Nonprofit Financial Statements Explained

- 1. Statement of Financial Position The Statement of Financial Position is a snapshot of what your organization owns and what it owes to others at a specific point in time. You may know it better by its name in the for-profit world: the Balance Sheet. ...

- 2. Statement of Activities ...

- 3. Statement of Cash Flows ...

- 4. Budget vs. Actual Report ...

- 5. IRS Form 990

How to read non-profit financial statements?

How Do We Read the Ratios for a Nonprofit's Financial Statement?

- Locate the company financial information for the last few years. Nonprofit organizations are required to make their financial statements available for public viewing.

- Obtain a list of financial ratio calculations, and determine which ratios you want to measure. ...

- Search the financial statements for each necessary value and calculate the ratios. ...

How to write a value statement for a nonprofit?

Examples of Nonprofit Organization Core Values

- Purpose. A nonprofit requires a set of core values compelling enough to provide vision and purpose to the organization.

- Examples. Defining core values requires first determining the concepts for which the organization wants to be known, for example, "integrity" and "excellence."

- Creating Core Values. ...

- Formal and Informal. ...

Does your nonprofit need financial expertise?

Nonprofit boards need up-to-date financial information to make informed decisions. But not every board member arrives with a deep appreciation for, or even a passing familiarity with, financial reports. Help your board increase its financial literacy by reducing the mystery of nonprofit budgets, financial reports, and audits. Budgets: Yuk or Yay?

What are the best practices for nonprofits?

Top reviews from the United States

- Advocate and Serve. The best organizations integrate grassroots programs with policy advocacy. ...

- Make Markets Work. Nonprofits can invite business to "do well while doing good" through better business practice, corporate partnerships and earned income. ...

- Inspire Evangelists. ...

- Nurture Nonprofit Networks. ...

- Master the Art of Adaptation. ...

- Share Leadership. ...

Is a 990 the same as a financial statement?

The presentation in the Form 990 is more extensive than that shown in the audited financial statements and is complicated. The revenue and expenses are segregated in the revenue section of the Form 990, while the audited financial statements may show this information as a net number.

Why do nonprofits need financial statements?

Financial statements are a critical component used by management and boards of nonprofit organizations (NPO) to gauge how well the organization is performing, determine the strength of financial position, and to make informed decisions for the future of the organization.

Where do I find financial statements for a non profit?

Search for annual reports on GuideStar or the nonprofit's website. All nonprofits with $100K in annual contributions or over $250K in assets are required to file an IRS Form 990. The Form 990 is publicly available and can be found on the organization's page or on nonprofit databases such as GuideStar.

Do nonprofits have to provide financial statements?

Tax-exempt nonprofits are required to provide copies, upon request, of their three most recently filed annual information returns (IRS Form 990) and their application for tax-exemption.

What 3 financial statements must a nonprofit organization prepare annually?

Nonprofits use four main financial reporting statements: balance sheet, income statement, statement of cash flows and statement of functional expenses.

What statements are usually prepared by non profit organizations?

The Not-for-Profit Organisations usually prepare the Income and Expenditure Account and a Balance Sheet with the help of Receipt and Payment Account.

What is a nonprofit balance sheet called?

Emily. A balance sheet, also known in the nonprofit world as a "Statement of Financial Position" is one of the core nonprofit financial statements. This document is often complemented by a statement of activities (the nonprofit version of an income statement), statement of retained earnings, and statement of cash flows ...

What is the difference between nonprofit and for profit financial statements?

A for-profit corporation keeps a balance sheet that reflects the assets the corporation owns, which can be distributed as retained earnings to shareholders. Meanwhile, a nonprofit keeps a statement of financial position, which reflects the assets on hand that can be used to further the mission of the organization.

What goes on a nonprofit balance sheet?

The balance sheet reports an organization's assets (what is owned) and liabilities (what is owed). The net assets (also called equity, capital, retained earnings, or fund balance) represent the sum of all the annual surpluses or deficits that an organization has accumulated over its entire history.

What records should a nonprofit Keep?

Keep these records permanentlyArticles of Incorporation.Audit reports, from independent audits.Corporate resolutions.Checks.Determination Letter from the IRS, and correspondence relating to it.Financial statements (year-end)Insurance policies.Minutes of board meetings and annual meetings of members.More items...

