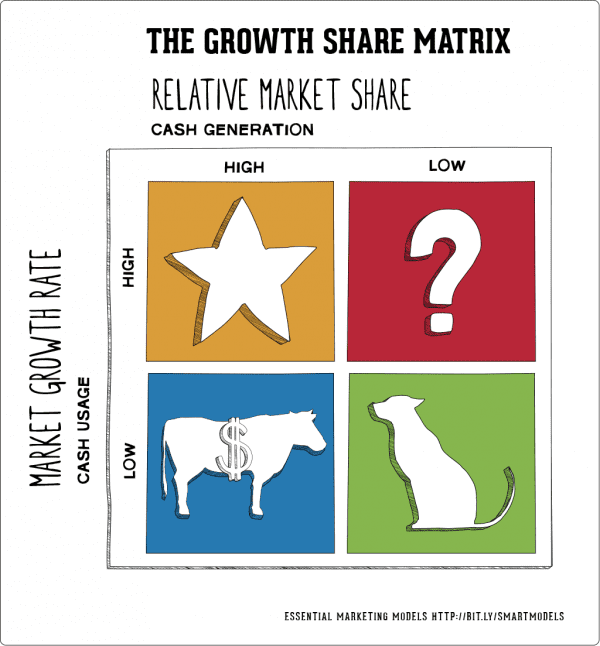

The quadrants of the BCG Growth Share Matrix

Let us study the four categories identified in the BCG matrix and how they can be used to decide on the appropriate business strategies. Stars “Stars” are business units that have a high market share but consume a high amount of cash as they are situated in a high-growth market.

What is a star in the BCG matrix?

Sharper Insight. What’s it: A star is a product with a significant market share and is in a high-growth market. It is one of four categories in the Boston Consulting Group Matrix (BCG matrix). The other three are: Cash cow – a product with a large market share and being in a low-growth market (mature stage).

What is a star in the Boston Consulting Group Matrix?

What’s it: A star is a product with a significant market share and is in a high-growth market. It is one of four categories in the Boston Consulting Group Matrix (BCG matrix). The other three are: Cash cow – a product with a large market share and being in a low-growth market (mature stage).

What does the vertical axis of the BCG matrix represent?

The vertical axis of the BCG Matrix represents the growth rate of a product and its potential to grow in the particular market. In addition, there are four quadrants in the BCG Matrix: Question marks: Products with high market growth and a low market share. Stars: Products with high market growth and a high market share.

What are the four quadrants in the BCG matrix?

In addition, there are four quadrants in the BCG Matrix: Question marks: Products with high market growth but a low market share. Stars: Products with high market growth and a high market share.

What are the stars in BCG matrix?

The BCG Matrix: Stars Stars consume a significant amount of cash but also generate large cash flows. As the market matures and the products remain successful, stars will migrate to become cash cows. Stars are a company's prized possession and are top-of-mind in a firm's product portfolio.

What is a star in strategic management?

Stars. Stars operate in high growth industries and maintain high market share. Stars are both cash generators and cash users. They are the primary units in which the company should invest its money, because stars are expected to become cash cows and generate positive cash flows.

What is a star Matrix?

The Star Matrix © is an assessment system based on research and understanding that there is more than one path to dependency on mood altering substances and therefore more than one way to conceptualize the problem. There are multiple components that affect the most important question in all substance abuse disorders.

What is star in relative market share?

Stars are business units with a high market share (potentially market leaders) in a fast-growing industry. These products generate large amounts of cash due to their high relative market share.

What is a star product?

Star products all have rapid growth and dominant market share. This means that star products can be seen as market leading products. These products will need a lot of investment to retain their position, to support further growth as well as to maintain its lead over competing products.

What are star companies?

For more than three decades, Star Companies has been a local insulation and drywall contractor providing quality workmanship, unmatched customer service and competitive pricing. Owner Brian Bamesberger grew up on job sites, spending hours each week learning the tricks of the trade from his father.

What is a star company in marketing?

Established as a Partnership firm in the year 2011, we “Star Marketing” are a leading Manufacturer and Trader of a wide range of SS Glass, Polycarbonate Glass, Water Bottle, etc. Star Marketing is based out of Delhi.

What are stars in the growth share matrix quizlet?

Stars are high-growth, high-share businesses or products. They often need heavy investments to finance their rapid growth. Eventually their growth will slow down, and they will turn into cash cows.

What is better cash cow or star?

Special Considerations. In contrast to a cash cow, a star, in the BCG matrix, is a company or business unit that realizes a high market share in high-growth markets. Stars require large capital outlays but can generate significant cash. If a successful strategy is adopted, stars can morph into cash cows.

What is Star Dog question mark and cash cow?

The four quadrants are designated Stars (upper left), Question Marks (upper right), Cash Cows (lower left) and Dogs (lower right). Place each of your products in the appropriate box based on where they rank in market share and growth.

What is a good relative market share?

The purpose of the “relative market share metric” is to access a firm's or a brand's success and its position in the market. A firm with a market share of 25% would be a powerful leader in many markets but a distant “number two” in others.

How do you calculate relative share?

Relative market share is calculated by subtracting a company's market share from 100 to find the percentage it does not control. If Company Z controls 30% of its market, this means it does not control 70%. From there, the company's market share is divided by the percentage of the market it does not control.

