Accounting Equation Components

- Assets An asset is a resource that is owned or controlled by the company to be used for future benefits. ...

- Liabilities A liability, in its simplest terms, is an amount of money owed to another person or organization. ...

- Equity Equity represents the portion of company assets that shareholders or partners own. ...

What are liabilities in accounting balance sheet?

Liabilities are the debts you owe to other parties. A liability can be a loan, credit card balances, payroll taxes, accounts payable, expenses you haven't been invoiced for yet, long-term loans (like a mortgage or a business loan), deferred tax payments, or a long-term lease.

What are the 4 types of liabilities?

Different Types of Liabilities in AccountingCurrent Liabilities. These can also be commonly known as short-term liabilities. ... Non-current Liabilities. Non-current liabilities can also be referred to as long-term liabilities. ... Contingent Liabilities.

What are liabilities List 3 examples?

Some of the examples of Liabilities are Accounts payable, Expenses payable, Salaries Payable, Interest payable.

What are 10 examples of liabilities?

Current Liability Accounts (due in less than one year):Accounts payable. Invoiced liabilities payable to suppliers.Accrued liabilities. ... Accrued wages. ... Customer deposits. ... Current portion of debt payable. ... Deferred revenue. ... Income taxes payable. ... Interest payable.More items...•

What are the 5 current liabilities?

What are the Current Liabilities? Current liabilities are the obligations of the company which are expected to get paid within one year and include liabilities such as Accounts payable, short term loans, Interest payable, Bank overdraft and the other such short term liabilities of the company.

Is a car a liability or asset?

The vehicle itself is an asset, since it's a tangible thing that helps you get from point A to point B and has some amount of value on the market if you need to sell it. However, the car loan that you took out to get that car is a liability.

Is cash a liability or asset?

In short, yes—cash is a current asset and is the first line-item on a company's balance sheet. Cash is the most liquid type of asset and can be used to easily purchase other assets. Liquidity is the ease with which an asset can be converted into cash.

What is an asset vs liability?

Your balance sheet is divided into two parts, assets and liabilities. Assets are the resources your company owns, while liabilities are what your company owes.

What are the main types of liabilities?

Liabilities can be classified into three categories: current, non-current and contingent.

What are the 2 types of liabilities?

Types of Liabilities. Businesses sort their liabilities into two categories: current and long-term. Current liabilities are debts payable within one year, while long-term liabilities are debts payable over a longer period.

What are examples liabilities?

Examples of liabilities are -Bank debt.Mortgage debt.Money owed to suppliers (accounts payable)Wages owed.Taxes owed.

What are the types of liability in law?

Liability (Strict Liability, Absolute Liability and Vicarious Liability) Under Law of Tort. Generally, a person is liable for his own wrongful acts and one does not incur any liability for the acts done by others.

What are liabilities in accounting?

Liabilities are any debts your company has, whether it’s bank loans, mortgages, unpaid bills, IOUs, or any other sum of money that you owe someone else.

Where should liabilities be listed on a balance sheet?

The important thing here is that if your numbers are all up to date, all of your liabilities should be listed neatly under your balance sheet’s “liabilities” section.

What is the most important equation in credit accounting?

By far the most important equation in credit accounting is the debt ratio. It compares your total liabilities to your total assets to tell you how leveraged —or, how burdened by debt—your business is.

What do accountants call debts?

Accountants call the debts you record in your books “liabilities,” and knowing how to find and record them is an important part of bookkeeping and accounting. Here’s everything you need to know about liabilities.

What does it mean when a business has a lower debt ratio?

Generally speaking, the lower the debt ratio for your business, the less leveraged it is and the more capable it is of paying off its debts . The higher it is, the more leveraged it is, and the more liability risk it has.

What does it mean when your balance sheet doesn't balance?

Assets = Liabilities + Equity. If your assets don’t equal your liabilities and equity, the two sides of your balance sheet won’t ‘balance,’ the accounting equation won’t work, and it probably means you’ve made a mistake somewhere in your accounting. These days, the two-column balance sheet format is less popular.

What is current liability?

Current liabilities are debts that you have to pay back within the next 12 months.

What is accounting equation?

What is the Accounting Equation? The accounting equation is a basic principle of accounting and a fundamental element of the balance sheet. Balance Sheet The balance sheet is one of the three fundamental financial statements. These statements are key to both financial modeling and accounting. .

What is account payable?

Accounts Payable Accounts payable is a liability incurred when an organization receives goods or services from its suppliers on credit. Accounts payables are. , Short-term borrowings. Current Liabilities Current liabilities are financial obligations of a business entity that are due and payable within a year.