What kind of accounting do nonprofits use?

fund accountingThat's why nonprofits employ a type of accounting known as fund accounting. Fund accounting enables nonprofits to allocate their money into different groups or “funds” in order to keep them organized and only spend funds on what they're designated for.

Who is financially responsible for a nonprofit?

The Board of DirectorsThe Board of Directors is also responsible for nonprofit financial management and reporting. While the Audit Committee or Finance Committee will review and approve the annual audit and IRS Form 990, the full Board will also be asked to approve these documents based on the recommendation of the Audit Committee.

Why is financial statement so important to organizations?

Financial statements provide a snapshot of a corporation's financial health, giving insight into its performance, operations, and cash flow. Financial statements are essential since they provide information about a company's revenue, expenses, profitability, and debt.

Why do we need accounting for non profit organizations?

Accounting for nonprofits requires professionals to exhibit a certain level of financial accountability to prove how an organization is spending its funds and furthering its cause. While IRS 501(c)(3) status allows nonprofits to be tax-exempt, they are permitted by law to make a profit.

Why is accounting important for nonprofit organizations?

Nonprofit accounting reports provide decision-makers with key information to understand an organization's financial state, assess funding streams, and develop strategies. Financial statements include information about balances, revenues, and expenses. Nonprofit accounting tracks how money is spent in different funds.

What are the Key Financial Statements for a Nonprofit?

A nonprofit entity issues a somewhat different set of financial statements than the statements produced by a for-profit entity. One of the statements is entirely unique to nonprofits. The financial statements issued by a nonprofit are noted below.

What is the purpose of statement of activities?

The statement of activities quantifies the revenues and expenses of a nonprofit for a reporting period. These revenues and expenses are broken down into the “Without Donor Restrictions” and “With Donor Restrictions” classifications that were referred to earlier for the statement of financial position.

What is the statement of financial position?

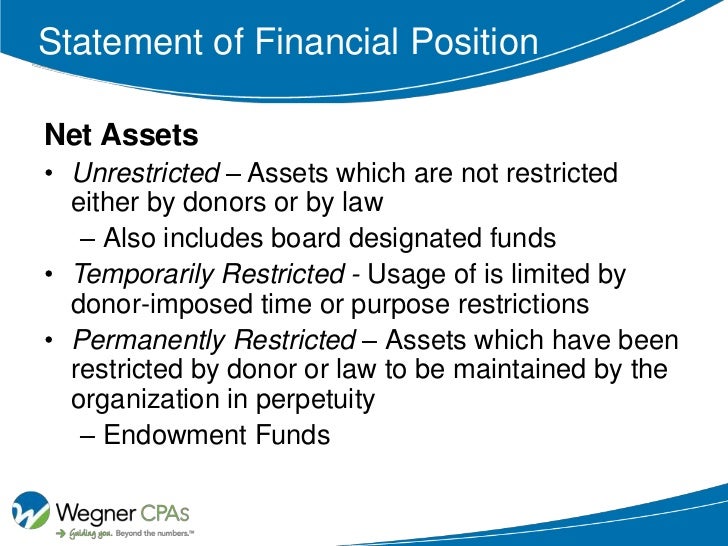

Statement of financial position. This is similar to the balance sheet of a for-profit entity, except that a net assets section takes the place of the equity section that a for-profit entity uses. The net assets section breaks out net assets with donor restrictions and net assets without donor restrictions.

What is functional expense?

The statement of functional expenses shows how expenses are incurred for each functional area of the business. Functional areas typically include management and administration, fund raising, and programs.

What is a statement of cash flows?

The statement of cash flows contains information about the flows of cash into and out of a nonprofit; in particular, it shows the extent of those nonprofit activities that generate and use cash.

1. Statement of Financial Position

The Statement of Financial Position is a snapshot of what your organization owns and what it owes to others at a specific point in time.

2. Statement of Activities

The Statement of Activities summarizes the money you’ve received (revenues) and the money you’ve spent (expenses) during a given period.

3. Statement of Cash Flows

The Statement of Cash Flows is one of the core external nonprofit financial statements required for an independent audit, so you should be familiar with it.

