10 common types of business ownership

- Sole proprietorship. A sole proprietorship is owned and operated by one individual. ...

- Partnership. A partnership is a form of ownership that involves two or more owners controlling a business. ...

- Limited liability company. ...

- Private corporation. ...

- Cooperative. ...

- Nonprofit corporation. ...

- Benefit corporation. ...

- Close corporation. ...

- C corporation. ...

- S corporation. ...

- Sole proprietorship.

- Partnership.

- Limited liability company.

- Corporations.

- Cooperative.

What is the best type of business ownership?

Review common business structures

- Sole proprietorship. A sole proprietorship is easy to form and gives you complete control of your business. ...

- Partnership. ...

- Limited liability company (LLC) An LLC lets you take advantage of the benefits of both the corporation and partnership business structures.

- Corporation. ...

What are the four basic patterns of business ownership?

Types of Business Ownership

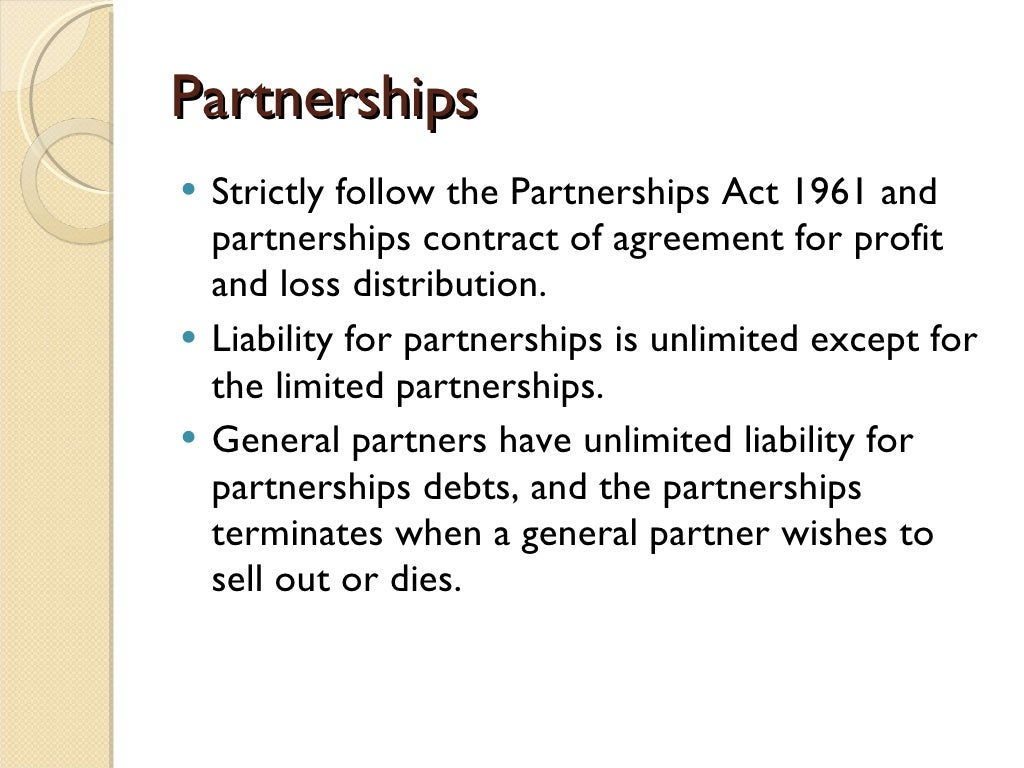

- Partnership. Partnerships are a form of business ownership where two or more people act as co-owners. ...

- Corporations. Unlike the previous two examples, Corporations are a form of ownership that is a legal entity separate from its owners.

- Limited Liability Company. ...

- S Corporation. ...

What are the 4 main forms of business ownership?

Though you may have heard about a number of different types of ownership when researching business options, there are only four primary types that you'll likely have to consider: sole proprietorships, partnerships, limited liability companies and corporations.

What is the most common form of business ownership?

- Sole Proprietorship. A sole proprietorship is the most common form of business organization. ...

- Partnership. A partnership is the relationship existing between two or more persons who join to carry on a trade or business.

- Corporation. A corporate structure is more complex than other business structures. ...

- Limited Liability Company. ...

- Subchapter S Corporation. ...

What are the 4 main types of business ownership?

4 Types of Legal Structures for Business:Sole Proprietorship.General Partnership.Limited Liability Company (LLC)Corporations (C-Corp and S-Corp)

What are the 5 different legal forms of business ownership?

