| Commodity Code | Description | Account Code |

| P2512 | ADVERTISING PROMOTIONS | 637259 |

| P2525 | ADVERTISING RECRUITMENT | 637460 |

| L0106 | AIR FILTRATION EQUIPMENT $200-$1,499 | 638049 |

| L0106NON | AIR FILTRATION EQUIPMENT $$1,500-$4,999 | 639000 |

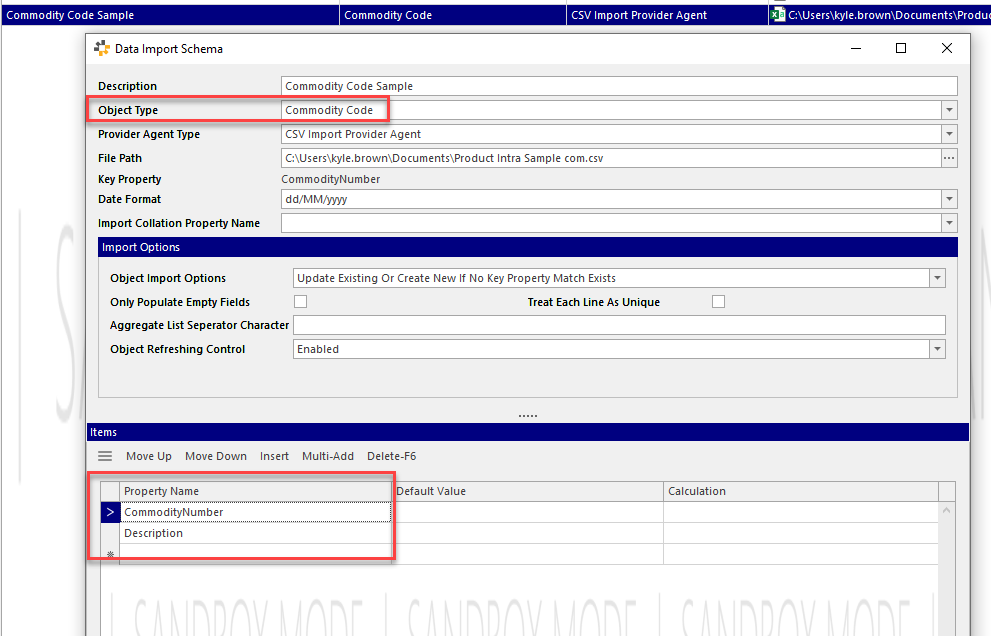

How do I search for commodity codes?

- Benefits of Commodity Codes. Simplified communication between state agencies and vendors about the products and services the state needs and what a business can provide.

- Commodity Code Structure. ...

- Tips for searching for and selecting commodity codes. ...

- Commodity Code Governance Process. ...

- Additional Help. ...

What is a 10 digit commodity code?

The commodity or tariff codes used can vary in length and structure depending on the type of goods, and where they’re moving to and from. For example, goods coming into the UK from outside of the EU will usually have a 10 digit commodity code, which can go up to 14 digits for some products.

What is the meaning of commodity code?

*Helpful Tips:

- Each commodity code has a suggested account code associated with it. ...

- If the code you are looking for isn't found on the list, try searching by a single keyword that best describes the purchase. ...

- We recommend using the first four digits followed by four zeros when searching the commodity code in Ariba by number.

What is NIGP Commodity code?

The accessing features of the Living Code include:

- Real-time access to correct State of Texas commodity or service class and items

- Standardization of generally accepted specifications

- Support for inventory management and procurement planning and management

Is commodity code the same as HS code?

The commodity code determines the duty rates that are levied on the goods, as well as restrictions and prohibitions, among other things. Commodity Codes can also be loosely referred to as Taric Codes, HS Codes, Tariff Codes or Tariff Headings.

What is commodity code USA?

U.S. Commodity Codes The United States uses a modified form of the Harmonized System (HS) as the basis for its classification of imports and exports. The U. S. adds additional digits to the 6-digit HS code to identify products unique to the U.S. markets.

What is EU commodity code?

A commodity code is a sequence of numbers made up of six, eight or ten digits which are used within the European Union (EU) countries or outside the territory of member states.

What is a commodity code Ireland?

Commodity codes are sequence of numbers which classify products for import and export so you can fill in declarations and other paperwork, check if there's duty or VAT to pay and find out about duty reliefs.

How do I find my commodity code?

You can search UK Trade Info to find the right commodity code. You can also use the UK Trade Tariff tool (opens in new tab) to search for import and export commodity codes as well as the tax, duty and licenses that apply to goods.

How do I find the HS code for my product?

The HS code for your product will be listed on the commercial invoice a buyer receives with their order. It may be used to classify products upon export and to calculate applicable taxes and duties upon import.

What is the purpose of commodity codes?

Commodity codes are standard classification codes for products and services used to detail where money is spent within a company. Using these codes tells Procurement Services what kinds of items are purchased most, so we can build better contracts to serve your needs.

