With that in mind, here's a look at the 2019 long-term capital gains tax brackets:

| Long-Term Capital Gains Tax Rate | Single Filers (taxable income) | Married Filing Jointly | Heads of Household | Married Filing Separately |

| 0% | $0-$39,375 | $0-$78,750 | $0-$52,750 | $0-$39,375 |

| 15% | $39,376-$434,550 | $78,751-$488,850 | $0-$461,700 | $39,376-$244,425 |

| 20% | Over $434,550 | Over $488,850 | Over $461,700 | Over $244,425 |

When are long term capital gains taxed?

Short-term capital gains are when you hold the assets and investments for less than a year. Meanwhile, long-term capital gains are when you hold it for more than a year. That’s when tax filers can often benefit from a reduced tax rate on profits. How can you minimize capital gains?

How do you calculate capital gains rate?

Work out your total taxable gains

- Work out the gain for each asset (or your share of an asset if it’s jointly owned). ...

- Add together the gains from each asset.

- Deduct any allowable losses.

Who is exempt from paying capital gains tax?

What Is The Capital Gains Exemption For 2021? During the period 2021, individuals who earn less than $40,400 taxable income will not face capital gains tax. As long as their income is $40,401 to $445,850, there is no capital gain tax. These rates jump to 20 percent if the income level is above this amount.

What are the long term capital gains tax rate?

The long-term capital gains tax rates are 0 percent, 15 percent and 20 percent, depending on your income. These rates are typically much lower than the ordinary income tax rate. Sales of real estate and other types of assets have their own specific form of capital gains and are governed by their own set of rules (discussed below).

What are the short-term capital gains rates for 2019?

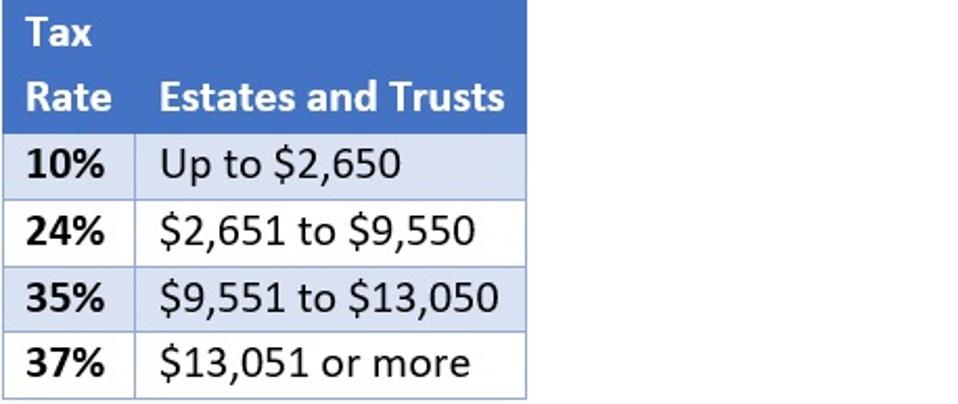

Gains you make from selling assets you've held for a year or less are called short-term capital gains, and they generally are taxed at the same rate as your ordinary income, anywhere from 10% to 37%.

What are the brackets for long term capital gains?

Long-Term Capital Gains Rates2021 Long Term Capital Gains Tax BracketsTax Bracket/RateSingleMarried Filing Jointly0%$0 - $40,400$0 - $80,80015%$40,401 - $445,850$80,801 - $501,60020%$445,851+$501,601+May 3, 2022

What are long term capital gains rates for 2020?

Long Term Capital Gain Brackets for 2020 Long-term capital gains are taxed at the rate of 0%, 15% or 20% depending on your taxable income and marital status. For single folks, you can benefit from the zero percent capital gains rate if you have an income below $40,000 in 2020.

What is the highest 2018 long term capital gain rate?

So, for 2018 through 2025, the tax rates for higher-income people who recognize long-term capital gains and dividends will actually be 18.8% (15% + 3.8% for the NIIT) or 23.8% (20% + 3.8% for the NIIT).

Are all long term capital gains taxed at the same rate?

Short-term capital gains are taxed as ordinary income at rates up to 37 percent; long-term gains are taxed at lower rates, up to 20 percent.

How do I calculate long term capital gains on a property?

Long-term capital gain = Final Sale Price – (indexed cost of acquisition + indexed cost of improvement + cost of transfer), where: Indexed cost of acquisition = cost of acquisition x cost inflation index of the year of transfer/cost inflation index of the year of acquisition.