How do you find the relative market share of a market leader?

Market share is the percentage of total industry revenue that flows to your company. If you divide your percentage share by the percentage share of the largest company, you have your relative market share.

What is the market share formula?

Market share is calculated by dividing the company's total revenues by the total sales of the whole industry during a specific period of time. This indicator is used by data analysts and other professionals to assess the size, or presence, of a company within a given industry.

What is the BCG matrix for dogs?

The BCG Matrix: Dogs. Products in the dogs quadrant are in a market that is growing slowly and where the product (s) have a low market share. Products in the dogs quadrant are typically able to sustain themselves and provide cash flows, but the products will never reach the stars quadrant. Firms typically phase out products in ...

What are the quadrants of the BCG matrix?

In addition, there are four quadrants in the BCG Matrix: 1 Question marks: Products with high market growth but a low market share. 2 Stars: Products with high market growth and a high market share. 3 Dogs: Products with low market growth and a low market share. 4 Cash cows: Products with low market growth but a high market share.

What is a cash cow?

Products in the cash cows quadrant are in a market that is growing slowly and where the product (s) have a high market share. Products in the cash cows quadrant are thought of as products that are leaders in the marketplace. The products already have a significant amount of investments in them and do not require significant further investments to maintain their position.

What is the horizontal axis of the BCG matrix?

The horizontal axis of the BCG Matrix represents the amount of market share of a product and its strength in the particular market. By using relative market share, it helps measure a company’s competitiveness. The vertical axis of the BCG Matrix represents the growth rate of a product and its potential to grow in a particular market.

What is the assumption in the matrix?

The assumption in the matrix is that an increase in relative market share will result in increased cash flow. A firm benefits from utilizing economies of scale. Economies of Scale Economies of scale refer to the cost advantage experienced by a firm when it increases its level of output.The advantage arises due to the.

What is a question mark product?

Products in the question marks quadrant are in a market that is growing quickly but where the product (s) have a low market share. Question marks are the most managerially intensive products and require extensive investment and resources to increase their market share.

Why are stars important?

It allows a company to achieve superior margins. . Stars consume a significant amount of cash but also generate large cash flows. As the market matures and the products remain successful, stars will migrate to become cash cows. Stars are a company’s prized possession and are top-of-mind in a firm’s product portfolio.

How Does the Growth Share Matrix Work?

The growth share matrix was built on the logic that market leadership results in sustainable superior returns. Ultimately, the market leader obtains a self-reinforcing cost advantage that competitors find difficult to replicate. These high growth rates then signal which markets have the most growth potential.

BCG Classics Revisited: The Growth Share Matrix

The growth share matrix—put forth by BCG founder Bruce Henderson in 1970—remains a powerful tool for managing strategic experimentation amid rapid, unpredictable change.

Why are dogs considered a cash trap?

If a company’s product has a low market share and is at a low rate of growth, it is considered a “dog” and should be sold, liquidated, or repositioned. Dogs, found in the lower right quadrant of the grid, don't generate much cash for the company since they have low market share and little to no growth. Because of this, dogs can turn out to be cash traps, tying up company funds for long periods of time. For this reason, they are prime candidates for divestiture. 2

What is matrix in business?

Special Considerations. The matrix is a decision-making tool, and it does not necessarily take into account all the factors that a business ultimately must face. For example, increasing market share may be more expensive than the additional revenue gain from new sales.

What is matrix plot?

The matrix plots a company’s offerings in a four-square matrix, with the y-axis representing the rate of market growth and the x-axis representing market share. It was introduced by the Boston Consulting Group in 1970. 1 .

What is a star in the market?

Products that are in high growth markets and that make up a sizable portion of that market are considered “stars” and should be invested in more. In the upper left quadrant are stars, which generate high income but also consume large amounts of company cash. If a star can remain a market leader, it eventually becomes a cash cow when the market's overall growth rate declines. 2

What is a cash cow?

Cash Cows. Products that are in low-growth areas but for which the company has a relatively large market share are considered “cash cows,” and the company should thus milk the cash cow for as long as it can. Cash cows, seen in the lower left quadrant, are typically leading products in markets that are mature. 2 .

Where are question marks on a company's growth?

Question marks are in the upper right portion of the grid. They typically grow fast but consume large amounts of company resources.

Who is Khadija Khartit?

Khadija Khartit is a strategy, investment, and funding expert, and an educator of fintech and strategic finance in top universities. She has been an investor, an entrepreneur and an adviser for 25 + years in the US and MENA. Article Reviewed on October 30, 2020. Learn about our Financial Review Board. Khadija Khartit.

Definition

BCG matrix (or growth-share matrix) is a corporate planning tool, which is used to portray firm’s brand portfolio or SBUs on a quadrant along relative market share axis (horizontal axis) and speed of market growth (vertical axis) axis.

Understanding the tool

BCG matrix is a framework created by Boston Consulting Group to evaluate the strategic position of the business brand portfolio and its potential. It classifies business portfolio into four categories based on industry attractiveness (growth rate of that industry) and competitive position (relative market share).

Using the tool

Although BCG analysis has lost its importance due to many limitations, it can still be a useful tool if performed by following these steps: