The most common types of dilutive securities are:

- Options. These instruments give the holder the option to acquire shares at a certain price, and within a certain date...

- Warrants. These instruments also give the holder the option to acquire shares at a certain price, and within a certain...

- Convertible bonds. These are debt instruments that give the holder the option to...

What are dilutive securities examples?

Share Dilutive securities are any financial instrument that can increase the number of shares a company has outstanding. Examples include convertible bonds, options, warrants and preferred stock. The effect of dilutive securities is to reduce the price of shares and earnings attributable to each share.

What are the advantages of a dilutive security?

Dilutive securities attract investors with its option of conversion to common stock at a later date and thus help in raising finance, especially for start-up companies.

What are anti-Dilutive securities?

In anti-dilutive securities, there is a provision that allows existing shareholders to buy additional shares when conversion options on dilutive securities are exercised by the investors. These types of securities are known as anti-dilutive securities.

What happens when Dilutive securities are converted to stock?

Unless the existing shareholders have the right to maintain their ownership when dilutive securities are converted, their stock will become slightly less valuable. What Does Dilutive Securities Mean? Like most investments, dilutive securities can take a few different forms.

What are examples of dilutive securities?

Examples of dilutive securities include stock options, convertible preferred stocks, convertible bonds and warrants.

What are dilutive shares?

Share dilution is when a company issues additional stock, reducing the ownership proportion of a current shareholder. Shares can be diluted through a conversion by holders of optionable securities, secondary offerings to raise additional capital, or offering new shares in exchange for acquisitions or services.

Which of the following types of securities potentially could be dilutive with respect to EPS?

19. Convertible securities are potentially dilutive securities and part of diluted earnings per share if their conversion increases the EPS numerator less than it increases the EPS denominator; i.e., the EPS with conversion is less than the EPS before conversion.

Why warrants are called dilutive securities?

Debt and Equity Convertible securities and options, warrants and other securities are called dilutive securities because when they use can reduce (dilute) earnings per share.

Why would a company dilute shares?

Dilution of shares occurs when a company issues additional shares of stock to raise money, acquire another business, or for other reasons. Dilution of shares reduces existing shareholders' equity in the company, but not the dollar value of their stake.

How do you know if a stock is diluted?

1:148:54How To Tell If A Stock Is Being Diluted - YouTubeYouTubeStart of suggested clipEnd of suggested clipYou down to kind of a net income here then it shows you an earnings per share here. On this line.MoreYou down to kind of a net income here then it shows you an earnings per share here. On this line. And most more importantly shows you the number of shares that it's using to calculate.

What are dilutive and antidilutive convertible securities?

Shareholders typically resist dilution as it devalues their existing equity stake and reduces a firm's earnings per share. Anti-dilutive securities such as convertible notes, or clauses that protect shareholders from dilution, include mechanisms that keep the overall number of shares outstanding the same.

When several types of potential common shares exist the one that enters the computation of diluted EPS first is the one with the?

When several types of potential common shares exist, the one that enters the computation of diluted EPS first is the one with: - Lowest incremental effect.

What are potential common shares?

- Adjust prior year for any split or stock dividends for presentation purposes. Potential common shares? Securities that are not common stock but might become common stock through their exercise or conversion.

Are warrants dilutive?

Unlike options, warrants are dilutive. When an investor exercises their warrant, they receive newly issued stock, rather than already-outstanding stock. Warrants tend to have much longer periods between issue and expiration than options, of years rather than months.

What is the difference between a stock and a warrant?

Stock options are purchased when it is believed the price of a stock will go up or down. Stock options are typically traded between investors. A stock warrant represents future capital for a company.

What are non dilutive shares?

are shares that don't get diluted in the next funding round. Every investor would love to have special shares that don't get diluted in subsequent rounds.

What is the effect of dilutive securities?

