In the world of risk management, there are four main strategies:

- Avoid it.

- Reduce it.

- Transfer it.

- Accept it.

- Risk acceptance.

- Risk transference.

- Risk avoidance.

- Risk reduction.

What are the four methods of risk management?

Let us understand those terms thoroughly:

- Risk Identification This is the first step in risk management. It is the process of identifying the risk in project development. ...

- Risk Analysis The risks have been identified now it is time for the analysis process. In this stage, we analyze and prioritize the risk. ...

- Risk Control

What are the five risk control strategies?

- Determined the level of risk posed to the information asset

- Assessed the probability of attack and the likelihood of a successful exploitation of a vulnerability

- Estimated the potential damage or loss that could result from attacks

- Evaluated potential controls using each appropriate type feasibility

- Performed a thorough CBA

What are the methods of risk management?

implicit risk management and explicit risk management. Implicit risk management is a method where by the software process is designed to reduce risk. Explicit risk management is a method where the risks are addresses directly by the process of identification, assessment, prioritisation, planning, resolution and monitoring.

What are examples of risk management?

According to The Insight Partners’ latest Operational risk management solution market study on “Operational Risk Management Solution Market Forecast to 2028 – COVID-19 Impact and Global Analysis – by Deployment Type, Enterprise Size, and Geography ...

What are the strategies to manage risk?

In the world of risk management, there are four main strategies:Avoid it.Reduce it.Transfer it.Accept it.

Which are 5 risk management strategies?

The basic methods for risk management—avoidance, retention, sharing, transferring, and loss prevention and reduction—can apply to all facets of an individual's life and can pay off in the long run.

What are the 4 types of risk?

The main four types of risk are:strategic risk - eg a competitor coming on to the market.compliance and regulatory risk - eg introduction of new rules or legislation.financial risk - eg interest rate rise on your business loan or a non-paying customer.operational risk - eg the breakdown or theft of key equipment.

What are the 3 types of risk management?

Widely, risks can be classified into three types: Business Risk, Non-Business Risk, and Financial Risk.

What are the five steps of risk assessment process?

Step 1: Identify the hazards.Step 2: Decide who might be harmed and how. ... Step 3: Evaluate the risks and decide on precautions. ... Step 4: Record your findings and implement them. ... Step 5: Review your risk assessment and update if.

What are the 10 types of risk?

Here are several types of business risks to look for as you evaluate a company's standing:Compliance risk. ... Legal risk. ... Strategic risk. ... Reputational risk. ... Operational risk. ... Human risk. ... Security risk. ... Financial risk.More items...

What are the 10 financial risk management strategies for protecting a business?

10 Financial risk management strategies for protecting your businessIdentify the Risks. ... Measure the Financial Risks. ... Learn about Investments. ... Turn to Insurance Policies. ... Build an Emergency Fund. ... Review Financial Ratings of your Bank. ... Invest in Your Skills. ... Diversify Your Income Sources.More items...•

What is organisational risk and risk management?

According to the Higher Education Funding Council for England (HEFCE), “risk” is broadly defined as ‘the threat or possibility that an action or event will adversely or beneficially affect an organisation’s ability to achieve its objectives.’

What is a risk management strategy?

A risk management strategy is a planned and systematic approach to identify, assess, and manage risks. It is essentially a cost-benefit analysis of any type of organisational risk identified.

The importance of a risk management strategy for health and safety

Many studies have shown that people tend to think they have more control over events than they actually do due to cognitive biases such as confirmation biases.

The different types of risk management strategies

There are four types of risk management strategies that can be applied when a company evaluates the cost-benefit of health and safety risks in the workplace.

