transfers the cost of equipment maintenance to the leasing company, again according to the terms of your contract.

Do operating leases need to be capitalized?

Capitalizing Operating Leases Operating leases will need to be recorded as equal and offsetting amounts of assets and liabilities. This will not change the amount of equity but will significantly change the debt to equity ratio. The amount to be recorded will be the present value of the future lease payments.

What are the 3 main types of lease?

The three main types of leasing are finance leasing, operating leasing and contract hire.Finance leasing. ... Operating leasing. ... Contract hire.

Should leases be capitalized or expensed?

For accounting purposes, short-term leases under 12 months in length are treated as expenses and longer-term leases are capitalized as assets. For tax purposes, operating lease payments can be written off as expenses during the term of the lease.

What are the 2 types of leases?

The two most common types of leases are operating leases and financing leases (also called capital leases). In order to differentiate between the two, one must consider how fully the risks and rewards associated with ownership of the asset have been transferred to the lessee from the lessor.

Which type of lease must be capitalized quizlet?

FASB says that an entity should capitalize a lease that transfers substantially all the benefits and risks of property ownership, provided the lease is noncancelable.

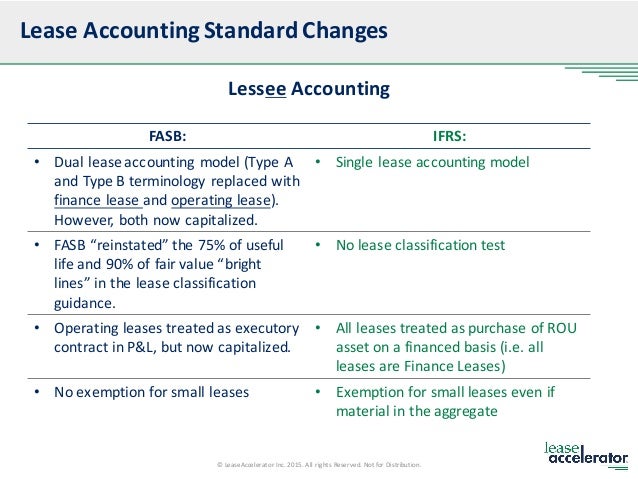

Which type of lease will be capitalized under FASB ASU No 2016 02?

Operating leases The FASB generally expects most leases that were classified as a capital lease prior to ASU 2016-02 to be a finance lease. Similarly, the FASB anticipates that most operating leases will continue to be operating leases.

Are car leases capital or operating?

Capital leases are considered the same as a purchase for tax and accounting purposes. Operating leases cover the use of the vehicle, equipment, or other assets, making payments during the lease term.

Can rent be capitalized during construction?

If the floors are identified as separate components and the amount has been capitalised on the construction of floor basis then the rent from particular floor should be revenue or capital on the basis of the completion of construction.

What Is Capital Lease?

A capital lease is a contract entitling a renter to the temporary use of an asset and has the economic characteristics of asset ownership for accounting purposes .

What is capital lease accounting?

A capital lease is an example of accrual accounting's inclusion of economic events, which requires a company to calculate the present value of an obligation on its financial statements. For instance, if a company estimated the present value of its obligation under a capital lease to be $100,000, it then records a $100,000 debit entry to the corresponding fixed asset account and a $100,000 credit entry to the capital lease liability account on its balance sheet.

What is an operating lease?

An operating lease is different in structure and accounting treatment from a capital lease. An operating lease is a contract that allows for the use of an asset but does not convey any ownership rights of the asset.

How does a capital lease affect a company?

Capital leases can have an impact on companies' financial statements, influencing interest expense, depreciation expense, assets, and liabilities. To qualify as a capital lease, a lease contract must satisfy any of the four criteria. First, the life of the lease must be 75% or greater for the asset's useful life.

Why are operating leases not included in the balance sheet?

Operating leases used to be counted as off-balance sheet financing—meaning that a leased asset and associated liabilities of future rent payments were not included on a company's balance sheet in order to keep the ratio of debt to equity low.