The five major forms of business in the United States are sole proprietorships, partnerships, LLCs, and C and S corporations. Each form has implications for how individuals are taxed, the personal liability of the owners, and how resources are managed and deployed in the set up and operations.

What are the 3 types of business ownership differentiate each?

Here's a rundown of what you need to know about each one.Sole Proprietorship. In a sole proprietorship, you're the sole owner of the business. ... Partnership. A partnership is a non-incorporated business created between two or more people. ... Corporation. A corporation is a legal entity separate from its shareholders.

What are the 3 major forms of ownership?

When you start a business, you have a choice as to how the ownership is legally organized. Business ownership can take one of three legal forms: sole proprietorship, partnership, or corporation.

What is the most common form of ownership?

A sole proprietorship is the most common form of business organization. It's easy to form and offers complete control to the owner.

What is ownership of business?

Business ownership refers to the control over an enterprise, providing the power to dictate the operations and functions.

What are the three forms of business ownership and its advantages and disadvantages?

There are three basic forms of business ownership: sole proprietorship, partnership and corporation. Each of these forms of business organization has advantages and disadvantages in such areas as setting up the company, paying taxes and assessing liability for business debts.

What is the best type of business ownership?

Corporations offer the strongest protection to its owners from personal liability, but the cost to form a corporation is higher than other structures. Corporations also require more extensive record-keeping, operational processes, and reporting.

How many business types are there?

Typically, there are four main types of businesses: Sole Proprietorships, Partnerships, Limited Liability Companies (LLC), and Corporations. Before creating a business, entrepreneurs should carefully consider which type of business structure is best suited to their enterprise.

What are the five 5 types of small business?

Small businesses can choose to organize as a sole proprietorship, partnership, corporation, S corporation or limited liability company.

What are the 5 entity types?

U.S. state governments recognize many different legal entity types, but most small businesses incorporate under one of five entity types: sole proprietorship, partnership, C corporation, S corporation, or limited liability company (LLC).

How many types of legal form of business are there?

There are 4 main types of business organization: sole proprietorship, partnership, corporation, and Limited Liability Company, or LLC. Below, we give an explanation of each of these and how they are used in the scope of business law.

Which is the best legal form of business?

Corporations offer the strongest protection to its owners from personal liability, but the cost to form a corporation is higher than other structures. Corporations also require more extensive record-keeping, operational processes, and reporting.

What are the 4 types of partnership?

These are the four types of partnerships.General partnership. A general partnership is the most basic form of partnership. ... Limited partnership. Limited partnerships (LPs) are formal business entities authorized by the state. ... Limited liability partnership. ... Limited liability limited partnership.

How many forms of business ownership are there?

Here are eight forms of business ownership and their main advantages and disadvantages:

What is a business owner?

A business owner is an individual who has the power to make decisions regarding the operations, functions and direction of their business. They typically delegate tasks to employees to handle the daily organizational activities so they can make high-level decisions that affect the entire business. They are also typically responsible ...

What is a limited liability company?

In a limited liability company, the owner's assets, like their car, house and personal accounts, are protected if their business goes bankrupt. Here are some advantages and disadvantages of a limited liability company:

What is a partnership agreement?

A partnership is a form of ownership that involves two or more owners controlling a business. The joint owners may run the day-to-day activities by themselves or through appointed representatives. In a partnership, the owners sign a formal agreement that clearly states a partner's rights, shares and responsibilities.

Why is it important to own a business?

Owning a business is an important undertaking that offers immense benefits as well as a fair share of challenges. Among many other decisions to make when beginning a business, it is essential to figure out the best structure. In this article, we discuss what a business owner is, different forms of business ownership and the advantages and disadvantages of each.

What is limited liability partnership?

In a limited liability partnership, individual partners don't accept losses caused by another, meaning one partner's possessions can't be seized or sold to pay for the other partner's debts. In an unlimited liability partnership, both partners are responsible for the business.

What is the article of incorporation?

Those starting a corporation submit a document called the articles of incorporation in the state where their business is located. Private corporations allow individuals to buy stock from the corporation, giving the business more capital to grow the business or invest in better technology or tools.

How many different forms of business ownership are there?

Eight Different Forms of Business Ownership. There are eight different forms of legal status for a business. The eight are divided into two distinct categories. One category is driven by profit. The other category is customer oriented. In business, there are generally three goals. Make a profit.

How many new businesses start out as sole proprietorships?

The Internal Revenue Service reports that over 70% of all new businesses start out as sole proprietorships. Why? It is simply the most cost effective form of ownership at the small business level. Most of these businesses are home based and have very low if any pure risk. Furthermore, many do not even get to the level of a micro business (profits less than $100,000/yr).

What is sole proprietorship business?

