Are Premium Bonds a bad investment?

With Premium Bonds there is no risk to your capital – so the money you put in is totally safe – it is only the 'interest' that is a gamble. And as Premium Bonds are operated by NS&I which, rather than being a bank, is backed by the Treasury, this capital is as safe as it gets.

What are some benefits of buying premium bonds?

- Coupon income [for most, but not all bonds]

- Less extreme volatility than many other asset classes

- Many bonds back have full or partial tax benefits for US investors.

- Diversification relative to other assets; bonds are known to typically move in negative correlation to stocks.

What is the maximum amount of Premium Bonds?

Maximum amount you can hold: £50,000; Age limit: Over 16 to buy them; under that age they may be held in the name of under-16s by parents or guardians. Anyone can now buy Premium Bonds for under-16s, then nominate the child's parent or guardian to hold them. In general, you need to hold the bonds for a full month before they're eligible to win.

How do you check Premium Bonds?

This includes the:

- NS&I premium bond prize checker app

- Prize checker app on Google Play

- Premium bonds prize checker skill on Amazon Alexa

What is a premium bond and how does it work?

What are Premium Bonds. Premium Bonds are an investment product issued by National Savings and Investment (NS&I). Unlike other investments, where you earn interest or a regular dividend income, you are entered into a monthly prize draw where you can win between £25 and £1 million tax free.

What is the benefit of Premium Bonds?

Premium Bonds are provided under a government guarantee to buy them back at the price you purchased them. That means that you can withdraw your investment at will and know that you will not face any type of punitive charges for doing so.

Is it worth keeping money in Premium Bonds?

Premium Bonds could be worth investing in if you: Have a lot of money to save (the more bonds you have, the bigger your chance of winning a prize) Pay tax on savings interest (and have already used up your annual cash ISA allowance) Like the idea of a prize draw (you could win big, but you also may not win anything)

How much do Premium Bonds pay out each month?

What are the chances of winning? The stated interest rate is 1.4%. This means that every year, £1.40 worth of prizes are awarded for every £100 invested, with a prize drawer taking place once a month. For every £1 you hold in premium bonds, your chances of winning premium bonds are 24,500:1.

What are disadvantages of Premium Bonds?

Premium bonds: the consNo interest. Unless you win a pay-out in the monthly prize draw, you won't see a return on your investment.Extremely low odds. If you expect a guaranteed win, premium bonds aren't for you. ... No regular income. There's a chance you'll only earn a small percentage of the amount you've invested.

How much should I put into my Premium Bonds?

How do I buy Premium Bonds? The easiest way is online through the NS&I website. Minimum purchase amount: £25 for one-off purchases and monthly standing orders. Maximum amount you can hold: £50,000.

What is the average return on 50000 premium bonds?

Furthermore, average winnings are around 1% or even less, which can still see your cash being beaten by inflation. The same research found that holding £50,000, the maximum amount of bonds, would give a 0.9% return with average luck.

What are the odds of winning with 50000 premium bonds?

You are lucky – only 9.16% of people who have put £50000 in premium bonds over 6 months win more than £450. So there you have it. Pretty lucky.

What is better than premium bonds?

While Cash ISAs and Premium Bonds are very low-risk, they are unlikely to offer high returns. If you're happy to take more risk for the possibility of better returns, then a Stocks and Shares ISA might be better for you.

What happens if you win a big prize on Premium Bonds?

You can choose to have your prizes paid directly to your bank account (or NS&I Direct Saver) or reinvested into more Bonds, giving you even more chances to win. Choose either of these options and we'll let you know by text or email if you win. It's the quicker, easier, safer and greener way to receive your prizes.

Do I have to declare Premium Bonds on my tax return?

Tax and you do not need to declare it on your tax return. Anybody over the age of 16 can buy Premium Bonds, and you can also buy them on behalf of your child or grandchild.

How do I cash in my premium bonds?

Premium Bonds cash in formCash in my Premium Bonds. You'll need your holder's number and bank account details to hand. Please also have your Bond record ready, if you'd like to cash in specific Bonds.Cash in my child's Premium Bonds. You'll need your child's holder's number and your bank account details to hand.

How does someone make money when they buy a bond?

There are two ways to make money by investing in bonds. The first is to hold those bonds until their maturity date and collect interest payments on them. Bond interest is usually paid twice a year. The second way to profit from bonds is to sell them at a price that's higher than you initially paid.