4. Budget vs. Actual Report

The budget vs. actual report helps you to easily compare what happened in your business to what you expected to happen.

5. IRS Form 990

Even though you don’t have to pay federal taxes, almost all nonprofit organizations (the few exceptions are listed here) must file an IRS Form 990 each year.

What Are Financial Statements?

First, you set up your chart of accounts, and then you use those accounts when recording transactions. Once those are complete, you can begin to generate reports based on the information you’ve recorded. When compiled in specific ways, these are referred to as your financial statements. Reports can vary from listing contacts to reviewing your transaction history, but there are two specific reports every organization needs to know.

What is nonprofit accounting?

A nonprofit accounting system begins with accounts that are used to record transactions, that then allow you to create nonprofit financial statements. This is essentially the nuts and bolts of any accounting system. Check out this article to explore other resources going over these reports. Now that you have a foundational understanding ...

What is functional expense?

The statement of functional expenses is where fund accounting really begins to shine. This report shows not only how much money you’ve spent, but it breaks each expense down by fund and category. For instance, it would show the total administrative costs across your entire organization. It also shows how much each fund has spent using these accounts. Assuming you have created an effective chart of accounts and recorded everything properly, these reports should be very simple to create.

What is a report for a nonprofit?

A report is really just a collection of data presented in a certain way. That being said, this can truly be anything you want to see about your nonprofit. The ability to generate different types of reports is going to come down to the amount of detail you have been recording, and the method you use to generate nonprofit financial statements.

How to choose a nonprofit reporting software?

Especially for nonprofits, you want to choose software that will allow you to find the information you need quickly. Also, think through the other types of information you may want to see in a report. For instance, will you want or need to see how many people have given to a particular fund? Will you want or need to see how much you have received and spent on a fundraiser within a certain timeframe? Again, all of these reports will come down to the amount of detail you’ve been recording, and the capabilities of the software you’ve chosen to use.

What is the balance sheet of a nonprofit?

The balance sheet, known as the statement of financial position for nonprofits, illustrates an accounting equation, and shows a snapshot of your organization’s financial health. The accounting equation is: What this means is the things you own (assets), equal the debt you have (liability), plus your overall worth (equity).

What is the amount of money you receive minus the amount you spend?

What this means is the money you receive, minus the money you spend, is called your net income (or the increase in net assets for a nonprofit). When viewing this report, it will quickly show whether your organization is making more than it’s spending.

What is net asset?

That said, net assets are any assets left over after liabilities are taken out.

What are the assets of a nonprofit?

You will find things like furniture, supplies (office supplies, event supplies, or any equipment needed for programs), and money (cash, donations, and grants) under assets.

What is an income statement?

As the name suggests, it will show all of the financial activity of your organization and the financial result of your work.

What is a nonprofit balance sheet?

This statement shows what your company owns and what it owes at a specific date. Think of it as a picture of your financial situation at one point in time. The IRS does ask for this information when you are registering your organization, as well as when filling out your 990, so it is best to have it updated before you do your annual 990.

Why does the Statement of Activities never show expenses of donor restricted amounts?

Because net assets with donor restrictions are not available until released , the Statement of Activities will never show expenses of donor restricted amounts. Instead the amounts show as a release of restriction with the qualifying expenses showing as a change in net assets without donor restrictions.

How to report 990?

When considering how best to report your information either in your financial statements or in your Form 990, first consider who will be reading the information as they may have different nonfinancial objectives that can be displayed via these reports. Donors and grantors want to ensure that the mission is in alignment with their own values and goals. They may evaluate the governance structure and policies and procedures and are also likely interested in the Organization’s program accomplishments and community outreach and results. Board members and prospective board members will also be interested in the mission aligning with their personal values but also from a fiduciary responsibility as well. Board members have a duty to confirm the Organization has the structures and policies in place to comply with all external requirements. The Organization should balance these needs and wants of external parties when considering how best to use the financial statements and Form 990 in telling their unique story.

Why is the 990 important?

As the Form 990 is available for public inspection it is important for the 990 to be used as a marketing tool for the Organization rather than just a required form to be filed each year. Page 2 of the Form reports on the mission and programs of the Organization for the year.

What is a net asset with donor restrictions?

