What are permanent and temporary accounts?

Assets, liabilities, and equity accounts are all permanent accounts and are found on your balance sheet, while income and expense accounts are temporary accounts that are found on your income statement, and must be closed each accounting period.Apr 27, 2020

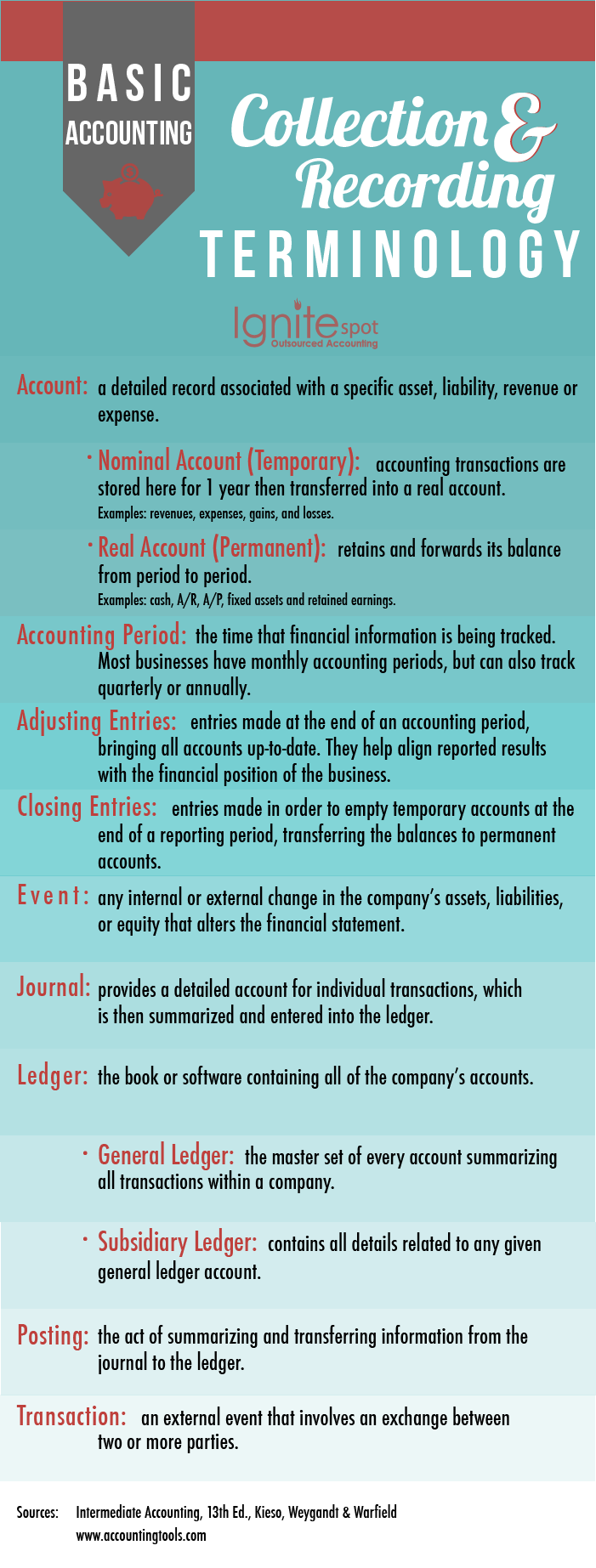

What are temporary accounts in accounting?

A temporary account is an account that begins each fiscal year with a zero balance. At the end of the year, its ending balance is shifted to a different account, ready to be used again in the next fiscal year to accumulate a new set of transactions.Feb 9, 2022

What are the permanent accounts in accounting?

Permanent accounts are those accounts that continue to maintain ongoing balances over time. All accounts that are aggregated into the balance sheet are considered permanent accounts; these are the asset, liability, and equity accounts.May 14, 2017

What is a permanent account example?

Examples of permanent accounts are: Asset accounts including Cash, Accounts Receivable, Inventory, Investments, Equipment, and others. Liability accounts such as Accounts Payable, Notes Payable, Accrued Liabilities, Deferred Income Taxes, etc.

Is cash a temporary or permanent account?

Asset accounts - asset accounts such as Cash, Accounts Receivable, Inventories, Prepaid Expenses, Furniture and Fixtures, etc. are all permanent accounts.

Is salaries expense a permanent account?

Liabilities Accounts Short-term and Long-term liabilities that include Accounts Payable, Notes Payable, Mortgage Payable, Salaries and Wages Payable, Income Tax Payable, Interest Payable, Rent Payable and other types of payables are also classified as a permanent account.Nov 23, 2021

Which accounts are permanent or real accounts?

Also referred to as real accounts. Accounts that do not close at the end of the accounting year. The permanent accounts are all of the balance sheet accounts (asset accounts, liability accounts, owner's equity accounts) except for the owner's drawing account.

What is another name for permanent account?

Permanent accounts, which are also called real accounts, are company accounts whose balances are carried over from one accounting period to another.Sep 22, 2021

Why are revenue and expense accounts called temporary or nominal accounts?

Revenue and expense accounts are referred to as temporary or nominal accounts because each period they are closed out to Income Summary in the closing process. Their balances are reduced to zero at the end of the accounting period; therefore, the term temporary or nominal is given to these accounts.

Is withdrawal a permanent account?

Temporary accounts refer to accounts that are closed at the end of every accounting period. These accounts include revenue, expense, and withdrawal accounts. They are closed to prevent their balances from being mixed with those of the next period.

Is dividend a permanent account?

All income statement and dividend accounts are closed each year into retained earnings which is a permanent account, which can be carried forward on the balance sheet. Therefore, all income statement and dividend accounts are temporary accounts.

Is prepaid expense a temporary account?

Statement accounts such as Cash, accounts Receivable, Inventories, Prepaid expenses, Furniture Fixtures. Expense is an expense account and therefore classified as a temporary account at the end of period.

What is the difference between temporary and permanent accounts?

Temporary accounts accrue balances only for a single accounting period. At the end of the accounting period, those balances are transferred to either the owner's capital account or the retained earnings account. Which account the balances are transferred to depends on the type of business that is operated.

What is temporary account?

Temporary accounts, which are also called nominal accounts, are company accounts whose balances are not carried over from one accounting period to another, but are closed, or transferred, to permanent accounts at the end of an accounting period.

What is a permanent account?

Permanent accounts, which are also called real accounts, are company accounts whose balances are carried over from one accounting period to another. Temporary accounts come in three forms: revenue, expense, and drawing accounts.

What does it mean when a temporary account is closed?

Temporary accounts are zeroed out by an action called closing. Closing an account means that the balance of a temporary account is transferred to a permanent account. Temporary accounts are closed at the end of the accounting period to get them ready to use in the next accounting period.

What is the transfer of balances at the end of the accounting period?

At the end of the accounting period, those balances are transferred to either the owner's capital account or the retained earnings account. Which account the balances are transferred to depends on the type of business that is operated. A corporation's temporary accounts are closed to the retained earnings account.

What is revenue account?

Revenue accounts are the accounts that increase owner's equity due to sales of goods or services. Expense accounts are the accounts that decrease owner's equity due to expenses related to day-to-day operations.

Do permanent accounts have zero balances?

That is not to say that permanent accounts never have zero balances; it just means that the closing activities that take place in temporary accounts don't occur in permanent accounts. Lesson Summary. A company's accounts are classified in several different ways.

What Are Temporary Accounts?

Temporary accounts remain tied to a specific fiscal period. At the end of that period, financial professionals include a closing entry, so the balance returns to zero. Any balances remaining in those accounts are transferred to a permanent account. Accountants then prepare financial documents to show that this took place.

What Are Good Examples of Temporary Accounts?

While accountants and business owners have a lot of leeway in how they determine which accounts become temporary or permanent, some accounts traditionally fall into temporary categories. These include:

What Are Permanent Accounts?

These accounts do not close. They remain open throughout business operations. So, at the end of a fiscal period, accountants note the closing balance, but they don’t close out the account by zeroing it out. Consequently, when the next fiscal period begins, the account continues with the closing balance it had from the previous fiscal period.

What Are Good Examples of Permanent Accounts?

Permanent accounts tend to document general business transactions. Common examples include:

Temporary vs. Permanent: What Are the Main Differences?

