Receivables consist of several types, namely:

- Accounts Receivable. The definition of accounts receivable is an amount of credit purchases from customers. Receivables arise as a result of the sale ...

- Notes Receivable.

- Other Receivables.

What are the 3 classifications of receivables?

Receivables are frequently classified into three categories: accounts receivable, notes receivable, and other receivables. Accounts receivable are balances customers owe on account as a result of the sale of goods or services. They are usually short-term, unsecured, noninterest-bearing and represent the most significant receivables held by a ...

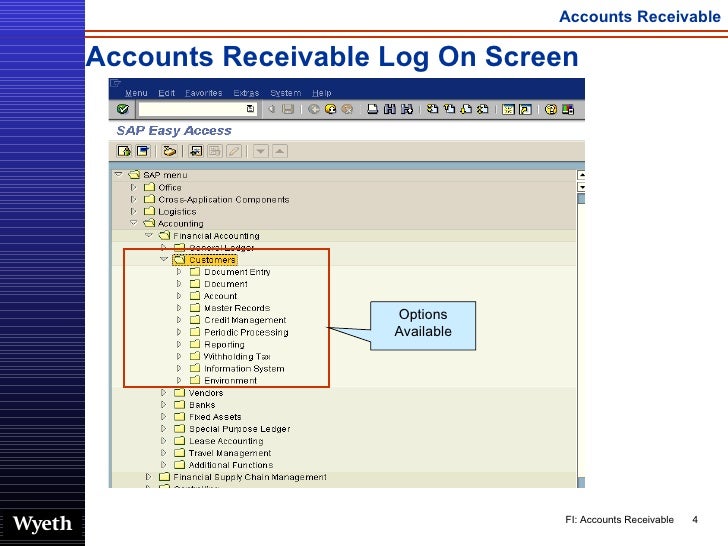

What are the basics of accounts receivable?

Accounts receivable uses a sales ledger to record sales the business has made, the amount of money that has been received for services or goods, and the amount of money that is owed at the end of each month. The accounts receivable team is tasked with tracking and receiving funds on behalf of the company and applying it to current pending balances.

What are other receivables?

- receivables. n.

- assets. n.

- liabilities.

- receivable.

- accounts payable. exp.

- debt. n.

- debtors.

- obligors.

What type of account is accounts receivable?

There are several characteristics of receivables that are important to consider:

- receivables are typically due within 30 days

- receivables may be secured or unsecured

- receivables may be interest-bearing or non-interest bearing

- receivables may be assigned or sold to third parties

- receivables can be a source of cash flow for a company, helping it to continue operating in the face of slow customer payments.

What is the most common type of receivable?

Notes ReceivableOne of the most common categories of receivables is Notes Receivable, which is not all that different from regular Accounts Receivable except for where payment deadlines are concerned. ... This extended payment timeframe is agreed upon between you and the customer (the debtor) by using a promissory note.More items...•

What are two types of receivables?

Generally, receivables are divided into three types: trade accounts receivable, notes receivable, and other accounts receivable.Accounts Receivable. Accounts receivable usually occur because of credit sales. ... Notes Receivable. This receivable has a physical form of a formal letter. ... Other Receivables.

What are examples of receivables?

An example of accounts receivable includes an electric company that bills its clients after the clients received the electricity. The electric company records an account receivable for unpaid invoices as it waits for its customers to pay their bills.

What are the three classifications of receivables explain each?

what are the three classifications of receivables? Accounts Receivable. Notes Receivable. Other Receivable.

What are receivables?

What Are Receivables? Receivables, also referred to as accounts receivable, are debts owed to a company by its customers for goods or services that have been delivered or used but not yet paid for.

What is account receivable category?

current assetsYou can find your accounts receivable balance under the 'current assets' section on your balance sheet or general ledger. Accounts receivable are classified as an asset because they provide value to your company.

What are some common types of receivables other than accounts receivable or notes receivable?

What are some common types of receivables other than accounts receivable and notes receivable? Other receivables include nontrade receivables such as interest receivable, loans to company officers, advances to employees, and income taxes refundable.

What is equity receivables?

Equity Receivable includes Cash Sales Proceeds +/- booked profit/(loss) made from equity. Derivative Receivable. Derivative Receivable includes profit/(loss) made from trading in derivatives segment. Collateral Limit. You can hold the stocks in your demat account as collateral to increase your trading limit.

What are the components of accounts receivable?

Here are five key components of a good accounts receivable system:Verify accounts receivable balances. Use source documents such as invoices to keep balances accurate.Send accurate and timely invoices. ... Generate accounts receivable reports. ... Post the paid invoices. ... Match your records.

What is the difference between accounts receivable and other receivable?

However, both accounts are different in nature. Trade receivables are the receivable from credit sales that the company sells its goods or products while Other receivables are the receivable from non-trading activities.

What Does trade and other receivables mean?

