Key Takeaways

- Like any business organization, the Federal Reserve maintains a balance sheet listing its assets and liabilities.

- The Fed's assets include various Treasuries and mortgage-backed securities purchased in the open market and loans made to banks.

- Liabilities for the Fed include currency in circulation and bank reserves held at commercial banks.

| Asset | 2019 | |

|---|---|---|

| 1 | Total | 129,479 |

| 2 | Gold stock1 | 11,041 |

| 3 | Special drawing rights2 3 | 50,749 |

| 4 | Reserve position in International Monetary Fund2 5 | 26,153 |

What are the major assets of the Federal Reserve System?

What are the main assets and liabilities in the Federal Reserve System? ... The main assets are treasury and government agency securities, treasury currency, and gold and foreign exchange. Identify the monetary policy tools used by the federal reserve! LG 4-3.

What are Federal Reserve liabilities?

The major items on the liability side of the Federal Reserve balance sheet are Federal Reserve notes (U.S. paper currency) and the deposits that thousands of depository institutions, the U.S. Treasury, and others hold in accounts at the Federal Reserve Banks.

What were the Federal Reserve's large-scale asset purchases?

With short-term interest rates at nearly zero, the Federal Reserve made a series of large-scale asset purchases (LSAPs) between late 2008 and October 2014. In conducting LSAPs, the Fed purchased longer-term securities issued by the U.S. government and longer-term securities issued or guaranteed by government-sponsored agencies such as Fannie Mae or Freddie Mac.

Does the Federal Reserve buy and sell stocks?

While the Fed is ostensibly barred from buying stocks, it may be able to find a loophole that does not involve a legal expansion of its mandate.

See more

What is the major asset of the Federal Reserve?

The major asset of the Federal Reserve is currency outside banks and the major liability is U.S. Treasury securities. 3. The seven members of the Board of Governors of the Federal Reserve System serve 14-year nonrenewable terms.

Are reserves assets or liabilities for the Fed?

Like balances in the TGA, commercial banks' reserves are Fed liabilities—they account for a large part of the electronic liabilities category in figure 1. As a result, when the government uses its checking account, the size of the Fed's liabilities remains the same, but the composition changes.

Where does the Federal Reserve get the money to buy assets?

The Federal Reserve is not funded by congressional appropriations. Its operations are financed primarily from the interest earned on the securities it owns—securities acquired in the course of the Federal Reserve's open market operations.

How much money does the Federal Reserve have 2022?

about $8.9 trillionOverall, as shown in table 1, the size of the Federal Reserve's balance sheet increased roughly $490 billion from about $8.4 trillion on September 29, 2021, to about $8.9 trillion as of March 30, 2022.

What assets is the Fed buying?

From June 2020 to October 2021, the Fed bought $80 billion of Treasury securities and $40 billion of agency mortgage-backed securities (MBS) each month. As the economy rebounded in late 2021, Fed officials began slowing—or tapering—the pace of its bond purchases.

Who owns the Federal Reserve?

The Federal Reserve System is not "owned" by anyone. The Federal Reserve was created in 1913 by the Federal Reserve Act to serve as the nation's central bank. The Board of Governors in Washington, D.C., is an agency of the federal government and reports to and is directly accountable to the Congress.

Does Federal Reserve print money?

The Fed does not actually print money. This is handled by the Treasury Department's Bureau of Engraving and Printing. The U.S. Mint makes the country's coins.

What do banks do with the money not held in reserve?

Required and Excess Bank Reserves Banks have little incentive to maintain excess reserves because cash earns no return and may even lose value over time due to inflation. Thus, banks normally minimize their excess reserves, lending out the money to clients rather than holding it in their vaults.

How much is the Federal Reserve worth?

$8.5 trillionOverall, as shown in table 1, the size of the Federal Reserve's balance sheet increased from about $7.4 trillion at the end of 2020 to nearly $8.5 trillion as of September 29, 2021.

What is the US dollar backed by?

Why Is Fiat Money Valuable? In contrast to commodity-based money like gold coins or paper bills redeemable for precious metals, fiat money is backed entirely by the full faith and trust in the government that issued it. One reason this has merit is that governments demand that you pay taxes in the fiat money it issues.

Which country has highest gold reserve?

the United StatesAs of December 2020, the United States had the largest gold reserve – more than 8,000 metric tons of gold.

Which country has the most cash reserves?

