A security check is a background investigation of a possible candidate for a job opening or company interested in a business relationship. A security check is primarily based on criminal records, financial records, and commercial records of the individual or company.

What makes a Check Secure?

All checks have some built-in security, starting with the magnetic ink character recognition (MICR) font that’s used for the account and routing numbers. This computerized font allows checks to be read by machines, but it’s also what prevents people—and counterfeiters—from printing checks on their own.

What is security screen on a check?

Security Screen: The words "Original Document" will fade, distort or disappear if a check has been copied or scanned by traditional means. 11. Security Weave®: This pattern on the back of the check deters check fraud and makes it very difficult to duplicate. 12.

How do QuickBooks secure checks work?

QuickBooks secure checks contain microcapsules of ink around the payee and amount. If someone tampers with those areas, visible stains appear on the check. We've designed our checks with white boxes around the payee and amount lines for maximum protection against toner removal, as well as a clean background that makes alteration attempts stand out.

What is the difference between regular checks and high security checks?

While regular checks have fewer basic security features, High Security checks are designed to deter fraud attempts, and can provide the protection you need. Here are four reasons you should make the switch today.

Are high security checks worth the extra cost?

Scammers manipulate checks in various ways in attempts to dupe honest businesses or their customers out of hard-earned money. So yes, purchasing high-security checks is worth the few extra dollars they cost — check fraud losses are simply too high to believe otherwise.

What are the most secure checks?

Key Takeaways. Both cashier's checks and certified checks are official checks that are guaranteed by a bank. Compared to personal checks, cashier's checks and certified checks are generally viewed as more secure and less susceptible to fraud.

What are security personal checks?

Secure Plus Personal Checks These carbonless duplicate checks offer advanced protection against check fraud with 23 security features, including a heat sensitive icon that prevents photocopying, a CheckLock™ Custom True Watermark that protects against forgery and counterfeiting.

How do you make a check more secure?

For better check security, you can restrict the check by dictating that it can only be deposited in the bank account of the intended recipient. Simply write “For deposit only” on the back of the check where the signature goes. This method isn't 100% foolproof, as a bank teller could miss it or ignore it.

Which bank is most secure?

The Verdict. Citibank and Bank of America offer the most protection for their customers, each providing three additional dimensions of security.

How can I secure my bank account?

Online banking safety tipsPassword protect your phone, tablet, computer. ... Create strong, unique passwords and change them every 3 months. ... Use multi factor authentication. ... Don't keep your accounts logged in. ... Avoid banking on public WIFI. ... Don't access your bank account from a shared computer.More items...

How can you tell its a fake check?

Here are some tip-offs to the rip-offs:Edges: Most legit checks have at least one perforated or rough edge. ... Bank logo: A fake check often has no bank logo or one that's faded, suggesting it was copied from an online photo or software.Bank address: No street address, just a P.O.

Is a certified check or cashiers check better?

The bank guarantees a cashier's check—meaning the bank is held responsible if the check bounces. With a certified check, you guarantee the check you write from your account. That makes cashier's checks safer and potentially slightly more expensive to obtain.

Is a certified check as good as cash?

Because the face value is guaranteed, legitimate certified checks are as good as cash. This can help ease your mind when exchanging goods or services in a large transaction.

Can someone steal your money with a check?

They could create counterfeit checks and use them to steal money from your account, or they could use your account information to purchase things online, using “echeck” or “electronic check” payment options. Here are some of the reasons why checks can be risky: Potential mail theft.

Can you get scammed with a check?

Fake checks can look so real that it's very hard for consumers, or even bank employees, to detect. Fake bank checks are typically used in scams where the scammer tries to get you to cash or deposit the check.

Can someone steal your bank info from depositing a check?

Scammers know the simple fact, if they can trick you into depositing into your account, you will be responsible for the loss and theft of your money. Knowing who is conducting business and what transactions are happening in your account is an important part of transacting deposits at the credit union.

QuickBooks secure check features

Our secure checks are designed with features that help stop check fraud before it happens, protecting against counterfeiting while helping to identify your checks as genuine. These security features help protect your business from the risk of check fraud.

Protection against counterfeiting

For fast and easy authentication, our checks include a verification icon that disappears when warmed by the touch of a finger or breath

Protection against tampering

Our checks feature paper specially formulated to securely anchor printer toner, making removal nearly impossible without causing visible damage to the paper.

What are the enhanced security features of our security check?

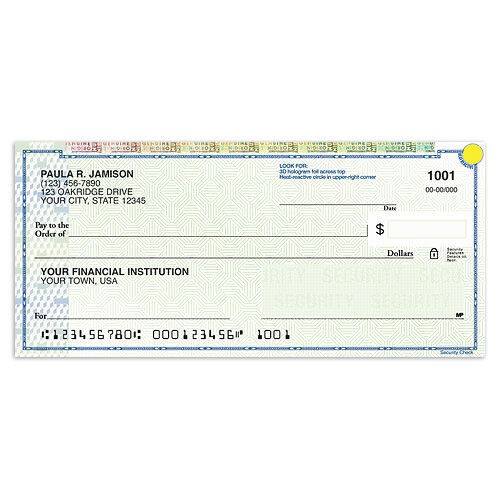

The enhanced security features of our Security Check exceed industry standards and include the following: 1. Hologram Foil Bar provides a reflective, 3-D appearance that is easy to verify with the human eye, and not easily reproduced by ordinary copying or printing. 2.

