Some of the most recognizable economic indicators examples include:

- Gross domestic product (GDP)

- Personal income and real earnings

- International trade in goods and services

- U.S. import and expert prices

- Consumer prices (as measured by the Consumer Price Index or CPI)

- New residential home sales

- New home construction

- Rental vacancy rates

Full Answer

What are the most important indicators of the economy?

Here, we look at several of the most important types of indicators that measure everything from economic growth to changes in prices to unemployment. The gross domestic product, or GDP, of an economy provides the overall value of the goods and services it produces and indicates whether an economy is growing or slowing.

What are the three types of economic indicators?

An economic indicator may possess one of the three following attributes: 1 1. Procyclical. It is an indicator that moves in a direction similar to the economy. For example, GDP is procyclical because it increases if the ... 2 2. Countercyclical. 3 3. Acyclical.

What are the indicators of macroeconomic performance?

The Gross Domestic Product (GDP) is widely accepted as the primary indicator of macroeconomic performance. The GDP, as an absolute value, shows the overall size of an economy, while changes in the GDP, often measured as real growth in GDP, show the overall health of the economy. The GDP consists of four components, namely:

How are economic indicators collected?

Economic indicators are often collected by a government agency or private business intelligence organization in the form of a census or survey, which is then analyzed further to generate an economic indicator.

What are major economic indicators?

Economic Indicator Explained Leading indicators, such as the yield curve, consumer durables, net business formations, and share prices, are used to predict the future movements of an economy. The numbers or data on these financial guideposts will move or change before the economy, thus their category's name.

What are the 10 leading economic indicators?

GDP.Employment Figures.Industrial Production.Consumer Spending.Inflation.Home Sales.Home Building.Construction Spending.More items...

What are economic indicators 5 examples?

Top Five Leading Indicators. There are five leading indicators that are the most useful to follow. They are the yield curve, durable goods orders, the stock market, manufacturing orders, and building permits.

How many economic indicators are there?

From these censuses and surveys 13 economic indicators are produced, serving as the foundation for gross domestic product (GDP). Produced by the Bureau of Economic Analysis, GDP data is ranked as one of the three most influential economic measures that affect U.S. financial markets.

What are the 4 economic indicators?

For investors in the financial services sector, these four economic indicators can act as a sign of overall health or potential trouble.Interest Rates. Interest rates are the most significant indicators for banks and other lenders. ... Gross Domestic Product (GDP) ... Government Regulation and Fiscal Policy. ... Existing Home Sales.

What are the three types of indicators?

Outcome, process and structure indicators Indicators can be described as three types—outcome, process or structure - as first proposed by Avedis Donabedian (1966).

What are the 5 indicators of economic growth?

Economic indicators include measures of macroeconomic performance (gross domestic product [GDP], consumption, investment, and international trade) and stability (central government budgets, prices, the money supply, and the balance of payments).

What are 3 examples of leading indicators?

Key Takeaways The index of consumer confidence, purchasing managers' index, initial jobless claims, and average hours worked are examples of leading indicators.

Why are economic indicators important?

The main purpose of economic indicators is to give an understanding of the state of an economy. For investors, traders and analysts, economic indicators provide information that can help them to discover new opportunities and adjust their portfolios.

What is the best indicator of economic growth?

The most comprehensive measure of overall economic performance is gross domestic product or GDP, which measures the "output" or total market value of goods and services produced in the domestic economy during a particular time period.

What are the 5 key macroeconomic indicators?

Some of the most important macroeconomic indicators include:Non-Farm Payrolls (NFPs)Consumer Price Index (CPI)Decisions on interest rates.Retail Sales.Industrial Production.Gross Domestic Product (GDP)

Is inflation an economic indicator?

The rate of inflation is one of the indicators monitored by the authorities to set monetary policy. inflation is a sign of macroeconomic imbalances. It often reduces economic growth and future growth prospects, thereby reducing the means of implementation available for achieving sustainable development goals.

What is the best leading indicator?

Popular leading indicators include:The relative strength index (RSI)The stochastic oscillator.Williams %R.On-balance volume (OBV)

What are the 5 indicators of economic development?

Economic indicators include measures of macroeconomic performance (gross domestic product [GDP], consumption, investment, and international trade) and stability (central government budgets, prices, the money supply, and the balance of payments).