Trade receivables are defined as the amount owed to a business by its customers following the sale of goods or services on credit. Also known as accounts receivable, trade receivables are classified as current assets on the balance sheet.

What are some common types of receivables other than accounts receivable and notes receivable?

What are some common types of receivables other than accounts receivable and notes receivable? Other receivables include nontrade receivables such as interest receivable, loans to company officers, advances to employees, and income taxes refundable.

What is the difference between trade and non trade receivables?

What are trade and nontrade receivables? Trade receivables are those accounts that arise from the sale of goods or services that the company has received an unconditional legal right to payment. Nontrade receivables are those accounts that do not meet this criterion.

What is the difference between accounts receivable and other receivable?

However, both accounts are different in nature. Trade receivables are the receivable from credit sales that the company sells its goods or products while Other receivables are the receivable from non-trading activities.

How are receivables different from accounts payable?

Accounts payable and receivable are the complete opposites in accounting. The differences between them are briefly described in the definitions tha...

What are the two major types of receivables in accounting?

Accounts receivable The proceeds or money that the company will receive from its customers who have purchased goods and services on credit is refer...

Are all receivables accounts receivable?

Accounts receivable are considered receivable, but not all receivables are considered AR. Receivables also include nontrade receivables that are tr...

What is accounts receivable?

The meaning of accounts receivable is a claim or bill that we can get from other parties. In bookkeeping, the types of receivables are listed in the financial statements if the person/company has not received payment from the sale, loan, or other transaction. Since it is an obligation, accounts receivable usually have a certain period ...

What happens if an installment period exceeds one year?

If the installment period exceeds one year, it is not reported to exist assets but enters another group of assets. This is the definition of accounts receivable, the difference between accounts payable and receivable, and the types of accounts receivable in accounting that can illustrate the obligation to pay loans to other parties.

How long does it take to pay accounts receivable?

It arises as a result of buying goods or services on credit. In general, the payment period ranges from one to two months.

What is trade receivable?

Meanwhile, trade receivables are claims that a person has against another person or business entity that owns or must pay a certain amount of money against him within a certain period. Receivables are included as one of the current assets in the company’s balance sheet.

Is accounts payable the same as accounts receivable?

But despite having almost the same naming, the fact is that accounts payable and accounts receivable are two very different things. Debt is an obligation in the form of money that a person must pay to the creditor.

Is a shipment of items to be stored recorded as receivables?

What these accounts receivable want are bills paid in money. Therefore shipment of items to be stored is not recorded as receivables until the items deposited have been sold out. The accounts receivable from sales in installments will be separated into current and non-current assets depending on the installment period.

Can notes be reported separately on the balance sheet?

Due to their general nature, notes can be reported separately on the balance sheet.

What is interest receivable?

This is interest earned on Notes Receivable or other assets are added to the Interest Receivable account at the end of each accounting period. Other receivables include loans made to employees or other companies and advances on wages paid to employees.

What is Accounts Receivable?

If you’re running your own business, you probably already know about Accounts Receivable in the general sense: it’s money owed to you that you haven’t yet received. When you allow a customer to purchase something from you on credit, you’re extending them a loan. They, in turn, must make payment within a certain set timeframe.

Can a receivable be extended?

Whereas you would normally give a customer a two-month window to repay you with a regular receivable, with Notes Receivable this payment due date can be extended, generally up to a year or longer.

Is a note receivable a long term asset?

If the note comes due within a year or less, then the Note Receivable is part of your current assets and will be noted as such on your balance sheet. If the note gives the debtor more than a year to pay, then the receivable becomes a long-term asset.

The characteristics of accounts receivable are

The characteristics of receivables can be analyzed through the length of debt that must be paid before the agreed time.

Types of Receivables Are

The definition of accounts receivable is an amount of credit purchases from customers. Receivables arise as a result of the sale of goods or services.

Manage Accounts Receivable in Business with Accounting Software

Receivables in a business are important things that must be managed properly to get benefits for a company, as well as encourage the achievement of company goals.

How does a company improve its cash flow?

To improve cash flow, a company can reduce credit terms for its accounts receivable or take longer to pay its accounts payable. This shortens the company's cash conversion cycle, or how long it takes to turn cash investments such as inventory into cash for operations.

How long does it take for a receivable to become cash?

A receivable does not become cash until it is paid. If the customer pays the bill in six months, the receivable is turned into cash and the same amount received is deducted from receivables. The entry at that time would be a debit to cash and a credit to accounts receivable.

What does 30% of sales on a widget mean?

Recording Receivables. If a company sells widgets and 30% are sold on credit, it means 30% of the company's sales are in receivables. That is, the cash has not been received but is still recorded on the books as revenue. Instead of a debit to increase to cash at the time of sale, the company debits accounts receivable and credits ...

Why are receivables considered assets?

They are considered a liquid asset, because they can be used as collateral to secure a loan to help meet short-term obligations. Receivables are part of a company’s working capital. Effectively managing receivables involves immediately following up with any customers who have not paid and potentially discussing a payment plan arrangement, if needed. This is important because it provides extra capital to support operations and lowers the company’s net debt .