What color is the ink on a security check?

2. Heat - reactive ink in the front, upper-right corner fades from green to yellow when warmed by touch or breath, allowing immediate authentication, and guards against the use of solvents and color photocopying. The front side of the Security Check features instructions that direct the check recipient to look for the hologram foil bar and ...

Why do I need a paper check?

When making a large payment for something like a down payment on a new house, a college tuition payment, a deposit for a wedding venue, or even a payment to a government agency like the IRS, you may want to use a paper check. This can help ensure that your payment was received because you’ll be able to see when the other party deposits or cashes the check in your next bank statement or through your bank’s online portal. Some banks will even show you a photo of the cashed check so you can ensure it’s correct. This may even help prevent you from incurring any late fees since the transactions will all be dated.

What does it mean when a check is bad?

A bad check is one that cannot be cashed by the recipient because of insufficient funds or a stop payment on the check.

How long does it take for a check to clear?

First, you may opt to give cash or initiate an online transfer if your recipient needs money immediately. Since checks usually take two to three business days to clear, other forms of payment are often faster. 4.

How to stop payment on check?

To place a stop payment on a check, you’ll need to select the “stop payment” option via your bank’s online portal— but you must do so before the check has been cashed. You may also need to enter the account number, the check number, and the amount of the check.

Why do people gift money via check?

If they set cash to the side and revisit it later, they may not remember who gifted it to them. Gifting money via check may also encourage the recipient to save the funds rather than spend them right away .

Why do I have to pay off my credit card when I write a check?

This is because when you write a check, the funds are taken directly from the associated bank account. And if you don’t have enough money to cover the check, it could bounce, leading to penalties and fees with your bank.

Is it safe to write a paper check?

While writing a paper check isn’t a fail-safe strategy, keeping your sensitive information offline and swiping your credit card less may help decrease the instances of identity theft, fraud, and other financial crimes.

Get Your 10-Minute SecureCheck Demo Here!

SecureCheck can improve your current traditional payments, while also giving you easy access to electronic payments that could save up to 80% on your current costs!

Need Secure Check Stock and MICR Toner?

TruePrint is America's favorite check stock. MICR toner and tax e-filing, too!

What to do if you don't have a check?

If you don’t have a check to refer to, you can go online to your bank account or call your bank to get what you need. Along with your account information, you’ll need to share what information you want to appear on the checks including your name, business name (if applicable), and contact information (optional).

How much is 660 checks?

Case in point: you can get 660 checks for $34.68. There are also a variety of options like software compatible checks that work with Quicken, QuickBooks, and other accounting programs. In addition, personal checks are inexpensive with a vast selection of designs available, and one order will likely last for years.

How long does it take for a check to arrive?

Even though people are used to ordering items online and getting them delivered quickly, with checks, expect it to take a few weeks for them to arrive. Be sure to carefully review the delivery time estimates when you order checks online (some sites have better turnaround times than others).

Is checking in the mail a good idea?

When ordering checks without going through your actual bank, you should choose a company that’s reputable and affordable. Checks In The Mail is a reliable choice, with ample check designs, a low minimum order requirement, and competitive pricing. If you’re looking for more unique check designs, it’s tough to beat Walmart Checks, which offers a great deal on custom-designed checks.

Is Checks in the Mail a reputable company?

It's safe to say that Checks In The Mail is a reputable company: It sells over a billion checks per year to customers in all 50 states. Its site also features around 200 different check styles and often has multiple coupon codes, as well as new customer offers for even deeper discounts. 1

Why are high security checks important?

High Security checks are specifically designed with multiple layers of defense to protect against fraud. With modern copiers producing duplicates that rival originals, it's easier than ever for fraudsters to copy and fake a business check.

How to see watermark on check?

It's just as important to have them on your checks. Watermark pressed into paper can be seen by holding the check up to a light source but cannot be reproduced by copiers or scanners. 5. Mobile remote deposit reminder. These days, it's important to utilize financial solutions that you can use on the go.

What is built in security?

Built-in security is one of the most exciting and practical fraud protection features. High Security checks have a number of measures you can't see, including chemically sensitive paper, a chemical-wash detection area, invisible fluorescent fibers and more.

What is a safety hologram?

A safety hologram adds another layer of protection to your checks. You may have seen something similar on your driver's license. Each check is hot stamped with a multi-dimensional seal that cannot be copied, as it contains embedded security features.

Do you need to worry about check duplication?

There's no need to worry about check duplication. Proprietary technology compromises reproduction on the majority of commonly used copiers. Fraudsters will end up with a black or blank page, no matter the quality of the copier they use.