Here are some of the benefits of offering discounts:

- Assists in drawing in new customers. The majority of people prefer to shop around for a bargain to save money. ...

- Instantly increase the volume of sales. It is simple economics that when you decrease the price of an in-demand product you increase sales. ...

- Make way for new inventory. ...

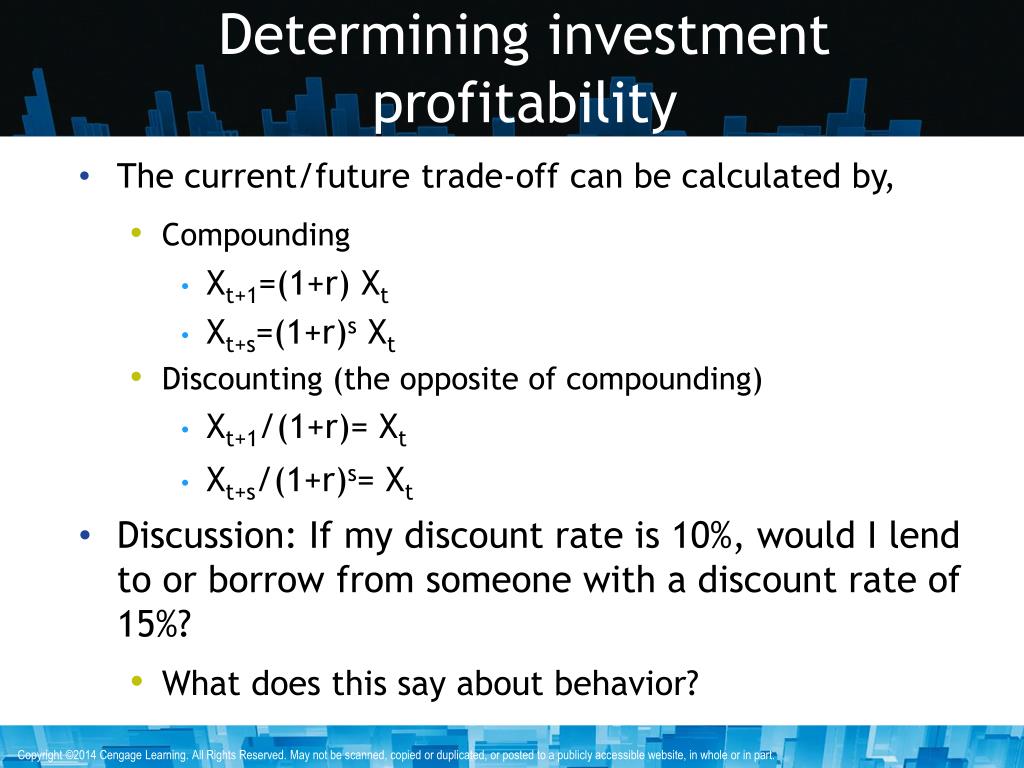

What is the difference between discounting and compounding?

Discounting and compounding are two sides of the same coin. Both are used to adjust the value of money over time. They just work in different directions: You use discounting to express the value of a future sum of money in today's dollars, and you use compounding to find the value of a current sum of money in future dollars. Time Value of Money

What is the difference between compound interest rate and discount rate?

Compounding uses compound interest rates while discount rates are used in Discounting. Compounding of a present amount means what will we get tomorrow if we invest a certain sum today. Discounting of future sum means, what should we need to invest today to get the specified amount tomorrow.

What are the benefits of compounding in investing?

The main benefit of compounding is that it gives you an opportunity to exponentially grow the returns from your investments. More importantly, it teaches you the importance of time. As your investment time period increases so do the benefits from compounding.

What is the concept of discounting?

1 Discounting is the process of determining the present value of a future payment or stream of payments. 2 A dollar is always worth more today than it would be worth tomorrow, according to the concept of the time value of money. 3 A higher discount indicates a greater the level of risk associated with an investment and its future cash flows.

What are the benefits of compounding?

Compound interest makes your money grow faster because interest is calculated on the accumulated interest over time as well as on your original principal. Compounding can create a snowball effect, as the original investments plus the income earned from those investments grow together.

