What are due diligence documents in real estate?

- Do a title review.

- Inspect the property thoroughly.

- Consider the surrounding property and neighborhood.

- Examine recent sales activity.

- Review price trends.

- Find out how many homes in the area are in foreclosure.

- Look at the upside potential.

- Go to open houses.

What are due diligence reports?

- For Acquisition

- For Investment

- For Listing

What does due diligence mean when you buy a property?

To accomplish proper due diligence, examine:

- the deed and title review,

- the documents covering the various insurance policies,

- the surveying documents,

- the property inspections, and

- the environmental assessments.

What is due diligence when buying land?

KUALA LUMPUR: Bank Negara Malaysia (BNM) had not carried out adequate due diligence when buying the RM2.07 billion piece of government land in Kuala Lumpur to pay off 1MDB's debts, read the Public Accounts Committee (PAC) report. The report which was ...

What is EITC due diligence?

- Earned income tax credit (EITC),

- Child tax credit (CTC), additional child tax credit (ACTC), credit for other dependents (ODC),

- American opportunity tax credit (AOTC), or

- Head of household (HOH) filing status.

What is due diligence documentation?

Due diligence documents are the research and analysis of a company or organization done in preparation for a business transaction (such as a corporate merger or purchase of securities). Due diligence documents typically include the following categories; legal, financial, sales and marketing, and human resources.

What is due diligence example?

Due Diligence Examples A business exhaustively examining another to determine whether it is a sound investment prior to initiating a merger. Consumers reading reviews online prior to purchasing an item or service. People checking their bank accounts and credit cards frequently to ensure that there is no unusual ...

What does due diligence include?

Due diligence is defined as an investigation of a potential investment (such as a stock) or product to confirm all facts. These facts can include such items as reviewing all financial records, past company performance, plus anything else deemed material.

How do you conduct due diligence on property?

Real Estate Due Diligence: 10 Steps to Take Before You BuyDo a title review. ... Inspect the property thoroughly. ... Consider the surrounding property and neighborhood. ... Examine recent sales activity. ... Review price trends. ... Find out how many homes in the area are in foreclosure. ... Look at the upside potential. ... Go to open houses.More items...•

What are the three 3 types of diligence?

Types of Due Diligence - Financial, Legal, HR and more | Ansarada.

What is due diligence when buying a house?

First things first: due diligence in real estate refers to a buyer's investigation of the various aspects of a property, either before making an offer or (more often) within a specific timeframe between entering into the contract and closing, known as a due diligence period.

What is a due diligence checklist?

A due diligence checklist is an organized way to analyze a company that you are acquiring through sale, merger, or another method. By following this checklist, you can learn about a company's assets, liabilities, contracts, benefits, and potential problems.

What Are due diligence requirements?

What is due diligence? Basically, the IRS requires that a tax preparer who prepares a return for a client that claims any of these credits or head-of-household status thoroughly interview and question the taxpayer and collect documentation to show that the taxpayer is qualified for the tax advantage.

What are the 3 due diligence check?

Property agents representing landlords and tenants must conduct these three checks: Check original immigration/work or other passes of the tenant for forgery. Keep photocopies of these passes. Cross-check particulars on these passes against original passports.

Is due diligence the same as earnest money?

The Due Diligence Fee is Not Earnest Money. Due diligence money is non-refundable, whereas earnest money is refundable if the buyer decides not to buy the home within the due diligence period. Earnest money is usually a much larger amount than the due diligence fee.

How much does due diligence cost?

Typically, the amount ranges anywhere from three to five percent of the offer price of a home. Sometimes you may hear someone refer to this fee as “good faith” money, as it is a fee that you are giving the buyer directly to let them know that you are serious about buying the property.

What is the purpose of a due diligence period in real estate?

Signing a contract to purchase a home is just the beginning. Homebuyers must then navigate the due diligence period, which allows them to inspect the property and review important information before closing on the sale.

What is due diligence in real estate?

In the world of investment transactions, due diligence is a legal term for “do your homework.”. Before buying a property, you should fully investigate it for potential problems that could cost major money to fix after you’ve moved in, and verify that you still want to buy the property. “Due diligence in residential real estate means [making sure] ...

Is due diligence important when buying a home?

Due diligence is definitely a process worth taking seriously when you buy such an important asset. Here’s a checklist of what you’ll want to scrutinize before closing the deal.

Does the seller have to fix every item the buyer finds?

The seller is not obligated to fix every item the buyer or an inspector finds. If you discover during due diligence that the home has defects that should be fixed, you have time to negotiate with the seller, who may agree to fix the defects or lower the home price.

