Disadvantages of fixed exchange rates

- Conflict with other macroeconomic objectives. To maintain a fixed level of the exchange rate may conflict with other...

- Less flexibility. In a fixed exchange rate, it is difficult to respond to temporary shocks. For example, if the price...

- Join at the wrong rate. It is difficult to know the right rate to join at. If the...

What are the benefits of fixed exchange rates?

What is a Fixed Exchange Rate?

- Advantages of a Fixed Exchange Rate. Setting a fixed exchange rate with your trading partner will provide currency rate certainty to importers and exporters.

- Disadvantages of a Fixed Exchange Rate. ...

- Capital Market Arbitrage. ...

- Learn More. ...

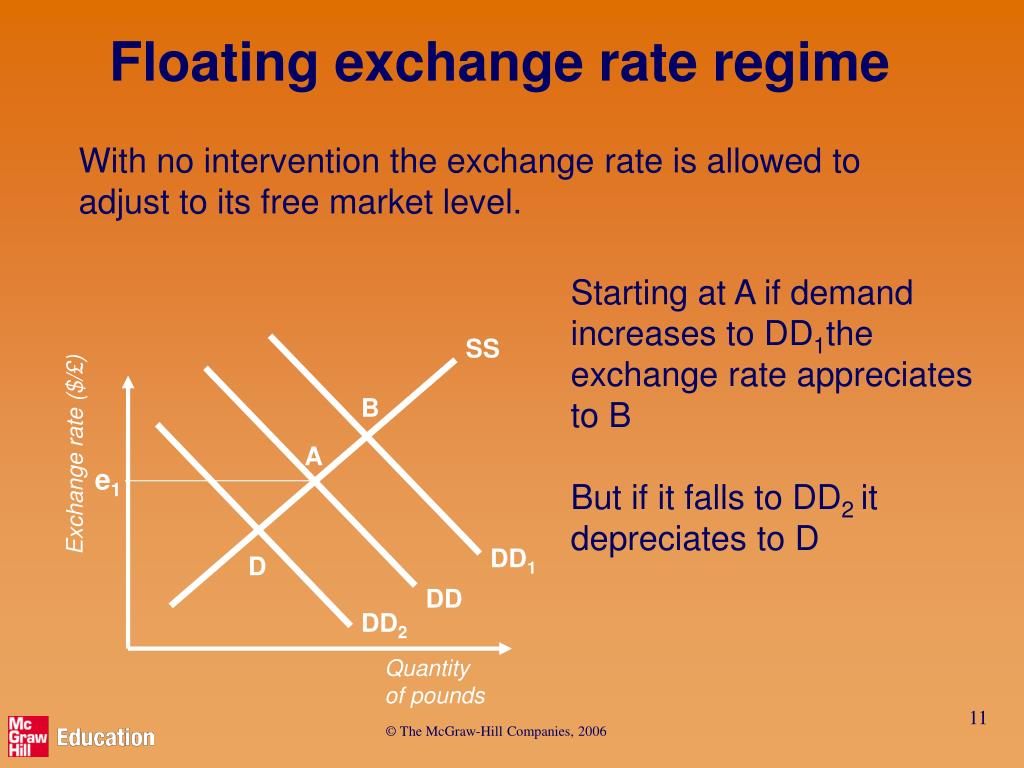

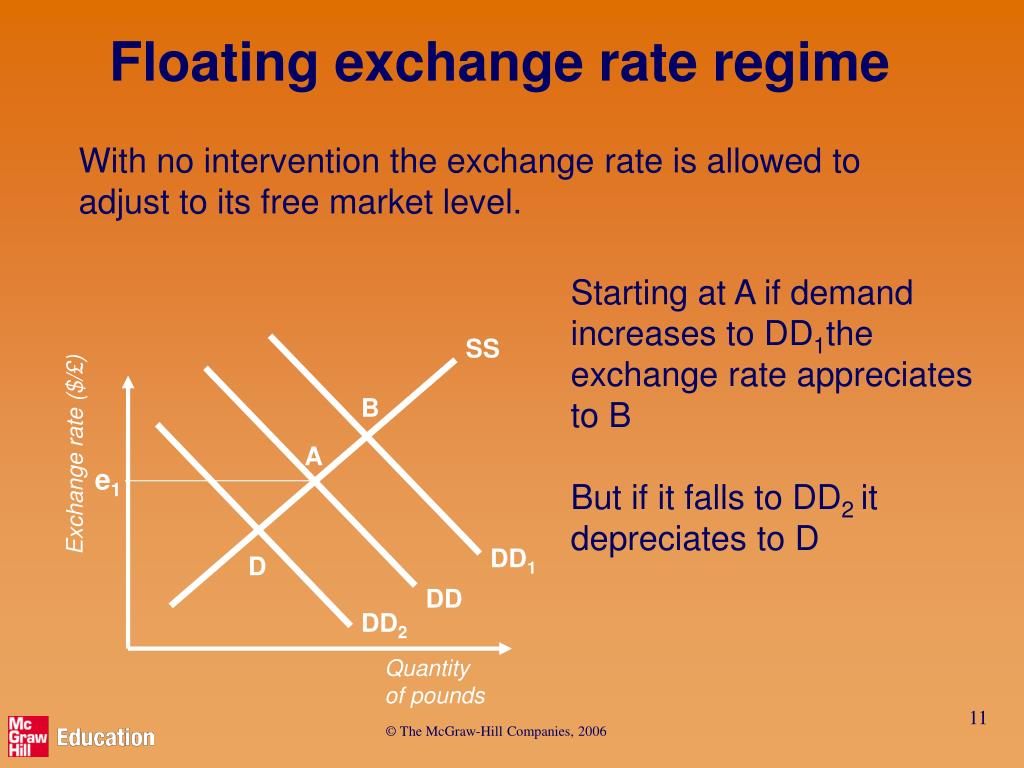

What are the disadvantages of freely floating exchange rates?

Floating exchange rates also have disadvantages: Higher volatility: Floating exchange rates are highly volatile. Additionally, macroeconomic fundamentals cant explain especially short-run volatility in floating exchange rates. Use of scarce resources to predict exchange rates: Higher volatility in exchange rates increases the exchange rate risk ...

What is an unfavorable exchange rate?

If foreign exchange is quoted in the money of the country where it is payable a falling rate for it signifies that the exchange situation is unfavorable to (against) the country where the exchange is issued and favorable to (in favor of) the country where it is payable.

Do exchange rate changes improve the trade balance?

The main finding is that exchange rate changes do have asymmetric effects on the bilateral trade balances. Bahmani-Oskooee and Fariditavana ( 2016) argued that, since traders’ reaction to currency depreciation might be different from their reaction to appreciation, the trade balance might respond in an asymmetric manner.

What are the disadvantages of fixed exchange rates?

