Will fiscal policy really be expansionary?

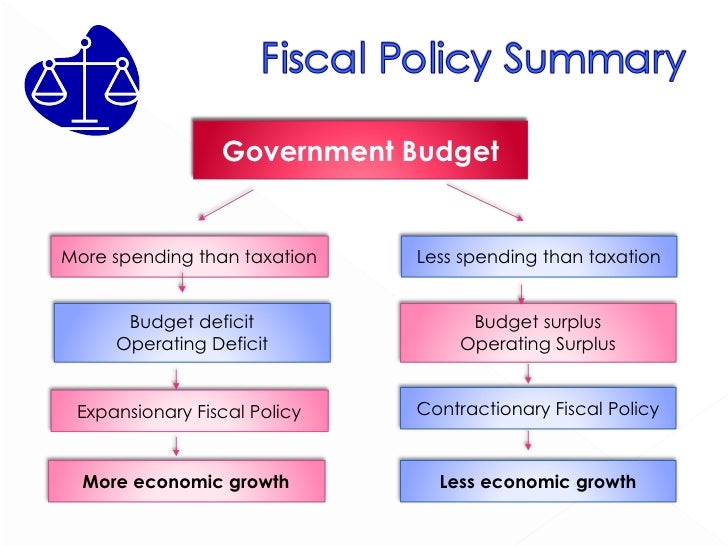

Fiscal policy is said to be tight or contractionary when revenue is higher than spending (i.e., the government budget is in surplus) and loose or expansionary when spending is higher than revenue (i.e., the budget is in deficit). Often, the focus is not on the level of the deficit, but on the change in the deficit.

What is included in an expansionary fiscal policy?

Expansionary fiscal policy tools include increasing government spending, decreasing taxes, or increasing government transfers. Doing any of these things will increase aggregate demand, leading to a higher output, higher employment, and a higher price level.

Which would be an example of contractionary fiscal policy?

International economics can be used to illustrate the effects of contractionary fiscal policy. An example of contractionary fiscal policy would be the case of Greece in 2008, when it was facing a budget deficit that reached 15 percent of GDP. Due to this, the government imposed higher taxes on consumers and businesses with lower income levels.

What would be an example of expansionary fiscal policy?

What is an example of an expansionary fiscal policy? An example of expansionary fiscal policy could be an increase in welfare spending. However, it is only considered expansionary if the government doesn’t bring in the same amount through taxes. In other words, it’s spending more than it’s bringing in.

What are examples of expansionary and contractionary fiscal policy?

Expansionary fiscal policy occurs when the Congress acts to cut tax rates or increase government spending, shifting the aggregate demand curve to the right. Contractionary fiscal policy occurs when Congress raises tax rates or cuts government spending, shifting aggregate demand to the left.

What are examples of contractionary fiscal policy?

When the government uses fiscal policy to decrease the amount of money available to the populace, this is called contractionary fiscal policy. Examples of this include increasing taxes and lowering government spending.

What are expansionary fiscal policies?

Expansionary fiscal policy includes tax cuts, transfer payments, rebates and increased government spending on projects such as infrastructure improvements. For example, it can increase discretionary government spending, infusing the economy with more money through government contracts.

What are two contractionary fiscal policies?

Contractionary fiscal policy includes raising taxes, decreasing spending, or a combination of the two. These actions reduce an economy's aggregate demand.

What are 5 examples of expansionary monetary policies?

Tools for an Expansionary Monetary PolicyLower the short-term interest rates. ... Reduce the reserve requirements. ... Expand open market operations (buy securities) ... Stimulation of economic growth. ... Increased inflation. ... Currency devaluation. ... Decreased unemployment.

What is the difference between contractionary and expansionary?

Contractionary fiscal policy is when the government taxes more than it spends. Expansionary fiscal policy is when the government spends more than it taxes.

What is contractionary policy used for?

Note that the goal of contractionary monetary policy is to decrease the rate of demand for goods and services, not to stop it. So, higher interest rates through contractionary policy can be used to dampen inflation and move the economy back to the price stability component of the dual mandate.

What are the types of fiscal policy?

There are two main types of fiscal policy: expansionary and contractionary.

What is the goal of contractionary fiscal policy?

The purpose of contractionary fiscal policy is to slow growth to a healthy economic level. That's between 2% to 3% a year. 1 An economy that grows more than 3% creates four negative consequences. It creates inflation.

What is the difference between expansionary fiscal policy and contractionary fiscal policy quizlet?

Expansionary fiscal policy is when the government lowers taxes or raises government spending. Contractionary fiscal policy is the opposite - when the government raises taxes or lowers government spending.

Which of the following is an example of contractionary monetary policy?

