Essential Features of Accounting Principles

- Usefulness: The Usefulness of accounting means it must useable to the users in their decision-making process. ...

- Man-Made: Accounting principle made my man it is not made by nature. ...

- Flexible: Accounting principle is not hard to follow it is Flexible to follow. ...

- Accepted by Everyone: Accounting principle is accepted by everyone from every organization. ...

- Relevance or Usefulness: ADVERTISEMENTS: A principle will be relevant only if it satisfies the needs of those who use it. ...

- Objectivity: A principle will be said to be objective if it is based on facts and figures. ...

- Feasibility: The accounting principles should be practicable.

What are the 5 major generally accepted accounting principles?

What are the 5 basic principles of accounting?

- Revenue Recognition Principle. When you are recording information about your business, you need to consider the revenue recognition principle.

- Cost Principle. Recording your assets when you purchase a product or service helps keep your business’s expenses orderly.

- Matching Principle. ...

- Full Disclosure Principle. ...

- Objectivity Principle. ...

What are the three basic rules of accounting?

Three Golden Rules of Accounting. 1. First Rule: Debit The Receiver, Credit The Giver. This principal applies to the personal accounts. Every business deals with a number of people. Personal accounts are maintained for such persons. If a person gives something to the business (e.g. a loan) she is called giver and if a person receives something ...

What are the basic concepts of accounting?

What are the three fundamental concepts of accounting?

- Accruals concept. The accruals concept states that revenues can be recognised only when they are earned, and expenses, when assets are used.

- Going concern concept. In accounting, it is always assumed that a business remains in operation in future time periods. ...

- Economic entity concept. ...

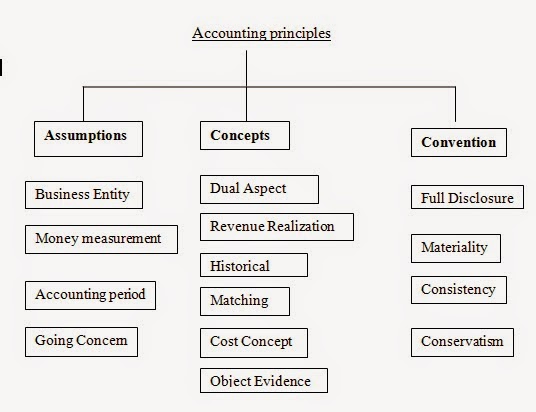

What are the accounting principles, assumptions, and concepts?

Accounting concepts are the basic rules, assumptions, and conditions that define the parameters and constraints within which the accounting operates. In other words, accounting concepts are the generally accepted accounting principles, which form the fundamental basis of preparation of universal form of financial statements consistently.

What are the 5 basic features of accounting?

What are the 5 basic principles of accounting?Revenue Recognition Principle. When you are recording information about your business, you need to consider the revenue recognition principle. ... Cost Principle. ... Matching Principle. ... Full Disclosure Principle. ... Objectivity Principle.

What are the features of accounting class 11th?

(1) Identification: It is the process of identifying and analysing business transactions. (2)Recording: For recording, we use 'Journal' or Subsidiary Books. (3) Classification of transactions: Classification means segregation of transactions on the basis of nature and posting them in a format known as Ledger Account.

What are the 7 principles of accounting?

The Finest 7 Basic Accounting Principles:Consistency Principle:Going Concern Principle:Accrual Principle:Conservatism Principle:Objectivity Principle:Matching Principle:Full Disclosure Principle:

What are the features of accounting software?

So here are the 7 key features of accounting software to look for.Security. This should be a given but it's so important that it's worth double-checking. ... Cloud-readiness. ... User-friendliness. ... Integrations. ... Bookkeeping capabilities. ... CRM capabilities. ... Financial reporting and projections.

Why is it important to understand the feature of accounting?

It provides the most vital information you need to understand how your business grows, makes money, where the profit of a business goes, and what your cash flow is. In short, if you do not understand the basic principles of accounting, you cannot run a business, nor can you even hope to help a business grow and profit.

What are accounting principles explain?

Accounting principles are the general rules and guidelines that companies are required to follow when reporting all accounts and financial data. Maintain and manage your business practices with Debitoor's online accounting platform to help you stay on top of your financial reporting.

What are the 12 basic accounting concepts?

: Business Entity, Money Measurement, Going Concern, Accounting Period, Cost Concept, Duality Aspect concept, Realisation Concept, Accrual Concept and Matching Concept.

How many accounting principles are there?