What are the 5 key macroeconomic indicators?

Some of the most important macroeconomic indicators include:Non-Farm Payrolls (NFPs)Consumer Price Index (CPI)Decisions on interest rates.Retail Sales.Industrial Production.Gross Domestic Product (GDP)

What are the leading and lagging economic indicators?

A leading indicator is an economic factor that tends to change before the economy starts to change. A lagging indicator is an economic factor that changes only after the change in the economy has already taken place.

Why is PMI the most followed economic indicator?

One of the reasons why PMI is one of the most followed economic indicators is because of its strong correlation with GDP while being one of the first economic indicators to be released monthly. The component GDP that the PMI most closely relates to is the Investment component. Legend: White line: Real US GDP Basket Price0; Blue line: ISM PMI.

What are the characteristics of an economic indicator?

An economic indicator may possess one of the three following attributes: 1. Procyclical. It is an indicator that moves in a direction similar to the economy. For example, GDP is procyclical because it increases if the economy is performing well. If the economy is not doing well (i.e., recession), GDP decreases. 2.

What is GDP in economics?

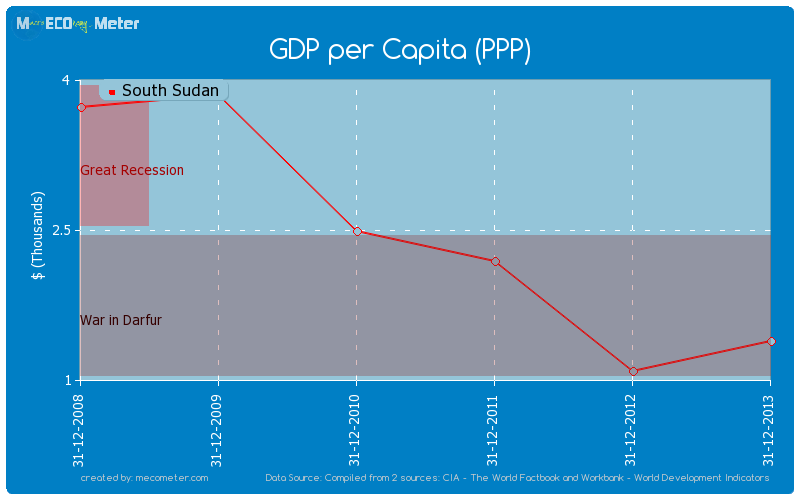

GDP Formula Gross Domestic Product (GDP) is the monetary value, in local currency, of all final economic goods and services produced in a country during a. is widely accepted as the primary indicator of macroeconomic performance. The GDP, as an absolute value, shows the overall size of an economy, while changes in the GDP, ...

How often is GDP released?

Another issue relating to reliance on GDP as an economic indicator is that it is only released every three months. In order to make timely decisions, alternative economic indicators that are released more frequently are used. The indicators, which are selected based on a high predictive value in relation to GDP, ...

What is NAICS used for?

The information collected can be used to forecast the overall business confidence within the economy and helps determine if it shows an expansionary or contractionary outlook.

What is the most used indicator to measure inflation?

To measure inflation, one of the most followed indicators is the Consumer Purchasing Index (CPI). The CPI measures the change of prices of a basket of goods, relative to a base year. The formula is as follows: A basket is aggregated by the most consumed consumer goods or services.

Why does GDP vary?

It is because GDP can vary by political definition even if there is no difference in the economy. For example, the EU imposed a rule on indebtedness that a country should maintain a deficit within 3% of its GDP. By estimating and including the black market in its GDP calculations, Italy boosted its economy by 1.3%.

What are economic indicators?

Economic indicators are statistics or data used to assess the current or past health of an economy and make financial forecasts. The indicators are typically a good reflection of what is happening in the economy, so when monitored, they can reveal its general strength. They can also be used to predict changes to economies and markets in the future.

Why are economic indicators important?

Economic indicators can reveal important news that can affect the markets and impact their performance. As traders, it is our responsibility to make our own forecasts and monitor financial market activity in a way that benefits us. Making economic predictions is largely subjective – we can all use the same indicators but may have countless ways ...

What is GDP in economics?

