5 Benefits of Offering Employee Health Insurance

- It’s a simple process. Getting company healthcare insurance is definitely easier than you think. ...

- Employee health insurance attracts talent. Naturally, you want to attract the best talent to your company. ...

- It keeps employees happy and productive. ...

- You can retain employees. ...

- You can save a lot of money. ...

- It can reduce absenteeism. A healthy employee is present and more productive. ...

- It can be a recruiting tool. ...

- It can increase retention. ...

- It can boost employee satisfaction. ...

- It's convenient. ...

- It can save money.

Why your business should offer health insurance to employees?

Some of the advantages of offering health benefits to employees are:

- It helps you draw in and keep the most talented employees in your firm. ...

- As a small business, you are entitled to certain tax advantages even if you offer your employees a component that increases their remuneration. ...

- Self-employed people can deduct 100 percent of their health insurance premium costs as a business expense. ...

What health insurance do they offer employees?

- Carrier: Identifying the best insurance carrier for your business is a key component in managing cost. ...

- Deductible: Plans with high deductibles typically feature lower premium amounts, and vice versa. ...

- Co-pay: Offering a plan with a higher co-pay amount may help to reduce plan premiums. ...

Can you afford to provide health insurance to employees?

Under the Affordable Care Act's employer mandate, large employers (those with 50 or more full-time equivalent employees) must offer health insurance to their full-time (30+ hours per week) employees or face a financial penalty.

Do employers have to offer health insurance to all employees?

The ACA’s employer shared responsibility provision, also known as the employer mandate, requires large employers to offer affordable, comprehensive health coverage to their full-time employees. If an employer doesn’t comply and then has full-time employees who obtain subsidized coverage in the marketplace/exchange, the employer can be subject to financial penalties.

Why is it important to offer health insurance to employees?

Insurance plans offer preventative care that can keep employees healthy and working. If employees don't get preventative care and yearly physicals (which they might not do if they don't have insurance), you could end up having more employees out for long periods of time with serious illnesses.

What benefits are offered to employees?

10 Most Commonly Offered Employee BenefitsHealth Insurance Benefits. This one is a no-brainer. ... Life Insurance. ... Dental Insurance. ... Retirement Accounts. ... Flexible Spending Accounts (FSAs) or Health Savings Accounts (HSAs) ... Paid Vacation and Sick Time. ... Paid Holidays. ... Paid Medical Leave.More items...•

What health benefits do employees want?

In order, these are the benefits that are most important to the employees who took our survey:Health insurance.Paid time off.Retirement benefits.Vision insurance.Dental insurance.Parental leave.Life insurance.HSA and FSA accounts.

Why offering benefits is important?

Offering benefits to your employees is important because it shows them you are invested in not only their overall health, but their future. A solid employee benefits package can help to attract and retain talent. Benefits can help you differentiate your business from competitors.