Disadvantages of fixed exchange ratesConflict with other macroeconomic objectives. ... Less flexibility. ... Join at the wrong rate. ... Require higher interest rates. ... Current account imbalances. ... Difficulty in keeping the value of the currency – If a currency is falling below its band the government will have to intervene.More items...•

What is the biggest disadvantage of a fixed exchange rate?

Disadvantages. A fixed exchange rate can be expensive to maintain. A country must have enough foreign exchange reserves to manage its currency's value. A fixed exchange rate can make a country's currency a target for speculators.

Why is a fixed exchange rate bad?

Wrong Value. If you join an exchange rate at the wrong value, it can cause certain problems. If the value of the exchange rate is too high, then exports will become uncompetitive; this can lead to lower demand and lower growth.

What is the disadvantage of flexible exchange rate system?

(i) Uncertainty and Confusion: Flexible exchange rate and trade presents an atmosphere of uncertainty and confusion in trade and investment. Susceptibility to uncertainty is greater as soon as exchange rate fluctuates freely. Suppose an Indian has despatched an export 'invoice' to the foreign buyers.

What are the advantages and disadvantages of fixed exchange rates quizlet?

Fixed exchange rates reduce foreign exchange risk for companies with cross border trade. The major disadvantage of fixed exchange rate system is that it establishes a direct link between domestic and foreign inflation and employment.

Which of the following is a big disadvantage of fixed exchange rate Mcq?

A _______ involves an exchange of currencies between two parties, with a promise tore-exchange currencies at a specified exchange rate and future date....Q.The biggest disadvantage of a fixed exchange rate is theC.tradeoff between supporting the exchange rate and maintaining full employment.4 more rows

How does fixed exchange rate affect business?

Fixed exchange rates were then possible, because there was far less global trade and exchange of currencies. Businesses benefited from the fixed exchange rates because it eliminated foreign exchange risk.

Is a fixed exchange rate good?