Why is discounting important in economics?

Discounting makes current costs and benefits worth more than those occurring in the future because there is an opportunity cost to spending money now and there is desire to enjoy benefits now rather than in the future.

Which is better compounding or discounting?

The primary difference between the two is that we use discounting to express the value of a future amount of money in present dollars. While compounding is exactly the opposite of that wherein we try to get a value of current dollars in the future point of time.

Why is discounting important in accounting?

Discounting helps in pricing issues based on the future financial prospects of a company. In the case of bonds, the present market price is determined by discounting the future interest payments. The discounting factor is applied to determine today's price of future cash flow receipts.

What is discounting and compounding?

The concept of compounding and discounting are similar. Discounting brings a future sum of money to the present time using discount rate and compounding brings a present sum of money to future time.

How is discounting helpful in decision making?

Discounting is used by decisionmakers to fully understand the costs and benefits of policies that have future impacts.

What means compounding?

Compounding is the process whereby interest is credited to an existing principal amount as well as to interest already paid. Compounding thus can be construed as interest on interest—the effect of which is to magnify returns to interest over time, the so-called “miracle of compounding.”

What is discounting technique?

Discounting is the process of determining the present value of a payment or a stream of payments that is to be received in the future. Given the time value of money, a dollar is worth more today than it would be worth tomorrow. Discounting is the primary factor used in pricing a stream of tomorrow's cash flows.

Do Stocks compound daily?

Earnings in your 401(k) and investment accounts also compound over time. The percentage that stocks gain from day to day are calculated based on their performance the day before, meaning they compound each business day.

What is discount cost benefit analysis?

This concept is made tangible by a process called discounting. This is where a discount rate is applied to anticipated costs and benefits of a project over the duration or 'life span' of the project to convert the value of a return in the future into today's value.

What are discounting factors?

What is a “Discount Factor”? The term “discount factor” in financial modeling is most commonly used to compute the present value of future cash flows values. It is a weighting factor (or a decimal number) that is multiplied by the future cash flow to discount it to the present value.

What is discount factor used for?

What is the Discount Factor? Discount Factor is a weighing factor that is most commonly used to find the present value of future cash flows and is calculated by adding the discount rate to one which is then raised to the negative power of a number of periods.

How do discount rates affect the economy?

The Discount Rate and Monetary Policy A decrease in the discount rate makes it cheaper for commercial banks to borrow money, which results in an increase in available credit and lending activity throughout the economy.

Why is discounting important in terms of environmental policy?

The Rationale for Discounting. Discounting reflects how individuals value economic resources. Empirical evidence suggests that humans value immediate or near-term resources at higher levels than those acquired in the distant future (NOAA 1999).

What does discount rate mean in economics?

The discount rate is the interest rate charged to commercial banks and other financial institutions for short-term loans they take from the Federal Reserve Bank. The discount rate refers to the interest rate used in discounted cash flow (DCF) analysis to determine the present value of future cash flows.

Why discount rate is important in cost benefit analysis?

The use of discount rate has become an integral part of CBA because a high discount rate tends to give a lower value to benefits which accrue after longer periods and result in giving more attention to the interests of future generations.

Why do finance professionals use compounding and discounting?

Finance professionals use compounding and discounting all the time to evaluate investments. Since money changes in value over time, you must express all cash values in the "same" dollars to be able to compare them.

What is compounding and discounting?

Compounding and discounting are integral to the economic concept of the time value of money. This is the idea that a sum of money in the present time has more economic value than an equal sum of money at some point in the future. In simpler terms: A dollar today is worth more than a dollar tomorrow.

What is the difference between discounting and compounding?

To distinguish between discounting and compounding, consider that they just work in different directions: You use discounting to express the value of a future sum of money in today's dollars, and you use compounding to find the value of a current sum of money in future dollars.

How to compare discounting and compounding?

When discounting, you divide the cash flow by the factor " (1 + r)^n," which reduces the present value of the cash flow. When compounding, you multiply the cash flow by the same factor, which increases the future value of the cash flow.

How does compounding work?