How do premium bonds make money?

With Premium Bonds, there is no interest earned. Instead the interest rate funds a monthly prize draw for tax-free prizes. Remember that inflation can reduce the true value of your money over time.

What is better than premium bonds?

While Cash ISAs and Premium Bonds are very low-risk, they are unlikely to offer high returns. If you're happy to take more risk for the possibility of better returns, then a Stocks and Shares ISA might be better for you.

Why would you buy a bond?

Investors buy bonds because: They provide a predictable income stream. Typically, bonds pay interest twice a year. If the bonds are held to maturity, bondholders get back the entire principal, so bonds are a way to preserve capital while investing.

What is premium bond?

A premium bond refers to a financial instrument that trades in the secondary market at a price exceeding its face value. This occurs when a bond’s coupon rate surpasses its prevailing market rate of interest. For instance, a bond with a face value (par value) of $750, trading at $780, will reflect that the bond is trading at a premium of $30 ...

How Does a Premium Bond Work?

Premium bonds help in generating higher earnings in the bond market. Bonds Bonds Bonds refer to the debt instruments issued by governments or corporations to acquire investors’ funds for a certain period. read more are relatively safer than shares because bonds are essentially a debt to the issuer. As such, they carry lesser risk and usually have fixed returns. For example, a $2000 bondholder with a 5-year maturity and 10% annual interest or coupon rate Coupon Rate The coupon rate is the ROI (rate of interest) paid on the bond's face value by the bond's issuers. It determines the repayment amount made by GIS (guaranteed income security). Coupon Rate = Annualized Interest Payment / Par Value of Bond * 100% read more will earn $200 in interest for five years. If the bond is held till maturity, $2000 will be repaid to the bondholder.

How do investors make higher gains in a bond market?

Investors try to make higher gains in a bond’s market by taking advantage of the changing coupon rates. When new bonds provide lower interest rates, the older bonds of the same category with higher interest rates attract investors. Resultantly, older bonds start trading at a premium in the secondary market.

What does BV mean in bond pricing?

BV = Bond Value or Bond Price Bond Price The bond pricing formula calculates the present value of the probable future cash flows, which include coupon payments and the par value, which is the redemption amount at maturity. The yield to maturity (YTM) refers to the rate of interest used to discount future cash flows. read more

What does YTM mean in bond?

YTM depicts the annual return one makes on the bond and eventually till maturity. Interestingly, if the coupon rate is lesser than YTM, the bond price will be less than its face value. If the coupon rate is higher than YTM, the bond’s price will be higher than its face value, reflecting that it is trading at a premium.

Why are premium bonds overvalued?

As such, premium bonds could at times seem overvalued if their returns struggle to match the price paid.

What are the risks associated with buying bonds?

There are various risks associated with bonds, including inflation, bond’s overvaluation/undervaluation, capital restructuring uncertainty, etc. However, the investors can make good returns when they buy bonds at a discount or premium if they wisely consider all the above factors.

