From a careful analysis of these definitions, we can enlist the characteristic features of audit evidence as follows:

- 1. Evidence should be the reflection of the realities of the situation and should not be fictitious based on imagination.

- 2. Evidence should be capable of creating a definite impact on the opinion of the auditor regarding the truthfulness of the financial data.

- 3. Evidence may be direct or indirect

What is the relevance of audit evidence?

The relevance of audit evidence refers to its relationship to the assertion or to the objective of the control being tested. The relevance of audit evidence depends on:

What are the characteristics of reliable audit information?

These are both characteristics of reliable audit information. It is considered sufficient when the auditors determine the quantity of the audit evidence enough on which they base their opinion. Therefore, sufficiency relates to the quantity of the audit evidence, rather than its quality.

What is the amount and type of auditing evidence?

The amount and type of auditing evidence considered vary considerably based on the type of firm being audited as well as the required scope of the audit. Auditing evidence is the information collected by an auditor to ascertain the accuracy and compliance of a company's financial statements.

What are the 4 characteristics of evidence?

It is, in short, relevant, verifiable, representative, and actionable. It is important to note that evidence per se does not lead to confirmations of value and quality.

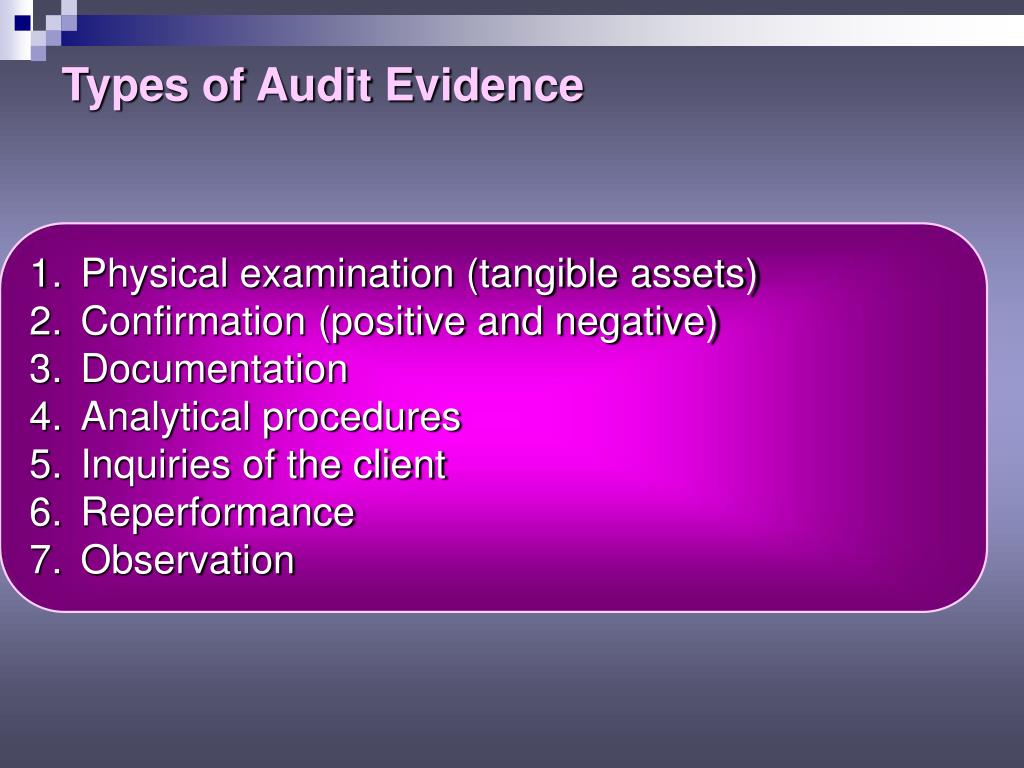

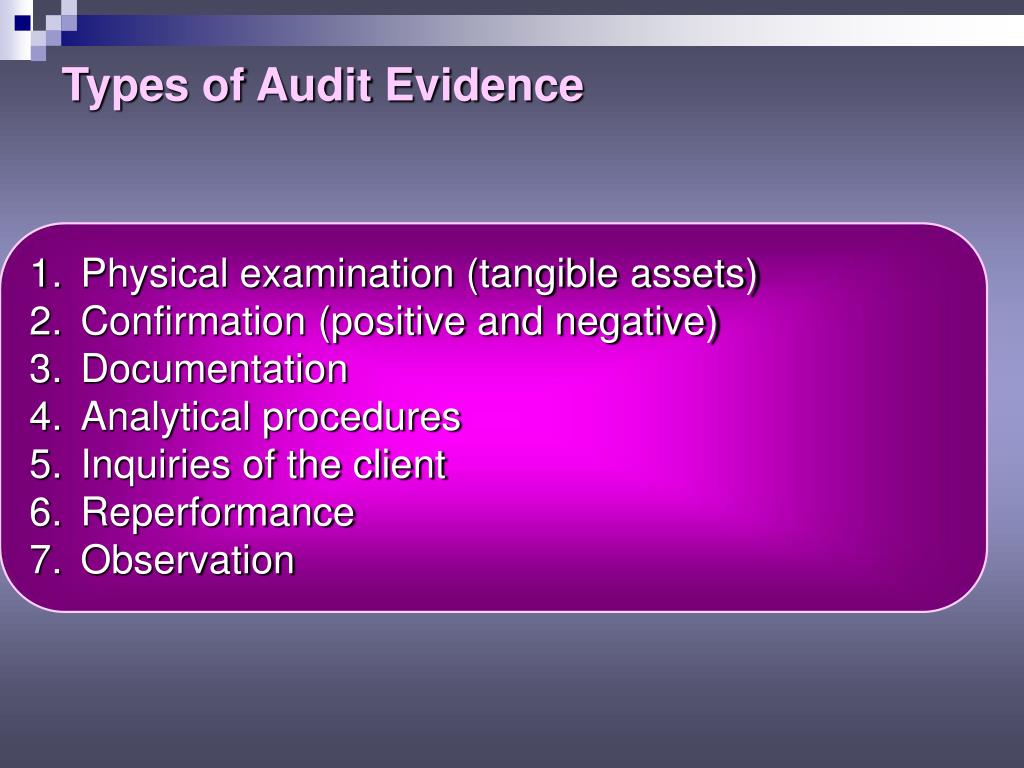

What are the 8 types of audit evidence?

What Are the Types of Audit Evidence?Physical examination. ... Confirmations. ... Documentary evidence. ... Analytical procedures. ... Oral evidence. ... Accounting system. ... Reperformance. ... Observatory evidence.

What are the two characteristics of audit evidence according to ISA 500?

ISA 500 require auditor for using information produced by the entity; Obtaining audit evidence about the accuracy and completeness of the information; and. Evaluating whether the information is sufficiently precise and detailed for the auditor's purposes.

What are the characteristics of an auditor give 3 main characteristics?

The 5 Characteristics of an AuditorHave the Required Experience. Certifications are key academic qualifications for an auditor. ... Ability to Make Independent Decisions. ... Auditors Have the Ability to Understand Different Business Needs. ... Dependable. ... Effective Communication Skills.

What is audit evidence and its types?

The auditing evidence is meant to support the company's claims made in the financial statements and their adherence to the accounting laws of their legal jurisdiction. Examples of auditing evidence include bank accounts, management accounts, payrolls, bank statements, invoices, and receipts.

What is the importance of audit evidence?

Auditing evidence provides your auditors with the information that will assist them in their determination of whether the entity's financial statements are accurate and true. Auditing evidence also corroborates the information provided by management through the financial statements.

Which of the following is not a characteristic of audit evidence?

Answer:D. be persuasive enough to enable the auditor to issue an audit report . the auditor lacks the competence to evaluate the evidence . quality of evidence .

What are the three 3 methods of collecting audit evidence?