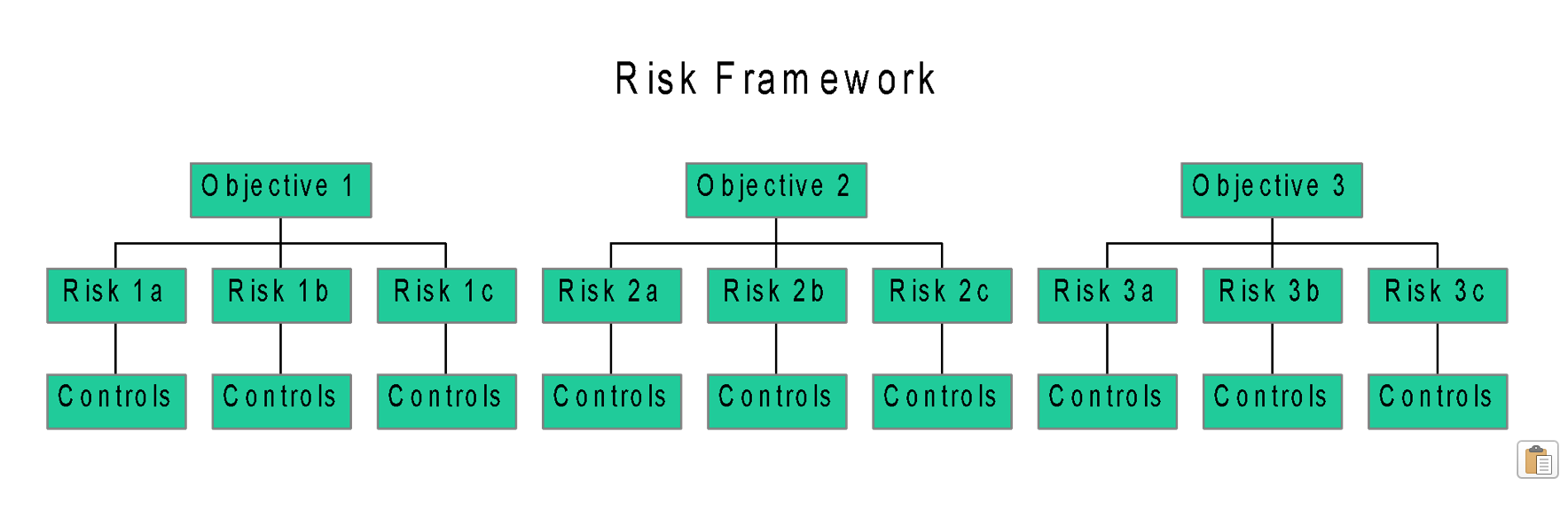

Risk management framework for workplace safety

Now that we understand the importance, benefits, and types of risk management strategies for workplace safety, the next step is to implement a risk management framework.

Following Up on a Risk Management Strategy

The success of a risk management strategy lies in the follow-up actions you take.

What is the most common strategy for handling risk?

Mitigate. The most common strategy for handling risk is to reduce that risk to an acceptable level. Since completely eliminating risk is often impossible or too costly, risk-mitigation is a key strategy for most project managers.

What happens when you identify your risk strategy?

Once you’ve identified your risk strategies, you’re ready to move forward with your project. As the project unfolds, you might discover that you underestimated certain risks and over-estimated others, so don’t be afraid to change your assessment and make adjustments as you go.

How to mitigate risk of not getting government sign off?

To mitigate the risk of not getting government sign-off in time for the proposed roll-out date, the company might engage the services of a consulting firm that specializes in insurance compliance in the state of California ( in addition to having their lawyers scrutinize the plan, of course). The company might also negotiate flexible terms with advertisers, allowing them to postpone publication dates if necessary. Both are ways to potentially mitigate risk.

What is transfer risk?

Transferring risk involves shifting the risk to some other entity, such as an insurance company. We do this all the time when we pay insurance premiums—paying a small amount each month and collectively absorbing risk for the unlucky few who need to file a claim. In all likelihood, you won’t need to use your insurance in any given year. However, if a costly accident does occur, that accident won’t bankrupt you.

What does it mean to avoid a risk?

Avoid. Avoiding a risk means to completely eliminate it. Not all risks can be eliminated, and some can only be eliminated at great cost, so you’ll want to analyze the costs and benefits of eliminating a given risk. Only then can you decide whether it’s worth the time, money, and effort.