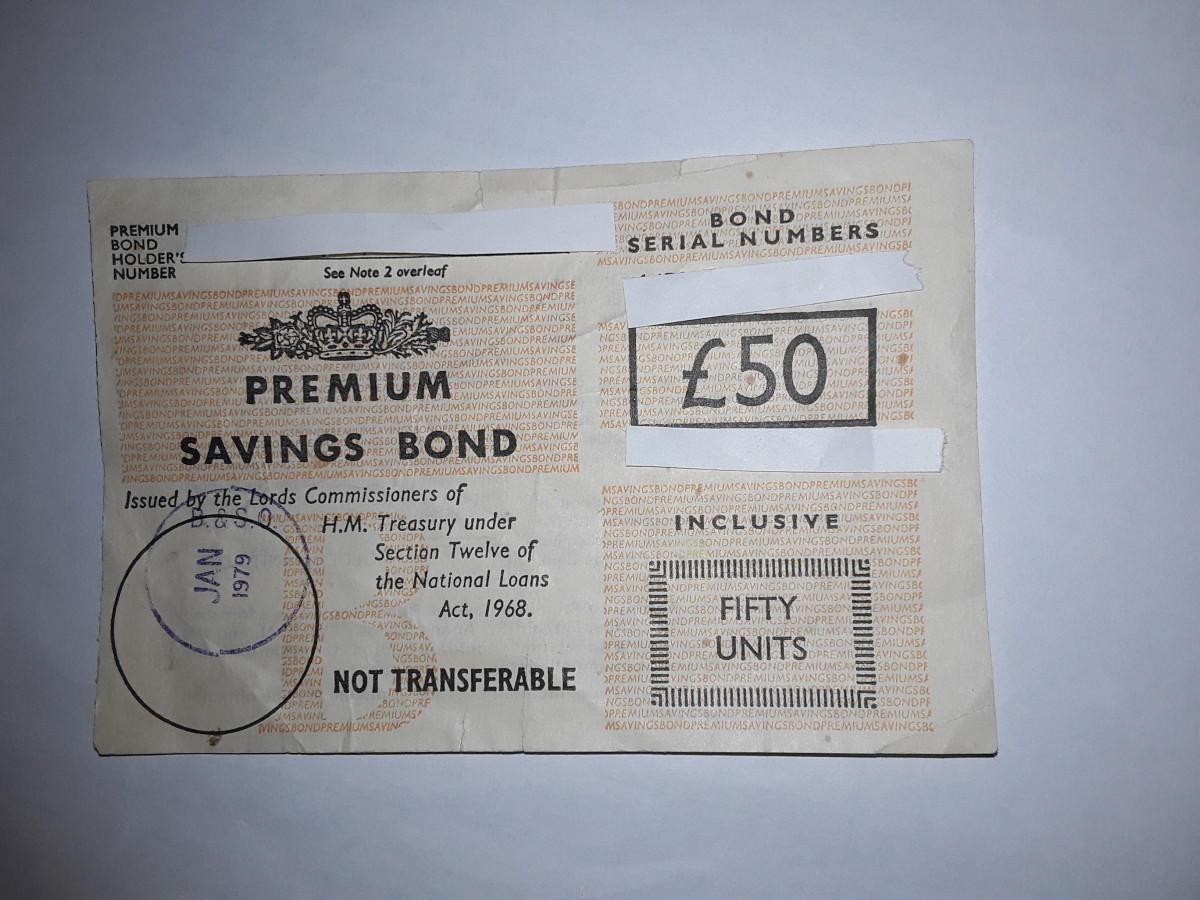

What is holder number on premium bonds?

We give a holder’s number to everyone who owns Premium Bonds. It links all the individual Premium Bonds you have. Quote it whenever you buy more Bonds, cash them in or have a query.

How old do you have to be to buy a bond?

You must be aged 16 or over and buying Bonds for yourself or for a child under 16. You or the child must already have some Premium Bonds, and you must know your (or the child’s) holder’s number. Each investment must be at least £25 and in whole pounds. The bank account must be a UK account in your name.

Can you cash in bonds?

You can cash in all or part of your Bonds at any time.

Do premium bonds have interest?

With Premium Bonds, there is no interest earned. Instead the interest rate funds a monthly prize draw for tax-free prizes. Remember that inflation can reduce the true value of your money over time.

Who introduced premium bonds?

The modern iteration of Premium Bonds were introduced by Harold Macmillan, as Chancellor of the Exchequer, in his Budget of 17 April 1956, to control inflation and encourage people to save. On 1 November 1956, in front of the Royal Exchange in the City of London, the Lord Mayor of London, Alderman Sir Cuthbert Ackroyd, bought the first bond from the Postmaster General, Dr Charles Hill, for £1. Councillor William Crook, the mayor of Lytham St Anne's, bought the second. The Premium Bonds office was in St Annes-on-Sea, Lancashire, until it moved to Blackpool in 1978.

How many Britons invest in premium bonds?

One in three Britons invest in Premium Bonds. The thrill of gambling is significantly boosted by enhancing the skewness of the prize distribution. However, using data collected over the past fifty years, they found that the bond bears relatively low risk compared to many other investments.

How many people hold premium bonds in the UK?

Although many avenues of lotteries and other forms of gambling are now available to British adults, Premium Bonds are held by more than 22 million people, equivalent to about 1 in 3 of the UK population.

What is Aaron Brown's conclusion about premium bonds?

His conclusion is that it makes little difference, either to a retail investor or from a theoretical finance perspective, whether the added risk comes from a random number generator or from fluctuations in financial markets.

