Characteristics of Bretton Woods are as follows:

- Stabilizing international exchange rates was the primary objective of Bretton Woods.

- It was an attempt to help nations recover economically post-World War II.

- Bretton Woods was adopted by 44 countries—they agreed to peg their currencies against the USD.

- The US Dollar was pegged against the price of gold—fixed at $35 per ounce of gold.

- The US Dollar was considered—an international reserve currency.

What is the Bretton Woods system?

The Bretton Woods system was an international monetary agreement that standardized currency exchange rates. Currencies belonging to various nations were pegged against the US dollar. The US dollar itself was pegged against the price of gold. It aimed to bring uniformity to global exchange rates.

What is Bretton Woods system of exchange rates?

Bretton Woods System Bretton woods was a semi-fixed exchange rates set up in the post-war period. The Bretton Woods exchange rate system had a system of pegged exchange rates with currencies pegged to the dollar. The dollar was fixed to the price of gold ($35 an ounce) – giving the US Dollar a fixed value.

What was the purpose of the Bretton Woods Agreement?

The Bretton Woods Agreement, which led to the Bretton Woods System, unified forty-four nations to tackle a communal problem. It created fixed foreign exchange rates under the Bretton Woods Monetary System, where all signatories pegged their currency to the US Dollar within 1% of fixed parity rates.

Was Bretton Woods a gold standard?

The architects of Bretton Woods had conceived of a system wherein exchange rate stability was a prime goal. Yet, in an era of more activist economic policy, governments did not seriously consider permanently fixed rates on the model of the classical gold standard of the 19th century.

What is the main point of Bretton Woods system?

Those at Bretton Woods envisioned an international monetary system that would ensure exchange rate stability, prevent competitive devaluations, and promote economic growth.

What are the features of Bretton Woods system and what were the reasons of its failure?

The US decision to suspend gold convertibility ended a key aspect of the Bretton Woods system. The remaining part of the System, the adjustable peg disappeared by March 1973. A key reason for Bretton Woods' collapse was the inflationary monetary policy that was inappropriate for the key currency country of the system.

What are the three components of the Bretton Woods system?

According to Barry Eichengreen, the Bretton Woods system operated successfully due to three factors: "low international capital mobility, tight financial regulation, and the dominant economic and financial position of the United States and the dollar."

What are the benefits of Bretton Woods system?

The benefits of the Bretton Woods system were a significant expansion of international trade and investment as well as a notable macroeconomic performance: the rate of inflation was lower on average for every industrialized country except Japan than during the period of floating exchange rates that followed, the real ...

What are the 5 elements of Bretton Woods system?