What is double entry accounting?

Double-entry accounting is a system where every transaction affects both sides of the accounting equation. For every change to an asset account, there must be an equal change to a related liability or shareholder’s equity account. It is important to keep the accounting equation in mind when performing journal entries.

What are the items that fall under each section of the accounting section?

Below are some examples of items that fall under each section: Assets: Cash, Current Assets Current assets are all assets that a company expects to convert to cash within one year. They are commonly used to measure the liquidity of a. Accounts Receivable.

When are shareholders entitled to any of the company's assets?

Only after debts are settled are shareholders entitled to any of the company’s assets to attempt to recover their investments. Regardless of how the accounting equation is represented, it is important to remember that the equation must always balance.

What is shareholder equity?

As you can see, shareholder’s equity is the remainder after liabilities have been subtracted from assets. This is because creditors – parties that lend money – have the first claim to a company’s assets. For example, if a company becomes bankrupt.

What Is the Accounting Equation?

The accounting equation states that a company's total assets are equal to the sum of its liabilities and its shareholders' equity.

What is the difference between assets and liabilities?

Assets represent the valuable resources controlled by the company. The liabilities represent their obligations.

What Are the 3 Elements of the Accounting Equation?

The three elements of the accounting equation are assets, liabilities, and shareholders' equity . The formula is straightforward: A company's total assets are equal to its liabilities plus its shareholders' equity. The double-entry bookkeeping system, which has been adopted globally, is designed to accurately reflect a company's total assets.

What does the liability and shareholders' equity represent?

Both liabilities and shareholders' equity represent how the assets of a company are financed. If it's financed through debt, it'll show as a liability, and if it's financed through issuing equity shares to investors, it'll show in shareholders' equity. The accounting equation helps to assess whether the business transactions carried out by ...

Why is accounting equation important?

The accounting equation is important because it captures the relationship between the three components of a balance sheet: assets, liabilities, and equity. All else being equal, a company’s equity will increase when its assets increase, and vice-versa.

How to calculate total equity?

The balance sheet holds the basis of the accounting equation: 1 Locate the company's total assets on the balance sheet for the period. 2 Total all liabilities, which should be a separate listing on the balance sheet. 3 Locate total shareholder's equity and add the number to total liabilities. 4 Total assets will equal the sum of liabilities and total equity.

What is the third section of the balance sheet?

Owners’ equity, or shareholders' equity, is the third section of the balance sheet. The accounting equation is a representation of how these three important components are associated with each other. The accounting equation is also called the basic accounting equation or the balance sheet equation. While assets represent ...

What is the equation for assets and liabilities?

Assets = Liabilities + Owners Equities. The ingredients of this equation - Assets, Liabilities, and Owner's equities are the three major sections of the Balance sheet. By using the above equation, the bookkeepers and accountants ensure that the "balance" always holds i.e., both sides of the equation are always equal.

What is the accounting equation called?

The entire financial accounting depends on the accounting equation which is also known as the ‘Balance Sheet Equation’ . The following are the different types of basic accounting equation:

What are the basic accounting equations?

The entire financial accounting depends on the accounting equation which is also known as the ‘Balance Sheet Equation’. The following are the different types of basic accounting equation: 1 Asset = Liability + Capital 2 Liabilities= Assets - Capital 3 Owners’ Equity (Capital) = Assets – Liabilities

What is the equation for assets?

The first among them is the basic accounting equation which written as Assets = Liabilities + Equities.

What is the difference between assets and owner's investment?

The difference of assets and owner’s investment into business is your liabilities which you owe others in the form of payables to suppliers, banks etc.

What is total debits?

Total debits always equal to total credits -Total Debits = Total Credits. The accounting equation represents an extension of the ‘Basic Equation’ to include another fundamental rule that applies to every accounting transaction when a double-entry system of bookkeeping is used by the businesses.

Do debit and credit equal?

Debit and Credit should be equal for every event that impacts accounts. Across any specified timespan, the sum of all debit entries must equal the total of all credit entries, meaning the same balance applies for every pair of ‘entries’ that follows a transaction.

Why do equity and liabilities equal assets?

A company's assets, or the total of all items the company owns, have been bought with the company's current capital, or equity, and debts, or liabilities. This relationship is known as the accounting equation:

Purpose of the accounting equation

The accounting equation is important to determine the full financial value of a business. Where other financial measurements, like the income sheet, show a company's financial health and earnings, the balance sheet shows the business's financial performance for the entire year.