Compounding allows you to project what a given sum of money will be worth in the future. Say you have $100 and you want to know what it will be worth a year from now. Compounding requires you to make an assumption about the kind of return you can earn on your money if you invest it. Say you assume you can earn an average four percent annual return. In one year, therefore, you forecast that you will have $104, or $100 multiplied by 1.04. After another year, you'll have $108.16 — or $104 times 1.04. With compounding, each year's earnings become part of the next year's principal, which allows money to grow faster.

What is discounting in financial terms?

Discounting is the opposite of compounding. You're taking a sum of money from a point in the future and translating it to its value in today's dollars — which usually will be less . Continuing from the previous example, say you assume an annual return of four percent.

How much money do you have after another year?

After another year, you'll have $108.16 — or $104 times 1.04. With compounding, each year's earnings become part of the next year's principal, which allows money to grow faster. Advertisement.

What is compounding used for?

Compounding is helpful to know the future values, of the cash flow, at the end of the particular period, at a definite rate. Contrary to this, Discounting is used to determine the present value of the future cash flow, at a certain interest rate. Here, in this article, we’ve described the differences between compounding and discounting.

What is the future value of compounding?

So the worth of the investment in future is known as its Future Value.

What are the two methods of ascertaining the value of money?

There are two methods used for ascertaining the worth of money at different points of time, namely, compounding and discounting. Compounding method is used to know the future value of present money. Conversely, discounting is a way to compute the present value of future money. Compounding is helpful to know the future values, of the cash flow, ...

What is discounting in cash flow?

Discounting is the process of converting the future amount into its Present Value. Now you may wonder what is the present value? The current value of the given future value is known as Present Value. The discounting technique helps to ascertain the present value of future cash flows by applying a discount rate. The following formula is used to know the present value of a future sum:

How to use discount factor to find present value?

You can also use discount factor to arrive at the present value of a future amount by simply multiplying the factor with the future value. For this purpose, you need to refer the present value table.

What is the process of determining the present value of the amount to be received in the future?

The process of determining the present value of the amount to be received in the future is known as Discounting.

Is present value given in compounding?

In compounding, present value amount is already specified. On the other hand, the future value is given in the case of discounting.

How are discounting and compounding similar?

The concept of compounding and discounting are similar. Discounting brings a future sum of money to the present time using discount rate and compounding brings a present sum of money to future time.

What is discounted value?

In economic evaluations, “ discounted ” is equivalent to “ present value ” or “ present worth ” of money. As you know, the value of money is dependent on time; you prefer to have 100 dollars now rather than five years from now, because with 100 dollars you can buy more things now than five years from now, and the value of 100 dollars in the future is equivalent to a lower present value. That's why when you take loan from the bank, the summation of all your installments will be higher than the loan that you take. In an investment project, flow of money can occur in different time intervals. In order to evaluate the project, time value of money should be taken into consideration, and values should have the same base. Otherwise, different alternatives can’t be compared.

What does 10% discount mean?

So, if the discount rate is i =10% per year, it means the value of money that you have now is 10% higher next year. So, if you have P dollars money now, next year you will have P + i P = P ( 1 + i) and if you have F dollars money next year, your money is equivalent to F / ( 1 + i) dollars at present time.

Why is compound interest important?

Compound interest helps exponentially increase the wealth of the investor in the long run. The power of compound interest is one of the best dreams any investor wants to achieve. This is the amount of interest that an investor gets from savings but also on the interest received from their investment.

How to maximize compound interest?

How to Maximize the Power of Compound Interest 1 If you understand the power of the compound interest, it can help you advance your finances. When you know that you can make money from your money, then it should act as an incentive to invest and save as much as you can and to not touch it for as long as you can. 2 You need to get started early to maximize this benefit. The power of compound interest is one of the main reasons why most financial planning professionals and retirement experts recommend starting a retirement plan soon. 3 Another consideration to check is how often the interest is compounded. Investments whose interest compounds monthly grows faster than the investment with interest that compounds annually. Try to compound your returns as often as possible by continually reinvesting over time.

What is dividend reinvestment?