Answer and Explanation: (c) The Fed raises the discount rate is an example of contractionary monetary policy.

Which are contractionary fiscal policies quizlet?

Contractionary Fiscal Policy involves decreasing government spending or increasing taxes, which leads to a decrease in aggregate demand. Austerity Measures involves decreasing government spending and increasing taxes in order to reduce a budget deficit.

Which of these is an example of contractionary fiscal policy quizlet?

An example of contractionary fiscal policy would be to decrease government spending on goods and services.

When would the government use contractionary fiscal policy?

The government can use contractionary fiscal policy to slow economic activity by decreasing government spending, increasing tax revenue, or a combination of the two. Decreasing government spending tends to slow economic activity as the government purchases fewer goods and services from the private sector.

Which are contractionary fiscal policies quizlet?

Contractionary Fiscal Policy involves decreasing government spending or increasing taxes, which leads to a decrease in aggregate demand. Austerity Measures involves decreasing government spending and increasing taxes in order to reduce a budget deficit.

Which of the following represents the most contractionary fiscal policy?

The answer is b). Contractionary fiscal policies are increases in taxes or cut in government spending. Holding the dollar value the same, cut in government spending is more contractionary than the same increase in taxes, because government spending carries a larger multiplier.

What is contractionary fiscal policy?

Contractionary fiscal policy is explained as a decline in government expenditure. Alternatively, it can be defined as a raise in taxes that causes the government’s budget surplus to increase, or its budget deficit to decrease. A budget deficit or surplus usually determines the type of fiscal policy either as contractionary or expansionary. Contractionary fiscal policy includes:

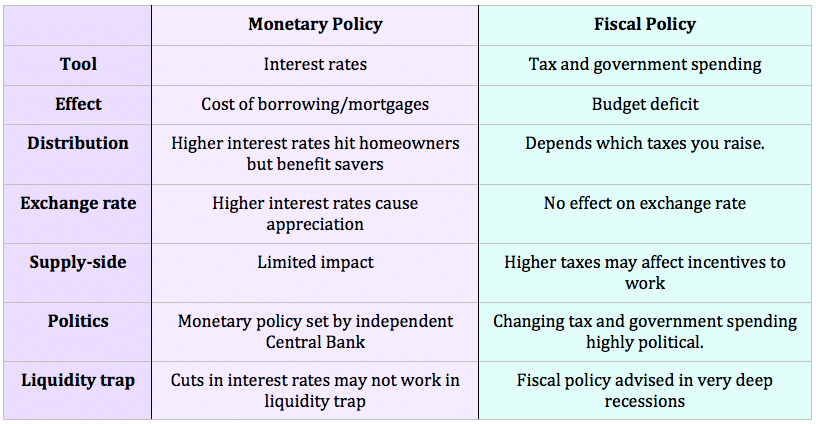

What are the two main instruments of fiscal policy?

The two main instruments of fiscal policy are taxes and government expenditure. The government amasses taxes to finance its expenditures. Therefore, fiscal policy can affect production and may be used as an instrument for economic stabilization. It can either be contractionary or expansionary.

What is the purpose of the government during a recession?

During a recession, the government employs idle resources and tries to boost economic output. This increased spending makes the aggregate demand to increase; hence, a higher real GDP. This is referred to as an expansionary fiscal policy. It is usually an attempt to raise employment rates and, subsequently, output. The expansionary policy includes:

Why is it bad to raise fiscal deficits?

A common argument against raises in fiscal deficits is that the additional borrowing to fund the deficit in the financial markets will displace private-sector borrowing that would otherwise be invested by corporations that would create economic growth. This is referred to as “crowding-out.”

What is a government budget?

A government budget is a document prepared by a political entity. A budget presents the amount of revenue the political entity aims to raise and the modalities it will use to raise it. Above all, a budget proposes how the revenue would be spent in the coming financial year.

What is contractionary fiscal policy?

Contractionary fiscal policy is defined as the type of fiscal policy that works toward contracting the economy. Expansionary fiscal policy is defined as the policy that works towards promoting the consumption in the economy. It works for expansion of the economy.

Why is contractionary policy used?

As less capital is available for business, the economy contracts and also causes unemployment. Contractionary policy is used to control inflation.

What is fiscal policy?

Fiscal policy is the financial tool that is used by the government to influence the aggregate demand of the economy and also the total output of the economy.

What are the two types of fiscal policies?

There are two kinds of fiscal policy which is contractionary and expansionary fiscal policy. Contractionary fiscal policy is said to be in action when the government reduces spending and increases the taxes at the same time in the country.

What is contractionary monetary policy?

Generally speaking contractionary monetary policies and expansionary monetary policies involve changing the level of the money supply in a country. Expansionary monetary policy is simply a policy which expands (increases) the supply of money, whereas contractionary monetary policy contracts (decreases) the supply of a country's currency.

What is the effect of expansionary monetary policy on bond prices?

Expansionary monetary policy causes an increase in bond prices and a reduction in interest rates. Lower interest rates lead to higher levels of capital investment. The lower interest rates make domestic bonds less attractive, so the demand for domestic bonds falls and the demand for foreign bonds rises.

What Effects Does Monetary Policy Have?

He teaches at the Richard Ivey School of Business and serves as a research fellow at the Lawrence National Centre for Policy and Management .

What causes a decrease in the exchange rate?

The demand for domestic currency falls and the demand for foreign currency rises , causing a decrease in the exchange rate. (The value of the domestic currency is now lower relative to foreign currencies)

What are the three things that the Federal Open Market Committee can do to increase the money supply?

In the United States, when the Federal Open Market Committee wishes to increase the money supply, it can do a combination of three things: Purchase securities on the open market, known as Open Market Operations. Lower the Federal Discount Rate. Lower Reserve Requirements. These all directly impact the interest rate.

What causes a decrease in bond prices and an increase in interest rates?

Contractionary monetary policy causes a decrease in bond prices and an increase in interest rates.

What would the Fed do if inflation exceeded 2 percent?

Suppose that inflation has exceeded 2 percent for some time and the Fed recognizes that individuals are starting to expect high and rising inflation going forward. In this situation, the FOMC might decide to use contractionary monetary policy to bring actual and expected inflation back toward its target, to maintain price stability. To do this, the FOMC could raise its target range for the federal funds rate (FFR) and increase the administered rates—interest on reserve balances (IORB) rate, overnight reverse repurchase agreement (ON RRP) offering rate, and discount rate—accordingly. See the animation below.

How does increased production affect the economy?

With increased production, businesses are likely to hire additional employees and spend more on other resources. As these increases in spending ripple through the economy, unemployment decreases, moving the economy toward maximum employment . So, the Fed’s monetary policy tools can be effective for moving the economy back toward ...

What happens to the economy when consumption decreases?

The decrease in consumption spending by consumers and in investment spending by businesses decreases the overall demand for goods and services in the economy. With decreased production, businesses are less likely to hire additional employees and spend more on other resources.

What does the decrease in consumption spending by consumers and in investment spending by businesses mean?

The decrease in consumption spending by consumers and in investment spending by businesses decreases the overall demand for goods and services in the economy.

How does lower interest rate affect the economy?

Lower interest rates decrease the cost of borrowing money, which encourages consumers to increase spending on goods and services and businesses to invest in new equipment.

Will inflation fall below the target?

Meanwhile, the inflation rate is showing signs that it will fall below the target. The Federal Open Market Committee (FOMC) might decide to use expansionary monetary policy to provide stimulus for the economy. That is, the FOMC could lower its target range for the federal funds rate (FFR).

What are expansionary and contractionary fiscal policies?

Expansionary and contractionary fiscal policies raise and lower money supply, respectively, into the economy. In this Buzzle article, you will come across the pros and cons of using expansionary and contractionary fiscal policy.

What is contractionary fiscal policy?

Contractionary Fiscal Policy. It is a policy that helps decrease money supply in the economy. It is generally adopted during high economic growth phases. Decision to implement it can come from the nation’s finance ministry or the central bank. It leads to increased imports. It decreases expenditure of the government.

What is fiscal policy?

A fiscal policy defines the relationship between taxation and expenditure. It uses a variety of tools for this purpose, in turn, having a profound effect on factors like unemployment, inflation, aggregate demand, and investments. It is mainly divided into 2 types: expansionary and contractionary. However, a third stance called ‘neutral’ has been ...

How does slowing down production affect economic growth?

Once production slows down, it takes a long time to gear up again. It stabilizes prices and increases consumer confidence. Reduced price fluctuation leads to non-erratic expenditure. It reduces economic growth since there is reduced supply of money. Reduced prices, less demand, etc., leads to stunted economic growth.

How does reduced demand affect economic growth?

Reduced prices, less demand, etc., leads to stunted economic growth. It slows down the inflation. This is also achieved through reduced government spending. Interest rates can be raised, and this leads to reduced demand and prices to match the low money supply. It leads to increased unemployment.

What happens if the government isn't careful regarding its expenditure?

If the government isn’t very careful regarding its expenditure and if there is excess money supply, this policy could lead to inflation. Increased inflation leads to unnecessary problems in the economy.

Why is there a lack of price stability?

There is a lack of price stability on various products. The increase in money supply causes it to lose its importance as regards to the related products, and higher costs are set for limited goods. Due to an increase in revenue and profits, there is a rising demand for labor.