How to use the accounting equation

To use the accounting equation, there are a few steps to follow. Here is how to use this equation in your business's accounting:

Using the accounting equation

Using the accounting equation is easier when you understand what it looks like. Here are two examples of how to use the accounting equation:

What are the liabilities on a balance sheet?

Consider adding the following liabilities to your balance sheet: 1 Accounts Payable: Money you owe that’s not for a bank loan. For example, unpaid invoices for a service, such as your cell phone bill. Or an invoice from a supplier, such as materials for your jewelry business. 2 Taxes Payable: Taxes owed to the government such as sales, employment or income tax. 3 Current Loans Payable: Loans you must pay back within the next year. 4 Long-Term Loans Payable: Loans you must pay back after a year or more. 5 Credit Cards Payable: The balance of your unpaid credit card debt.

How to find total liabilities?

Add together all your liabilities, both short and long term, to find your total liabilities.

How to make a balance sheet for a business?

To make your own balance sheet, review the above liability types and include the ones that are relevant to your business. Then plug in the amount owing for each liability type. Only include the amount owing for the accounting period you're reviewing- the past financial year, quarter or month.

Why do total liabilities have to be correct?

Total liabilities must be correct because the equation balances. Source: FreshBooks. If you're using Excel, plug in your assets and equity and make sure the equation works. For more information on balance sheets and how to read and use them, read this article.

What is a company's liabilities?

Liabilities are a company's debts. Accounting software makes this easy. It produces a financial statement called a balance sheet that lists and adds up all liabilities for you, according to the Houston Chronicle. That said, you should still check your work by using the basic accounting formula.

What is an expense in business?

Expenses are continuing payments for services or things of no financial value. Buying a business cell phone is an expense. Liabilities are loans used to purchase assets (items of financial value), like equipment, according to The Balance. 2. Make a Balance Sheet. It's possible to create a simple balance sheet in Excel.

How long does it take to calculate current liabilities?

To calculate current liabilities, you need to add together all the money you owe lenders within the next year (within 12 months or less).

What is the accounting equation?

The basic accounting equation is fundamental to the double-entry accounting system common in bookkeeping wherein every financial transaction has equal and opposite effects in at least two different accounts .#N#This basic accounting equation “balances” the company’s balance sheet, showing that a company’s total assets are equal to the sum of its liabilities and shareholders’ equity. This formula, also known as the balance sheet equation, shows that what a company owns (assets) is purchased by either what it owes (liabilities) or by what its owners invest (equity).#N#If a company wants to manufacture a car part, they will need to purchase machine X that costs $1000. It borrows $400 from the bank and spends another $600 in order to purchase the machine. Its assets are now worth $1000, which is the sum of its liabilities ($400) and equity ($600).

What are long term liabilities?

Long-term liabilities, on the other hand, include debt such as mortgages or loans used to purchase fixed assets. These are paid off over years instead of months.

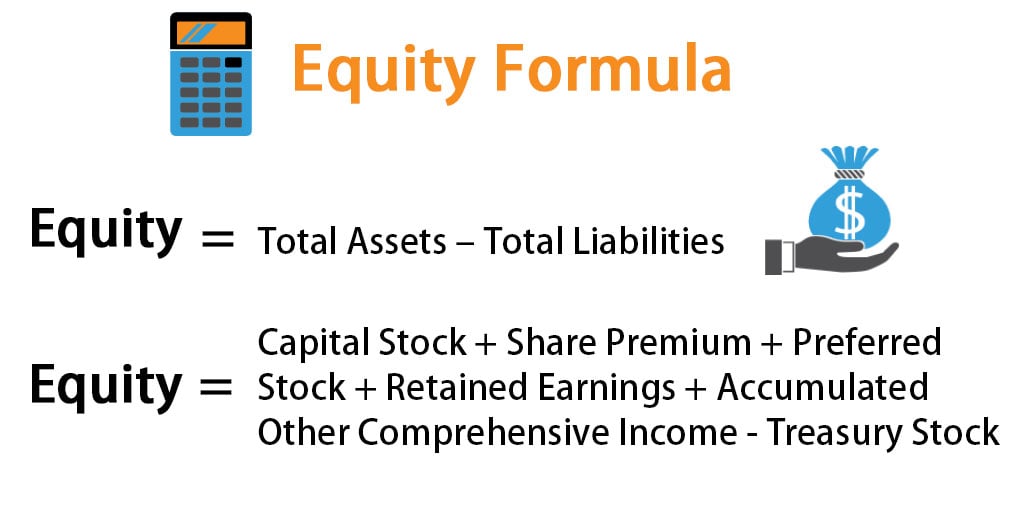

How to calculate equity?