Understanding a Fixed Exchange Rate Fixed rates provide greater certainty for exporters and importers. Fixed rates also help the government maintain low inflation, which, in the long run, keep interest rates down and stimulates trade and investment.

Which is better fixed or floating exchange rate?

Fixed exchange rates work well for growing economies that do not have a stable monetary policy. Fixed exchange rates help bring stability to a country's economy and attract foreign investment. Floating exchange rates work better for countries that already have a stable and effective monetary policy.

What is the difference between fixed and flexible exchange rate?

Fixed exchange rate system is referred to as the exchange system where the exchange rate is fixed by the government or any monetary authority....Difference between Fixed and Flexible Exchange Rate.Fixed RateFlexible Exchange RateFixed rate is determined by the central governmentFlexible rate is determined by demand and supply forcesImpact on Currency10 more rows•Aug 6, 2021

What are the advantages and disadvantages of high exchange rate?

A high value of a currency may be good to fight inflation, but may create unemployment problems, whereas a low value of a currency may be good for solving unemployment problems, but may create inflationary pressure.

Which is better fixed or floating exchange rate?

Fixed exchange rates work well for growing economies that do not have a stable monetary policy. Fixed exchange rates help bring stability to a country's economy and attract foreign investment. Floating exchange rates work better for countries that already have a stable and effective monetary policy.

What is a fixed exchange rate quizlet?

What is a fixed exchange rate? A Fixed exchange rate is an exchange rate system where a currency's value is matched (or pegged) to the value of another single currency, a basket of currencies or to another measurable value (Gold).

How does fixed exchange rate affect inflation?

If a country fixes its exchange rate, it effectively imports this policy from the reserve country. A country fixing its exchange rate can experience high inflation if this country also experiences high inflation.

What are the advantages and disadvantages of floating exchange rate?

Higher demand means higher value, while lower demand means lower value. Using a floating currency can be considered a fiscal benefit when the economy is strong and fiscal policy is sound. But, if market sentiment towards the government and its monetary policy is weakened, it could lead to a devaluation of its currency.

Why is fixed exchange rate important?

A fixed exchange rate provides currency stability. Investors always know what the currency is worth. That makes the country's businesses attractive to foreign direct investors. They don't have to protect themselves from wild swings in the currency's value. They are hedging their currency risk.

What happens to the currency of a country without a fixed exchange rate?

Without that fixed exchange rate, the smaller country's currency will slide. As a result, the imports from the large economy become more expensive. That imports inflation, as well as goods. For example, the U.S. dollar's value is 3.75 Saudi riyals.

What will happen if a country increases its money supply in a fixed exchange rate system?

If a country increases its money supply, it's unlikely that it will be able to maintain a fixed exchange rate. 2 It will have to adjust its exchange rate, or else speculators could target it in foreign exchange markets.

What is fixed exchange rate?

A fixed exchange rate is when a country ties the value of its currency to some other widely-used commodity or currency. The dollar is used for most transactions in international trade. Today, most fixed exchange rates are pegged to the U.S. dollar. Countries also fix their currencies to that of their most frequent trading partners.

How do countries maintain a fixed exchange rate?

There are several ways countries maintain a fixed exchange rate. The purest form is when its currency is pegged to a set value against a single currency. Alternatively, many countries fix a set value to a basket of currencies, instead of just one currency.

How can a country avoid inflation?

A country can avoid inflation if it fixes its currency to a popular one like the U.S. dollar or euro. It benefits from the strength of that country's economy. As the United States or European Union grows, its currency does as well. Without that fixed exchange rate, the smaller country's currency will slide.

Why do you know a dollar will buy you riyals?

For example, if you go to Saudi Arabia, you always know a dollar will buy you 3.75 Saudi riyals, since the dollar's exchange rate in riyals is fixed. Saudi Arabia did that because its primary export, oil, is priced in U.S. dollars.

Why is foreign exchange rate fixed?

Fixed foreign exchange rate ensures internal economic stabilization and checks unwarranted changes in the prices within the economy. In a system of flexible exchange rates, the liquidity preference is high because the businessmen will like to enjoy wind fall gains from the fluctuating exchange rates. This tends to Increase price and hoarding activities in country.

Why is fixed exchange rate important?

(i) It ensures orderly growth of world’s money and capital markets and regularises the international capital movements. (ii) It ensures smooth functioning of the international monetary system.

What are the difficulties of the IMF system?

It involves certain difficulties, such as deciding as to.

What are the main arguments for the system of fixed or stable exchange rates?