How many premium bonds will be issued in 2021?

As of June 2021 there are 109.29 billion eligible Premium Bonds, each having a value of £1 . When introduced to the wider public in 1957, the only other similar game available in the UK was the football pools, with the National Lottery not coming into existence until 1994.

How to check if you won a bond?

Bond holders can check whether they have won any prizes on the National Savings & Investment Premium Bond Prize Checker website, or the smartphone app, which provides lists of winning bond numbers for the past six months. Older winning numbers (more than 18 months old) can also be checked in the London Gazette Premium Bonds Unclaimed Prizes Supplement.

When were blue premium bonds issued?

The bonds were generally identified by their colour, for instance the blue premium bonds were issued in 1948, and were redeemed in 1998 (10 years + 4 10-year extension). The first 200 DKK of each prize was tax free, the rest taxed at only 15% (compared to 30% or more for ordinary income).

What is premium bond?

A premium bond is a bond that is valued higher than its face value (i.e.) at a premium. A bond might be valued and traded at a premium because of the returns it gives to its investors (i.e.) the interest rate offered by the bond will be higher than the market rate and other bonds.

How to Buy Premium Bonds?

Premium bonds are traded in the secondary market; an investor who expects more return than the market rate and wants to buy from a high credit rating issuer can go for these bonds considering the returns and security of investment.

How do bonds work?

Bonds are fixed-income securities, and it trades at the premium price considering the returns , creditworthiness of the issuing company , etc. When the demand for the bond increases in the market, it pushes the price of the bond to high levels. Bond price can be volatile in the market; it may not always be at a premium ordiscount as market movements determine it. When the returns are better than the market rate, then the price moves up, and when the returns are lower than the market rate, then the price of the bond reduces as investors lose interest in the investment.

Do bond rates change?

Bonds are fixed-income securities, and it pays the fixed interest to the bondholders till the maturity period. Market rate movements will not change the interest rate of the bond. As the interest rate doesn’t change with respect to market conditions, the bond changes’ value with respect to interest rate movements.

What happens when you win premium bonds?

In other words, your winnings will buy more bonds. That increases your holding, and therefore increases your chances of winning.

What is personal savings allowance?

The personal savings allowance means that basic-rate taxpayers can earn £1,000 of interest a year tax-free (£500 for higher-rate taxpayers, nothing for additional-rate taxpayers). So that makes the Premium Bond rate very easy to compare with other savings (rates correct at 1 May 2021).

Is the premium bond rate higher than the savings rate?

The Premium Bond rate is currently higher than almost all savings rates, except for one-year fixed savings and two-year fixed cash ISAs, but the prize rate's almost irrelevant to what you actually win, so the question still stands: "Should I move cash to Premium Bonds or savings?"

Do premium bonds look better than savings?

Yet once you've more than £5,000 saved in Premium Bonds, you're actually more likely to win close to the prize rate, and therefore Premium Bonds do look a little better – though you'll need to have this average luck to beat savings.

Do premium bonds increase your chances of winning?

In other words, your winnings will buy more bonds. That increases your holding, and therefore increases your chances of winning. If you are going to put money in Premium Bonds and you don't need the cash, then this is a sensible move, as it is effectively like compound interest in a normal savings account.

Is premium bond interest tax free?

Premium Bond prizes (the interest) are paid tax-free. However for most people that's no longer a bonus. Since 2016, the personal savings allowance (PSA) has meant all savings interest is automatically paid tax-free.

Can you claim premium bonds before the 12 month limit?

However if prizes were won before the 12-month limit, they can still be claimed with no time-limit. Premium Bonds aren't inheritance tax free, so if the capital tied up in them forms part of the estate and is passed on, they may be taxed (see our inheritance tax guide for when you might need to pay).

What are the best investment opportunities?

Who is this suitable for? 1 Clients wanting the chance every month to win a £1 million jackpot and other tax-free prizes 2 Clients wanting to make the most of tax-free investment opportunities 3 Clients that have £25 or more to invest 4 Clients who want 100% security for their money 5 Clients who want to buy them as a gift for a child under 16 6 Clients who want the option to invest either online or by phone or post

Can you invest in premium bonds?