Dividend reinvestment. Dividend reinvestment is yet another investment with compounding interest. The compounding in dividends comes from the fact that dividends provide a regular flow of additional income that is reinvested in more shares of stock.

What delights an investor more than the magic of compound interest on their savings and investments?

Nothing delights an investor more than the magic of compound interest on their savings and investments.

How much compound interest do you have in the second year?

Compound interest benefits will begin to manifest in in the second year as well as all the subsequent years for as long as your investment remains intact. At the end of the second year, you’ll have $120 with simple interest but $121 with compound interest.

What is compound interest?

Compound interest means the multiplication of your investment, and it offers you the time value of money. A majority of people look at the interest in terms of interest accumulating when you have a loan. Well, interest can also be the money that you earn on your savings and investments.

What does the investor get interest in?

The investor gets an interest in the principal sum in addition to the previously accumulated interest in the subsequent period.

What does discounting mean in business?

When it comes to business ventures and investments, assets are considered to not carry value unless they come with cash flow generation potential. It means that they can produce cash flows that allow the business owner or investor a return. Examples of such cash flows can be interest received from a bond ...

What is discounting in finance?

What is Discounting? In relation to the time value of money, which argues that a dollar today is worth more than a dollar tomorrow, discounting can be defined as the act of estimating the present value of a future payment or a series of cash flows that are to be received in the future. Discounting is a key element in valuing future cash flows.

What is discount rate?

A discount rate (also referred to as the discount yield) is the rate used to discount future cash flows back to their present value. When discounting the cash flows of investments or business ventures, it is vital to note that the discount rates used will vary depending on various elements.

Why are mature companies discounted?

Start-ups tend to be discounted at relatively higher rates to account for the risk associated with the investment and uncertainties on the guarantee of the future cash flows.

How much is a start up's cash flow discounted?

The projected cash flows for start-ups that are seeking money can be discounted at any rate between 40% to 100%, early-stage start-ups can be discounted at any rate between 40% to 60%, late start-ups can be discounted at 30% to 50%, and mature company cash flows can be discounted at 10% to 25%.

What is the most powerful impact of compounding?

The effect of compounding can be seen across asset classes. In fact, the most powerful impact of compounding is seen in stocks or equity mutual funds. One of the best examples of wealth creation through the power of compounding over long investment period is the returns since inception of Reliance Growth Fund.

Does compounding work for you?

All of us work for money but compounding makes money work for you. This is how investors create wealth. Though we explained the concept of compounding using interest rates, compounding does not only takes place in fixed income or debt investments. The effect of compounding can be seen across asset classes.

How does discounting work?

For example, the coupon payments found in a regular bond are discounted by a certain interest rate and added together with the discounted par value to determine the bond's current value. From a business perspective, an asset has no value unless it can produce cash flows in the future. Stocks pay dividends.

What Is Discounting?

Discounting is the process of determining the present value of a payment or a stream of payments that is to be received in the future. Given the time value of money, a dollar is worth more today than it would be worth tomorrow. Discounting is the primary factor used in pricing a stream of tomorrow's cash flows.

What does it mean to discount a stream of cash flows?

Discounting and Risk. In general, a higher the discount means that there is a greater the level of risk associated with an investment and its future cash flows . Discounting is the primary factor used in pricing a stream of tomorrow's cash flows.

What is discounting in finance?

Discounting is the process of determining the present value of a future payment or stream of payments. A dollar is always worth more today than it would be worth tomorrow, according to the concept of the time value of money. A higher discount indicates a greater the level of risk associated with an investment and its future cash flows.

What does 10% off mean in finance?

When a car is on sale for 10% off, it represents a discount to the price of the car. The same concept of discounting is used to value and price financial assets. For example, the discounted, or present value, is the value of the bond today. The future value is the value of the bond at some time in the future. The difference in value between the future and the present is created by discounting the future back to the present using a discount factor, which is a function of time and interest rates.

Do junk bonds have a discount?

Indeed, junk bonds are sold at a deep discount. Likewise, a higher the level of risk associated with a particular stock, represented as beta in the capital asset pricing model, means a higher discount, which lowers the present value of the stock.