10 accounting principlesWhat Are the Basic Principles of Accounting? GAAP incorporates three components that eliminate misleading accounting and financial reporting practices: 10 accounting principles, FASB rules and standards, and generally accepted industry practices.

What is accounting for Class 11?

Accounting: Accounting is the art of recording, classifying, summarizing in a significant manner, transactions and events which are of financial character, and interpreting the results thereof.

What are the characteristics of accounting class 11 Pseb?

Accounting information is useful for interested users only if it possess the following characteristics :Reliability. Means the information must be based on facts and be verified through source documents by anyone. ... Relevance. ... Understandability. ... Comparability.

What are the basic terms of accounting class 11?

Basic accounting terms, acronyms, abbreviations and concepts to rememberAccounts receivable (AR) ... Accounting (ACCG) ... Accounts payable (AP) ... Assets (fixed and current) (FA, CA) ... Asset classes. ... Balance sheet (BS) ... Capital (CAP) ... Cash flow (CF)More items...•

Is accountancy hard in class 11?

4. Are the CBSE Class 11 Accountancy Revision Notes difficult to learn? No, the CBSE Class 11 Accountancy Revision Notes are not at all difficult to learn.

What is accounting principles?

Accounting principles are the rules and guidelines that companies must follow when reporting financial data. The Financial Accounting Standards Board (FASB) issues a standardized set of accounting principles in the U.S. referred to as generally accepted accounting principles (GAAP). 1.

Who Sets Accounting Principles and Standards?

Various bodies are responsible for setting accounting standards. In the United States, GAAP is regulated by the Financial Accounting Standards Board (FASB). In Europe and elsewhere, the IFRS are established by the International Accounting Standards Board (IASB).

When Were Accounting Principles First Set Forth?

Standardized accounting principles date all the way back to the advent of double-entry bookkeeping in the 15th and 16th centuries that introduced a T-ledger with matched entries for assets and liabilities. 5 Some scholars have argued that the advent of double-entry accounting practices during that time provided a springboard for the rise of commerce and capitalism. The American Institute of Certified Public Accountants and the New York Stock Exchange attempted to launch the first accounting standards to be used by firms in the United States in the 1930s. 6

How Does IFRS Differ from GAAP?

IFRS is a standards-based approach that is used internationally, while GAAP is a rules-based system used primarily in the U.S. The IFRS is seen as a more dynamic platform that is regularly being revised in response to an ever-changing financial environment, while GAAP is more static.

What is GAAP regulated by?

Various bodies set forth accounting standards. In the United States, GAAP is regulated by the Financial Accounting Standards Board (FASB). In Europe and elsewhere, the IFRS are set out by the International Accounting Standards Board (IASB).

Why are accounting standards important?

Accounting standards are implemented to improve the quality of financial information reported by companies . In the United States, the Financial Accounting Standards Board (FASB) issues Generally Accepted Accounting Principles (GAAP). GAAP is required for all publicly traded companies in the U.S.; it is also routinely implemented by non-publicly ...

What is revenue recognition principle?

Revenue recognition principle. Time period principle. Accounting principles help govern the world of accounting according to general rules and guidelines. GAAP attempts to standardize and regulate the definitions, assumptions, and methods used in accounting.

What are Accounting Principles?

Accounting principles are the set guidelines and rules issued by accounting standards like GAAP and IFRS for the companies to follow while recording and presenting the financial information in the books of accounts. These principles help companies present a true and fair representation of financial statements.

Which principle should an accountant use to report loss of machinery?

As per the conservatism principle, the accountant should go with the former choice, i.e., to report the loss of machinery even before the loss would happen. Conservatism principle encourages the accountant to report more significant liability amount, lesser asset amount, and also a lower amount of net profits.

What is the Consistency Principle?

Consistency Principle According to the Consistency Principle, all accounting treatments should be followed consistently throughout the current and future periods unless compelled by law to change or the change provides a better accounting presentation.

What is the going concern principle?

As per the going concern principle, a company would go on operating for as long as it can in the near or foreseeable future. By following the going concern principle, a company may defer its depreciation or similar expenses for the next period of time.

What is financial reporting?

Financial Reporting Financial Reporting is the process of disclosing all the relevant financial information of a business for a particular accounting period. These reports are used by the stakeholders (investors, creditors/ bankers, public, regulatory agencies, and government) to make investing and other relevant decisions. read more.

What are the Principles of Accounting?

To put it simply, principles of accounting may be defined as the basic guidelines that every professional accountant is expected to follow while working on various accounting processes.