Gathering audit evidence as part of an audit involves a mix of techniques that are used interchangeably: visual observation, examination of records, and employee interviews.

What are the 7 audit assertions?

There are numerous audit assertion categories that auditors use to support and verify the information found in a company's financial statements.Existence. ... Occurrence. ... Accuracy. ... Completeness. ... Valuation. ... Rights and obligations. ... Classification. ... Cut-off.

What do you mean by auditing explain its characteristics?

Auditing is a systematic process. It is a logical and scientific procedure to examine the accounts of an organization for their accuracy. There are rules and procedures to follow. The audit is always done by an independent authority or a body of persons with the necessary qualifications.

What are the characteristics of audit plan?

Audit Plan The planned nature, timing, and extent of the risk assessment procedures; The planned nature, timing, and extent of tests of controls and substantive procedures;12 and. Other planned audit procedures required to be performed so that the engagement complies with PCAOB standards.

What are the important characteristics of an internal auditors?

Six Characteristics Leading Internal Auditors Possess1) Great Communication Skills. ... 2) Unyielding Curiosity. ... 3) Technological Savvy. ... 4) Ability to Work Independently and on a Team. ... 5) Drive to Be Life-long Learners. ... 6) Integrity and Courage.

What are the 8 audit procedures?

8 Types of Audit ProceduresAnalytical procedures. Performing analytical procedures is one the most basic yet among the most powerful tools that auditors have at their disposal. ... Confirmations. ... Inquiry. ... Inspecting records or documents. ... Inspecting assets. ... Observation. ... Recalculation. ... Reperformance.

What are the 7 audit procedures?

What are Audit Procedures?Cutoff Testing. Audit procedures are used to determine whether transactions have been recorded within the correct reporting period. ... Occurrence Testing. ... Existence Testing. ... Rights and Obligations Testing. ... Valuation Testing.

What are the 7 steps in the audit process?

Audit ProcessStep 1: Planning. The auditor will review prior audits in your area and professional literature. ... Step 2: Notification. ... Step 3: Opening Meeting. ... Step 4: Fieldwork. ... Step 5: Report Drafting. ... Step 6: Management Response. ... Step 7: Closing Meeting. ... Step 8: Final Audit Report Distribution.More items...

What are the 10 audit procedures?

10 Steps of the Audit ProcessNotification. Audits begin with the issuance of some kind of notification to the company or organization being audited. ... Planning Process. ... Initial Meeting. ... Fieldwork. ... Communication. ... Draft Audit. ... Management Response. ... Exit Meeting.More items...•

1. Why does the Auditor need evidence according to the type of audit evidence being conducted?

There has to be enough evidence to be trustworthy in anyone's opinion. Without any evidence, you cannot prove you are right. In law, without any pr...

2. When is Audit evidence considered the most sufficient?

The Audit evidence is usually considered sufficient when the audit has enough data on the components like- the materiality of the item and the reli...

3. What are some of the financial documents required as the Audit Evidence?

Following are some of the financial documents required as the audit evidence:Invoices and ReceiptsFixed assets registrationsManagement accountsPayr...

4. Mention the types of Audit Evidence.

Financial documents, Confirmation, an inspection of the document, Recalculation, and client inquiry are the types of audit evidence.

What are the characteristics of audit evidence?

The characteristics of audit evidence are a set of international rules called the International Standard of Auditing (ISA) 500. These were made effective from December 15, 2009.

What is audit evidence?

Audit evidence is the data or the information collected by auditors to review a company's financial reports and transactions. The reports may need to be verified to prove the authenticity, which can be conducted by the Auditor or the Certified Public Accountant (CPA). Hence, the evidence is required to ensure the authenticity of these reports.

What are the two most important aspects of making sure the audit evidence is efficient?

The two most important aspects of making sure the audit evidence is efficient are the reliability and the relevance of the financial documents. The firm should provide documents that are not manipulated in favour of the firm's interest.

What is considered sufficient evidence for audit?

Ans: The Audit evidence is usually considered sufficient when the audit has enough data on the components like- the materiality of the item and the reliability of the financial documents obtained by the Auditor from the firm. The two most important aspects of making sure the audit evidence is efficient are the reliability and the relevance of the financial documents. The firm should provide documents that are not manipulated in favour of the firm's interest. If it is found that documents are forged or changes have been made, serious actions could be taken against the company for misleading auditors. Therefore, the firm has to offer authentic documents.

What is auditing a company?

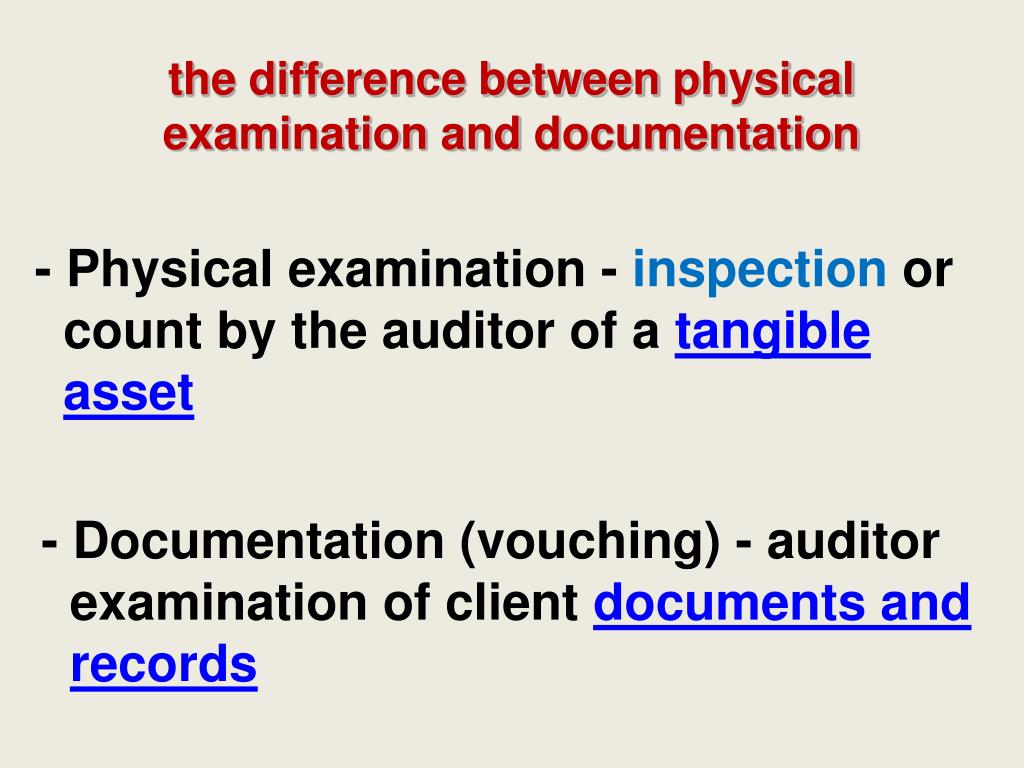

This means vouching of the claim made by the financial statements of the company to the original documents. The Auditor conducts this through verifying the claim against any asset by comparing its sale invoice.

Which is more reliable, audit evidence or documentary evidence?

If the related controls that are imposed by the corporation or the firm are thoroughly effective, the Audit evidence is the most reliable.

Why is external source information always preferred over internal information?

External source information will always be preferred over any internal information because it is generally considered void of any bias.

What is good audit evidence?

Good auditing evidence should be sufficient, reliable, provided from an appropriate source, and relevant to the audit at hand.

What Is Auditing Evidence?

Auditing evidence is the information collected for review of a company's financial transactions, internal control practices, and other items necessary for the certification of financial statements by an auditor or certified public accountant (CPA). The amount and type of auditing evidence considered vary considerably based on the type of firm being audited as well as the required scope of the audit.

What is the purpose of auditing financial statements?

The goal of any audit is to determine whether a company's financial statements comply with generally accepted accounting principles (GAAP), international financial reporting standards (IFRS), or another set of accounting standards applicable to an entity's jurisdiction. Publicly traded companies are generally required to present fully audited financial statements to shareholders periodically, and thus the compilation and organization of auditing evidence are essential for auditors and accountants to do their work. In short, auditing evidence is meant to provide auditors with the information for them to make the judgment on whether or not financial statements are accurate and true.

What is the purpose of the Public Company Accounting Oversight Board?

The Public Company Accounting Oversight Board (PCAOB), created by the Sarbanes-Oxley Act of 2002, defines auditing evidence as all the information that can be used by auditors to make their decision on the quality and accuracy of a company's financial statements.

What does sufficiency mean in accounting?

Sufficiency: Sufficiency takes into account whether or not the material provided is of an adequate quantity that would allow auditors to make an accurate judgment. If an auditor was given just one bank statement of a company, it would not be enough to make any determinations on the financial standing of that company.

What do auditors prefer?

In general, auditors prefer information that is written as opposed to provided orally; information that is from a third-party source as opposed from inside the company; original documents as opposed to copies of those documents; a strong understanding of the firm by the auditor to request appropriate auditing evidence; firsthand observations by the auditor as opposed to documentation provided via another source.

What is the purpose of reliability?

Reliability: Reliability seeks to determine whether or not the material can be trusted and counted on for forming an opinion. Reliability typically factors from the source of the information.

What is objective evidence?

Objective evidence is data that supports the verification of something being represented and includes records or statements of fact that are relevant and can be confirmed. There are four main components to gathering objective evidence. First, confirming or corroborating evidence is documentation that verifies represented facts or figures and is sourced outside of the entity being audited. Second, observation is the physical act of watching a process being performed by the company. Next, documentation is evidence that is written information that can used to confirm decisions that were made. Lastly, measurement is done by quantitative analysis, typically on the fair market value assets, liabilities, and equity. Fair market value is the amount two willing parties agree on a price of an asset or liability in a transaction.

What is confirmation evidence?

Confirmed or corroborated: This type of evidence is documentation that verifies represented facts or figures and is sourced outside of the entity being audited. An example of this type of evidence would be a bank statement produced by the bank that confirms the amount of cash on deposit compared the amount listed on the company's balance sheet.

What is evidence gathering?

Observation: This method of evidence gathering is the physical act of watching a process being performed by the company. An example of observing is the auditor watching the process the company performs while counting inventory. It is important to verify the process in action verses their stated process in the company's internal policies. This ensures accuracy in the inventory numbers being represented on financial statements as well as a measure of their internal controls.

What is audit evidence?

Audit evidence refers to all records, statement of facts as well as other information which are collected by the auditors of the company as part of their audit work assignment and proper discharge of their responsibilities. Audit evidence is necessary for the auditor to draw a reasonable opinion on the financial statements of the company and accordingly based on his opinion. further audit evidence enables auditors to draw an independent opinion with an objective state of mind using a sample of information which are verifiable.

What is a good type of audit evidence?

Physical Examination: A physical visit by the audit team itself can be another good type of audit evidence as it provides a first-hand view and helps me make a better opinion.

What is the audit exercise of ABC Bank?

As part of its audit exercise, the auditors checked the balances of securities held by abc bank in its trading book with the actual securities held in depository format to reconcile that the securities reported in the books of account by the bank actually tally with the securities that the bank is having in its dematerialized account maintained with the broker.

Why is evidence important in auditing?

in this audit, evidence plays an important part by making the audit team take appropriate actions which may include reconfirmation or modification of audit plan, changes to audit objective, or even termination of the audit if conditions require so. However, it is pertinent to note here that audit evidence is based on samples of available information and therefore involves a lot of uncertainty and anybody acting based on audit conclusion should keep this in mind before taking any action.

Why is audit evidence important?

Audit evidence is necessary for the auditor to draw a reasonable opinion on the financial statements of the company and accordingly based on his opinion. further audit evidence enables auditors to draw an independent opinion with an objective state of mind using a sample of information which are verifiable.