The main arguments advanced in favor of the system of fixed or stable exchange rates are as follows: 1. Promotes International Trade: Fixed or stable exchange rates ensure certainty about the foreign payments and inspire confidence among the importers and exporters. This helps to promote international trade.

What is fixed exchange rate?

Fixed exchange rates eliminate the speculative activities in the international transactions. There is no possibility of panic flight of capital from one country to another in the system of fixed exchange rates.

Which countries have fixed exchange rates?

Fixed exchange rates are even more essential for the smaller nations like the U.K., Denmark, Belgium, in whose economies foreign trade plays a dominant role. Fluctuating exchange rates will seriously affect the process of economic growth in these economies.

Does the fixed exchange rate reflect the true cost-price relationship between the currencies of the countries?

The fixed exchange rate system does not reflect the true cost-price relationship between the currencies of the countries. No two countries follow the same economic policies. Therefore the cost-price relationship between them go on changing. If the exchange rate is to reflect the changing cost-price relationship between the countries, it must be flexible.

What is the main issue with fixed exchange rates?

The main issue with fixed exchange rates is that it limits a central bank’s ability to adjust interest rates to affect a country’s growth rate.

Why set a fixed exchange rate?

Setting a fixed exchange rate with your trading partner will provide currency rate certainty to importers and exporters.

What factors affect the strength of a currency?

The strength of a currency depends on a number of factors such as its inflation rate, prevailing interest rates in its home country, or the stability of the government, to name a few. Currency Risk. Currency Risk Currency risk, or exchange rate risk, refers to the exposure faced by investors or companies that operate across different countries, ...

Why is a fixed exchange rate important?

A fixed exchange rate helps to ensure the smooth flow of money from one country to another. It helps smaller and less developed countries to attract foreign investment. It also helps the smaller countries to avoid devaluation. Devaluation Devaluation is a downward adjustment to the country’s value of money relative to a foreign currency or standard.

What happens to the currency in a floating exchange rate?

In a floating exchange rate, when the trade account deficit increases, the country needs to borrow more of the foreign currency. Hence, the price of the foreign currency goes up, which also pushes the price of foreign goods up in the domestic market. It reduces the demand for the foreign goods and brings down the trade deficit. However, this rebalancing is not possible in the case of a fixed exchange rate.

Why is the exchange rate floating?

A floating exchange rate helps the central bank to ensure the stability of the economy, as it is not bound by any rules to maintain the exchange rate. Also, with a floating rate, the money supply can be used to its best use.

When is it best to use a floating rate or a fixed rate?

Hence, when the movement of money between countries is smooth, it is best to either adopt a floating rate or set a rate domestically, but not both. Fixed exchange rates are best for countries with similar macro-economic factors and have the same economic strength; for example, the U.S. and the European Union.

What are the problems caused by exchange rate fluctuations?

Any undue fluctuations in exchange rate cause problems to the plans and programmes of both exporters and imports. In other words, incomes of export-earners and the cost of imports of the importers tend to become uncertain if the exchange rate fluctuates. This uncertainty can be removed by a fixed exchange rate method.

What is fixed exchange rate?

Fixed exchange rate system is anti-inflationary in character. If exchange rate is allowed to decline, import goods tend to become dearer. High cost import goods then fuels inflation. Such a situation can be prevented by making the exchange rate fixed.

What is the condition for a stable exchange rate?

For the effectiveness of stable exchange rate, the necessary condition is the adequacy of holding foreign exchange reserves. Poor, developing countries find it difficult to maintain an adequate volume of foreign exchange reserves. Speculators then anticipate currency devaluation in advances if BOP needs to be corrected. Before 1970, fixed exchange rate, in fact, prevailed because of low volume of global trade and, hence, low volume of foreign exchange reserves.

Why is the exchange rate system important?

Stable exchange rate system prevents government from adopting irresponsible macroeconomic policies like devaluation of currencies. Above all, under the fixed exchange rate system, deflationary policies can even be pursued to tide over BOP deficit, even without bringing any change in domestic policies.

What happens if the central bank sells home currencies?

ADVERTISEMENTS: If such sell of home currencies continue for a longer period, the central bank will then be forced to reduce exchange rate, instead of keeping it at the old fixed rate . Under the circumstance, speculators go on buying home currencies where exchange rates have been reduced.

When did the Bretton Woods exchange rate system start?

