Advantages of a corporation include personal liability protection, business security and continuity, and easier access to capital. Disadvantages of a corporation include it being time-consuming and subject to double taxation, as well as having rigid formalities and protocols to follow.

What are the pros and cons of a corporation?

Pros and Cons: Why Form a Corporation?

- PROS. Owner Protection from Legal Liability: Once a new business's owner (s) successfully completes the incorporation process, the owner (s) have a limited amount of legal liability for the corporation's ...

- CONS. Time and Cost of Incorporation: The incorporation process can be expensive and time-consuming. ...

- Still Unsure About Whether to Incorporate? ...

What are the major advantages of a corporation?

What is a Corporation – Advantages and Disadvantages of a Corporation

- Corporation. A corporation is owned by shareholders, however, it is the corporation that is held accountable for its actions and debts.

- Advantages of a Corporation. Corporations have many advantages including protecting shareholders from legal action. ...

- Disadvantages of a Corporation. ...

What are the benefits of forming a LLC?

Top 5 LLC Advantages

- Limited Personal Liability. The main and immediate benefit of forming an LLC is that it separates your personal assets from the business, making it much more difficult for someone ...

- Pass-through Taxation. When it comes to filing taxes, an LLC is a disregarded entity. ...

- Flexible Ownership Structure. ...

- Less Formalities and Paperwork. ...

What are the primary advantages of forming a joint venture?

What Are the Primary Advantages of Forming a Joint Venture? A joint venture affords each party access to the resources of the other participant(s) without having to spend excessive amounts of capital.

What are the disadvantages of a corporation?

The disadvantages of a corporation are as follows: 1 Double taxation. Depending on the type of corporation, it may pay taxes on its income, after which shareholders pay taxes on any dividends received, so income can be taxed twice. 2 Excessive tax filings. Depending on the kind of corporation, the various types of income and other taxes that must be paid can require a substantial amount of paperwork. The exception to this scenario is the S corporation, as noted earlier. 3 Independent management. If there are many investors having no clear majority interest, the management team of a corporation can operate the business without any real oversight from the owners.

Why is corporate entity important?

The corporate entity shields them from any further liability, so their personal assets are protected. This is a particular advantage when a business routinely takes on large risks for which it could be held liable. Source of capital.

What is independent management?

Independent management. If there are many investors having no clear majority interest, the management team of a corporation can operate the business without any real oversight from the owners. A private company has a small group of investors who are unable to sell their shares to the general public.

How can a publicly held corporation raise capital?

Source of capital. A publicly-held corporation in particular can raise substantial amounts by selling shares or issuing bonds. This is a particular advantage when its shares trade on a stock exchange, where it is easier to buy and sell shares.

Can a shareholder sell shares in a corporation?

It is not especially difficult for a shareholder to sell shares in a corporation, though this is more difficult when the entity is privately-held. Perpetual life. There is no limit to the life of a corporation, since ownership of it can pass through many generations of investors. Pass through.

Does a S corporation pay income tax?

Pass through. If the corporation is structured as an S corporation, profits and losses are passed through to the shareholders, so that the corporation does not pay income taxes.

Can a corporation pay double taxes?

Double taxation. Depending on the type of corporation, it may pay taxes on its income, after which shareholders pay taxes on any dividends received, so income can be taxed twice.

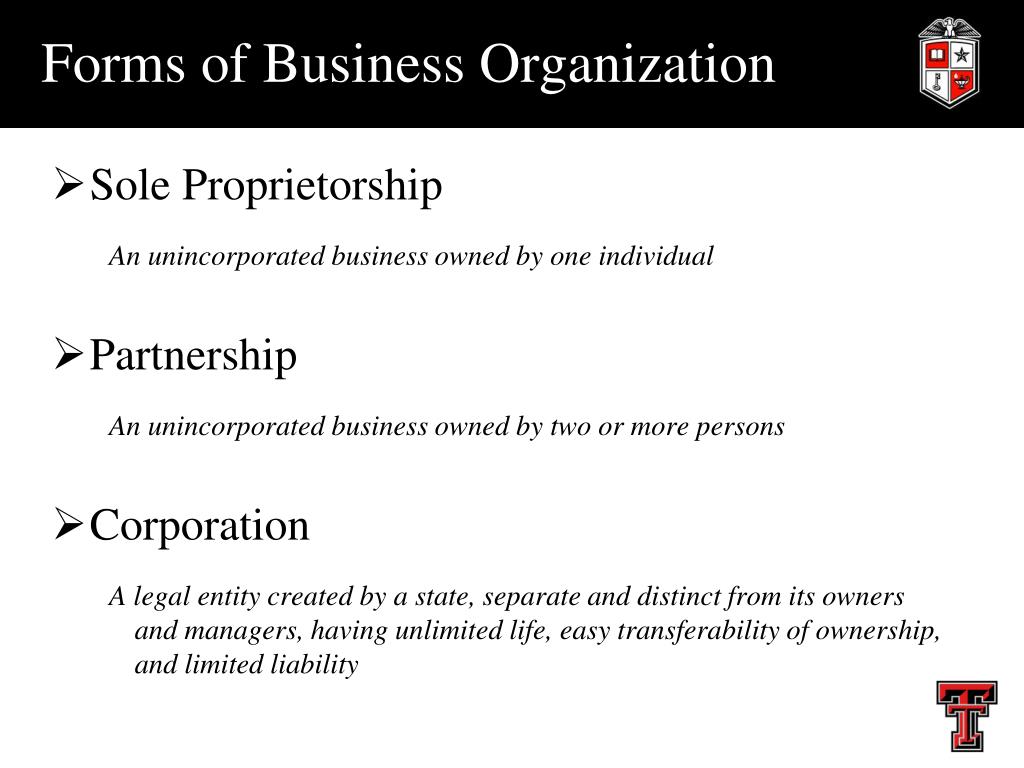

What are corporations?

A corporation can be defined as a group of people that form a company, and are authorized (legally) to operate as a single entity. It is incorporated in the place where it is formed, and therefore, all applicable rules and regulations are levied in the locality too.

Why are corporations the number one choice for entrepreneurs?

However, this does not eradicate the fact that corporations are still the number one choice for entrepreneurs because of the fact that they do not involve unlimited liability. Registering a business as a separate entity might be time-consuming to begin with, but in the longer run, it reaps multiple benefits for both, owners as well as investors. This is because the opportunities that can be availed once corporations are formed are endless.

What is business security and ownership?

Business security and ownership: Ownerships in corporations functions with the mechanism of stocks. This means that all stockholders are technically the owners of the company. Since corporations deal with stocks, it is easier for owners to deal with stocks. This means that companies can sell ownership in terms of stock, relatively easily. On the contrary, with sole proprietorships, or partnerships, share of ownership is relatively difficult. This is because ownership in these kind of business entities is based on percentage terms.

How are corporations created?

In technical terms, a corporation is created when it is incorporated by a group of shareholders who share ownership of a given corporation. This is represented by their holding of the stock shares, which further helps to pursue a common goal. Mostly, corporations are established with a common view of profit sharing. However, some corporations are also formed for other objectives, which might be important enough on a number of grounds.

Why are corporations listed on the stock exchange?

Access to capital: Corporations are normally listed on the public stock exchanges after cumbersome processes. This, in return, gives them access to capital. Publicly raising funds is relatively easier for corporations as compared to unincorporated companies. Additionally, investors, as well as lenders are more confident in investing in corporations, as compared to other unincorporated companies.

What are operational changes?

Operational Changes: Corporations operate on the basis of a certain hierarchy present within the organization. For example, there should be strict internal control implemented within the company to prevent fraud or cash embezzlement.

What is limited liability?

Limited Liability: Within business entities like sole proprietorship and partnerships, owners have unlimited liability. This is because in these business models, there is no difference between the legal identity of the owner, and the legal identity of the business entity. Therefore, the owner can be liable for all the transactions that are made by the owner, and this in itself tends to very risky for the owner of the business.

What are the advantages of forming a corporation?

There are several advantages to becoming a corporation, including the limited personal liability, easy transfer of ownership, business continuity, better access to capital and (depending on the corporation structure) occasional tax benefits. The legal structure of your corporation and the benefits you receive from it will depend on the specific setup of your business.

What are the disadvantages of a corporation?

Disadvantages of a corporation include it being time-consuming and subject to double taxation, as well as having rigid formalities and protocols to follow. This article is for entrepreneurs who are trying to determine their business structure and whether a corporation makes sense for them. Small business owners have a variety ...

How do corporations work?

According to Shannon Almes, attorney at Feldman & Feldman, corporations can generally conduct any lawful business as well as the actions necessary to conduct the business, like entering into contracts, owning assets, borrowing money, hiring employees, suing and being sued. Corporations are generally governed by a board of directors elected by the shareholders.

What types of corporations are there?

There are several types of corporations, including C corporations, S corporations, B corporations, closed corporations and nonprofit corporations. Each has it benefits and disadvantages. Some alternatives to corporations are sole proprietorships, partnerships, LLCs and cooperatives.

What is a C corp?

As one of the most common types of corporations, a C corporation (C-corp) can have an unlimited number of shareholders and is taxed on its income as a separate entity. C-corp shareholders are also taxed on the dividends they receive from the company, and they receive personal liability protection from business debts and litigation. Ownership for this type of corporation is divided based on stocks, which can be easily bought or sold. A C-corp can raise capital by selling shares of stock, making this a common business entity type for large companies.

Why do corporations have personal liability protection?

For example, if a corporation is sued, the shareholders are not personally responsible for corporate debts or legal obligations – even if the corporation doesn't have enough money in assets for repayment. Personal liability protection is one of the main reasons businesses choose to incorporate.

What is double taxation?

Most corporations (like C-corps) face double taxation, which means that the business income is taxed at the entity level as well as the shareholder level (based on their percentage of profits earned). The only way around this is to operate as an S corporation. S-corps eliminate this problem by only taxing each shareholder on their ...

Why are corporations more complex than other forms of business?

This is due to the fact that corporations must follow tougher laws than most forms of businesses. Similarly, the original founders of a corporation must go through many phases in order to create a corporation.

Why are corporations beneficial to shareholders?

Corporations provide an advantage for their shareholders in that they encourage their shareholders to pass ownership without limitations. Shareholders can freely purchase and sell a corporation’s shares in a stock market without requiring prior approval.

What do you mean by Corporation?

A corporation is a legal body formed by individuals, stockholders, or shareholders to operate for profit. Corporations can make arrangements, prosecute and be sued, own properties, pay federal and state taxes, and borrow money from financial institutions.

How many shareholders are in an S corporation?

S Corporations are formed in the same manner as a C Corporation, but they vary in terms of owner restriction and taxation. An S Corporation is made up of 100 shareholders and is not charged separately; rather, the profits/losses are borne by the shareholders on their personal income tax returns.

What is the purpose of incorporation?

The incorporation process provides the business entity a distinct function that shields its owners from criminal liability in the case of litigation or legal argument.

How is a corporation formed?

A corporation is formed by the legal procedure known as incorporation, in which legal documents containing the primary intent of the enterprise, its name, and location, as well as the types of stokes and number of shares issued, are drafted.

What happens to a partnership after a shareholder leaves?

Any time dynamics of the partnership alter, a new partnership deed is created. Furthermore, corporations continue to survive long after a shareholder leaves , joins, or even dies, which other types of businesses will not be able to do.

Why is a corporation important?

Also, when you set-up a corporation, you can attract top talent in the market to grow your business rapidly. Hence, a corporation conveys the credibility of your business to suppliers, customers are other stakeholders of the business.

What happens to the shareholders of a corporation?