What is the life of a lease?

First, the life of the lease must be 75% or greater for the asset's useful life. Second, the lease must contain a bargain purchase option for a price less than the market value of an asset. Third, the lessee must gain ownership at the end of the lease period.

When did the capital lease amendment become effective?

The amendment became effective Dec. 15, 2018, for public companies and Dec. 15, 2019, for private companies. 1 . Even though a capital lease is a rental agreement, GAAP views it as a purchase of assets if certain criteria are met. Capital leases can have an impact on companies' financial statements, influencing interest expense, ...

How long do you have to capitalize a lease?

According to the amendments made by FASB in 2016, a company must capitalize all the lease agreements that are for more than one year.

How Does Capital Lease Work?

For a lease to be called a capital lease, certain requirements defined by FASB must be met. According to ASC 840, a lease agreement will be a capital lease if:

What is a finance lease?

According to the ASC 842 and IFRS 16, a capital lease or a finance lease can be defined as, When the lessor gives the lessee a right to use a property or asset as a purchased asset, it is called a capital lease or finance lease.

What is lease accounting?

In general, the lease is kind of a rental agreement between two parties. The lessor gives the lessee right to use a certain property or asset for a specific period.

What is the difference between a capital lease and an operating lease?

The main difference between the operating lease and finance lease (capital lease) is the transfer of ownership rights and risks.

When does the transfer of an asset from the lessor to the lessee occur?

The transfer of an asset from the lessor to the lessee will occur at the end of the lease. So the first criteria hold.

What is a monthly lease payment?

The monthly lease payment consists of a portion of interest and capital. As soon as the company receives invoices from the lessor, they will record a portion as interest expense and the remaining principal amount. The interest expense will be debited to the expense account. The remainder value will be debited to the lease liability account, and cash or bank will be credited.

Examples of Capitalized Lease in a sentence

On any date with respect to any Person, in respect of any Synthetic Lease Obligation of such Person, the capitalized amount of the remaining lease payments under the relevant lease that would appear on a balance sheet of such Person prepared as of such date in accordance with GAAP if such lease were accounted for as a Capitalized Lease.

More Definitions of Capitalized Lease

Capitalized Lease means any lease the obligation for Rentals with respect to which is required to be capitalized on a consolidated balance sheet of the lessee and its subsidiaries in accordance with GAAP.

What does capitalized lease mean?

Capitalized Leases means all leases that have been or should be, in accordance with GAAP, recorded as capitalized leases on a balance sheet of the lessee.

What is a lease obligation?

All obligations of the Borrower or any of its Subsidiaries under any rental agreements or leases of real or personal property, other than (a) obligations that can be terminated by the giving of notice without liability to the Borrower or such Subsidiary in excess of the liability for rent due as of the date on which such notice is given and under which no penalty or premium is paid as a result of any such termination, and (b) obligations in respect of any Capitalized Leases or any Synthetic Leases.

Who owns the assets on the consolidated balance sheet?

The Borrower and its Subsidiaries own all of the assets reflected in the consolidated balance sheet as at the Interim Balance Sheet Date or acquired since that date (except property and assets operated under capital leases or sold or otherwise disposed of in the ordinary course of business since that date), subject to no mortgages, Capitalized Leases, conditional sales agreements, title retention agreements, liens or other encumbrances except Permitted Liens.

What are the two types of leases?

The new lease accounting standard still designates two types of leases. Under the old standard, the two types of leases were capital and operating leases. Now, the two types of leases are operating and finance. Though the consideration for operating leases is the same, the consideration for finance leases has slightly changed.

What is an operating lease?

If a lease does not meet any of the five criteria, it is an operating lease. Unlike the old standards, both leases must be accounted for on your balance sheet. 3. There will be an exemption for low-value assets. Under the FASB rules, there is not a standard exemption for low value assets.

How long is a lease term?