The effect of dilutive securities is to reduce the price of shares and earnings attributable to each share. That’s one reason many shareholders object when a board of directors issues dilutive securities. Dilutive Securities Explained.

What is a dilutive security?

The descriptive term “dilutive security” refers to any financial instrument that can lead to an increase in a company’s total outstanding shares and thereby a decrease in the company’s earnings per share. So, for example, contracts which cause the company to transfer existing shares would not count as a dilutive security.

What is a dilutive stock?

Dilutive securities are financial products that cause a company to issue new shares. They can cause share prices and earnings per share to decline, creating some resistance among existing shareholders. Among the many types of dilutive securities are convertible bonds, warrants, preferred stock and stock options.

What is a dilutive security?

What are Dilutive Securities? Home » Accounting Dictionary » What are Dilutive Securities? Definition: A dilutive security is any type of investment security that has the potential to increase the number of common shares outstanding. In other words, it’s any securities that can be turned into common stock.

What happens if a security increases its outstanding shares?

The idea is that if a security increases the outstanding shares it will dilute the current shareholders stake in the company as well as their owner benefits like future dividends and voting power.

What is stock option?

These are contracts that give the owner the right to purchase common stock at a given price at a given time. When stock options are exercised, the options become common shares and increase the number outstanding.

What causes a stock to dilution?

Dilution can be caused due to a number of dilutive securities such as stock options. Stock Option A stock option is a contract between two parties which gives the buyer the right to buy or sell underlying stocks at a predetermined price and within a specified time period.

Why does dilution cause a decline in stock price?

Dilution may cause the share price to decline because it reduces the company’s earnings per share (EPS). The extent of the decline depends on the percentage of dilution. Given basic shares outstanding, share price, and information about dilutive securities, we can calculate dilution using the treasury stock method, ...

Why is the new share price of a company lower than its share price before dilution?

The reason for this is that the market capitalization of the company is divided by a greater number of shares. Dilutive securities cause the EPS of a company to decline.

What is the seller of a stock option called?

A seller of the stock option is called an option writer , where the seller is paid a premium from the contract purchased by the stock option buyer. Cost of Preferred Stock The cost of preferred stock to a company is effectively the price it pays in return for the income it gets from issuing and selling the stock.

What is a dilutive stock?

Rather, most dilutive securities provide a mechanism through which the owner of the security can obtain additional common stock. This mechanism can be either an option or conversion.

What is it called when a security instrument is diluted?

These are often called anti-dilution provisions.

Why do shareholders resist dilution?

Shareholders typically resist dilution as it devalues their existing equity stake and reduces a firm's earnings per share. Anti-dilutive securities such as convertible notes, or clauses that protect shareholders from dilution, include mechanisms that keep the overall number of shares outstanding the same.

What is a dilution protection clause?

Similarly, an anti-dilution provision is a provision in an option or a convertible security, and it is also known as an "anti-dilution clause.".

What is publicly traded stock?

These terms commonly refer to the potential impact of any securities on the stock's earnings per share. The fundamental concern of existing shareholding after new securities are issued, or after securities are converted, is that their ownership interests are diminished as a result.

Types of Dilutive Securities

You are free to use this image on your website, templates etc, Please provide us with an attribution link How to Provide Attribution? Article Link to be Hyperlinked For eg: Source: Dilutive Securities (wallstreetmojo.com)

Conclusion

Dilutive securities are more important because companies issue convertible securities Convertible Securities Convertible securities are securities or investments (preferred stocks or convertible bonds) that can be easily converted into a different form, such as shares of an entity's common stock, and are typically issued by entities to raise money.

Recommended Articles

This article has been a guide to what is Dilutive Securities. Here we discuss the types of dilutive securities, including convertible bonds, convertible preferred stocks, Options and Warrants with examples. You may also have a look at the following recommended articles in accounting –

What is dilutive versus antidilutive?