What is an example of an auto insurance plan?

Example: An insurance company is planning to release a new auto insurance plan in the state of California. California has strict rules surrounding compliance, and if the plan doesn’t get approved by the state’s Insurance Commissioner, it might not launch on the roll-out date.

Is it okay to make mistakes?

It’s okay to make mistakes. Failing to document your mistakes and learn from them, however, is a fatal flaw. Each project you implement will provide valuable data and powerful lessons, so be sure to document your findings and communicate them to your team, executive sponsors, and any other departments involved.

What are the four risk management strategies?

Project risk management is defined as the process of identifying, analysing and then responding to any risk that arises over the life cycle of a project to help the project remain on track and meet its goal. It anticipates the returns on investments and projects all potential backlash an organisation might face. Hence, effective project risk management strategies enable you to identify your project’s strengths, weaknesses, opportunities and threats. Once you have identified the risks, it’s the responsibility of the project management professional to tackle them with right strategy. Each strategy has their own advantages and disadvantages. Here are the 4 Main Strategies for Project Risk Management:

How to reduce risk?

The organisation should improve quality control processes, compliance with legislation, staff training etc. to reduce the likelihood of risk happening in the first place. In order to mitigate the impact from it, organisations should set-up emergency procedures and minimize the exposure to the sources of any potential risks.

What is risk reduction strategy?

Risk reduction strategies comes at its own costs and in risk transferring the organisations has to pay the risk premium. Sometimes, when the risk is moderate is other strategies don’t seem that viable, organisations just go ahead and accept the risk.

When is Project Risk Management 2020?

Project Risk Management is a 3-day training course held from 24 – 26 August 2020 (Kuala Lumpur). In this 3-day course, you’ll work through the proactive approach to threat and opportunity—based on a clear understanding of the powerful nature of both qualitative and quantitative approaches to risk management. You will be able to effectively pinpoint the various types of risks, identify, analyse and prioritise risk, master the various risk-based financial tools and techniques.

Does insurance cover the whole risk?

The organisations have a pay a charge known as risk premium in order to avail the benefits. It is very rare that an insurance would cover the whole risk amount, but it cover a decent portion of the damage.

Accept

In some instances you must simply accept the risk and the consequences if it is realized. This might happen when there truly are no other strategies available. For example, your project might be dependent upon a certain government approval, the duration of which can vary wildly.

Avoid

The aim of avoidance is to eliminate the risk altogether. One way to do this is to not pursue the activity that gives rise to the risk. For example, perhaps there is a complex enhancement in the project plan that is difficult to estimate and likely to run over schedule.

Mitigate

The aim of mitigation is to put in place strategies to reduce the probability and/or impact of the risk. For example, your project might require the team to learn a new technology, and there is a substantial risk that mastering this tech will take longer than your schedule allows.

Transfer

The aim of the transfer strategy is to move the the risk to another party. The classic risk transference tool is insurance, where you pay someone a fee to assume the risk for you. For example, there is a risk that your facility could burn down, incurring massive costs to relocate and rebuild.

What is the best approach to risk management?

Sometimes the best approach to risk management lies in sharing the risk across different customers, vendors, departments, and external organizations. This works by figuring out where the risks are shared and working on solutions collaboratively to mitigate and manage risks.

When are different approaches taken for different kinds of risks?

Once the risks are identified and the risk management strategy has been implemented, different approaches can be taken for different kinds of risks – depending on their severity and effects on the business.

What is risk avoidance?

Risk avoidance isn’t turning a blind eye to the advent of risks. Instead, it is ensuring that you are avoiding risks from happening. Prevention is better than cure, and that’s what risk avoidance tries to live by. A risk avoidance approach works by deflecting as many threats as possible to avoid all potential future disruptions, costly damages, and downtimes to businesses.

Why do we put different risks in priority?

One of the primary reasons for arranging different risks in the priority level is determining whether some risks are worth it from the business perspective. That priority list comes in handy for this approach by helping companies understand whether or not they even need to retain some risks. For example, in case the level of severity of a risk is less than the efforts and time it would take to manage it, it’s better not to retain that particular risk, and so on.