Is capital gains tax going up in 2021?

In 2021 and 2022, the capital gains tax rate is 0%, 15% or 20% on most assets held for longer than a year. Capital gains taxes on assets held for a year or less correspond to ordinary income tax brackets: 10%, 12%, 22%, 24%, 32%, 35% or 37%.

How do I avoid long term capital gains tax?

Invest for the long term. ... Take advantage of tax-deferred retirement plans. ... Use capital losses to offset gains. ... Pick your cost basis. ... Invest for the long term. ... Take advantage of tax-deferred retirement plans. ... Use capital losses to offset gains. ... Pick your cost basis.

What is the capital gains exemption for 2021?

If you have a capital gain from the sale of your main home, you may qualify to exclude up to $250,000 of that gain from your income, or up to $500,000 of that gain if you file a joint return with your spouse.

What is the long-term capital gains rate for 2017?

to 15 percentThe rate for most long-term capital gains was reduced from 20 percent to 15 percent; further, qualified dividends were taxed at this same 15-percent rate.

What was capital gains tax in 2017?

Capital gains rates for individual increase to 15% for those individuals in the 25% - 35% marginal tax brackets and increase even further to 20% for those individuals in the 39.6% marginal tax bracket. Net capital gain from selling collectibles (such as coins or art) is taxed at a maximum 28% rate.

When did long-term capital gains change?

The Tax Reform Act of 1986 repealed the exclusion of long-term gains, raising the maximum rate to 28% (33% for taxpayers subject to phaseouts).

What is the 2022 capital gains tax rate?

2022 Long-Term Capital Gains Tax Rate ThresholdsCapital Gains Tax RateTaxable Income (Single)Taxable Income (Married Filing Jointly)0%Up to $41,675Up to $83,35015%$41,675 to $459,750$83,350 to $517,20020%Over $459,750Over $517,200

What are the tax brackets for 2022?

2022 Federal Income Tax Brackets and RatesTax RateFor Single FilersFor Married Individuals Filing Joint Returns12%$10,275 to $41,775$20,550 to $83,55022%$41,775 to $89,075$83,550 to $178,15024%$89,075 to $170,050$178,150 to $340,10032%$170,050 to $215,950$340,100 to $431,9004 more rows•Nov 10, 2021

What is the capital gains tax for 2021?

For example, in 2021, individual filers won't pay any capital gains tax if their total taxable income is $40,400 or below. However, they'll pay 15 percent on capital gains if their income is $40,401 to $445,850. Above that income level, the rate jumps to 20 percent.

Do capital gains put you in a higher tax bracket?

Ordinary income is calculated separately and taxed at ordinary income rates. More long-term capital gains may push your long-term capital gains into a higher tax bracket (0%, 15%, or 20%), but they will not affect your ordinary income tax bracket.

What is a long-term capital gain?

The term "capital gain" simply refers to a profit made by selling an asset for more than you paid for it. As an example, if you paid $3,000 for a stock investment and sell it for $4,000, you'd have a $1,000 capital gain on the sale.

The long-term capital gains tax brackets

It may seem odd, but the income ranges long-term capital gains tax brackets look rather different than those for ordinary income and short-term gains. While the Tax Cuts and Jobs Act made significant changes to the income thresholds for the ordinary income brackets, it didn't make any such changes to the long-term capital gains brackets.

How much could the long-term capital gains tax rates save you?

To illustrate just how valuable these long-term capital gains tax rates can be for investors, here's a simplified example.

Think twice before selling winners after just a few months

The long-term capital gains tax rates are designed to encourage long-term investment and are yet another reason why it can be a bad idea to move in and out of stock positions frequently.

What is net capital gain?

The term "net capital gain" means the amount by which your net long-term capital gain for the year is more than the sum of your net short-term capital loss and any long-term capital loss carried over from the previous year. Net capital gains are taxed at different rates depending on overall taxable income, although some or all net capital gain may ...

What is the federal capital gains tax rate for 2013?

Hence, it is possible that an individual’s federal tax on capital gain could be as high as 23.8% (20% + 3.8% NIIT).

What is the maximum amount of capital loss you can carry forward?