The Premium Savings Bond Regulations do not allow for Premium Bonds to be invested in trust as the investment was created for individuals to invest in. Only solely named individuals can invest in Premium Bonds - the regulations do not allow joint investors or any organisation , whether incorporated or unincorporated, to invest in Premium Bonds as this would go against the intention of the investment.

Can Premium Bonds be held in a SIPP or SSAS?

No. Premium Bonds were designed as a tax-free product and the maximum holding limit gives individuals the opportunity to have a potential tax-free return by way of the prize draw. The Premium Savings Bond Regulations do not allow for Premium Bonds to be invested in trust as the investment was created for individuals to invest in. Only solely named individuals can invest in Premium Bonds - the regulations do not allow joint investors or any organisation, whether incorporated or unincorporated, to invest in Premium Bonds as this would go against the intention of the investment.

Are the winning Premium Bonds the ones bought most recently?

So even though Premium Bonds have been on sale for over 60 years, this is why newer Bonds seem to win more frequently. When ERNIE randomly generates winners, it doesn’t store any numbers, so there’s no way any Bonds can be left out.

Does buying Premium Bonds in a sequence increase the chances of winning?

It’s a popular myth that holding Premium Bonds in a sequence can improve your chances of winning, but this simply isn’t true. The machine we use to generate the numbers for each prize draw—ERNIE—generates numbers completely at random, which are then matched to our database of eligible Bonds to determine the winners. Since no Bonds are actually entered into ERNIE, it doesn’t ‘know’ anything about the Bonds themselves, such as whether the Bond number is part of a sequence of numbers or not. The only thing that can increase your chances of winning is holding more Premium Bonds – but holding them in sequence won’t make any difference.

The next generation

The power behind Premium Bonds has now been upgraded to the next generation – ERNIE 5. Unlike previous versions which used thermal noise to produce random numbers, ERNIE 5 is powered by quantum technology, which uses light.

The clever bit

Using light, ERNIE 5 generates random numbers that are matched against eligible Bond numbers to determine the lucky winners. And because it’s random, every Bond number, whether it has 8, 9, 10 or 11 digits, has a separate and equal chance of winning a prize.

One in a million

Our Agents Million have the important task of delivering the winning news in person to the two monthly jackpot winners. Since the first Premium Bonds millionaire in 1994, over 400 new millionaires have been paid a visit.

Proud heritage

A Bletchley Park code breaker invented the first ERNIE in 1956. Following this, Harold Macmillan announced the launch of Premium Bonds on Budget Day, 17 April 1956, offering everyone an alternative way to save. Since then, there have been five generations of ERNIE and with continuous advances in technology, each has become faster and more powerful.

Premium Bonds today

There are now more ways than ever to check, manage and Buy Premium Bonds. Anyone can see if they have won a prize by using our online prize checker or choose from our mobile or voice apps. And of course you can buy more Bonds whenever you like, 24 hours a day.

Why purchase premium bonds?

As a result of the decline in interest rates during the last decade, and the preference of institutional investors for premium bonds, only a small segment of the municipal market consists of bonds priced at par or less. At the end of February 2021 only 11.8% of the bonds in the Standard & Poor’s Municipal Bonds Index had coupon rates of less than 4% but more than 0%. Furthermore, 65.8% of the bonds had coupon rates of 5% or more.

Why are investors discouraged from buying premium bonds?

Many investors are discouraged from purchasing premium bonds because of the idea that the value of their investment will decrease as the price of the bond declines from its premium purchase price to par. They realize they need to reinvest part of the coupon payment if they want to maintain the principal value of their portfolio.

What are the risks of investing in municipal bonds?

Investing in municipal bonds involves risks such as interest rate risk, credit risk and market risk. The value of the portfolio will fluctuate based on the value of the underlying securities. There are special risks associated with investments in high yield bonds, hedging activities and the potential use of leverage. Portfolios that include lower rated municipal bonds, commonly referred to as “high yield” or “junk” bonds, which are considered to be speculative, the credit and investment risk is heightened for the portfolio. Bond insurance guarantees only the payment of principal and interest on the bond when due, and not the value of the bonds themselves, which will fluctuate with the bond market and the financial success of the issuer and the insurer. No representation is made as to an insurer’s ability to meet their commitments. This information should not replace an investor’s consultation with a financial professional regarding their tax situation. Nuveen is not a tax advisor. Investors should contact a tax professional regarding the appropriateness of tax-exempt investments in their portfolio. If sold prior to maturity, municipal securities are subject to gain/losses based on the level of interest rates, market conditions and the credit quality of the issuer. Income may be subject to the alternative minimum tax (AMT) and/or state and local taxes, based on the state of residence. Income from municipal bonds held by a portfolio could be declared taxable because of unfavorable changes in tax laws, adverse interpretations by the Internal Revenue Service or state tax authorities, or noncompliant conduct of a bond issuer. It is important to review your investment objectives, risk tolerance and liquidity needs before choosing an investment style or manager.