What is the fourth step of audit?

The fourth step involves doing inspection based on the scope of audit work and involves a substantial time of the audit team as under this step only the actual sample output is checked based on which opinions are mostly formed.

What is the purpose of observing the activities of an auditor?

Observation: By observing the actual activities auditor can substantiate the other audit evidence and make a meaningful observation.

What is the appropriateness of audit evidence?

The appropriateness of audit evidence represents the relevance and reliability of audit evidence in providing support for the conclusions on which auditors base their opinion .

Why is Audit Evidence Important?

Many reasons show the importance of audit evidence. First of all, audit evidence is the basis on which auditors base their opinion. In the absence of audit evidence, auditors cannot form an opinion. Similarly, when the audit evidence is not sufficient or appropriate, the quality of the opinion provided also suffers. Furthermore, in case of a dispute, audit evidence forms the basis for auditors to illustrate their point of view.

What do auditors do during a financial audit?

Usually, auditors need to perform specific procedures on all material items in the financial statements. Auditors carry out these procedures during the audit to ensure all the assertions related to a financial statement item are correct . By checking these assertions, auditors can form an opinion about each individual item of financial statements. Once auditors cover all the material aspects of the client’s financial statements, they can present an opinion and provide an audit report. However, to support their opinion, auditors must gather audit evidence.

How many types of audit evidence are there?

Types of Audit Evidence. While there are 8 types of audit evidence, some auditors only rely on 6 types of audit evidence. Which type of audit evidence auditors obtain for a specific item in the financial statements depends on the item itself, the assertion auditors are testing, the nature of the client, etc.

Why do independent auditors gather evidence?

The major reason an independent auditor gathers audit evidence is to support their conclusions related to financial statement items. For auditors’ work to be trustworthy, they must use proper procedures and techniques to evaluate the truthfulness and fairness of the financial statements.

What is the internal standard for auditing?

The Internal Standard on Auditing that deals with Audit Evidence are ISA 500 – Audit Evidence. The standard states that the auditor’s responsibility is “to design and perform audit procedures in such a way to enable the auditor to obtain sufficient appropriate audit evidence to be able to draw reasonable conclusions on which to base the auditor’s opinion.”

Why is documentation important in audit?

Documentation is also a crucial part of any audit. Documentation requires auditors to gather documents regarding different aspects of an audit, which may be internal or external. With documentation, the sources of audit evidence also matter.

What is audit evidence?

Audit evidence consists of both information that supports and corroborates management's assertions regarding the financial statements or internal control over financial reporting and information that contradicts such assertions.

What is the relevance of audit evidence?

.07 Relevance. The relevance of audit evidence refers to its relationship to the assertion or to the objective of the control being tested. The relevance of audit evidence depends on:

What is the objective of an auditor?

.03 The objective of the auditor is to plan and perform the audit to obtain appropriate audit evidence that is sufficient to support the opinion expressed in the auditor's report. 1

Why do auditors select specific items?

The auditor may decide to select specific items within a population because they are important to accomplishing the objective of the audit procedure or exhibit some other characteristic, e.g., items that are suspicious, unusual, or particularly risk-prone or items that have a history of error.

What should an auditor evaluate when a third party provides evidence to an auditor subject to restrictions, limitations, or disclaim?

Note: If a third party provides evidence to an auditor subject to restrictions, limitations, or disclaimers, the auditor should evaluate the effect of the restrictions, limitations, or disclaimers on the reliability of that evidence.

What is observation in audit?

.16 Observation consists of looking at a process or procedure being performed by others, e.g., the auditor's observation of inventory counting by the company's personnel or the performance of control activities. Observation can provide audit evidence about the performance of a process or procedure, but the evidence is limited to the point in time at which the observation takes place and also is limited by the fact that the act of being observed may affect how the process or procedure is performed. 8

What is an example of an inspection?

An example of inspection used as a test of controls is inspection of records for evidence ...