This kind of exchange rate developed after the World War II. The International Monetary Fund set up by the Bretton Woods Agreement of 1944 came into operation in March 1947. The period 1947-1971 came to be known as ‘fixed but adjustable exchange rate system’ or ‘par value system’ or ‘pegged exchange rate system’, or ‘Bretton Woods system.

When countries experience large and persistent deficits or ‘fundamental disequilibrium?

When countries experience large and persistent deficits or ‘fundamental disequilibrium’ in BOP, they are down with foreign exchange reserves. Countries then opt for devaluation of their currencies and take some internal measures to reduce their deficits. These harsh internal measures tend to contract economies. But the fallouts of these measures are rising prices and rising unemployment. These then reduce economic growth.

How to ensure a fixed exchange rate system is effective?

To ensure that a fixed exchange rate system is effective, it is crucial that a country has adequate foreign exchange reserves. However, it is usually challenging for small or poor nations to maintain an adequate amount of reserves. And this becomes the biggest bottleneck in fixed exchange rate system.

What is fixed exchange rate?

A Fixed Exchange Rate is a system where a country ties the value of its currency (or the exchange rate) with the currency of any other nation, or with any commodity. A country primarily adopts such a currency system to steady the value of its currency. We may also call such an exchange rate system a pegged exchange rate.

Why is stable exchange rate important?

It helps in the prevention of the depreciation of the currency of developing nations. If a country is facing a BOP crisis, then regular changes in the exchange rate could make BOP crises more severe. So, a stable exchange rate prevents this to some extent.

Why do central banks sell their currency?

The central bank of a country, who pegs its currency to another currency, will buy and sell its currency in the global exchange market, to maintain the supply and demand. However, one pre-requisite of this practice is that the central bank of that country must hold a sufficiently large chunk of reserves, of that currency to which its currency is pegged or linked.

Why is it important for small countries to keep a check on inflation?

This is because if their currency appreciates, the imports get expensive, resulting in inflation.

Why do small nations peg their currency against bigger nations?

Small nations usually peg their currency against bigger nations, such as the U.S. and EU. This helps them to lower their import cost. And at the same time it helps them to raise the export value. Further , this in turn also helps to improve the balance of trade.

Why do countries tie their currency?

If a country ties its currency with its trading partner, then it helps to ensure certainty of the payment amount. Both importers and exporters will know the exact amount they will have to pay and the money they would get. Or, we can say, such an exchange rate system takes away the exchange rate risk element from the business and contracts.

Why is the exchange rate fixed?

The fixed exchange rate promotes economic stability. But, it can also be destroyed if the central bank’s credibility is weak and foreign exchange reserves are insufficient. Because exchange rates do not change over time, it provides greater certainty for exporters and importers. Say, the rupiah exchange rate against the US dollar is Rp14,000 in 2018 and 2019, so when you exchange the Rp14,000 you have in 2019, you will get 1 USD, the same as in 2018.

What is fixed exchange rate?

A fixed exchange rate is an exchange rate system in which domestic currency is pegged to other currencies or gold prices. For instance, the rupiah exchange rate against the US dollar is fixed at Rp14,000 per USD. The value will remain Rp14,000 per USD over time, regardless of the exchange market’s supply and demand conditions. Maintaining the exchange rate still requires government intervention.

How does the central bank keep the exchange rate fixed?

The central bank keeps a fixed exchange rate by buying or selling its currency. Say, the rupiah exchange rate against the US dollar is fixed at Rp14,000 per USD. When the domestic currency appreciates to, say, Rp10,000 per USD, the market tends to experience excess demand of the local currency. Therefore, to prevent exchange rate appreciation, the central bank will sell its domestic currency reserves. By doing so, the supply of domestic currency on the forex market increases and reduces upward pressure on the exchange rate.

What happens to the currency exchange rate when the exchange rate depreciates?

By doing so, the supply of domestic currency on the forex market increases and reduces upward pressure on the exchange rate. Conversely, when the exchange rate depreciates, for example, to Rp20,000 per USD, the market tends to experience an excess supply.

How does the central bank intervene?

The central bank must intervene by buying or selling its currency to absorb slight variations in exchange rates. Such interventions often require sizeable foreign exchange reserves, considering the foreign exchange market’s large transaction values .

How does deviation affect capital flows?

Any deviation will affect capital flows so that the exchange rate will change. If the domestic interest rate rises while the international interest rate is fixed, it causes an inflow of capital. Capital inflows increase the demand for local currency, driving an appreciation.