This equity becomes an asset as it is something that a homeowner can borrow against if need be. You can calculate it by deducting all liabilities from the total value of an asset: (Equity = Assets – Liabilities). In accounting, the company’s total equity value is the sum ...

What is total equity value?

In accounting, the company’s total equity value is the sum of owners equity—the value of the assets contributed by the owner (s)—and the total income that the company earns and retains.

Why is it important to pay close attention to the balance between liabilities and equity?

It is important to pay close attention to the balance between liabilities and equity. A company’s financial risk increases when liabilities fund assets. This is sometimes referred to as the company’s leverage.

What is owner equity statement?

A Statement of Owner’s Equity (also known as a Statement of Changes in Owner’s Equity) provides an accounting of how a company’s capital has changed during a specified period due to contributions, withdrawals, net income, or net loss. Net income is equal to income minus expenses.

What is balance sheet?

Make a balance sheet—a financial statement that shows a company’s assets, liabilities and equity. (See “Assets = Liabilities + Equity” below.) To create this balance sheet, you can use a spreadsheet software like Excel, but you should consider using accounting software for such important statements.

What is the accounting equation for assets, liabilities and equity?

The accounting equation for assets, liabilities and equity. Equity, liabilities and assets are all used by accountants to determine the "balance sheet equation," otherwise known as the "accounting formula.". This equation combines a company's equity and liability to determine their total assets, basically reworking the equity formula.

What is the difference between assets and liabilities?

Assets represent a company's resources while liabilities represent a company's obligations. An asset helps business owners and financial professionals find out what the company owns. Liabilities show what a company owes.

What is equity?

Equity is the remaining amount after a company deducts their total liabilities from the total assets. It's a way to figure out a company's value once all debts are paid and profit is left over.

What are the items that accountants consider when calculating the financial outlook of a company?

These items are called "assets" and "liabilities." It's important to understand these figures because they can help determine the overall financial stability of a company. In this article, we explain the meaning of assets and liabilities, give examples of each and share how companies use these figures on a balance sheet to calculate the total value or equity of a business.

How to determine equity?

Equity is determined by totaling a company's assets and subtracting their total liabilities from that number. The remaining figure represents a company's equity. A quick way to think of equity is assets minus liabilities.

Why use a balance sheet?

Use the balance sheet for analysis. A balance sheet can be used to prepare financial modeling reports that give stakeholders an idea of a company's performance. If the assets far outweigh the liabilities, a company will most likely prove more financially successful in the future.

How to find the equity of a company?

The following steps can help you find the amount of equity in a business: 1. Determine your assets. To find the amount of equity a company possesses, you'll first need to calculate the total assets of a business .

What Is The Accounting equation?

Understanding The Accounting Equation

- The financial position of any business, large or small, is based on two key components of the balance sheet: assets and liabilities. Owners’ equity, or shareholders' equity, is the third section of the balance sheet. The accounting equation is a representation of how these three important components are associated with each other. Assets represent the valuable resources controlle…

Accounting Equation Formula and Calculation

- Assets=(Liabilities+Owner’s Equity)\text{Assets}=(\text{Liabilities}+\text{Owner's Equity})Assets=(Liabilities+Owner’s Equity) The balance sheet holds the elements that contribute to the accounting equation: 1. Locate the company's total assets on the balance sheet for the period. 2. Total all liabilities, which should be a separate listing on the balance sheet. 3. Locate t…

About The Double-Entry System

- The accounting equation is a concise expression of the complex, expanded, and multi-item display of a balance sheet. Essentially, the representation equates all uses of capital (assets) to all sources of capital, where debt capital leads to liabilities and equity capital leads to shareholders' equity. For a company keeping accurate accounts, every business transaction will …

Limits of The Accounting Equation

- Although the balance sheet always balances out, the accounting equation can't tell investors how well a company is performing. Investors must interpret the numbers and decide for themselves whether the company has too many or too few liabilities, not enough assets, or perhaps too many assets, or whether its financing is sufficient to ensure its long-term growth.

Real-World Example

- Below is a portion of Exxon Mobil Corporation's (XOM) balance sheet in millions as of Dec. 31, 2019: 1. Total assets were $362,597 2. Total liabilities were $163,659 3. Total equity was $198,9381 The accounting equation is calculated as follows: 1. Accounting equation= $163,659 (total liabilities) + $198,938 (equity) equals $362,597, (which equals the total assets for the perio…