Furthermore, general partnerships offer advantages such as the flexibility to combine resources and share financial risks. In general partnerships, there are disadvantages, most notably in terms of liability. Partnerships with general partners are personally responsible for their business’ obligations and debts.

- Advantage: Easy to Create.

- Disadvantage: Easy to Dissolve.

- Advantage: Flow of Personal Income.

- Disadvantage: Little Protection.

- Advantage: Flexibility.

- Disadvantages: Lack of Structure.

What are the pros and cons of a general partnership?

Pros, Cons & How to Form

- Understanding general partnerships. A general partnership is an unincorporated business, which means you don’t need to register your business with the state in order to legally operate.

- General partnership features. ...

- Pros and cons of a general partnership. ...

What are the advantages of a general partnership?

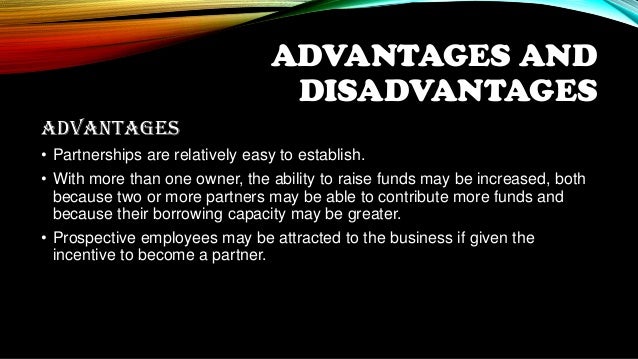

Advantages of a General Partnership. There are several key advantages to forming a GP: 1. A general partnership is easy to establish. Creating a general partnership is simpler, cheaper, and requires less paperwork than forming a corporation. 2. A general partnership faces simplified taxes. General partnerships do not pay income tax.

What are 3 disadvantages of a partnership?

What Are the Disadvantages of Partnerships?

- Liability. Generally, the members of a partnership are exposed to unlimited liability for the acts of the partnership as a whole.

- Transferability. ...

- Instability. ...

- Unclear Authority. ...

- Get Legal Help with Your Partnership Questions. ...

What are the disadvantages of a partnership?

Disadvantages of Partnership: Everything You Need to Know

- Disadvantages of Partnership. ...

- Partnerships Defined and Explained. ...

- Liability. ...

- Transferability. ...

- Instability. ...

- Management and Disputes. ...

- Types of Partnership. ...

- Advantages of a General Partnership. ...

- Advantages of a Limited Partnership. ...

- Disadvantages of a General Partnership. ...

What are advantages of general partnership?

Simplified taxes: The biggest advantage of a general partnership is the tax benefit. Businesses structured as partnerships do not pay income tax. Instead, all profits and losses are passed through to the individual partners.

What is a key disadvantage of a general partnership?

Disadvantages of a partnership include that: the liability of the partners for the debts of the business is unlimited. each partner is 'jointly and severally' liable for the partnership's debts; that is, each partner is liable for their share of the partnership debts as well as being liable for all the debts.

What are the disadvantages of general?

Disadvantages of a General PartnershipNo Separate Business Entity from Partners.Partners' Personal Assets Unprotected.Partners Liable for Each Others' Actions.Partnership Terminated Upon Death or Withdrawal of One of the Partners.

What is a potential disadvantage to the owners of a general partnership?

Your Personal Assets are Vulnerable. When you're in a general partnership, all partners are unprotected from any lawsuits that might arise against the business. As a general partner, your personal assets can be taken to pay for any of the business' debt obligations.

What is a disadvantage of a general partnership quizlet?

One major disadvantage of a general partnership is that each owner has unlimited liability for the debts of the company. Moreover, disagreements among partners can complicate decision making.

What are 5 disadvantages of a partnership?

Following are some of the disadvantages of the partnership form of business organization:Difficulty of ownership transfer. ... Relative lack of regulation. ... Taxation subject to individual's tax rate. ... Limited life. ... Unlimited liability. ... Mutual agency and partnership disagreements. ... Limited ability to raise capital.

What are the advantages and disadvantages of limited liability partnership?

The following are advantages of incorporating an LLP in India:No requirement of minimum contribution. There is no minimum capital requirement in LLP. ... No limit on owners of the business. ... Lower registration cost. ... No requirement of compulsory Audit. ... Taxation Aspect on LLP. ... Dividend Distribution Tax (DDT) not applicable.

What advantages does the limited partnership business form offer to them over the general partnership?

The key advantage to an LP, at least for limited partners, is that their personal liability is limited. They are only responsible for the amount invested in the LP. These entities can be used by GPs when looking to raise capital for investment. Many hedge funds and real estate investment partnerships are set up as LPs.

What is an example of general partnership?

For example, let's say that Fred and Melissa decide to open a baking store. The store is named F&M Bakery. By opening a store together, Fred and Melissa are both general partners in the business, F&M Bakery.

What are advantages and disadvantages?

As nouns, the difference between disadvantage and advantage is that disadvantage is a weakness or undesirable characteristic; a con while the advantage is any condition, circumstance, opportunity, or means, particularly favorable to success, or any desired end.

What are 4 disadvantages of a partnership?

Disadvantages of a PartnershipLiabilities. In addition to sharing profits and assets, a partnership also entails sharing any business losses, as well as responsibility for any debts, even if they are incurred by the other partner. ... Loss of Autonomy. ... Emotional Issues. ... Future Selling Complications. ... Lack of Stability.

What are the advantages and disadvantages of a partnership quizlet?

Advantages: Easy to start, easy to manage, profits are not shared, do not pay income taxes, and easy to end the business. Disadvantages: The one owner is fully responsible for all losses, difficult to raise capital ($), the owner often has little experience, and difficult to find qualified employees.

What are the disadvantages of a limited partnership?

Disadvantages of a Limited PartnershipExtensive Documentation Required.Lack of Legal Distinction for General Partners.General Partners' Personal Assets Unprotected.General Partners Liable for Each Others' Actions.Less Protection from Excessive Taxation.More items...

What are the advantages and disadvantages of limited liability partnership?

The following are advantages of incorporating an LLP in India:No requirement of minimum contribution. There is no minimum capital requirement in LLP. ... No limit on owners of the business. ... Lower registration cost. ... No requirement of compulsory Audit. ... Taxation Aspect on LLP. ... Dividend Distribution Tax (DDT) not applicable.

What are the major advantages and disadvantages of an LLC?

The Top 12 LLC Advantages and DisadvantagesIt limits liability for managers and members.Superior protection via the charging order.Flexible management.Flow-through taxation: profits are distributed to the members, who are taxed on profits at their personal tax level. ... Good privacy protection, especially in Wyoming.More items...

What are the disadvantages of corporation?

Before becoming a corporation, you should be aware of these potential disadvantages: There is a lengthy application process, you must follow rigid formalities and protocols, it can be expensive, and you may be double taxed (depending on your corporation structure).

What is the advantages of general partnership?

It is simple to establish a general partnership. It is more straightforward, less expensive, and requires less documentation to start a general par...

What is the disadvantage of a general partnership?

The following are some of the disadvantages of a partnership: The liability of the partners for the firm's debts is unlimited. Each partner is join...

Is general partnership better than limited partnership?

As a limited partner, your liability is restricted, but you will not have the same decision-making rights as a general partner has.

What do general partners do?

A general partner has power over the firm without the consent or awareness of the other partners. Unlike a limited or silent partner, a general par...

What is a general partnership?

A general partnership is the most basic form of a partnership. Found under common law, it is the definition of an association of people or an unincorporated company. It must be created by agreement, estoppel, and proof of existence. A minimum of two people is required.

What percentage of liability is a general partnership?

If there are 5 partners involved, then the liability percentage drops to 20%.

What is the self employment tax rate for partners?

Partners are classified as self-employed individuals when they are performing services for the business. Net earnings include the distributive share of income (or loss) that comes from the business. That means general partners are liable for the self-employment tax in the United States. In 2018, the self-employment tax is 15.3%, with 2.9% going to the Medicare tax and the remainder going to Social Security.

Why should a partnership agreement be in place?

The reason why a general partnership agreement should be in place is that the presence of all partners is necessary for the business to have life. If a partner should decide to leave the business for some reason, or happens to die unexpectedly, then the partnership is terminated without the presence of an agreement.

What is partnership structure?

Unlike a sole proprietorship, the structure of a partnership allows for multiple people to be engaged in fundraising efforts for the company. Although fundraising can be difficult in this structure due to the personal liabilities involved, having more people active can create more chances for success.

How many people are required to be a partner in a business?

A minimum of two people is required. Under the structure of this business type, all partners have an equal share in the liability and responsibility of the business. Under this structure, each partner is taxed on their personal income tax return instead of a business tax return.

How are agreements formed?

Many agreements are formed by verbal commitments and handshakes within the context of a general partnership. That occurs because most people who start a business together already know one another. When family or friends work together for the first time, there is an expectation of mutual morals and ethics.

What is a general partnership?

As in a general partnership, people from unique backgrounds and cultures come together bringing their resources in order to form a general partnership, it can lead to a successful business and making profits.

Can a business operate without a license?

In the United States, some states allow any kind of business structure to operate immediately without a license, however in case of a general partnership, they must wait for the business license receipt before serving their first customer.

Can a partner divest themselves of their business?

If not specified in the general partnership agreement, a partner is not allowed to transfer or divest themselves of their interest in the business of their own. Since there are no rigid regulations for a transfer of interest, some states adopt the unanimous voting method.

Is a general partnership a self employed individual?

As the partners in the general partnership are classified as self-employed individuals performing services for the business, their net earnings or losses including the distributive share of income is liable for the self-employment tax in the United States.

Is a general partnership an independent entity?

As general partnership does not act like an independent entity, which means they do not have the advantage of financial protection of personal assets such as in a corporation or other kinds of business structures.

Is a general partnership easy to form?

Now that you know the pros and cons of forming a general partnership, you can now take your decision wisely. Every new business venture has risks involved, but general partnership is easy to form with flexible regulations to run smoothly.

Do you need a business document before starting a partnership?

As long as each partner in a general partnership agrees over the guidelines for their business among themselves, there is no requirement of drafting a detailed legal business document before beginning the operations. Mostly states in the United States do not require maintenance activities either.

1. Bridging the Gap in Expertise and Knowledge

Partnering with someone can give you access to a wider range of expertise for different parts of your business. A good partner may also bring knowledge and experience you may be lacking, or complementary skills to help you grow the business.

2. More Cash

A prospective partner can bring an infusion of cash into the business. The person may also have more strategic connections than you do. This may help your company attract potential investors and raise more capital to grow your business.

3. Cost Savings

Having a business partner can allow you to share the financial burden for expenses and capital expenditures needed to run the business. This could result in more substantial savings than by going it alone.

4. More Business Opportunities

One of the advantages of having a business partner is sharing the labor. Having a partner may not only make you more productive, but it may afford you the ease and flexibility to pursue more business opportunities. It might even eliminate the downside of opportunity costs.

6. Moral Support

Everyone needs to be able to bounce off ideas or debrief on important issues. And we may need moral support when we encounter setbacks or have to cope with work and everyday frustrations.

7. New Perspective

It's easy to have blind spots about the way we conduct our business. A partnership can bring in a set of new eyes that can help us spot what we may have missed. It may help us adopt a new perspective or gain a different outlook about what we do, who we deal with, what markets we pursue and even how we price our products and services.

8. Potential Tax Benefits

A possible advantage of a general partnership may be a tax benefit. A general partnership may not pay income taxes. Instead, as indicated on the IRS Partnership website, a general partnership "passes through" any profits or losses to its partners.