When comparing temporary vs. permanent accounts, two important things come to mind. First, one account type involves a big reset and one does not. In fact, many small business owners find it easier to reset their accounts so the opening balance at the start of the year is zero. This makes it easy to track progress throughout the year.

How Can Accounts Receivable Automation Help?

It only takes one mistake for your accounts to be thrown off completely. When this happens, it can cause the company to miscalculate everything else, which could lead to overpaying or underpaying other financial obligations.

What are temporary accounting accounts?

A temporary account is an account that is closed at the end of every accounting periodFiscal Year (FY)A fiscal year (FY) is a 12-month or 52-week period of time used by governments and businesses for accounting purposes to formulate annual and starts a new period with a zero balance.

What are the permanent accounts in accounting?

Permanent accounts are those accounts that continue to maintain ongoing balances over time. All accounts that are aggregated into the balance sheet are considered permanent accounts; these are the asset, liability, and equity accounts.

Which account Below is a permanent account?

Permanent accounts are the accounts that are reported in the balance sheet. They include asset accounts, liability accounts, and capital accounts. Asset accounts – asset accounts such as Cash, Accounts Receivable, Inventories, Prepaid Expenses, Furniture and Fixtures, etc. are all permanent accounts.

Is cash a permanent or temporary account?

Examples of permanent accounts are: Asset accounts including Cash, Accounts Receivable, Inventory, Investments, Equipment, and others.

Are balance sheet accounts temporary?

Assets, liabilities, and equity accounts are all permanent accounts and are found on your balance sheet, while income and expense accounts are temporary accounts that are found on your income statement, and must be closed each accounting period.

Is salaries expense a temporary account?

Expense accounts – expense accounts such as Cost of Sales, Salaries Expense, Rent Expense, Interest Expense, Delivery Expense, Utilities Expense, and all other expenses are temporary accounts.

Why does an accounting system include both temporary and permanent accounts?

Why does an accounting system include both types of accounts? Permanent accounts represent the basic financial position elements of the accounting equation. Temporary accounts keep track of the changes in the retained earnings component of shareholders’ equity.

What is temporary account?

Temporary accounts. Temporary accounts, as you might have guessed, have a limited lifespan – typically a year. Once they have served their purpose, their balances are transferred to other related permanent accounts and they are closed for good. Thus, in temporary accounts, balances are not carried over from one accounting period to the next.

What is a permanent account?

Also known as real accounts, they are those accounts where balances are carried over from one accounting period the next. You can see these accounts listed on the company’s balance sheet.

Why do you set your revenue, expense and withdrawal accounts to zero?

When the new fiscal year begins, you will set the balances of your revenue, expense and withdrawal accounts to zero because the previous year’s balances have nothing to do with your new revenue, expense and withdrawal accounts.

What are the accounts that show the tangible and intangible assets that the company owns?

Asset accounts : These are the accounts that show the tangible and intangible assets that the company owns. Assets include cash, land, buildings, furniture, goodwill and other items. Liability accounts: These are the accounts that show the debts that the company owes to its creditors.

What are liabilities in accounting?

Liabilities include accounts payable, loans payable, interests payable, bonds payable, wage and income tax. Owner’s equity accounts: These are the accounts that show the investment that the company’s owners have made in the business. To choose the right type of account for your business, it is important to have an in-depth understanding ...

Do permanent accounts have to have a balance?

It is not always necessary for a permanent account to hold a balance. If no transaction has been done, it may have a zero balance. The following three types of accounts are classified as permanent accounts: Asset accounts: These are the accounts that show the tangible and intangible assets that the company owns.

What is temporary account?

A temporary account, as mentioned above, is an account that needs to be closed at the end of an accounting period. It aims to show the exact revenues and expenses for a company for a specific period.

What are temporary accounts? What are some examples?

Examples of Temporary Accounts. There are basically three types of temporary accounts, namely revenues, expenses. Inventoriable Costs Inventoriable costs, also known as product costs, refer to the direct costs associated with the manufacturing of products for revenue. , and income summary. 1.

Why are accounts closed in accounting?

and starts a new period with a zero balance. The accounts are closed to prevent their balances from being mixed with the balances of the next accounting period. The objective is to show the profits that were generated and the accounting activity of individual periods.