If your capital losses exceed your capital gains, the amount of the excess loss that can be claimed is the lesser of $3,000, ($1,500 if you are married filing separately) or your total net loss as shown on line 16 of the Form 1040 Schedule D, Capital Gains and Loses. If your net capital loss is more than this limit, you can carry the loss forward to later years. Use the Capital Loss Carryover Worksheet in Publication 550, to figure the amount carried forward.

What is the tax rate for selling collectibles?

Net capital gain from selling collectibles (such as coins or art) is taxed at a maximum 28% rate. The taxable part of a gain from selling Internal Revenue Code Section 1202 qualified small business stock is taxed at a maximum 28% rate. Specifically, for individual taxpayers, gross income does not include 50% of any gain from the sale or exchange ...

What is capital asset?

Almost everything owned and used for personal or investment purposes is a capital asset. 1 Examples are a home, household furnishings, and stocks or bonds held in a personal account. When a capital asset is sold, the difference between the basis in the asset and the amount it is sold for is a capital gain or a capital loss.

Do you have to pay estimated tax on capital gains?

If you have a taxable capital gain, you may be required to make estimated tax payments. Refer to IRS Publication 505, Tax Withholding and Estimated Tax, for additional information.

What is capital gain?

The term "capital gain" simply refers to a profit made by selling an asset for more than you paid for it. As an example, if you paid $3,000 for a stock investment and sell it for $4,000, you'd have a $1,000 capital gain on the sale.

What is income range?

Data source: Tax Foundation. Income ranges represent taxable income, not just capital gains. Married filing separately rates calculated as half of those for joint filers.

Does the IRS charge capital gains tax on long term investments?

Did you know that the IRS encourages long-term investing? Specifically, the capital gains tax the IRS charges Americans on their investment profits is considerably less when you've held an investment for longer than a year.

Is capital gains considered ordinary income?

A short-term capital gain occurs if you owned the asset for a year or less. If this is the case, the gain is considered ordinary income and is taxed at your applicable marginal tax rate.

Is a sale of an asset considered long term gain?

On the other hand, if you owned the asset for at least a year and a day, any profit made upon the sale of the asset is considered a long-term gain and is taxed at preferential rates.

Do long term capital gains tax brackets change?

While the Tax Cuts and Jobs Act made significant changes to the income thresholds for the ordinary income brackets, it didn't make any such changes to the long-term capital gains brackets.

How much could the long-term capital gains tax rates save you?

To illustrate just how valuable these long-term capital gains tax rates can be for investors , here's a simplified example.

What is the tax rate for 2019?

Here's a quick guide to the 2019 long-term capital gains tax rates, so you can determine whether you'll pay 0%, 15%, or 20% on your 2019 investment profits.

Why is capital gains tax bad?

The long-term capital gains tax rates are designed to encourage long-term investment and are yet another reason why it can be a bad idea to move in and out of stock positions frequently. Specifically, it can be tempting to sell winning stock positions quickly in order to lock in gains. However, be aware that the higher tax rates ...

How much capital gain do you get if you sell a stock for 4,000?

As an example, if you paid $3,000 for a stock investment and sell it for $4,000, you'd have a $1,000 capital gain on the sale. The IRS splits capital gains into two distinct baskets for tax purposes: long- and short-term capital gains. A short-term capital gain occurs if you owned the asset for a year or less.

What is income range?

Data source: Tax Foundation. Income ranges represent taxable income, not just capital gains. Married filing separately rates calculated as half of those for joint filers.

What is the marginal tax bracket for 2019?

To keep the numbers simple, we'll say that you have combined taxable income of $200,000 in 2019, which puts you firmly in the 24% marginal tax bracket.

Did the Tax Cuts and Jobs Act change the capital gains tax bracket?

While the Tax Cuts and Jobs Act made significant changes to the income thresholds for the ordinary income brackets, it didn't make any such changes to the long-term capital gains brackets.

Capital Gains Tax Rates in 2019

The table below outlines the 2019 long-term capital gains tax brackets by income and filing status:

Consider a 1031 Exchange

A 1031 exchange can help you avoid these hefty capital gains tax burdens. By moving all of your net proceeds into a new replacement property, you can effectively defer your capital gains taxes. This has the added benefit of keeping your money working for you in a continued investment – compounding and building wealth over time.

Meet with a Qualified Intermediary

If you’re mulling over the possibility of doing a 1031 exchange on your piece of real estate, do yourself a favor and meet with a qualified intermediary to discuss your situation.

What is the tax rate for long term capital gains?

Long-term losses can be used to offset future long-term gains. As of 2019, the long-term capital gains tax stood at 0%–20% depending on one's tax bracket.

What Is a Long-Term Capital Gain or Loss?

A long-term capital gain or loss is the gain or loss stemming from the sale of a qualifying investment that has been owned for longer than 12 months at the time of sale. This may be contrasted with short-term gains or losses on investments that are disposed of in less than 12 months time. Long-term capital gains are often given more favorable tax treatment than short-term gains. 1

Do you have to report capital gains on your taxes?

A taxpayer will need to report the total of their capital gains earned for the year when they file their annual tax returns because the IRS will treat these short-term capital gains earnings as taxable income. Long-term capital gains are taxed at a lower rate, which as of 2019 ranged from 0 to 20 percent, depending on the tax bracket that the taxpayer is in. 1 2

What is short term capital gains tax?

Short-term capital gains tax is a tax applied to profits from selling an asset you’ve held for less than a year. Short-term capital gains taxes are pegged to where your income places you in federal tax brackets, so you’ll pay them at the same rate you’d pay your ordinary income taxes. Long-term capital gains tax is a tax applied to assets held ...

What are the capital gains tax rates?

While the capital gains tax rates remained the same as before under the Tax Cuts and Jobs Act of 2017, the income required to qualify for each bracket goes up each year to account for workers’ increasing incomes. Here are the details on capital gains rates for the 2021 and 2022 tax years.

Why hold onto an asset longer than a year?

As we’ve highlighted, holding onto an asset for longer than a year could substantially reduce your tax liability due to favorable long-term capital gains rates. Other strategies include leveraging retirement accounts to delay paying capital gains taxes while maximizing growth.

How to offset capital gains liability?

One strategy to offset your capital gains liability is to sell any underperforming securities, thereby incurring a capital loss. If there aren’t capital gains, realized capital losses could reduce your taxable income, up to $3,000 a year.

What are the tax considerations when selling an asset?

For most investors, the main tax considerations are: how long you’ve owned the asset. the cost of owning that asset, including any fees you paid. your income tax bracket. your marital status. Once you sell an asset, capital gains become “realized gains.”.

How much do you owe on capital gains?

If you have a long-term capital gain – meaning you held the asset more than a year – you’ll owe either 0 percent, 15 percent or 20 percent, depending on how much overall income you have. However, an April proposal from the Biden administration aims to shake up how the capital gains tax is determined for some investors.

What are some ways to build wealth without capital gains?

Other types of accounts like a Roth IRA or a 529 college savings plan are great options for building wealth without incurring capital gains. After-tax money funds these long-term investment strategies, and because of their tax structure, any potential capital gains grow tax-free.

How much is capital gains taxed?

Some or all net capital gain may be taxed at 0% if your taxable income is less than $80,000. A capital gain rate of 15% applies if your taxable income is $80,000 or more but less than $441,450 for single; $496,600 for married filing jointly or qualifying widow (er); $469,050 for head of household, or $248,300 for married filing separately.

How long is capital gain?

To correctly arrive at your net capital gain or loss, capital gains and losses are classified as long-term or short-term. Generally, if you hold the asset for more than one year before you dispose of it, your capital gain or loss is long-term. If you hold it one year or less, your capital gain or loss is short-term. For exceptions to this rule, such as property acquired by gift, property acquired from a decedent, or patent property, refer to Publication 544, Sales and Other Dispositions of Assets; or for commodity futures, see Publication 550, Investment Income and Expenses. To determine how long you held the asset, you generally count from the day after the day you acquired the asset up to and including the day you disposed of the asset.

How much can you carry forward on a 1040?

If your capital losses exceed your capital gains, the amount of the excess loss that you can claim to lower your income is the lesser of $3,000 ($1,500 if married filing separately) or your total net loss shown on line 21 of Schedule D (Form 1040). Claim the loss on line 6 of your Form 1040 or Form 1040-SR. If your net capital loss is more than this limit, you can carry the loss forward to later years. You may use the Capital Loss Carryover Worksheet found in Publication 550, Investment Income and Expenses or in the Instructions for Schedule D (Form 1040) PDF to figure the amount you can carry forward.

What is net capital gain?

The term "net capital gain" means the amount by which your net long-term capital gain for the year is more than your net short-term capital loss for the year. The term "net long-term capital gain" means long-term capital gains reduced by long-term capital losses including any unused long-term capital loss carried over from previous years.

What is the difference between the adjusted basis in the asset and the amount you realized from the sale?

When you sell a capital asset, the difference between the adjusted basis in the asset and the amount you realized from the sale is a capital gain or a capital loss. Generally, an asset's basis is its cost to the owner, but if you received the asset as a gift or inheritance, refer to Topic No. 703 for information about your basis.

What is the tax rate for section 1250?

The portion of any unrecaptured section 1250 gain from selling section 1250 real property is taxed at a maximum 25% rate.

What is NIIT tax?

Individuals with significant investment income may be subject to the Net Investment Income Tax (NIIT). For additional information on the NIIT. For additional information on the NIIT, see Topic No. 559.

What Is A Long-Term Capital Gain?

The Long-Term Capital Gains Tax Brackets

- It may seem odd, but the income ranges long-term capital gains tax brackets look rather different than those for ordinary income and short-term gains. While the Tax Cuts and Jobs Actmade significant changes to the income thresholds for the ordinary income brackets, it didn't make any such changes to the long-term capital gains brackets. With that in mind, here's a look at the 201…

Think Twice Before Selling Winners After Just A Few Months

- The long-term capital gains tax rates are designed to encourage long-term investment and are yet another reason why it can be a bad idea to move in and out of stock positions frequently. Specifically, it can be tempting to sell winning stock positions quickly in order to lock in gains. However, be aware that the higher tax rates that apply to short-term gains can take a big bite ou…

What Is A Long-Term Capital Gain?

- The term "capital gain" simply refers to a profit made by selling an asset for more than you paid for it. As an example, if you paid $3,000 for a stock investment and sell it for $4,000, you'd have a $1,000 capital gain on the sale. The IRS splits capital gains into two distinct baskets for tax purposes: long- and short-term capital gains. A short-term capital gain occurs if you owned the a…

The Long-Term Capital Gains Tax Brackets

- It may seem odd, but the income ranges long-term capital gains tax brackets look rather different than those for ordinary income and short-term gains. While the Tax Cuts and Jobs Actmade significant changes to the income thresholds for the ordinary income brackets, it didn't make any such changes to the long-term capital gains brackets. With that in mind, here's a look at the 201…

How Much Could The Long-Term Capital Gains Tax Rates Save You?

- To illustrate just how valuable these long-term capital gains tax rates can be for investors, here's a simplified example. Let's say that you're married and that you and your spouse file a joint tax return. To keep the numbers simple, we'll say that you have combined taxable incomeof $200,000 in 2019, which puts you firmly in the 24% marginal tax b...

Think Twice Before Selling Winners After Just A Few Months

- The long-term capital gains tax rates are designed to encourage long-term investment and are yet another reason why it can be a bad idea to move in and out of stock positions frequently. Specifically, it can be tempting to sell winning stock positions quickly in order to lock in gains. However, be aware that the higher tax rates that apply to short-term gains can take a big bite ou…

What Is A Long-Term Capital Gain?

- The term "capital gain" simply refers to a profit made by selling an asset for more than you paid for it. As an example, if you paid $3,000 for a stock investment and sell it for $4,000, you'd have a $1,000 capital gain on the sale. The IRS splits capital gains into two distinct baskets for tax purposes: long- and short-term capital gains. A short-term capital gain occurs if you owned the a…

The Long-Term Capital Gains Tax Brackets

- It may seem odd, but the income ranges long-term capital gains tax brackets look rather different than those for ordinary income and short-term gains. While the Tax Cuts and Jobs Actmade significant changes to the income thresholds for the ordinary income brackets, it didn't make any such changes to the long-term capital gains brackets. With that in mind, here's a look at the 201…

How Much Could The Long-Term Capital Gains Tax Rates Save You?

- To illustrate just how valuable these long-term capital gains tax rates can be for investors, here's a simplified example. Let's say that you're married and that you and your spouse file a joint tax return. To keep the numbers simple, we'll say that you have combined taxable incomeof $200,000 in 2019, which puts you firmly in the 24% marginal tax b...

Think Twice Before Selling Winners After Just A Few Months

- The long-term capital gains tax rates are designed to encourage long-term investment and are yet another reason why it can be a bad idea to move in and out of stock positions frequently. Specifically, it can be tempting to sell winning stock positions quickly in order to lock in gains. However, be aware that the higher tax rates that apply to short-term gains can take a big bite ou…