In order to be useful to a user, accounting information should have the following characteristics:

- Prepared objectively. The accountant should record and report on accounting transactions from a neutral perspective, without any bias that would give the reader an incorrect impression about the financial position, results, or cash flows of a business.

- Consistency of recordation and presentation. ...

- In support of decisions. ...

- Matches reader knowledge. ...

- Reliability and completeness of information. ...

- Verifiability.

- Timeliness.

- Understandability.

- Comparability.

What are the key characteristics of accounting information?

The main qualitative characteristics of accounting information are:

- Relevance.

- Reliability.

- Comparability.

- Consistency.

What personal qualities do you need to be an accountant?

WHAT CHARACTERISTICS MAKE A GOOD ACCOUNTANT?

- A STRONG SENSE OF ETHICS. Ethics and integrity are valued characteristics in an accountant. ...

- CONSTANTLY LEARNING. While accountants need to have a strong grasp of the basics, they must also display interest in keeping up-to-date.

- EMPHASIZING ACCURACY. ...

- ORGANIZATIONAL SKILLS. ...

- SENSE OF ACCOUNTABILITY. ...

- ABILITY TO WORK IN A TEAM. ...

- KNOWLEDGE OF THE FIELD. ...

What are the disadvantages of Accounting Information System?

What are the advantages and disadvantages of Computerised accounting system?

- Advantage: Simplicity.

- Advantage: Reliability.

- Advantage: Cost-Effectiveness.

- Advantage: Ability to Collaborate.

- Disadvantage: Potential Fraud.

- Disadvantage: Technical Issues.

- Disadvantage: Incorrect Information. What is the benefit of accounting information system? The main benefit of information systems in accounting is the speed of processing tasks. ...

How does accounting information help an organization?

- laws and enterprise policies are properly implemented;

- accounting records are accurate;

- enterprise assets are used effective (e.g., that idle cash balance are being invested to earn returns);

What are the qualities of accounting information?

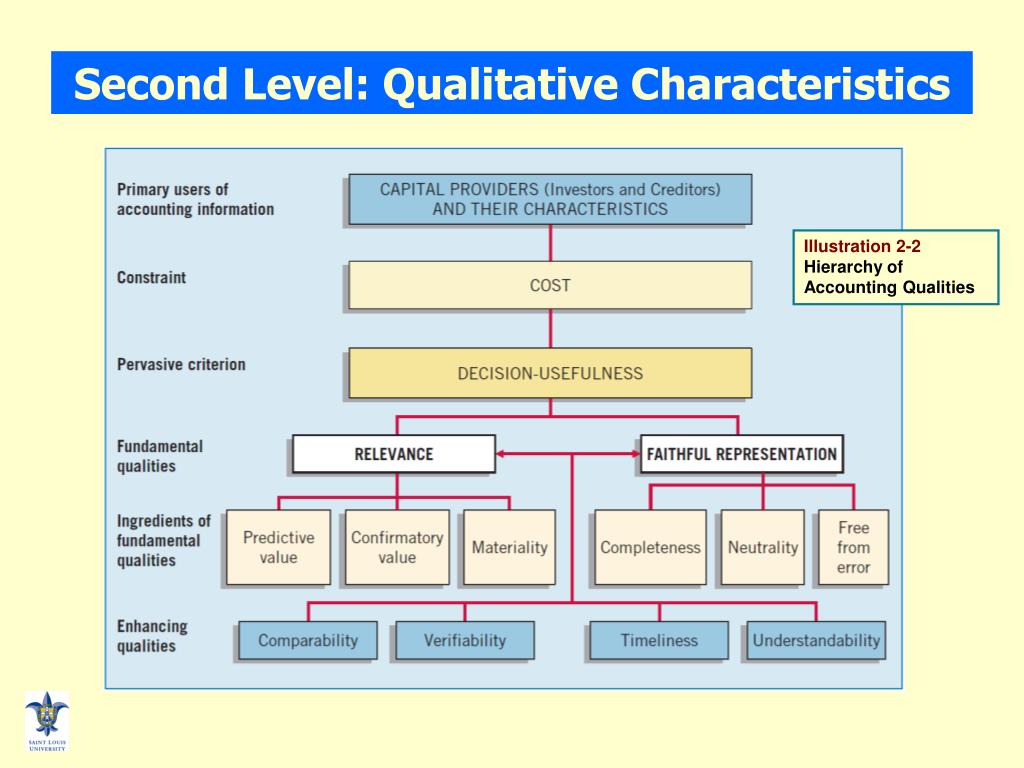

There are six different types of qualitative characteristics of accounting information, including:Relevance. ... Representational faithfulness. ... Verifiability. ... Understandability. ... Comparability. ... Timeliness. ... Extract relevant information. ... Check your information.More items...•

What are two fundamental qualities of accounting information?

Relevance and reliability are the two primary qualities that make accounting information useful for decision making.

What are the four key qualities of accounting information?

Discover the qualities of accounting information such as relevance, reliability, comparability and consistency.

Which of the following is the fundamental quality of useful accounting information?

Explanation : Relevance and reliability are the fundamental quality of useful accounting information. The accounting information must be appropriate as well as reliable since the information will be used by the users of the financial statements for decision making.