Net assets with donor restriction are restricted by the donor to be used only for a specific purpose or during a future period. Net assets with donor restrictions would also include amounts to be held in perpetuity as required by the donor.

What is a release of restricted amounts?

Once donor restricted amounts are used for their required purpose or as time has passed and the restricted amounts become available, a release of restriction is shown in the Statement of Activities as a reduction from net assets with donor restrictions and an increase in net assets without donor restrictions.

What is net asset?

Net assets include amounts without donor restrictions and with donor restrictions. These classifications are somewhat self-explanatory in that net assets without donor restrictions means that the entity may use those net assets for any program or administrative costs, and they may be used at any time.

How often should financial statements be reviewed?

Management and board members should be reviewing financial statements on a regular basis throughout the year. The timing may be dependent on the activity of the organization, but typically monthly reviews are recommended. The financial statements to be reviewed by management and the board should include comparisons to budget and prior periods when applicable. These internal reports used for management of the organization and fiscal oversight by the board may look different than those that are used for external purposes. Program and development directors should also be reviewing financial statements for their programs or grants on an ongoing basis throughout the year and comparing to budget or other expectations.

1. Restricted vs. unrestricted funds

Restricted and unrestricted funds are one of the biggest differentiators between nonprofit organizations and for-profit businesses. It’s important to have a clear understanding of which funds are restricted and which are unrestricted. Restricted funds are based on donor intent.

2. Revenue model structure

Typically, a nonprofit’s revenue model is broken down into contributions (or money donated) and earned income. The goal is to ensure that funds are appropriately balanced by tracking where they are coming into the organization. Reviewing the revenue model monthly allows the nonprofit to make adjustments when funding is “out of whack.”

3. True program costs

Understanding true program costs is at the heart of longevity and sustainability for nonprofits. Program operations involve many expenses, which means nonprofits need full visibility into their financial information to plan for the future, mitigate risk of cash shortfalls, and report appropriately to the IRS.

What is the financial statement of a nonprofit organization?

The Statement of Financial Position, also known as the Balance Sheet , is the financial statement that represents the financial position or condition of an organization. The Balance Sheet represents the accounting equation which states that the total assets of a business at the end of a period will always be equal to the total equity and total liabilities of the business. Since nonprofit organizations don’t have any owners, the equity portion of the Balance Sheet is replaced by net assets for nonprofit organizations.

What is the difference between nonprofit and profit-making organizations?

Another difference between the two types of organizations is the stockholders they report their financial activities to. Nonprofit organizations mainly report to donors while profit-making organizations report to shareholders. The financial statements of the two types of organizations also differ from each other.

How does a nonprofit's financial position differ from a profit-making organization's?

The Statement of Financial Position of nonprofits differ from the balance sheet of profit-making organizations mainly due to the inclusion of net assets instead of owners’ equity. Profit-making businesses use the classical approach to Balance Sheet where the assets of the organization are represented on one side of the equation and owner’s equity and total liabilities represented on the other. Nonprofits organizations balance sheets take the total liabilities of the organization and subtract them from the total assets of the organization to arrive at the net assets value at the end of a period.

How does a nonprofit organization differ from a for-profit organization?

One of the ways it is different from for-profit organizations is the key financial statements for nonprofit organizations are different than usual financial statements used in other businesses.

What is a non profit's net asset?

The net assets of a nonprofit organization are classified into three categories. These net assets can either be categorized as unrestricted, temporarily restricted or permanently restricted net assets. Nonprofit organizations may serve more than one purpose or goal and that is why some funds may be restricted by donors. When funds are restricted, it means the funds can be only used for a specific purpose and under specific conditions as described by the provider of the funds.

What is a statement of activities?

Statement of Activities. The Statement of Activities is a unique financial statement to nonprofit organizations. It is similar to the Income Statement of profit-making businesses. The Statement of Activities reports the revenues and the total expenses for different categories of a nonprofit organization. Furthermore, it describes the effects of ...

What is a nonprofit organization's balance sheet?

The Balance Sheet of a nonprofit organization signifies the overall stability of the organization. It can be used by donors to assess the overall position of the organization and whether further funds need to be donated to the organization. If nonprofit organizations want to obtain loans from financial institutions such as banks, the Statement of Financial Position is used by the financial institution to assess whether the loan should be granted or not.