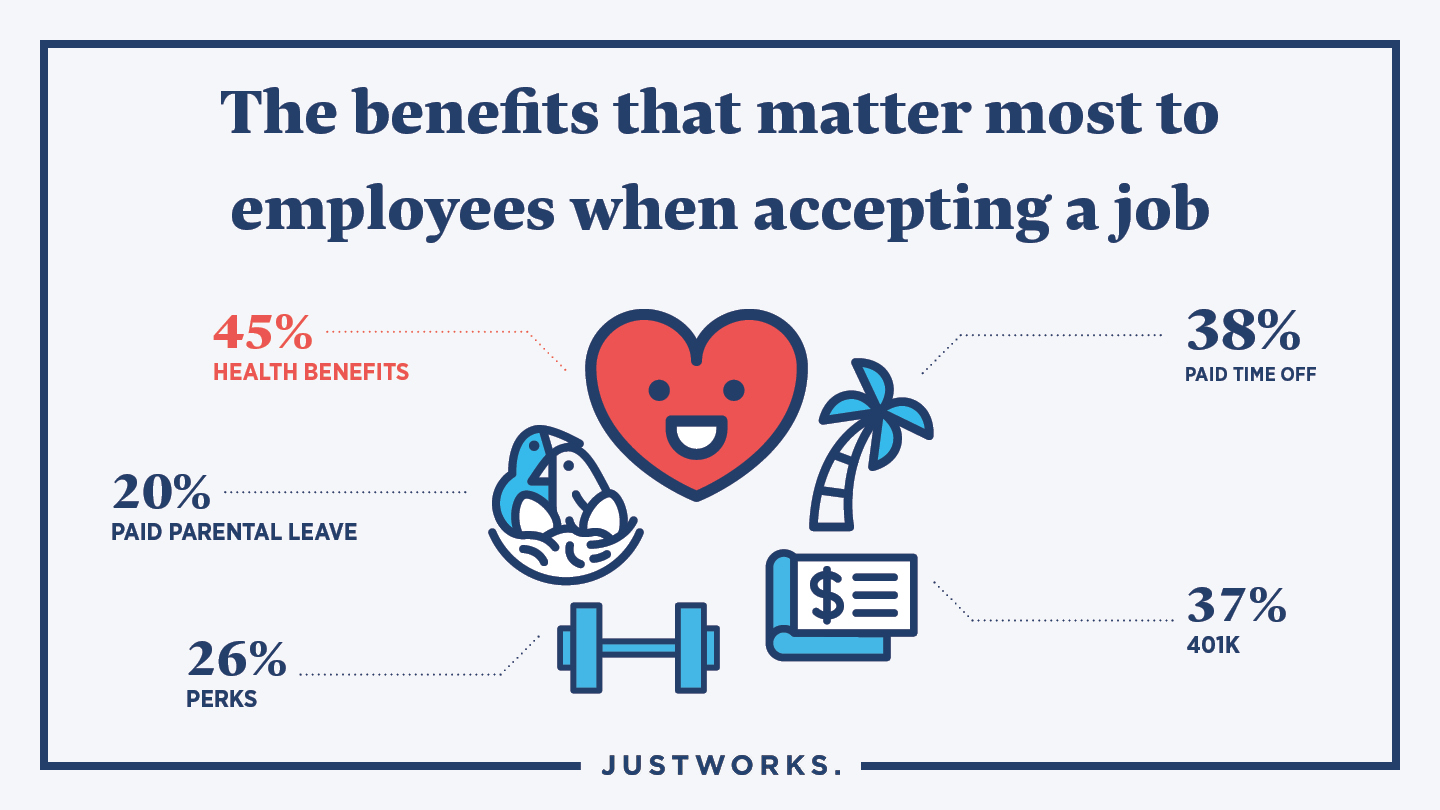

What benefits are most important to employees?

Health insurance, flexible hours, and vacation time. In today's hiring market, a generous benefits package is essential for attracting and retaining top talent.

What are the 4 types of benefits?

What are the four major types of employee benefits? These include medical, life, disability, and retirement. Here is a closer look at these employee benefits and why they are often offered by business owners.

What are employee benefits UK?

Mandatory employee benefits in the UK include retirement, holiday pay, maternity/paternity pay (companies often exceed the statutory limit as part of a comprehensive benefits offer), and sick pay.

What are the best benefits a company can offer?

Let's start with the four best company benefits that will help your employees feel appreciated and help them feel more focused at work.Health insurance. ... Life insurance. ... Paid time off—that actually gets taken. ... Family leave. ... 401(k) and retirement planning. ... Student loan assistance. ... Career development. ... Lunch stipend or team lunch.More items...•

What are employee benefits in South Africa?

Statutory and common employee benefits in South AfricaOvertime pay in South Africa. ... Paid time off in South Africa. ... Family responsibility leave in South Africa. ... Sick leave in South Africa. ... Maternity leave in South Africa. ... Paternity leave and parental leave in South Africa. ... Health insurance in South Africa.More items...

1. I own a small business with fifty employees. Should I opt for such a plan?

Employee Health Insurance is a good way to ensure financial assistance for employees in case of hospitalisation. You can opt for such a plan for a...

2. Can a company receive tax benefits for offering such a policy?

A company can receive tax benefits for offering Employee Health Insurance as per The Income Tax Act.

3. I have come across some companies that do not offer health insurance. What is the reason for it?

Prominent reasons for companies not choosing a group cover can be the cost factor, lack of awareness, and lack of customisation of the plan. Howeve...

4. What happens if I leave the company? Will the Group Health Insurance policy remain active?

When you leave the company, you will not be a part of the ‘group’ that is covered by the plan. Thus, your coverage will expire.