Dilutive versus Antidilutive Securities and Implications for EPS Calculation. Dilutive securities are those financial instruments that are potentially convertible into common stock and could potentially dilute or decrease EPS due to the increase in the number of ordinary shares after conversion. In contrast, some potentially convertible securities ...

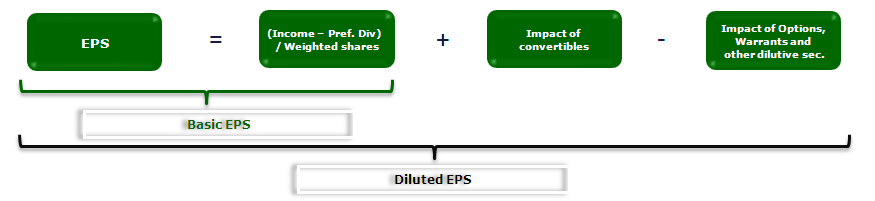

Is diluted EPS equal to basic EPS?

As a rule, diluted EPS should always be less than or equal to basic EPS, and should reflect the maximum potential dilution from the conversion of potentially dilutive financial instruments.

Why do companies issue dilutive securities?

A company issues dilutive security for various reason, one of them is that securities with an option of conversion to common stock at a later date attract investors, as the option may seem less risky to them . The earnings per share of a company is calculated through a simple formula i.e. total earnings divided by the no. of outstanding shares. Thus now, it can be easily understood as to why dilutive securities will reduce earnings per share if the conversion option is exercised by the investor.

Why are dilutive securities important?

Dilutive securities are an important aspect of the company’s share capital as it helps in attracting investors who consider these securities as a less risky option. The company’s dilutive earnings per share is always lower than basic earnings per share. But in the practical world dilutive securities is more of a theoretical concept as the investors will not exercise the option unless the purchase price will generate profit for them. But since strike prices are kept higher than the market price, investors do not exercise the option.

What is a dilutive stock?

Dilutive securities are financial instruments like debentures, bonds, and preference shares, etc. which have the option of conversion to common stock or normal securities at a certain point of time. If the option is exercised, it will reduce the earning per share for existing shareholders, thus it is called dilutive. In simple words, if the company’s outstanding number of shares increases, it will automatically reduce the earning per share.

What is diluted earnings per share?

The value of earnings per share if all these convertible securities (executive stock options, equity warrants, and convertible bonds) were converted to common shares is called dilu ted earnings per share (EPS). It's calculated and reported in company financial statements.

What is the indicator of a firm's potential share dilution?

In a scenario where a firm does not have the capital to service current liabilities and can't take on more debt due to covenants of existing debt, it may see an equity offering of new shares as necessary. Growth opportunities are another indicator of potential share dilution.

How much would the share count increase after 6,000 shares are repurchased?

Share count would increase by 4,000 (10,000 - 6,000) because after the 6,000 shares are repurchased, there is still a 4,000 share shortfall that needs to be created. Securities can be anti-dilutive. This means that, if converted, EPS would be higher than the company's basic EPS.

What is a share dilution?

What Is Share Dilution? Share dilution happens when a company issues additional stock. 1 Therefore, shareholders' ownership in the company is reduced, or diluted when these new shares are issued. Assume a small business has 10 shareholders and that each shareholder owns one share, or 10%, of the company.

How does dilution affect shareholders?

After all, by adding more shareholders into the pool, their ownership of the company is being cut down. That may lead shareholders to believe their value in the company is decreasing.

What is secondary offering?

Secondary offerings are commonly used to obtain investment capital to fund large projects and new ventures. Shares can also be diluted by employees who have been granted stock options. Investors should be particularly mindful of companies that grant employees a large number of optionable securities.

Why is dilution important for retail investors?

Because dilution can reduce the value of an individual investment, retail investors should be aware of warning signs that may precede potential share dilution, such as emerging capital needs or growth opportunities. There are many scenarios in which a firm could require an equity capital infusion.