What would happen if a temporary account was not closed?

If the temporary account was not closed, the total revenues seen would be $900,000. The company may look like a very profitable business, but that isn’t really true because three years-worth of revenues were combined. In order to properly compute for the year’s total profits, as well as the total expenses, the temporary accounts must be closed, ...

How much does an income summary need to be transferred to the capital account?

Since the income summary is a temporary account, it needs to be transferred to the capital account by making a debit entry of 15,000 from the income summary and making a credit entry to the capital account.

What is revenue account?

Revenue refers to the total amount of money earned by a company, and the account needs to be closed out at the end of the accounting year. To close the revenue account, the accountant creates a debit entry for the entire revenue balance.

Is a capital account a temporary account?

It is not a temporary account, so it is not transferred to the income summary but to the capital account. Capital Account The capital account is used to account for and measure any financial transaction within a country that isn’t exerting an active effect on that country’s savings, production, or income.

What are temporary and permanent accounts?

Temporary accounts are company accounts whose balances are not carried over from one accounting period to another, but are closed, or transferred, to a permanent account. Permanent accounts are found on the balance sheet and are categorized as asset, liability, and owner’s equity accounts.

What contains only permanent accounts?

The post-closing trial balance will include only the permanent/real accounts, which are assets, liabilities, and equity.

What do permanent accounts not include?

Question: Permanent accounts would not include: Interest expense. The purpose of closing entries is to transfer Accounts receivable to earnings when an account is fully paid. Balances in temporary accounts to a permanent account. Inventory to cost of goods when merchandise is sold.

What is permanent accounts?

Permanent accounts are those accounts that continue to maintain ongoing balances over time. All accounts that are aggregated into the balance sheet are considered permanent accounts; these are the asset, liability, and equity accounts. A permanent account does not necessarily have to contain a balance.

Is common stock a permanent account?

The net balance in the income and summary account and the balance in dividends paid account are carried to the retained earnings account. These accounts are temporary accounts while all other accounts (all assets, all liabilities, common stock and retained earnings) are permanent accounts.

Is prepaid rent a permanent account?

Prepaid rent is a permanent account which is not closed at the end of the period, while Income Summary is a temporary/nominal closing account used to transfer revenues and expenses to retained earnings. The correct answer is D. Prepaid Rent is a permanent account, and Income Summary is a nominal account.

Is Goodwill a permanent account?

Permanent accounts, as you might have guessed, exist indefinitely. Asset accounts: These are the accounts that show the tangible and intangible assets that the company owns. Assets include cash, land, buildings, furniture, goodwill and other items.

How many temporary accounts do businesses have?

They show balances for a very specific period of time. Most businesses will have at least two temporary accounts—expenses and revenues—though they may choose to create more by subdividing these accounts into more detailed ones. Dividends are another temporary account.

What does closing out temporary accounts mean?

The process of closing out temporary accounts means that you’re looking at how much you made (or lost) during the accounting period and adding it to your business’ running total of profits.

What is an adjusted trial balance?

The adjusted trial balance is like triple checking your work. You take the unadjusted trial balance, add a column for adjusting entries, and then check again that your debits and credits are equal. Assuming you made all the adjusting journal entries you need, your adjusted trial balance should simply be a signal that you’re ready to create financial statements.

What is an adjustment journal entry?

Adjusting journal entries are simply corrections to your accounting work. They help to tidy up your books and ensure that total credits do, in fact, equal total debits. They’re made on the last day of the accounting period to wrap up the period.

How many steps are there in the accounting cycle?

This process is called the accounting cycle. Depending on who you ask, the accounting cycle is made up of 5-9 steps—all of which are geared toward making sure that every penny is accounted for and that the financial reports generated are accurate. The closing process is part of the accounting cycle. Some refer to the very final step of making ...

What is the accounting cycle?

The Accounting Cycle. Accounting is cyclical. After each accounting period has ended, businesses start anew. They earn and spend money, track those transactions, and then create reports that look back at all those transactions. Then they do it all again.

Which financial statements are required to be developed as a part of the accounting closing process?

The two financial statements that must be developed as a part of the accounting closing process are the income statement and the balance sheet.