ChinaHere are the 10 countries with the largest foreign currency reserve assets. All figures are as of June 2022....Largest Foreign Reserves.RankCountryForeign Currency Reserves (USD billions)1China$3,4802Japan$1,3763Switzerland$1,0334Russia$6306 more rows

What is the Federal Reserve's balance sheet?

The Federal Reserve operates with a sizable balance sheet that includes a large number of distinct assets and liabilities. The Federal Reserve's balance sheet contains a great deal of information about the scale and scope of its operations. For decades, market participants have closely studied the evolution of the Federal Reserve's balance sheet ...

What is the role of the Federal Reserve Bank?

The Federal Reserve Bank of New York acts as a custodian in holding securities on behalf of foreign official and international institutions. Market participants often look for trends in these data to gauge foreign demand for U.S. Treasury and agency securities. This table also presents information on the securities lent by the Federal Reserve under its securities lending programs. As noted in more detail in Open market operations, the Federal Reserve lends securities from its portfolio of Treasury securities and federal agency debt securities to foster efficient and liquid trading in the market for these securities. When securities are lent, they continue to be listed as assets of the Federal Reserve because the Federal Reserve retains ownership of the securities.

Why is the level of reserve balances important?

Historically, the level of reserve balances was important to understand the effects of open market operations. In current circumstances, table 1 is of interest because it presents a detailed breakout of the assets held by the Federal Reserve.

What percentage of the Federal Reserve is paid in capital?

Each member bank of the Federal Reserve is required, by law, to subscribe to shares of its local Reserve Bank in an amount equal to 6 percent of its own paid-in capital and surplus.

What is term deposit?

A term deposit is a deposit with a specific maturity date. Balances held in term deposits are separate and distinct from balances placed in a master account; balances held in term deposits cannot be used to satisfy a reserve balance requirement or clear payments.

When does the Fed publish its balance sheet?

Each week, the Federal Reserve publishes its balance sheet, typically on Thursday afternoon around 4:30 p.m.

What is the dual mandate of the Fed?

The Fed’s dual mandate requires it to ensure both stable prices and maximum employment. The traditional tool the Fed uses to accomplish these goals is the adjustment of the federal funds rate, the short-term interest rate that determines how much it costs for banks to lend to each other overnight.

Is the Fed's balance sheet a quantitative asset?

Just as with any other firm, securities that the Fed purchases are considered assets and therefore are represented on the Fed’s balance sheet. This therefore is the most reflective guide of the state of quantitative easing and, by extension, the degree to which the Fed has deemed it necessary to intervene in the economy.

What is reserve asset?

Reserve assets are currencies or other assets, such as gold, that can be readily transferable and are used to balance international transactions and payments. A reserve asset must be readily available, physical, controlled by policymakers, and easily transferable.

Why do banks use reserve assets?

Reserve assets can be used to fund currency manipulation activities by the central bank . In general, it is easier to push the value of a currency down than to prop it up, since propping the currency up involves selling off reserves to buy domestic assets. This can burn through reserves quickly.

What is the most important official reserve?

Gold. Foreign currencies: By far the most important official reserve. The currencies must be tradable (can buy/sell anywhere), such as the USD or euro (EUR). Special drawing rights (SDRs): Represent rights to obtain foreign exchange or other reserve assets from other IMF members.

What is reserve position in IMF?

Reserve position with the IMF: Reserves that the country has given to the IMF that are readily available to the member country. 2

How does the central bank put downward pressure on the currency?

The central bank can put downward pressure on the currency by adding more money into the system and using that money to buy foreign assets. The downside to this strategy is the potential for increased inflation .

How does the SNB help the currency?

Manipulating the price of a currency, to cap it in this case, requires a number of tools. The SNB opted to print francs, which in itself creates more supply for francs and helps lower the price. The SNB then sold those francs to buy the euro and other foreign currencies. This helped pushed the franc down, and other currencies up. 5 6 At the end of 2014, the SNB's reserves increased by 64 billion francs versus the prior year. 7

What are the assets of the Fed?

The Fed's assets include various Treasuries and mortgage-backed securities purchased in the open market and loans made to banks.

Why does the Fed buy assets?

Generally, the Fed buys assets as a part of its monetary policy action whenever it intends to increase the money supply for keeping the interest rates closer to the Federal funds rate, and sells assets when it intends to decrease the money supply. 10 .

How does the Fed pay for government securities?

When the Fed buys government securities or extends loans through its discount window, it simply pays by crediting the reserve account of the member banks through an accounting or book entry. In case member banks wish to convert their reserve balances into hard cash, the Fed provides them dollar bills.

How does the Fed expand its balance sheet?

During economic crises, the Fed can expand its balance sheet by buying more assets , such as bonds—called quantitative easing (QE).

What is the Federal Reserve's balance sheet?

Like any business organization, the Federal Reserve maintains a balance sheet listing its assets and liabilities. The Fed's assets include various Treasuries and mortgage-backed securities purchased in the open market and loans made to banks.

Why is the Fed's balance sheet important?

In particular, the Fed's balance sheet allowed analysts to see details surrounding the implementation of an expansionary monetary policy used during the 2007-2009 crisis .

What is the purpose of the Fed's balance sheet expansion?

Bottom Line. The Federal Reserve System is the central bank of the United States and is responsible for the nation's monetary policy. The Fed's primary goals are to promote maximum employment, stable prices, and manage long-term interest rates. The Fed also helps to create stability in ...

What are the functions of the Federal Reserve?

Current functions of the Federal Reserve System include: To address the problem of banking panics. To serve as the central bank for the United States. To strike a balance between private interests of banks and the centralized responsibility of government. To supervise and regulate banking institutions.

What was the Federal Reserve system before?

Before the founding of the Federal Reserve System, the United States underwent several financial crises. A particularly severe crisis in 1907 led Congress to enact the Federal Reserve Act in 1913. Today the Federal Reserve System has responsibilities in addition to stabilizing the financial system.

How many members are on the Federal Open Market Committee?

The Federal Open Market Committee (FOMC) consists of 12 members, seven from the board of governors and 5 of the regional Federal Reserve Bank presidents. The FOMC oversees and sets policy on open market operations, the principal tool of national monetary policy. These operations affect the amount of Federal Reserve balances available to depository institutions, thereby influencing overall monetary and credit conditions. The FOMC also directs operations undertaken by the Federal Reserve in foreign exchange markets. The FOMC must reach consensus on all decisions. The president of the Federal Reserve Bank of New York is a permanent member of the FOMC; the presidents of the other banks rotate membership at two- and three-year intervals. All Regional Reserve Bank presidents contribute to the committee's assessment of the economy and of policy options, but only the five presidents who are then members of the FOMC vote on policy decisions. The FOMC determines its own internal organization and, by tradition, elects the chair of the board of governors as its chair and the president of the Federal Reserve Bank of New York as its vice chair. Formal meetings typically are held eight times each year in Washington, D.C. Nonvoting Reserve Bank presidents also participate in Committee deliberations and discussion. The FOMC generally meets eight times a year in telephone consultations and other meetings are held when needed.

Why is the Federal Reserve Bank important?

The purpose of keeping funds at a Federal Reserve Bank is to have a mechanism for private banks to lend funds to one another . This market for funds plays an important role in the Federal Reserve System as it is what inspired the name of the system and it is what is used as the basis for monetary policy.

How many Federal Reserve districts are there?

Map of the 12 Federal Reserve Districts, with the 12 Federal Reserve Banks marked as black squares, and all Branches within each district (24 total) marked as red circles. The Washington, DC, headquarters is marked with a star. (Also, a 25th branch in Buffalo, NY, was closed in 2008.)

Why did the Federal Reserve create the check clearing system?

Because some banks refused to clear checks from certain other banks during times of economic uncertainty, a check-clearing system was created in the Federal Reserve System. It is briefly described in The Federal Reserve System—Purposes and Functions as follows:

What events led to the expansion of the Federal Reserve?

Over the years, events such as the Great Depression in the 1930s and the Great Recession during the 2000s have led to the expansion of the roles and responsibilities of the Federal Reserve System.

Table 1. Factors Affecting Reserve Balances of Depository Institutions

Table 1A. Memorandum Items

Table 3. Supplemental Information on Mortgage-Backed Securities

Table 4. Information on Principal Accounts of Credit Facilities LLCs

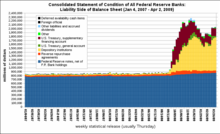

Table 5. Consolidated Statement of Condition of All Federal Reserve Banks

- Table 5 presents the balance sheet of the Federal Reserve System. The first page of table 5 presents the assets held by the Federal Reserve. The assets listed largely parallel the factors supplying reserve balances from table 1. The second page presents the liabilities of the Federal Reserve. Federal Reserve notes--that is, U.S. currency--is the fi...

Table 6. Statement of Condition of Each Federal Reserve Bank