Gross Domestic Product (GDP). This is the monetary measure of goods produced in a country, as well as the services provided. GDP is often compared between countries, and changes can reveal a lot about an economy. Increasing GDP is a sign of a healthy economy, and decreasing GDP is a sign of a shrinking economy. GDP might not directly inform your trades but it’s a good one to be aware of, as the overall health of the economy affects business. This means it has a bearing on forex, stock indices, and commodities markets.

What does manufacturing statistics tell us?

These can be quick and simple indicators showing the health of the economy, as higher production levels can in turn influence gross domestic product (GDP) figures. As manufacturing increases, jobs become available and economies generally grow, so taking a quick look at manufacturing statistics can tell you a lot about likely currency strength and the general state of a country’s finances.

What does it mean when there are more people in the workforce?

Unemployment rate. More people in work means a stronger economy with more money being spent, and fewer people in work means a weaker economy . This is an important one to watch in relation to US markets, as the weekly jobless claim report can cause shifts.

What do you want to know as a trader?

As a trader, you will want to have a general awareness of finance, what is happening in the markets, and what might affect them. This is so you can form predictions and decide on the contracts that you are going to buy or sell.

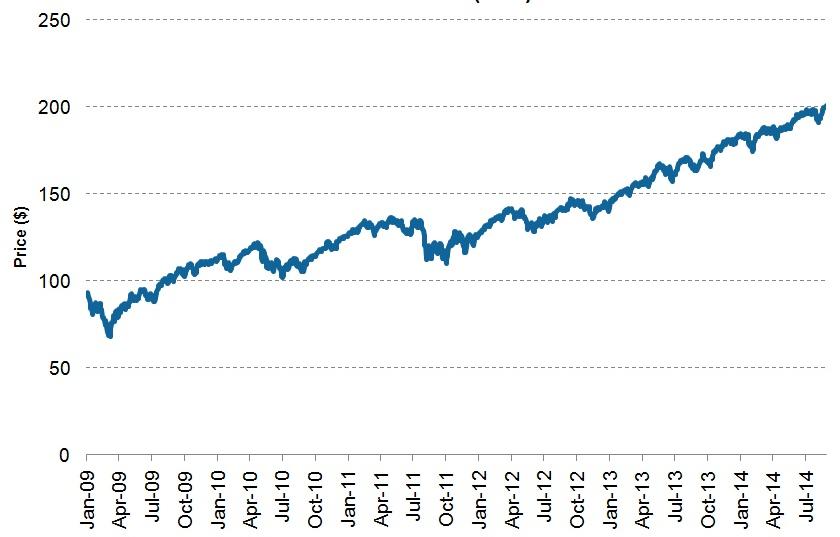

Why is the stock market important?

The stock market. This is directly relevant to stock indices, so it’s an important indicator for traders to understand. Good stock prices can indicate the general health of companies, and decreasing stock prices are less positive. If you are going to trade contracts based on stock indices, you should be aware of this indicator when predicting market movements and deciding whether to buy or sell.

Deputy Secretary Graves Applauds U.S. Census Bureau and Bureau of Economic Analysis for Producing Quality, Accurate and Equitable Data During Pandemic

Today, the nation demands data about our people, places and the economy that is more timely, accurate, and granular than ever before. Earlier this month, Commerce Deputy Secretary Don Graves visited the U.S.

Statement from U.S. Secretary of Commerce Gina M. Raimondo on Q1 2021 GDP Advance Estimate

Today, the Department of Commerce’s Bureau of Economic Analysis (BEA) released the advance estimate for gross domestic product (GDP) for the first quarter of 2021, finding that real gross domestic product increased at a 6.4-percent annual rate.

Commerce This Week: April 21

Each week, we recap the latest U.S. Department of Commerce highlights spanning a wide range of issues promoting job creation and economic growth, programs, and events in one blog post.

What is the homeownership rate in 2021?

Homeownership Rate. The homeownership rate in the second quarter 2021, 65.4 percent, was lower than the rate in the second quarter 2020. The homeownership rates in the Northeast, South, and West were lower than the rates in the second quarter 2020, while the rate in the Midwest was not statistically different. Current Press Release -.

How much will selected services revenue be in 2021?