5. I run a business venture. Can I buy Group Health Insurance for Employees from ACKO?

Yes, you can buy a Group Health Insurance Plan from ACKO by visiting GMC.

What percentage of employees said employers making improvements to their benefits would be something positive they could do to keep them in their jobs

Additionally, 42% of employees said employers making improvements to their benefits would be something positive they could do to keep them in their jobs. Employers that offer strong benefits programs paired with competitive salaries will find it easier to recruit and retain employees.

What is the role of employees in an organization?

These are the individuals who make the best addition to any team. They play an instrumental role in keeping the workplace culture alive and thriving through regular interactions with coworkers and leadership.

Is there a one size fits all approach to health insurance?

Gone are the days of the one-size-fits-all approach to health insurance and employee benefits. Today’s employees want to keep their doctors and access to hospitals and other wellness services within their communities. Plus, they often have different overall health and financial requirements as compared to their colleagues in different life phases.

What is employee health insurance?

An Employee Health Insurance Policy is a huge benefit, especially for those who cannot afford individual health insurance. The employees do not have to pay the premium for this plan. It is paid by the employer on behalf of the employee. This way, the employees receive health insurance coverage free of cost.

Why is tech-enabled health insurance important?

With such a policy, the employees can feel that the company cares for their wellbeing and does not treat them as just a resource. It can be one of the driving factors in creating a people-first company culture that is beneficial for both the employer and the employee.

What is a new age health insurance plan?

New-age health insurers are focusing on preventive health care initiatives. They are not restricted to conducting health check-ups. Such initiatives also include a fitness tracking app, rewarding healthy habits, discounts on gym memberships, etc. Some of these are also a part of the Employee Health Insurance Plans.

What is a waiting period for health insurance?

This is the duration for which the policyholders must wait before raising a claim and manage the expenses on their own without the insurer’s help. However, such Waiting Periods are relaxed for Employee Health Insurance. A prominent example of it is the Maternity Cover in such policies. Usually, individual plans for such a cover have a Waiting Period of more than a year but that’s not the case in Employee Health Insurance.

Why don't companies offer group medical coverage?

Prominent reasons for companies not choosing a group cover can be the cost factor, lack of awareness, and lack of customisation of the plan . However, new-age insurance companies offer enhanced benefits to overcome the challenges. You can have a look at these benefits by visiting ACKO’s Group Medical Coverage (GMC) Page.

How can a company be eligible for tax benefits?

Companies can be eligible for tax benefits by paying the premium for Employee Health Insurance. The benefit will depend upon the total premium paid and the provisions of The Income Tax Act.

Do people oriented companies offer health insurance?

Nowadays, it is the norm for people-oriented companies to offer Employee Health Insurance. While the availability of such a benefit might not be the sole reason for an employee to join or stay with the company for a long time, it can certainly be a contributing factor. Thus, offering an Employee Health Insurance policy can also be another tick in ...

Is it easier to get health insurance?

Getting company healthcare insurance is definitely easier than you think . It’s often as simple as hiring a health insurance advisor or broker to navigate the process for you. Alternatively, you can use a site such as PolicyScout to compare coverage across multiple providers.

Does health insurance make you happier?

It’s no secret that happy employees make for better workers. There’s no denying that health insurance makes employees feel more committed to their company. This, in turn, boosts productivity as workers feel happier and more loyal.

Why is health insurance important for employees?

Some of the advantages of offering health benefits to employees are: It helps you draw in and keep the most talented employees in your firm. However, the effectiveness of offering health insurance will depend on whether or not your direct competitors or similarly-sized employers in your industry are offering it as well.

Why do employers provide health insurance?

One of the main reasons employers willingly provide health care benefits is to take advantage of economical health insurance plans, which in turn, provide them with tax breaks.

What are the disadvantages of health insurance?

Some of the disadvantages of offering health benefits from the small-business point of view include: 1 Health care costs have witnessed a sharp increase in price over the last few years. Small employers may find this to be a costly affair, making financial planning extremely difficult. 2 Sometimes, small businesses share the cost of health insurance with employees as a means to keep their expenses under control. This means passing on additional costs to the employees, which may turn out to be an unpopular decision that causes more complications. 3 You could end up spending a considerable amount of time finding the right insurance options, filling out forms, remitting premiums, and acting as an intermediary between your employees and the insurer, as well as dealing with other tasks.