Hence, the shareholders will lose the amount invested. Creditors and lenders, however, have no claim on the personal properties and assets of the owners. This is what limited liability means: limited up to the extent of the amount invested.

How do corporations govern themselves?

For e.g., corporations must have a Board of Directors, hold meetings at regular intervals, keep certain records and publish some documents and reports periodically. A small mistake of manipulation by any of the top executives could penalize the corporate heavily. For e.g., if the accounts department forgets to disclose a liability say, bank loan, the federal government may consider it as a fraud and penalize the corporate. Due to this, the corporate may gain a bad image and its valuation in the stock market may go down. Hence, Sam may get punished for something which was not under his proper control. 1–4

How does it take to set up a corporation?

Setting up a corporation is a very complex process. It takes heavy paperwork to set up a corporate. The owners have to take lots of permissions from different regulatory authorities. Also, many norms of different regulatory bodies that a corporate must fulfill before it can start its business. For e.g., Sam will have to ensure that his business meets all the criteria set by stock exchanges if he wishes to list his business on. All this takes a long time to conclude which may demotivate the founders.

What is a corporation in Sam's case?

A corporation is a business organization that is distinct from its owners. Shareholders are the owners of a corporation. Shareholders, however, do not run the corporation. They appoint the Board of Directors who oversee ...

What happens if Sam turns his business into a corporation?

If Sam converts his business into a corporate, he will end up giving the decision-making power in the hands of the Board of Directors and the appointed officers. Sometimes, it happens that the Board of Directors and the executives may fulfill their personal interests by taking certain decisions.

What does Sam want before converting his business into a corporation?

Before converting his business into a corporation, Sam wants to be clear on what will he gain by setting up a separate legal entity. The biggest advantages of having a corporation which Sam could list down are:

What is a corporation?

A corporation is a business entity legally distinct from its owners. A board of directors governs it, with officers managing day-to-day operations. Advantages of a corporation include limited liability for its shareholders, a perpetual existence and ease of transferring ownership interests.

What is the difference between a C and S corporation?

The primary difference between an S-corporation and a C-corporation is its tax treatment. A C-corporation is subject to double income taxation, and an S-corporation is not.

How do Tom and Tim form a corporation?

Tom and Tim will form a corporation by filing articles of incorporation with the secretary of state for the state in which they want to form the corporation. As the only shareholders of the corporation, they will have to elect a board of directors who set the policy and vision for the corporation.

What is a corporation in Tom and Tim's business?

A corporation is a business organization that is considered a separate entity from its owners, who are called shareholders.

Why do corporations have a perpetual existence?

Another advantage of a corporation is that it can have a perpetual existence, which means it can outlive Tom and Tim because it is a separate person in the eyes of the law. This means investors don't have to worry about the untimely demise of the owners. It also allows the corporation to plan for the long-term.

Do corporations need an accountant?

All of this costs money. Most corporations will retain the services of an attorney and accountant to help them with drafting legal documents and corporation filings and maintaining compliance with complex corporation law and regulations.

Can a corporation elect S-corporation?

Generally, a corporation can only elect S-corporation status if it is a domestic corporation, has only the type of shareholders allowed under IRS regulations, has no more than 100 shareholders and has one class of stock. Some corporations, such as insurance companies, are ineligible to elect S-corporate status.

What Are Corporations?

Advantages of Corporation

- Establishing a corporation comes with its fair share of procedures and applications. However, when entities register themselves as corporations, they are able to enjoy numerous different benefits. They include the following: 1. Limited Liability: Within business entities like sole proprietorship and partnerships, owners have unlimited liability. Th...

Disadvantages of Corporations

- There are certain disadvantages associated with corporations that need to be accounted for. These disadvantages are as follows: 1. Establishing a corporation: Establishing a corporation (regardless of Private Ltd, or Public Limited, or S-Corp or C-Corp), is a cumbersome process. It involves several different objectives that need to be fulfilled in order for them to get a business li…