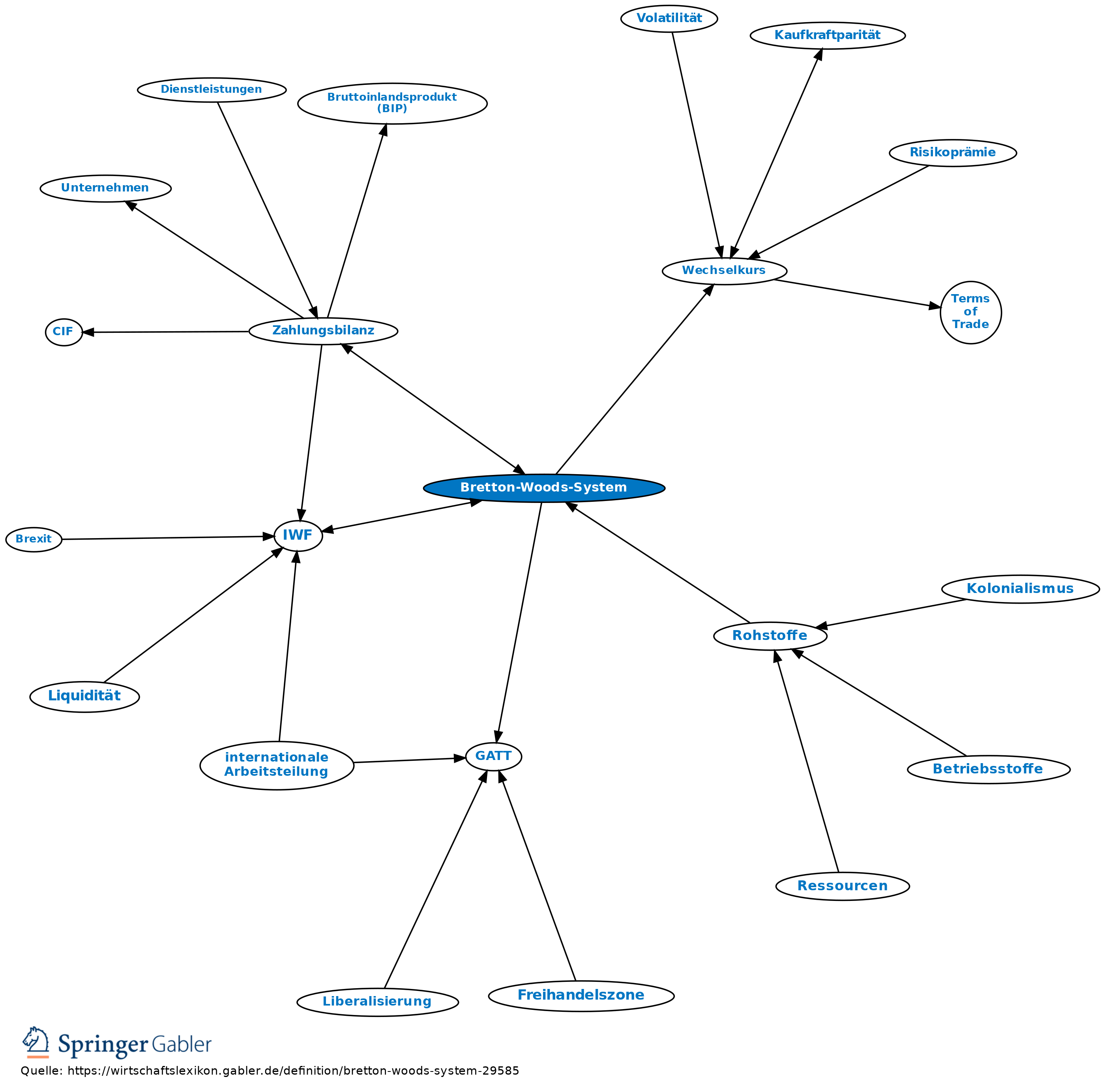

Bretton Woods SystemInternational Monetary Fund.Fixed Exchange Rate.Exchange Rate.Gold Standard.Exchange Rate Regime.Euro.Special Drawing Right.Balance of Payments.More items...

What are three major decisions from the Bretton Woods Conference?