Why do companies invest in risk management?

All businesses – whether big or small – face the consequences of unexpected dangers and threats and therefore invest in risk management plans. By having a foolproof risk management plan in place, organizations ensure that they can identify, plan, and prepare for rainy days. This way, the organizations can safeguard themselves in the long run from critical risks.

What is risk management?

In the corporate world, Risk Management is simply the forecasting and evaluation of all kinds of possible risks to minimize their impact and keep the business afloat. The dynamic business environment of today has exposed companies to threats and dangers of all kinds. Today, risks come in all forms – financial uncertainty, legal liabilities, management errors, natural disasters, and other accidents. To add to these are the cybersecurity threats that put all the crucial data and IT infrastructure at risk.

What are the types of risks that a business needs to protect itself from?

Generally speaking, the four main types of risks that a business needs to protect itself from are operational, financial, and strategic risks . These include all the kinds of threats and worries that a company can face. The first important step is always to identify the types of risks relevant to the business at hand. This is one of the first and most important steps of any risk management strategy. You can identify the risks by looking at the organization’s past experiences, internal history, consulting a professional, or performing extensive external research. Some other ways of identifying potential risks include group discussions, interviews, focus groups, and more.

How can risk be addressed?

Risk can be addressed by finding methods to reduce either the severity of the loss or the likelihood of the loss occurring.

Why do practitioners use risk management processes?

Practitioners use risk management processes to help them anticipate problems and implement solutions. This is part of a continuous process of assessment, prioritization, and feedback. At any point in this process, the objectives of the organization or circumstances of the external environment may change, requiring an organization to be flexible in its approach to emerging risks.

How are financial risks transferred?

Risks can also be transferred through contracts, as often happens in construction projects where the builder assumes any risks associated with faulty construction. Hedging strategies, futures contracts, and derivatives are other forms of transferring financial risks to others. Risks can also be pooled, and a group may decide to spread risk among its members and if any one of them suffers a loss, they all contribute to restitution.

What is the biggest risk in a business?

The biggest risk with any business venture is that the organization has no appreciation of risk or how it can affect them. Risk management is vital to any organization. When developing a strategy to manage risk, it is best to develop one that can fall into one or more of the following categories. 1. Risk Avoidance.

What is risk transfer?

Risk transfer means getting another party to accept the risk, such as having a syndicate like Lloyd’s of London provide insurance for the venture. This is what happens when organizations take out any form of insurance: the insurer assumes the risk and the responsibility for restitution should losses occur.

What happens if an organization does not analyze risks?

Without a careful analysis of specific risks and a plan to mitigate them, organizations may suffer loss. Once involved in an international trade venture, organizations must protect their operations and their profitability through continual risk analysis and planning.

What is risk avoidance?

1. Risk Avoidance. Organizations have the option to refrain from activities that carry unacceptable risks. For example, while looking to set up a subsidiary in a foreign location, an organization has been offered a site that was used by a chemical manufacturer.

Step 1: Risk Identification

The first step in the risk management process is to identify all the events that can negatively (risk) or positively (opportunity) affect the objectives of the project:

Step 2: Risk Assessment

There are two types of risk and opportunity assessments: qualitative and quantitative. A qualitative assessment analyzes the level of criticality based on the event’s probability and impact. A quantitative assessment analyzes the financial impact or benefit of the event. Both are necessary for a comprehensive evaluation of risks and opportunities.

Step 3: Risk Treatment

In order to treat risks, an organization must first identify their strategies for doing so by developing a treatment plan. The objective of the risk treatment plan is to reduce the probability of occurrence of the risk (preventive action) and/or to reduce the impact of the risk (mitigation action).

Step 4: Risk Monitoring and Reporting

Risks and opportunities and their treatment plans need to be monitored and reported on. The frequency of this will depend on the criticality of risk/opp. By developing a monitoring and reporting structure it will ensure there are appropriate forums for escalation and that appropriate risk responses are being actioned.