What are the four key qualities of accounting information quizlet?

b) identification, recording, analysis, reporting. The best explanation of relevance is: c) ensuring that information is useful for decision-making.

What are the 5 basic features of accounting?

What are the 5 basic principles of accounting?Revenue Recognition Principle. When you are recording information about your business, you need to consider the revenue recognition principle. ... Cost Principle. ... Matching Principle. ... Full Disclosure Principle. ... Objectivity Principle.

What is the main objective of accounting information?

The main objective of accounting is to keep a systematic record of financial transactions which helps the users to understand the day to day transactions in a systematic manner so as to gain knowledge about overall business.

Which is the most important purpose of accounting information?

Why Is Accounting Important? Accounting plays a vital role in running a business because it helps you track income and expenditures, ensure statutory compliance, and provide investors, management, and government with quantitative financial information which can be used in making business decisions.

What are fundamental qualitative characteristics?

The two fundamental Qualitative characteristics are : Relevance. Faithful Representation.

Which of the following is a fundamental quality?

Fundamental quantities are those which cannot be expressed or measured in terms of other physical quantities. The SI system has seven fundamental quantities i.e. time, length, mass, electric current, thermodynamic temperature, amount of substance, and luminous intensity.

Which of the following is not a fundamental quality of accounting information?

The answer is C. Materiality. Materiality is not one of the ingredients of the fundamental quality of faithful representation. This belongs to fundamental quality of relevance.

How can you improve the quality of accounting information?

To improve the quality of financial accounting information, public organisations need to be more proactive in improving their financial autonomy. The government also needs to have policies to encourage and actively support public organisations to enhance their financial autonomy.

What is the main objective of accounting information?

The main objective of accounting is to keep a systematic record of financial transactions which helps the users to understand the day to day transactions in a systematic manner so as to gain knowledge about overall business.

What is the importance of accounting information?

Why Is Accounting Important? Accounting plays a vital role in running a business because it helps you track income and expenditures, ensure statutory compliance, and provide investors, management, and government with quantitative financial information which can be used in making business decisions.

What are accounting principles?

What Are Accounting Principles? Accounting principles are the rules and guidelines that companies and other bodies must follow when reporting financial data. These rules make it easier to examine financial data by standardizing the terms and methods that accountants must use.

What are the qualitative characteristics of accounting information class 11?

Reliability: The first qualitative characteristic of accounting information is reliability. ... Relevance: The second qualitative characteristic of accounting information is relevance. ... Understandability: Understandability is the third most important qualitative characteristic of accounting information.More items...

What are qualitative characteristics of accounting information?

Qualitative characteristics of accounting information are traits that allow financial professionals to more easily understand and make decisions on accounting reports.

Why are qualitative characteristics of accounting information important?

Qualitative characteristics of accounting information are important because they assist business professionals in understanding and using the information found in accounting reports.

How to use qualitative characteristics of accounting information

Follow these steps to assist you in using qualitative characteristics of accounting information for your company:

Qualitative characteristics of accounting information example

Here is an example of how a company may use the above steps to help them with an important decision regarding their finances:

What are the characteristics of accounting information?

There are four (4) qualitative characteristics of accounting information that serve as the basis for decision making purposes in accounting: 1 Relevance : information makes a difference in decision making 2 Reliability : information is verifiable, factual, and neutral 3 Comparability : information can be used to compare different entities 4 Consistency : information is consistently presented from year to year

What is the meaning of materiality in accounting?

Materiality refers to a relative significance or importance of an item - dependent on individual’s judgment - to the overall financial condition of a company.

What is conservatism in accounting?

Conservatism (i.e., accounting practice of prudence when there is business uncertainty) can also affect the usefulness of accounting information. To learn more about materiality and conservatism, read this accounting article.

What are the characteristics of accounting information?

In order to be useful to a user, accounting information should have the following characteristics: Prepared objectively. The accountant should record and report on accounting transactions from a neutral perspective, without any bias that would give the reader an incorrect impression about the financial position, results, or cash flows of a business.

Why should there be an accounting system in place?

There should be an accounting system in place that is comprehensive enough to be able to routinely collect, record, and aggregate all transactions, so that users of the accounting information are assured that they are reading about the complete results of a business.

What is consistent recordation?

Consistency of recordation and presentation. A particularly important characteristic is for the accountant to record information using a consistent application of accounting standards, and to present aggregated results in the same way, for all periods presented. In support of decisions.

What should an accountant prepare for a shareholder meeting?

The accountant should prepare reports that are tailored to the knowledge of the reader. Thus, a short address at a shareholders meeting may call for an aggregated presentation of just a few key performance metrics, while a presentation to an institutional investor may call for a considerably more detailed report.

Why is it important to examine all reports issued by the accounting department?

It can be useful to examine all of the reports issued by the accounting department to see if they adhere to the preceding list of characteristics. If not, consider upgrading the sources of information, altering the reports to exclude the less useful items, or eliminating reports entirely.

Does an accountant issue boilerplate reports?

That is, the accountant does not just issue the same boilerplate reports, month after month. It may also be necessary to create new reports that deal with new situations confronting a business. Matches reader knowledge. The accountant should prepare reports that are tailored to the knowledge of the reader.