What are the basic principles and guidelines of accounting?

These basic guidelines that govern the whole process of accounting are commonly referred to as the “Basic princip les and guidelines of accounting.”. These rules and guidelines put forth the necessary groundwork for which the whole process of accounting is based. Various complicated and advanced forms of accounting work are based on these basic ...

What is the International Accounting Standards Board?

For International purposes, the International Accounting Standards Board, also known as the IASB, issues the basic principles or guidelines that every professional accountant working with international or Multinational companies are expected to abide by.

Why is it important to know the accounting principles?

With the help of these principles of accounting, accountants get a better insight into the core pieces of the financial proceedings of business. Business owners who are aware of these accounting principles will also communicate more adeptly with an accountant to hire the best-suited individuals for managing their accounts.

What is the accounting principle of short time intervals?

According to this accounting principle, it is assumed that various complicated and ongoing activities of an individual business, maybe quickly recorded at short time intervals with ease. It is also essential for accountants to keep in mind that the shorter each time interval is made, the more shall the need for fellow accountants to estimate the relevant period increase.

What is GAAP accounting?

For accountants to work with the various processes and kinds of accounting with utmost efficiency and proficiency, they must have proper understanding and knowledge. There are generally accredited basic guidelines that every user is expected to follow ...

What is the accounting principle of time?

This accounting principle alludes to an association being partitioned into different time-spans for simple accounting. Some of these time-spans incorporate quarterly, monthly, or annual periods.

What is accounting principles?

Meaning of Accounting Principles: Accounting principles are men made. Unlike the principles of Physics, Chemistry and other natural sciences; accounting principles were not deduced from basic axioms, nor their validity is verifiable through observations or experiments. These principles are drawn from practical practice of accounting.

Why is accounting principle important?

A principle will be relevant only if it satisfies the needs of those who use it. The accounting principle should be able to provide useful information to its users otherwise it will not serve the purpose .

Why is the cost principle more useful than the value principle?

The cost principle will be more useful than the value principle because value will be based on market prices and personal judgment will differ in finding out value. 3. Feasibility: The accounting principles should be practicable. The principles should be easy to use otherwise their utility will be limited.

Why do we show fixed assets at replacement cost?

We may show fixed assets at replacement cost because it is practicable and actual cost principle may not be able to give correct results as the rise in price index will make it less useful.

Why are there no universally accepted principles in accounting?

Lack of General Agreement: There are no universally accepted principles in accounting. Whatever principles are followed they are ‘generally accepted principles, and not principles accepted by everyone. The reason for this is that nature of business activities is different, problems faced by different concern are not similar and the thinking ...

Can accounting principles be used differently?

Even if similar accounting principles are used by different concerns, the application of these principles will be different. The same principles are used differently by different accountants. The conclusions drawn from these principles may also be different. Though depreciation may be provided on the basis of cost of the assets but there are a number of methods which are used for providing depreciation.

Can a list of universally accepted principles be prepared?

No list of universally accepted principles can be prepared but still certain principles are drawn which are accepted by most of the accountants. According to Terminology Committee of AICPA.

Why are accounting principles important?

The accounting principles are found to be useful and provide important information to the one who tries to find it in a simple way. There are different categories and headings under which different transactions are classified, which makes it for the finder to locate a particular transaction easy.

Why is accounting important in business?

Every business has multiple transactions going throughout the day, and it is essential that to determine the productivity of the business, these transactions be recorded. This one accounting was discovered. Accounting is an integral part of the business which is used to record the list of financial transactions occurring in the business.

Why do accountants use GAAP?

These principles are used in making financial statements and sharing those financial statements to the public and to shareholders.

What is financial summary?

This summary of financial transactions that are recorded in accounting gives detailed information about the financial health of an organization, including their financial position, the operations of the company, sustainability in the market and cash flows.

What is accounting in business?

Accounting is an integral part of the business which is used to record the list of financial transactions occurring in the business. Sometimes accounting is also defined as the process of collecting, recording, studying, and reporting the financial transactions of an organization. This summary of financial transactions that are recorded in ...

Why are cash flow statements important?

These statements are useful for investors to make investing decisions. Summaries also provide exams on the overall financial health of the organization without taking a lot of time.

What is accounting recording?

Recording. Accounting has a unique feature of recording every financial transaction. It provides a provision of recording the transaction in a detailed manner which can be used by the companies. The recording is systematic and can be done anyone who is adept in accounting basics and laws.