The sole proprietorship form of business status is ideal for micro-businesses and for home businesses especially those selling general consumer products either over the internet or at weekend events. The risk factor to others is generally none existent or extremely low and there are no employees.

What does it mean when an entrepreneur starts out on his long journey of building a legacy with his business?

His thoughts include: ‘Should I become a limited liability company or an S-Corporation?’; ‘What if I take on partners?’; ‘How do I get more capital without giving up control?’

Why do you need a corporation?

There are other more beneficial reasons to consider corporate status as the form of ownership. First is the ability to raise additional capital. In the partnership format, any new partners must sign the partnership agreement. That signature serves as title to ownership. In the corporation form, the stock certificate serves as title to ownership. Furthermore, a shareholder position does not entitle the bearer to a role in management. It only allows the holder the right to vote for directors that in turn appoint officers to manage the company. The average layman understands this exchange of financial investment for very restrictive rights in regards to corporate structure.

What is the number one goal of an entity?

Six of the eight entity forms are designed to maximize the number one goal – profit. The second category focuses on the third goal of business. Two of the eight forms place this goal as the priority in its legal structure. The following is a table of the two categories and the corresponding entity forms customarily found:

Why isn't a corporation a separate entity?

The best and often compelling reason to not exist in the corporate form is the legal separate entity status. Although beneficial for a layer of protection and recognition as a separate entity, it is also now taxable as a separate entity. With this taxable position there is the possibility of double taxation. Fortunately Congress provides an out to this known as S-Corporation status.

What are the different types of business entities?

There are four major types of business entities based on ownership: let's take a look at each one, and identify their main features. 1. Sole Proprietorship. Going purely by numbers (not size), the vast majority of businesses in the world today are small and medium enterprises. A sole proprietorship is one of the most popular forms ...

What factors to consider when selecting an ownership structure?

When making such a decision, the most crucial factor to consider is the nature of your business, or, to be more precise, the level of risk involved. If it is a highly competitive field, such as hospitality, for instance, it raises the potential risk to your personal finances.

What is sole proprietorship?

A sole proprietorship is one of the most popular forms of ownership for companies such as these. Arguably, the popularity of sole proprietorship stems from its incredible simplicity - setting one up is a breeze when compared to some of the more complex forms of business organisations. All you need are the necessary licenses ...

What is the biggest weakness of a business structure?

However, the single biggest weakness of this structure is, by far, the level of personal liability involved. Since there is no legal distinction between the business and your finances, your personal assets will end up in jeopardy if the business struggles.

Which is better, LLC or corporation?

For something with a bit more control, less compliance and tax requirements than a full-fledged corporation, an LLC is the ideal choice.

Can a business be a partnership?

Essentially, your business functions like a partnership, but with the limited liability of a corporation. If you can provide enough paperwork, you can also avoid getting taxed like a corporation. Like partnerships, you can involve individuals, businesses, trusts and corporations, as well as other LLCs.

Is a corporation a legal entity?

A corporation is considered a separate legal entity, with its own rights, liabilities, and obligations. As an owner, you will only have limited liability in a corporation, which means that even if the business gets sued, your personal assets will escape unscathed. Setting up a corporation is no easy task, though.

What are the different types of partnerships?

Partnership. There are generally two types of partnerships, including a general and limited partnership . There are benefits and disadvantages to each one, particularly in terms of the tax implications and business structure for managers, members, and shareholders. General Partnership.

What is a sole proprietorship?

A sole proprietorship is a one-person business that is not generally registered with the state. Advantages are that it is rather easy and straightforward to form, you need not worry about other opinions as you are the sole operator of your business, and there is very little government regulation on sole proprietorships. Some disadvantages include limited resources to financing, the business ends when the owner dies, and any losses must be specified on the owner’s personal tax return, meaning that the owner is personally liable for the company’s debts and obligations.

What is LLC in business?

An LLC, or a limited liability company, is an attractive business structure for those not wanting to have any personal liability for the company’s losses. An LLC carries many benefits, including the ability to operate as a sole person through a company in which you have no personal financial ties to the losses that your company may incur. Therefore, should you lose a significant amount of money through your LLC, you will not be held personally liable, thus, your personal assets are protected at all time. Furthermore, creating an LLC can help you gain popularity with the public if selling your services or goods. It can also help you obtain loans or financial assistance should you need help.

How are LLCs formed?

LLCs are formed under state laws - which vary state by state - when an individual files the Articles of Organization with the Secretary of State’s office in the state you choose to register.

What is a S corp?

S corporations are known as “pass-through” entities for tax purposes. C corporations are viewed as entirely independent entities from the owners and managers. Before you determine which type of corporation to operate, you’ll want to consider the benefits to each type of corporation.