The estimate of U.S. selected services total revenue for the second quarter of 2021, adjusted for seasonal variation but not for price changes, was $4,366.4 billion, an increase of 3.9 percent (+/- 0.4 percent) from the first quarter of 2021 and up 20.1 percent (+/- 0.6 percent) from the second quarter of 2020.

How much will the manufacturing industry make in 2021?

Manufacturing corporations' seasonally adjusted after-tax profits were $255.2 billion for the second quarter of 2021, up $26.9 (+/- 0.8) billion from first quarter of 2021.

What is the rental vacancy rate in 2021?

The rental vacancy rate in the second quarter 2021, 6.2 percent, was higher than the rate in the second quarter 2020. The rates in the Northeast and West were higher than their second quarter 2020 rates. The rates in the Midwest and South were not statistically different from the second quarter 2020 rates.

How much was the advance trade deficit in May?

Advance U.S. International Trade in Goods. The advance international trade deficit in goods increased to $88.1 billion in May from $85.7 billion in April as exports decreased and imports increased. Current Press Release -.

What is consumer spending?

Consumer spending accounts for two-thirds of US gross domestic product and is a good gauge of consumer health. The Department of Commerce’s monthly release on personal income and outlays provides input on consumer spending. It also provides input on inflation through a price index that reflects changes in how much consumers have to spend to buy certain items.

What is the Department of Commerce's monthly report on new residential sales?

This report, based on contracts to buy new or existing homes, provides input on sales of single-family homes nationally and also provides a regional breakup, as well as input on median and average sales prices. The National Association of Realtors (NAR), a private realty trade association, puts out a monthly report on sales of existing homes, based on closed sales.

What are economic indicators?

Economic indicators provide insight about the state of an economy and whether it is in expansion or contraction. Most indicators are released monthly by government agencies and typically provide input on activity in the previous month and year for comparison purposes. Here are some important US economic indicators that investors watch.

What is the Department of Commerce report on home sales?

Home sales represent a major purchase for most people. Thus, the Department of Commerce’s monthly report on new residential sales also speaks to consumer sentiment. This report, based on contracts to buy new or existing homes, provides input on sales of single-family homes nationally and also provides a regional breakup, as well as input on median and average sales prices. The National Association of Realtors (NAR), a private realty trade association, puts out a monthly report on sales of existing homes, based on closed sales.

What is a manufacturer's report?

A report on manufacturers’ shipments, inventories, and orders gives an indication of demand for manufactured items. The Department of Commerce puts out a preliminary monthly report as well as a more lengthy report as a follow up. These reports break manufactured goods up by many different types and industries, from electronic instruments, to machine tools, to nondurable consumer goods.

What does the number of houses that builders started working on as well as the number of permits that they obtained to start building?

The number of houses that builders started working on, as well as the number of permits that they obtained to start building houses, indicates real estate developers’ confidence level in the economy . The Census Bureau of the Department of Commerce’s monthly release on new residential construction provides this input nationally and also breaks it up by region.

What does it mean when the economy is overheating?

Inflation. Inflation is the general price level rise of goods and services in an economy. Too much inflation can mean the economy is "overheating" while very low inflation can be a harbinger of economic recession.

What is a lagging indicator?

A lagging indicator generally, they are a fundamental factor to look at. Look at finance news, and you’d notice that the IMF or some other institution has revised its GDP growth rate forecast of a country. GDP or the Gross Domestic Product is the monetary value of goods and services produced in the country.

What are the economic indicators?

Having gone through the caveats above, there are a few other things to note: 1 The following ten economic indicators are in fact, quite critical in today’s times given all the imbalance occurring in the financial world. Read the papers and you would know about a lot of global events. In order to have a good recap of the events making news, they have been used as examples to support the ten indicators which you will see. 2 The given indicators will try to cover as much as possible by including several other factors that form part of an indicator to help appreciate their interrelatedness. 3 Given these ten indicators are subjective, some of them may not be found in another article if you Google the same heading. To specifically note, the ones mentioned here are not from a collection of multiple Google searches. 4 I sincerely hope that reading this would enhance your knowledge and make you start looking at the financial world differently. 5 The indicators mentioned are not in order of ranking since ‘beauty lies in the eyes of the beholder’ – beauty often lies.