Any assets that are leased would be subject to capitalization under the new lease rules, except, as stated above, if the lease term is less than or equal to 12 months. There is, however, a method by which lessees can elect to exclude certain low-value assets.

What are the criteria for financing a lease?

Now, there are five criteria to consider for finance leases: Transference of title/ownership to the lessee. A purchase option that the lessee is reasonably certain to exercise.

When will leases be accounted for?

Any leases outstanding as of December 31, 2019 (2021 for non-public entities) will need to be accounted for under the new lease accounting rules. As a result, it is imperative that companies evaluate the impact of the new lease accounting rules for leases that are currently being signed.

Does the new lease accounting rule increase debt?

The new lease accounting rules will cause an increase in debt. This is probably the biggest misconception about the new lease accounting rules. Under ASC 842, the obligations for operating leases will be recorded as liabilities on the balance sheet, but those liabilities will not be deemed debt. This is another instance in which there is ...

Is there misinformation regarding lease accounting?

There is a lot of misinformation regarding the new lease accounting rules. IFRS 16 and ASC 842 are summarized in other blogs, but this post addresses the most common misconceptions about the lease accounting updates.

What is capital lease?

A capital lease is a lease in which the lessee records the underlying asset as though it owns the asset. This means that the lessor is treated as a party that happens to be financing an asset that the lessee owns. Note: The lease accounting noted in this article changed with the release of Accounting Standards Update 2016-02, which is now in effect.

What is depreciation in capital lease?

Depreciation. Since an asset recorded through a capital lease is essentially no different from any other fixed asset, it must be depreciated in the normal manner, where periodic depreciation is based on a combination of the recorded asset cost, any salvage value, and its useful life. For example, if an asset has a cost of $100,000, no expected salvage value, and a 10-year useful life, the annual depreciation entry for it will be a debit of $10,000 to the depreciation expense account and a credit to the accumulated depreciation account.

What does it mean when a lease payment is recorded as interest expense?

As the company receives lease invoices from the lessor, record a portion of each invoice as interest expense and use the remainder to reduce the balance in the capital lease liability account. Eventually, this means that the balance in the capital lease liability account should be brought down to zero.

How to record a lease payment?

Initial recordation. Calculate the present value of all lease payments; this will be the recorded cost of the asset. Record the amount as a debit to the appropriate fixed asset account, and a credit to the capital lease liability account. For example, if the present value of all lease payments for a production machine is $100,000, record it as a debit of $100,000 to the production equipment account and a credit of $100,000 to the capital lease liability account.

When an asset is disposed of, is the asset credited?

When the asset is disposed of, the fixed asset account in which it was originally recorded is credited and the accumulated depreciation account is debited, so that the balances in these accounts related to the asset are eliminated.

Who owns the leased asset?

Ownership of the leased asset shifts to the lessee following the lease expiration; or

Do leases have to be recorded as capital leases?

Under the old accounting rules, the lessor should record a lease as a capital lease if any of the following criteria are met:

What is capitalization?

Accounting heavily relies on the English language, and the terms used for different types of transactions all mean something intuitive. From Merriam Webster, to capitalize is “to take the chance to gain advantage from.”

Capitalized right-of-use asset example 2: Operating lease

Operating leases are still distinct from finance leases under ASC 842. A key distinction between the two for accountants is that operating lease ROU assets do not have a separate depreciation expense. The lease liability and ROU asset are amortized in tandem by lease expense.

Summary

To capitalize is “to take the chance to gain something from.” Capitalization in accounting is the term used to describe the establishment of an asset. Many types of assets exist, including leased assets.

What is a lease in accounting?

A lease is a type of transaction undertaken by a company to have the right to use an asset. In a lease, the company will pay the other party an agreed upon sum of money, not unlike rent, in exchange for the ability to use the asset. in accounting are operating and financing (capital lease) leases. This step-by-step guide covers all the basics ...

What are the two types of leases?