What is a general partnership?

General Partnership. This type of business structure is created by 2 individuals, each of whom will operate as partners in the business. Each partner will have personal liability in the event that the other partner fails to pay any debts or losses. Furthermore, both partners will be held personally liable to the partnership itself. In order to create a general partnership, the partners can simply draft a verbal or written agreement stating that they intend to enter into a general partnership. There are no specific guidelines that must be adhered to with this type of business structure, as the partners are free to operate the company as they see fit. Note that this type of business structure is quite popular for those specializing in law or medicine.

What are the disadvantages of a business?

Some disadvantages include limited resources to financing, the business ends when the owner dies, and any losses must be specified on the owner’s personal tax return, meaning that the owner is personally liable for the company’s debts and obligations.

Types of ownership in a business – Premise!

Starting a business is one thing, and making it a success is quite another. If you are familiar with accounting, you can recall one of the fundamental lessons of accountancy that any business is a “going concern” means companies are long-term projects. You start them with the belief that they live last perpetually.

Main Types of Ownership in a business

There can be many kinds of business entities in the United States, but the following four are the most important:

Conclusion – Types of ownership in a business!

Now that a budding entrepreneur, hidden in every reader of this article, knows about different types of ownership in a business and their merits and demerits, it will be easier for them to choose the most suitable business model for their dream project.

How many different types of business are there?

Broadly speaking, there are 4 different types of business structures: sole proprietorship, partnership, corporation, and LLC. Let’s talk about each of them (as well as a few variations). a. Sole proprietorship.

How much ownership control do you want?

First, you’ll need to think about how much control you want over your business. Do you want to make all of the leadership decisions and operate solely by yourself? Or are you open to giving up some control if it means growing your business bigger (or getting a more significant investment)?

Why is sole proprietorship the easiest business to start?

A sole proprietorship is the easiest kind of business to start, by far, because you don’t have to take any formal action or file any paperwork to start one. In fact, if you’re already selling a service or a good for money, ...

How long does a sole proprietorship last?

For example, a sole proprietorship lasts as long as the owner is operating the business (or until the business is sold). If you choose to stop operating your business—that’s it. The sole proprietorship automatically terminates (unless you’ve made explicit legal provisions for passing it along).

What is a sole proprietorship?

A sole proprietorship is pretty much the simplest form of business structure—it’s a business owned by one person that is unincorporated (which just means that it’s not a separate legal entity from the person who owns it).

What is a limited partnership?

A limited partnership is a business structure in which at least one partner (often called a silent partner) isn’t involved in the day-to-day operations. For example, a silent partner might invest money in the company but wouldn’t have a big say in making decisions.

What are the continuity factors of a business?

1. Here are the various types of business ownership. First, let’s define what we mean when we use the term “business entity,” or “business type,” or “ownership structure”—they’re all terms that mean, simply, how your business is organized. More specifically, they indicate how the government will view who owns your business, ...

Eight Different Forms of Business Ownership

Risk Management

- Risk is inherent in any business activity. There are some things in life that are certain including death, the proverbial taxation and risk. In business, the greater the risk the greater the reward sought for the risk taken. Risk is divided into two broad categories – pure and market risk. Pure Risk Pure risk is described as controllable. It includes acts of God and accidental errors by hum…

Selection Process

- With small business the key is to keep the eye on the prize. The selection of the proper form of ownership makes this task easier. Since most small businesses are not community service driven or designed to benefit a select few individuals, the non-profit and trust forms of ownership are not a part the selection group. Historically, most small businesses simply followed the pattern of dev…

Tax Consequences

- The reason tax consequences are not the primary driver in the decision model for the form of business is that practically speaking all of the models are taxed at the investor/owner level. Look at the following table: Form of OwnershipTaxation Level Sole Proprietorship Individual Partnership Individual Limited Partnership Individual Corporation Business Entity Level Limited Liability Co. I…

Insights to The Decision Model

- The Internal Revenue Service reports that over 70% of all new businesses start out as sole proprietorships. Why? It is simply the most cost effective form of ownership at the small business level. Most of these businesses are home based and have very low if any pure risk. Furthermore, many do not even get to the level of a micro business (profits less than $100,000/yr). Odds are t…

Summary – Forms of Business Ownership

- There is a profit and risk relationship that affects the form of business ownership. The goal of the particular form of ownership is to reduce market risk and not pure risk. Pure risk which is often a lawyer’s primary concern is managed with insurance and with enforced policies (including corresponding procedures) to prevent accidents. Market risk refers to investment loss. The form …