Why are interest rates important?

This is really simple but critical stuff. Monetary economics and policies suggest that interest rates majorly drive economic activity. Although it can be argued, they are one of the most important factors. Policy rates set by Central Banks have been seen with even more interest and expectation than Roger Federer winning an 18 th Grand Slam. Even a fractional move nowadays is seen as an anticipated big boost or a bust. Policy rates are both, a lagging and leading indicator to be honest. When the interest rate [nominal rate] on deposits/securities is adjusted for inflation rates, we get the real rate of interest which is left uneroded by inflation [Nominal rate minus the inflation rate is approximately the real rate]. Stable interest rates both nominal and real, relative to exchange rates, inflation, and other economies is seen as a signal of strength [for whatever it’s worth]. its???

What is debt cycle?

Term Debt Long-term debt is the debt taken by the company that gets due or is payable after one year on the date of the balance sheet. It is recorded on the liabilities side of the company's balance sheet as the non-current liability. read more.

Why is GDP important?

Not only because they are seen as a fundamental factor by top institutions are they important, but in a way, the country’s worth could be represented by the GDP. The growth rate in GDP if consistent is obviously considered good. Recently there have been debates about India’s GDP growth rate as it is considered the fastest-growing economy in the world. It creates further complications if the authenticity of fundamental numbers is in question. On a worse note, China’s GDP numbers have not been considered correct for a number of years which also includes the time when they were the fastest-growing economy.

What is debt in finance?

This is a leading indicator. A fairly large topic in itself but very important, debt is essentially borrowing money and comes in two forms: Private debt [debt issued by corporates and other institutions, loans taken by individuals/group (s) of individuals] and Public debt [borrowings by the government (s)]. The money borrowed can be used in many ways depending on who is issuing debt – to finance asset purchases, to pay equity holders, to fund projects, to take levered risks on trades, etc. When there is more borrowing than the ability to pay down the dues [preferably through legitimate income!], debt becomes risky and could lead to restructuring it for the good and in the worst case, debt defaults or failure to pay down the amount (s) due. Thus, there is a limit to how much debt can/should be taken. Other ways in which debt can be taken are either domestically or from abroad.

Why is the third reason subtle yet blatant?

The third reason is subtle yet blatant because this would interest you, the reader to believe that this is the key to success in your investment decisions. So here is the disclaimer you have not been hoping for – the indicators mentioned are generally looked at indicators and could be used to make investment decisions at your own risk. The pleasure is mine to point this out to you.

Which Is The Primary Economic Indicator?

- Gross Domestic Product

The Gross Domestic Product (GDP)is widely accepted as the primary indicator of macroeconomic performance. The GDP, as an absolute value, shows the overall size of an economy, while changes in the GDP, often measured as real growth in GDP, show the overall health of the econo…

What Are Other Economic Indicators?

- Purchasing Manager’s Index

In the US, one of the most followed economic indicators is the Institute of Supply Management’s Purchasing Manager’s Index or PMI for short. The ISM’s PMI is a survey sent to businesses that span across all North American Industry Classification System (NAICS)categories to collect info… - Consumer Purchasing Index

While not directly related to the GDP, inflation is a key indicator for financial analysts because of its significant effect on company and asset performance. Inflation erodes the nominal value of an asset, which leads to a higher discount rate. Based on the fundamental principle of the Time Val…

List of Economic Indicators

- Here is a list of the most common leading and lagging economic indicators: Leading Indicators 1. Stock Market Performance 2. Retail Sales Figures 3. Building Permits and Housing Starts 4. Level of Manufacturing Activity 5. Inventory Balances Lagging Indicators 1. GDP Growth 2. Income and Wage Growth/Decline 3. Unemployment Rate 4. CPI (Inflation) 5...

Video Explanation of Economic Indicators

- Watch the short video below to quickly understand the main concepts covered here, including what economic indicators are, the primary and other economic indicators, and the leading and lagging indicators.

Related Readings

- Thank you for reading CFI’s guide on Economic Indicators. To help you advance your career, check out the additional CFI resources below: 1. Gross National Product 2. Market Cap to GDP Ratio (The Buffett Indicator) 3. Market Economy 4. Purchasing Power Parity