What is Morningstar fund compare?

The Morningstar Fund Compare tool quickly evaluates different funds against one another. In addition to Nuveen funds, add any MF, CEF or ETF available from Morningstar. Important information and disclosures are included after you click Generate Report. Please ensure to enable pop-ups in your browser.

How does coupon rate affect pricing?

Bonds with lower coupons typically provide somewhat higher yields than bonds with higher coupons. This is because of their greater extension risk, longer duration and the greater likelihood that they may someday become discount bonds whose accreted market discount would be taxed as ordinary income. For example, according to Refinitiv, on 23 Feb 2021, high grade bonds with 5% coupons yielded 1.02% if due in 10 years, and 1.18% if due in 13 years and callable in 10 years, for a difference of 0.16%. However, a high grade bond issued on that same day included a 5% coupon bond due in 10 years that yielded 1.10%, and a 2% coupon bond due in 13 years and callable in 10 years that yielded 1.53%, for a difference of 0.43%.

Overview

History

- Each investment must be at least £25. Buying onlineYou can buy Premium Bonds online using our secure online system. Please have your debit card details at the ready. Buying over the phone You can c...

- Premium Bonds can make a special gift for a child under 16. Until the child’s 16th birthday, the parent or guardian named on the application looks after the Bonds, regardless of who bough…

- Each investment must be at least £25. Buying onlineYou can buy Premium Bonds online using our secure online system. Please have your debit card details at the ready. Buying over the phone You can c...

- Premium Bonds can make a special gift for a child under 16. Until the child’s 16th birthday, the parent or guardian named on the application looks after the Bonds, regardless of who bought them.We’...

- With Premium Bonds, there is no interest earned. Instead the interest rate funds a monthly prize draw for tax-free prizes. Remember that inflation can reduce the true value of your money over time.

- Yes! Just fill out a quick online form and we’ll get it sorted for you. Be sure to have the detail…

ERNIE

Winning

A Premium Bond is a lottery bond issued by the United Kingdom government since 1956. At present it is issued by the government's National Savings and Investments agency.

The principle behind Premium Bonds is that rather than the stake being gambled, as in a usual lottery, it is the interest on the bonds that is distributed by a lottery. The bonds are entered in a monthly prize draw and the government promises to buy them back, on request, for their original …

In other countries

The term "premium bond" has been used in the English language since at least the late 18th century, to mean a bond that earns no interest but is eligible for entry into a lottery.

The modern iteration of Premium Bonds were introduced by Harold Macmillan, as Chancellor of the Exchequer, in his Budget of 17 April 1956, to control inflation and encourage people to save. On 1 November 1956, in front of the Royal Exchange in the City of London, the Lord Mayor of London,

Academic studies

ERNIE is a hardware random number generator. The first ERNIE was built at the Post Office Research Station by a team led by Sidney Broadhurst. The designers were Tommy Flowers and Harry Fensom and it derives from Colossus, one of the world's first digital computers. It was introduced in 1957, with the first draw on 1 June, and generated bond numbers from the signal noise created by neon tubes…

See also

Winners of the jackpot are told on the first working day of the month, although the actual date of the draw varies. The online prize finder is updated by the third or fourth working day of the month. Winners of the top £1m prize are told in person of their win by "Agent Million", an NS&I employee, usually on the day before the first working day of the month. However, in-person visits have been suspended during the 2020 COVID-19 pandemic.

External links

Premium Bonds under various names exist or have existed in various countries. Similar programs to UK Premium Bonds include:

• In the Republic of Ireland, Prize Bonds also originated in early 1957.

• In Sweden, "Premieobligationer" usually run for five years and are traded on Nasdaq OMX Stockholm. The unit (one Bond) is generally 1000 SEK or 5000 SEK. Holders o…