The two most common types of leases are operating leases and financing leases (also called capital leases). In order to differentiate between the two, one must consider how fully the risks and rewards associated with ownership of the asset have been transferred to the lessee from the lessor.

What is a moral hazard in a lease?

In a lease, the lessor will transfer all rights to the lessee for a specific period of time, creating a moral hazard issue. Because the lessee who controls the asset is not the owner of the asset, the lessee may not exercise the same amount of care as if it were his/her own asset.

What is a lease classification?

Lease classifications. Lease Classifications Lease classifications include operating leases and capital leases. A lease is a type of transaction undertaken by a company to have the right to use an asset. In a lease, the company will pay the other party an agreed upon sum of money, not unlike rent, in exchange for the ability to use the asset.

What is a lease contract?

What is a lease? Leases are contracts in which the property/asset owner allows another party to use the property/asset in exchange for something, usually money or other assets. The two most common types of leases. Lease Classifications Lease classifications include operating leases and capital leases. A lease is a type of transaction undertaken by ...

Why is leasing more flexible than loan?

Leasing provides a number of benefits that can be used to attract customers: Payment schedules are more flexible than loan contracts. After-tax costs are lower because tax rates are different for the lessor and the lessee. Leasing involves 100% financing of the price of the asset.

What is equipment account?

The equipment account is debited by the present value of the minimum lease payments and the lease liability account is the difference between the value of the equipment and cash paid at the beginning of the year.

When do leases have to be capitalized?

The new rule, FASB ASU (Accounting Standards Update) 2016.02, will require that all leases with a term over one year must be capitalized effective for years beginning after 12/15/2021. This will cover existing leases and early adoption is permitted. This new rule applies only to operating leases and not to leases that already were required to be capitalized.

What is the term of a lease for the present value calculation?

The term of the lease for the present value calculation is the non-cancelable period of the lease. This is the period where the cooperative has the exclusive right to use the asset. This will include any periods of free rent which are sometimes at the inception of the lease.

How long until lease obligation is determined for 2022?

There is just one year until this rule is applicable to calendar 2022 financial statements. If a cooperative has any significant operating leases we recommend that you analyze what the implementation of these new rules will mean for your balance sheet. We expect that the determination of the lease obligation will take a significant amount of time. Looking at this now will help you to more easily implement these rules later and to start discussions now with lenders, boards and other users of your financial statements.

How to record lease expense?

Lease expense should be recorded on a straight line basis over the life of the lease. If the lease has a period of free rent at inception that period should be averaged with the payments over the life of the lease to give an equal expense amount each month. This is also the case for a lease where the payments increase each year over the life of the lease by a set amount. If the increases are tied to an index that will only be known each year, such as the CPI (Consumer Price Index), then future payments are assumed not to increase for the purpose of this calculation. In many cases the lease expense to record at the beginning of the lease will be less than the cash actually being paid. This will result in a payable being recorded. In some cases the difference between lease expense and the cash paid will not be material to the financial statements and cooperatives may decide not to follow this part of the lease rules.

What is a tenant improvement allowance?

Lease Incentives or Tenant Improvements Allowance. In some leases, the landlord will pay for some of the improvements needed to make the space useful for the cooperative. The logic in the treatment of the incentive or allowance is that the tenant will be repaying these to the landlord over the course of the lease.

What are the future obligations of a lease?

The future obligations under the lease need to be laid out for the term of the agreement. Any non-lease components, such as maintenance, common area maintenance, or real estate taxes should be removed if possible. If these elements are included in the lease payments with no separate identification, they are considered part of the future obligations of the lease for this calculation. Having an arrangement where the tenant separately pays the property taxes, common maintenance and building insurance, such as a triple net lease, will result in a smaller lease obligation to capitalize.

When will lease accounting change?

The rules for accounting for leases in a set of financial statements in accordance with GAAP (Generally Accepted Accounting Principles) will change significantly starting in 2022. The logic for making the change is that balance sheets are currently very different for businesses that own a building compared to businesses that rent a building.