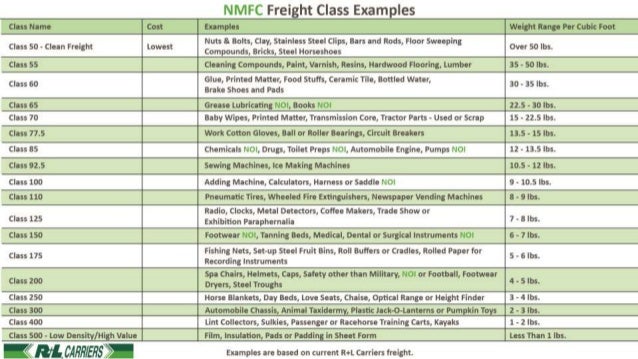

What does a commodity code look like?

Commodity codes are made up with a range of digits that identify a particular product. They specify the type of product, materials used and the production method as follows: HS code digits: It starts with the global standard – Harmonised System, or 10-digit HS code. The UK has used this format since January 2021.

What is an 8 digit commodity code?

Data Element 6/14: first 8-digits of the commodity code This is the first 8-digits of the commodity code used for imports and exports that identifies the goods being declared and decides the rate of Customs Duty needed.

Who can help with commodity codes?

HMRCInformal advice You can use HMRC's Tariff Classification Service to get non-legally binding classification advice. HMRC will try to respond to your email within 5 working days.

Why do customs need to know the customs commodity code for a product?

Why do you need a Commodity Code? The correct declaration of goods enables you to ensure that you pay the right amount of tax and duties, and that you can take advantage of any Customs benefits where relevant, such as duty suspension or preferential duty rates.

Do I need an import code?

SARS Customs in South Africa requires you to produce an Importers Code for customs clearance if you import goods into South Africa more than three (3) times in a single calendar year (either directly or through a clearing agent or courier company). The Importers Codes are issued by SARS.

What are commodity codes used for?

The code for your product helps you see what import or export declarations and other paperwork you need to complete and how to do it correctly.

What is the format of a commodity code?

This is where it gets more complex. Most countries around the world use the World Customs Organization’s trade tariff harmonized system (HS), which comprises more than 5,000 commodity groups, each identified by a six-digit code. However, product specific decisions are particular to each country. If you use the code from an overseas supplier, you must check if the treatment is the same and how much of the code applies in the UK.

What are the first two numbers in a WCO code?

The first two numerals in a code refer to which chapter your goods fall under in the WCO harmonized system. The next four refer to the HS heading and subheading. Digits seven and eight apply to the product’s combined nomenclature (CN) code. Nine and 10, if you need them, refer to the EU customs tariff (Taric) code. 14-digit numbers include an additional Taric code.

How many digits are in a commodity code?

Only the first six digits are used worldwide. In the European Union (EU), most commodity codes have an extra four digits to make 10, but certain goods have 14. To add to the complexity, exports out of the UK only need eight digits, but for imports, you need 10.

What do you need to know when you import goods?

If you import or export goods, you need to understand commodity codes as they classify your cross-border goods. This enables you to complete declarations and other paperwork correctly; check if there’s duty or VAT to pay; and find out about duty reliefs. You are responsible for providing the correct codes for your goods.

How to classify items sold in a set?

If your items are sold in a set to be used together, you should classify them using the most significant item in the set.

What is the UK code for ski boots?

So their code for export from the UK is 64031200. For import to the UK, it is 6403120000.

NAICS

The North American Industry Classification System (NAICS) was developed to assist Federal Statistical Agencies for the collection, analysis, and publication of statistical data concerning the US Economy.

PSF Markets

The PSF Markets Code is a code structure developed by the Public Spend Forum team, combining the work done within PSC, NAICS, NIGP and UNSPSC. The code is being maintained and improved through machine learning algorithms on a continuous basis. Check the PSF code for your business from GovShop!

NIGP

The NIGP Commodity /Services Code is an acronym for the National Institute of Governmental Purchasings Commodity/Services Code. The NIGP Codes is a coding taxonomy used primarily to classify products and services procured by state and local governments in North America. NIGP codes lookup is super easy now from GovShop!

What is the OCP 18th edition?

The Office of Contracting and Procurement (OCP) is pleased to provide online access to the National Institute of Government Purchasing (NIGP) 18th Edition Commodity/Services Code. The NIGP commodity codes have been expanded from a 5-digit to a 7-digit class-item-group format. Online Access to the National Institute of Government Purchasing (NIGP) Commodity Codes is to be used for the purpose of identifying 7-digit commodity code descriptions for goods and services. The commodity code (s) should also be used when completing the Government of the District of Columbia, Office of Contracting and Procurement, Purchase Notification (PN) form, referenced at 9 (b).

Is the NIGP code copyrighted?

The NIGP Code, a product of the National Institute of Governmental Purchasing, is copyrighted material and cannot be downloaded or used in any way other than for use by the District of Columbia government, Office of Contracting and Procurement (OCP), Vendor Registration Program, without a license from Periscope Holdings in Austin, Texas.

What to do if you can't find the commodity code?

If you cannot find the right commodity code for your goods, you can contact HMRC for advice or for a decision on your goods.

When should you classify items in a set?

If your items are packaged in a set to sell and be used together, you should classify them using the most significant item in that set.

Can you pay less customs duty?

you could pay less Customs Duty (for example because your goods are covered by a trade agreement)

Do you need specific information about what your goods are made of?

For certain types of goods, you may need precise details of what your goods are made up of. For these you may want to get advice from an independent laboratory.