What is due diligence in rental property?

As a rental property investor, due diligence helps you to verify that you are getting the property and cash flow that you’re paying for.

How long is due diligence for real estate?

In most residential real estate purchase contracts, the due diligence period is “boilerplate” or pre-defined in the contract. Some states have a period of 10 days, others 15 days or more . Sometimes the clock starts ticking on the due diligence period when the real estate contract is executed between buyer ...

What happens if you extend due diligence?

If you need to extend the due diligence period and the seller refuses, you could be at risk of losing your earnest money deposit if you decide not to proceed with the purchase. When you invest in income-producing real estate, there’s much more to consider than just the physical condition of the property. Here’s how the due diligence process works ...

What is the obligation of a seller to disclose material facts and known defects about the property?

A seller has the obligation to disclose material facts and known defects about the property in writing, usually in the form of a seller disclosure statement . Sellers who are long-distance real estate investors may ask their property manager to provide certain information, since the owner may honestly not know much about the property.

Do you need to do due diligence before making an offer?

There’s quite a bit of due diligence you can do before making an offer on a property . The more information you have ahead of time, the better you’re able to structure an offer that makes good business sense:

What is Due Diligence In Home Buying?

Due diligence basically means, doing your homework before buying real estate. Whether you are looking at a single-family home, duplex, or multi-unit rental property, there are several due diligence items to perform in order to minimize risk and potential cost upon purchase.

Why Do I Need to do My Own Due Diligence?

While real estate investment companies, like RealWealth, uses its best efforts and proven protocols to screen, review and understand the operations of each of its “property teams” or investment properties, it’s always recommended that investors perform his or her own due diligence prior to purchasing.

Real Estate Due Diligence Documents & Checklist

If you are new to real estate investing and unsure where to start with your own due diligence, there are several free resources available. Property Metrics offers a comprehensive due diligence checklist, along with hundreds of documents available to download.

9 Essential Due Diligence Items for All Real Estate Transactions

Many first-time buyers look at just a few properties before putting in an offer and purchasing real estate. The pitfall here is that you have no idea what else is out there because your sample size is so small.

Due Diligence Real Estate Contracts

Buyers and sellers work together to negotiate a contract that should include a defined real estate due diligence period. While a 17 day due diligence period is the default length of time in California, both parties can customize how long this period lasts, typically between one and 30 days.

Due Diligence in Commercial Real Estate

Commercial real estate due diligence works a little bit differently than residential or land. The first step, is to clearly define your objectives for buying commercial property.

Land Due Diligence

Just as buying commercial property requires certain additional due diligence, the same goes for purchasing land. It usually takes more time and work to perform due diligence on vacant land than an existing home. Below, we will cover a list of important due diligence items unique to buying land.

What is due diligence in real estate?

Due diligence is a key part of acquiring commercial real estate. For buyers, the due diligence process is a time consuming and costly process. But, it is necessary to uncover facts and circumstances that may impact the value of the property being acquired. It may also lead the buyer to the conclusion that they are either getting a great deal, ...

What is a copy of lease?

A copy of all leases (including all exhibits and attachments) and amendments, including guarantees and subleases. A copy of or access to review the tenants’ files maintained by the seller. Most recent financial statements and credit information and reports, if any, for all tenants and guarantors.

What is a copy of a notice of violation?

Copies of any notices of violations of or verifications of compliance with any federal, state, municipal, or other health, fire, building, zoning, safety, environmental protection, or other applicable codes, laws, rules, regulations, or ordinances relating or applying to the property.

What is a copy of a real estate tax bill?

Copies of real estate tax bills (including special assessments ) for the prior three (3) years, including evidence of payment of each.

Can sellers anticipate buyers during due diligence?

Sellers can anticipate the requests buyers will make during the due diligence and take preparatory steps to expedite the sale of commercial real estate, including organizing and preparing due diligence documents for buyers in advance of placing the property on the market. See below for a detailed, though not fully comprehensive, ...

Is due diligence important for commercial property?

Since most commercial property sales are done on an “as-is” basis (with minimal or no representations and warranties), conducting proper due diligence is especially important to buyers. Although there are many elements of the due diligence process, including obtaining new third-party inspection reports and a title report, ...

Can a buyer's list be wonowed down?

Depending upon the information available to the seller, the buyer’s list may be winnowed down by the seller during negotiations. This process, in itself, may provide the buyer with insight into unquantifiable risks or costs that will be incurred to obtain the information.