Why are foreign exchange reserves so important?

Conversely, if the foreign exchange reserves are relatively small, interventions can be ineffective when short-term speculative attacks. Supply and demand in the forex market involve a tremendous transaction value because it involves participants worldwide. In fact, exchange rate transactions are far greater than can be intervened by a country’s foreign exchange reserves.

Disadvantages of Fixed Exchange Rate

- There are a few disadvantages to using a fixed exchange rate. One disadvantage is that it can lead to artificially high inflation rates over time. Another disadvantage is that it can make it difficult for countries to adjust their currency values when their exports or imports become more expensive or cheaper than expected. Other drawbacks are as fo...

Conclusion on Fixed Exchange Rate – Advantages and Disadvantages

- As we have seen, a fixed exchange rate eliminates volatility – this can be beneficial for businesses that rely on foreign currency trading as their main source of income. Moreover, a fixed exchange rate makes transactions more predictable, which can help companies reduce costs and make their products more affordable to consumers. It’s also easier for businesses to plan for fut…

FAQs on Advantages and Disadvantages of Fixed Exchange Rate

- Question 1. What is Fixed Exchange Rate? Answer: A fixed exchange rate is a monetary system where the value of one currency is fixed against another. This means that the value of one currency will not fluctuate in relation to another currency. There are pros and cons to using a fixed exchange rate. The pros are that it eliminates market volatility and gives stability to financial ma…

What Is A Fixed Exchange Rate?

Advantages of Fixed Exchange Rate

- Let us see the advantages of the below-listed points. 1. Help in keeping inflation low: The main motive behind the Fixed exchange rate is to keep inflation low for the exporters, importers, as well as the government as the value of a currency remains at the narrow band for keeping the inflation level low. 2. Stability: To keep the currency value within the limit is the work of a fixed exchange …

Disadvantages of Fixed Exchange Rate

- Challenging for poor countries: Poor countries generally have the value of their currency lower than others because the stability of a nation is affected to a large extent. A less valued currency m...

- Do not follow the concept of the free market: The free market depends on market and supply factors for fixing prices in the market, which is the most likely to be the feature of the flexible …

- Challenging for poor countries: Poor countries generally have the value of their currency lower than others because the stability of a nation is affected to a large extent. A less valued currency m...

- Do not follow the concept of the free market: The free market depends on market and supply factors for fixing prices in the market, which is the most likely to be the feature of the flexible exchan...

- Cannot be automatically balanced: As the currency of other nations or the value of gold changes with the affluence of time and it’s not fixed how much changes will be there. Thus, each nation’s cur...

- Government intervention is required: The government has proposed various monetary policie…

FAQ’s on Pros and Cons of Fixed Exchange Rate

- Question 1. What is a Floating exchange rate system? Answer: Floating exchange rate system is also known as a flexible exchange rate system. It depends on the market forces to fix the value of the currency. Question 2. What is currency? Answer: Currency is the official money that is used in a nation for transactions of daily life. Every nation has a different currency than applies to a nati…

Disadvantages of Fixed Exchange Rate

- There are a few disadvantages to using a fixed exchange rate. One disadvantage is that it can lead to artificially high inflation rates over time. Another disadvantage is that it can make it difficult for countries to adjust their currency values when their exports or imports become more expensive or cheaper than expected. Other drawbacks are as fo...

Comparison Table For Advantages and Disadvantages of Fixed Exchange Rate

- Following are the advantages and disadvantages of a Fixed Exchange Rate: Advantages Currency fluctuations are reduced Stimulates and promotes investments Keeps inflation low Disadvantages Can conflict with macroeconomic objectives Has less flexibility Needs higher interest rates Difficult to keep the value of the currency

Conclusion on Fixed Exchange Rate – Advantages and Disadvantages

- As we have seen, a fixed exchange rate eliminates volatility – this can be beneficial for businesses that rely on foreign currency trading as their main source of income. Moreover, a fixed exchange rate makes transactions more predictable, which can help companies reduce costs and make their products more affordable to consumers. It’s also easier for businesses to plan for fut…

FAQs on Advantages and Disadvantages of Fixed Exchange Rate

- Question 1. What is Fixed Exchange Rate? Answer: A fixed exchange rate is a monetary system where the value of one currency is fixed against another. This means that the value of one currency will not fluctuate in relation to another currency. There are pros and cons to using a fixed exchange rate. The pros are that it eliminates market volatility and gives stability to financial ma…