What is Obamacare insurance?

Most companies that offer health insurance to their employees purchase group packages directly from insurance providers or pick from the options offered by new health care marketplaces created by the Affordable Care Act , also known as Obamacare.

How to find out what health benefits matter to you?

The best way to find out which aspects of health benefits matter most to your employees is by asking them. When deciding which benefits to offer your employees, consider asking them about their priorities. This is a great way to ensure that you don’t end up wasting money on benefits that are meaningless to them.

What is the most important health benefit for a business?

One of the most important (and costly) health benefits a business can offer its employees is health insurance. While this isn’t mandatory for businesses employing fewer than 50 full-time employees, it can play a role in hiring and retaining high-quality talent. Most companies that offer health insurance to their employees purchase group packages ...

What are the disadvantages of offering health benefits?

Some of the disadvantages of offering health benefits from the small-business point of view include: Health care costs have witnessed a sharp increase in price over the last few years. Small employers may find this to be a costly affair, making financial planning extremely difficult.

Do I have to offer health insurance to employees?

Whether you have to offer health insurance to your workers depends on the size of your business.

Do I have to offer health insurance to all employees?

If you offer an employer-sponsored group health plan, generally, all of your full-time employees must be given the opportunity to enroll. That’s because, under the ACA, if you offer health insurance to full-time employees, you must offer it to all similarly situated full-time workers.

Can I start a plan at any time during the year?

If you decide to begin offering health insurance to your employees, you can implement a plan at any time of year. Since health Insurance plans renew annually, many employers like to align their plans with the calendar or fiscal year, but it’s not required.

If I offer health insurance, how long does it take to implement a plan?

While every implementation is different, on average it can take 60 to 90 days to get everything set up from census collection through ID cards so you’ll want to start well in advance of your plan’s desired start date.

How to Best Implement Health Insurance at Your Company

There are a number of steps involved in starting a health plan for your company. And getting them right is essential to the success of your new benefit offering.

What is the minimum level of health insurance for full time employees?

According to the IRS, employers with more than 50 full-time employees must "offer affordable health coverage that provides a minimum level of coverage to their full-time employees and their dependents.". Minimal level of coverage is generally defined as 60% of health care costs for the standard population. You can also use the Employer Coverage ...

How many employees do you need to have health insurance in 2021?

by Justin Song updated Mar 4, 2021. If your business has over 50 employees, you are legally required to provide health insurance to employees due to the Affordable Care Act (ACA). If you have fewer than 50 employees, you'll need to make the decision whether to offer your employees health care benefits. We examined every major decision point ...

What is an EPO plan?

Exclusive Provider Organization (EPO): EPO plans only pay for services from a select list of providers. Point of Service (POS): POS plans are similar to HMOs in that you are required to get a referral for certain services, but a POS will still pay for certain out-of-network services.

What is premium insurance?

Premium: The monthly amount to be paid to the health insurance provider that is often split between the employer and employee. This doesn't include copays or deductibles. Deductible: The minimum amount of money the insured individual must spend before the health insurance coverage activates.

What is group health insurance?

Group health insurance is a single plan that provides coverage for (usually) all employees. Plans are typically paid for on a monthly basis, and those monthly premiums are dependent upon your location, the number of employees covered and the ages ...

How many tiers of health insurance can an employer select?

Employers have the opportunity to select from three tiers of health insurance based on price and coverage. Once a tier is selected, employees can then go into SHOP on their own and can select their own individual plan based on the tier the employer selected.

Which type of insurance plan is the most lenient?

Preferred Provider Organization (PPO): PPOs are often seen as the most lenient type of plan, since referrals aren't mandatory and the plan will at least partially pay for out-of-network services, but they also tend to carry the most expensive premiums. Also the most common group insurance plan.

Benefits for you and your employees

Offering health insurance to your employees can be a plus for you and your employees. When employers provide health insurance, employees don’t have to stress about how a medical emergency could impact them financially. Just one emergency can send a family into a financial downward spiral that can be incredibly difficult to recover from.

Decent helps small businesses and their employees

We understand the pressures that small businesses — and their employees — face. We know that even one unplanned medical issue can lead to significant financial strain for people who aren’t covered by health insurance.