What is due diligence in real estate?

Due Diligence for Commercial Real Estate. The term “commercial property” encompasses a large range of properties. If you’re thinking about buying commercial property, you have a particular purpose for the property in mind. Whatever this purpose may be, the property should fit your vision if you’re buying it.

What is the second item on a due diligence checklist?

Surveying. Proper surveys should be the second item on your due diligence checklist. Surveying allows you to evaluate the boundaries and legal description of the property compared to the actual land. Completing a survey will show if there is an encroachment on the property.

Why is preliminary due diligence important?

One of the primary reasons why preliminary due diligence is important in commercial and residential real estate transactions is so that the buyer can properly analyze the property’s value to create an offer strategically.

What is title review?

Title Review. The title review should be the first item on your due diligence checklist. The title is the transferable legal right to the property. Note, the title review isn’t the same thing as the deed. The deed refers specifically to the document used to transfer property.

How long does due diligence last?

The due diligence period will typically last anywhere from 30 days after closing to more than 9 months after. The safest bet is to complete your due diligence duties before the closing. Remember, if you want to build a bar, you don’t want to buy property in a zone that forbids alcohol sales.

What to consider before sealing a deal?

There are several things to consider before sealing the deal: the title search, the conditions of the property, the inspections, and the zoning rules. Additionally, there are numerous federal laws regulating various factors like the property survey, mortgages and other loans, insurances, and taxes.

What are some examples of relevant documents?

Examples of relevant documents are: the deed [pay attention to the type of deed] and the title review; existing, actual uses of the property; information about any current lessees; encumbrances, covenants, and zoning documents; any notices regarding currently pending or past legal and governmental actions ;

Breaking Down the Real Estate Due Diligence Process

Investors work off of real estate investment due diligence checklists to ensure that they’ve identified all potential risks a new deal holds. Throughout this process, the goal is to identify and understand any risk that could threaten the deal’s projected ROI.

Preliminary Checklist

Investment management teams work scrupulously to ensure that no stone is left unturned throughout the due diligence process. The preliminary stage is the first round of thorough inspections into regulations, tax implications, and other factors that could preclude profitability.

Site Underwriting Due Diligence Checklist

Further along in the deal lifecycle, investors perform the site underwriting process. This second leg of the real estate due diligence process is the final opportunity for investors to vet the property and learn everything they need to know.

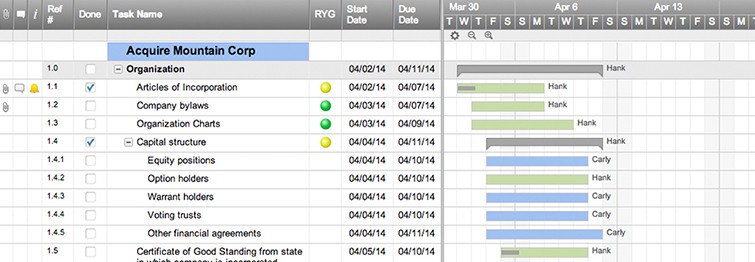

Digitally Systematizing the Real Estate Due Diligence Checklist

At a high level, the goal of due diligence is always to ensure that no minor details slip through the cracks, which might otherwise cause investors to incur unexpected expenses further down the line. Not all due diligence processes are the same, though.

Creating Visibility and Accountability

Standardizing due diligence checklists benefits firms in a number of other ways. After data is passed from the acquisition team to another team, deal management platforms ensure that all changes are tracked, and that up-to-date data is readily available to the entire organization.

Take Your Real Estate Due Diligence Checklist to the Cloud

Due diligence is inevitably a collaborative process, but many teams without modernized technology struggle to piece together data and checklists across various systems. Nonetheless, like all other steps throughout the investment process, maintaining clear visibility into how deals are progressing is crucial.

What is due diligence in real estate?

Before proceeding into any form of negotiations, it is vital to be aware of the reputation and track record of the seller. The full vetting of the seller may unearth facts that can sour the idea of the purchase altogether, e.g., a seller may be subject to money-laundering investigation or is a wanted criminal which could lead to possible seizure of the property by enforcement authorities.

Is a title deed enforceable?

At the risk of sounding blunt, owning a property is as much as holding a title deed to that property as in the absence of the latter, ownership rights are not recognised and enforceable. Therefore, numerous legal documents such as title deeds, leases, zoning regulations, tax certificates, surveyor’s reports, etc. must be assessed, evaluated, and verified. All these documents should be securely shared via a virtual data room (VDR) during real estate transaction.