When are receivables recorded?

Receivables are recorded at the time of a sale when a good or service has been delivered but not yet been paid for. Receivables will decrease when payment from customers is received. The amount of receivables estimated to be uncollectible is recorded in an allowance for doubtful accounts. 1:19.

What is receivable in accounting?

Receivables, also referred to as accounts receivable, are debts owed to a company by its customers for goods or services that have been delivered or used but not yet paid for.

Do companies have to use allowance method to estimate uncollectible expenses?

Therefore, companies must estimate a dollar amount for uncollectible account s using the allowance method.

What is GAAP call for?

In order to help statement readers assess earning power, GAAP call for the reporting of interest income earned from receivables and the losses incurred through non-collection. In order to help the assessment of solvency, accountants categorize receivables by when they are due. Receivables expected to be collected within 12 months or the operating cycle are classified as current. All others are noncurrent. Additionally, accountants disclose the net amount of cash that is expected to be collected, as well as any collateral agreements.#N#In order to help users make other decisions, GAAP call for other disclosures regarding receivables. One of the most commonly used methods for providing this information involves distinguishing trade from nontrade receivables. Trade receivables arise from normal transactions with customers. Nontrade receivables, on the other hand, arise from transactions that are outside this normal line of activity. Users may be interested in knowing the origin of these receivables as well as the amounts and due dates.#N#This form of disclosure is helpful in dealing with related-party transactions between the firm and (1) another affiliated company, (2) a stockholder, (3) an employee, or (4) a family member of a stockholder or employee. The purpose of the disclosure is to reveal that the receivable arose from a transaction which may not have been executed at arm’s length. Consequently, receivables from these related parties are separately identified in order that users are aware of the underlying events.#N#Other categories of nontrade receivables are disclosed separately if there is significant information conveyed to the reader by doing so. In the event that separate classification is not helpful, they can be combined into a single other receivables item.

What is nontrade receivable?

Nontrade receivables, on the other hand, arise from transactions that are outside this normal line of activity. Users may be interested in knowing the origin of these receivables as well as the amounts and due dates.

Why are receivables more risky than cash?

Compared to cash, there is more risk associated with receivables because of the possibility of not collecting the total amount due. This risk can be reduced by a collateral agreement with the debtor. The risk can be tolerated if it produces income through finance charges or through increased sales. Management tries to reduce the risk by controlling the procedures for granting credit. Controls are also created to assure that the balances of the receivables are correctly stated and that the debtors are correctly billed.

What is the primary source of receivables?

The primary sources of receivables are transactions with customers in which they are allowed to pay later. These items are collectively labeled as trade receivables. Receivables occasionally arise from lending cash to others, but these transactions are unusual for most businesses that are not financial institutions.

When do accountants disclose receivables?

Accountants disclose receivables when the reporting company has the right to receive cash, some other asset, or services from another party. Generally, only existing legal rights are disclosed in the body of the balance sheet. Contingent (or potential) rights to collect may be disclosed in the footnotes if they are material and if sufficient information is provided to allow the reader to understand the contingency.#N#For example, if the management believes that it will win a lawsuit that it filed against another company, a receivable cannot be recorded until management has signed a settlement or the court has entered judgment in its favor. The primary sources of receivables are transactions with customers in which they are allowed to pay later. These items are collectively labeled as trade receivables. Receivables occasionally arise from lending cash to others, but these transactions are unusual for most businesses that are not financial institutions. Other types of transactions may create receivables, such as payments of advances and deposits, or filing for tax refunds.

What is accounts receivable?

Accounts receivable – Definition. Accounts receivable result from the credit sales, and for many retailing firms, accounts receivable represents a substantial portion of their current assets. The function of the credit department is to establish and enforce credit policies. Credit policies should protect the firm against excessive bad debts ...

How does management reduce risk?

Management tries to reduce the risk by controlling the procedures for granting credit. Controls are also created to assure that the balances of the receivables are correctly stated and that the debtors are correctly billed.

What is combined balance in accounts receivable and allowance accounts?

The combined balances in the accounts receivable and allowance accounts represent the net carrying value of accounts receivable. The seller may use its accounts receivable as collateral for a loan, or sell them off to a factor in exchange for immediate cash.

Why is credit granted?

Credit is usually granted in order to gain sales or to respond to the granting of credit by competitors. Accounts receivable is listed as a current asset on the seller’s balance sheet.

Do notes receivable have to be written?

Like accounts receivable, notes receivable arise in the ordinary course of business; but unlike accounts receivable they are in written form. Notes receivable usually require the debtor to pay interest. They may be current and non-current.

When did JT pay $100,000?

Testing was completed on 30 April and the software became operational. JT paid an amount of $100,000 on 15 May. JT had to settle another large liability in April which resulted in it not being able to pay the remaining invoice amount (i.e. $100,000) by 30 May.