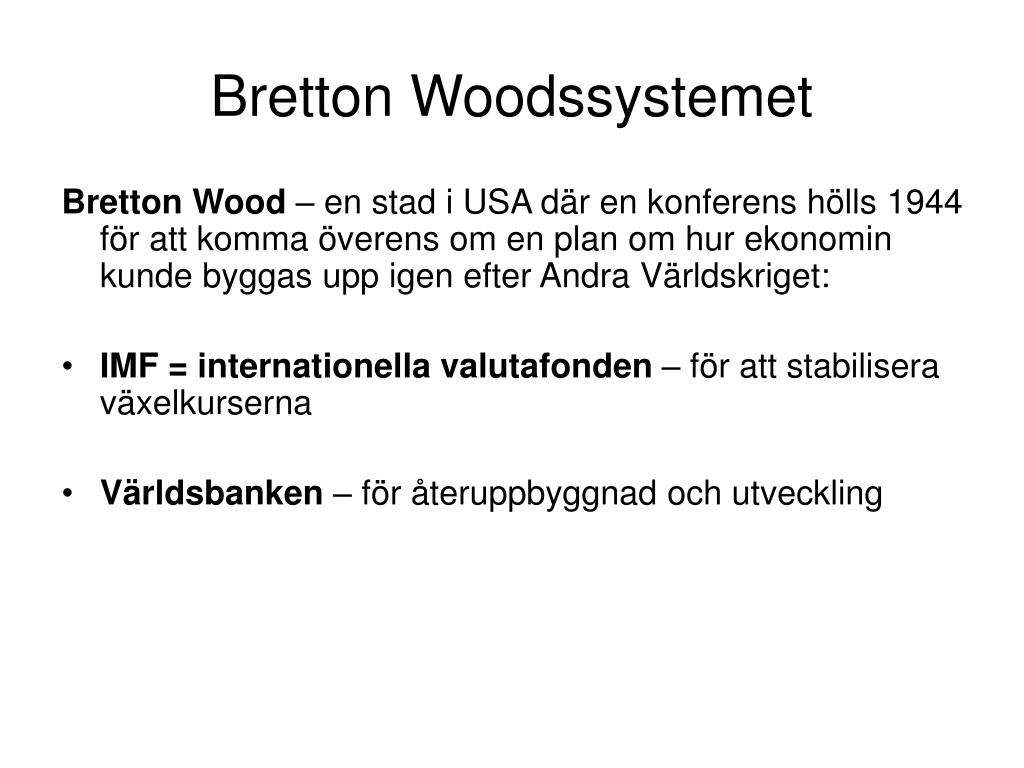

The conference was held from July 1 to 22, 1944. Agreements were signed that, after legislative ratification by member governments, established the International Bank for Reconstruction and Development (IBRD, later part of the World Bank group) and the International Monetary Fund (IMF).

What were the four major outcomes of the Bretton Woods Conference?

In July 1945, Congress passed the Bretton Woods Agreements Act, authorizing U.S. entry into the IMF and World Bank, and the two organizations officially came into existence five months later.

How many key elements does the Bretton Wood system have?

IMF income model has five key elements - Bretton Woods Project.

Why did Bretton Woods fail essay?

The Bretton Woods system then broke down because of its fundamental flaw of pledging convertibility to gold, which was unsustainable given the course of U.S. economic policy.

What are the weaknesses of Bretton Woods system?

Three basic weaknesses of the Bretton Woods System, identified by the Committee included liquidity, confidence and adjustment.

What led to the fall of the Bretton Woods system?

The monetary crisis reached its nadir when US President Richard Nixon caused the collapse of the Bretton Woods System by officially suspending the dollar's convertibility to gold on 15 August 1971.

Why did the Bretton Wood system collapse quizlet?

The Bretton Woods system collapsed when the U.S. could no longer guarantee gold redemption for the dollar. Over time many nations had devalued their currency relative to the dollar.

How did the Bretton Woods system help the world?

Countries were required to monitor and maintain their currency pegs which they achieved primarily by using their currency to buy or sell U.S. dollars as needed. The Bretton Woods System, therefore, minimized international currency exchange rate volatility which helped international trade relations. More stability in foreign currency exchange was also a factor for the successful support of loans and grants internationally from the World Bank. 1

When did the Bretton Woods system become fully functional?

It wasn't until 1958 that the Bretton Woods System became fully functional. Once implemented, its provisions called for the U.S. dollar to be pegged to the value of gold. Moreover, all other currencies in the system were then pegged to the U.S. dollar’s value.

What Was the Bretton Woods Agreement and System?

The Bretton Woods Agreement was negotiated in July 1944 by delegates from 44 countries at the United Nations Monetary and Financial Conference held in Bretton Woods, New Hampshire. Thus, the name “Bretton Woods Agreement. 1

What currency was used in the Bretton Woods system?

The Bretton Woods System required a currency peg to the U.S. dollar which was in turn pegged to the price of gold.

What were the goals of the Bretton Woods Agreement?

Approximately 730 delegates representing 44 countries met in Bretton Woods in July 1944 with the principal goals of creating an efficient foreign exchange system, preventing competitive devaluations of currencies, and promoting international economic growth. The Bretton Woods Agreement and System were central to these goals. The Bretton Woods Agreement also created two important organizations— the International Monetary Fund (IMF) and the World Bank. While the Bretton Woods System was dissolved in the 1970s, both the IMF and World Bank have remained strong pillars for the exchange of international currencies. 1

What were the two institutions created by the Bretton Woods Agreement?

The Bretton Woods Agreement created two Bretton Woods Institutions, the IMF and the World Bank. Formally introduced in December 1945 both institutions have withstood the test of time, globally serving as important pillars for international capital financing and trade activities. 1 .

When did the Bretton Woods system end?

dollar and other currencies were pegged to the U.S. dollar’s value. The Bretton Woods System effectively came to an end in the early 1970s when President Richard M. Nixon announced that the U.S. would no longer exchange gold for U.S. currency. 1

What were the main features of the Bretton Woods system?

The chief features of the Bretton Woods system were an obligation for each country to adopt a monetary policy that maintained its external exchange rates within 1 percent by tying its currency to gold and the ability of the International Monetary Fund (IMF) to bridge temporary imbalances of payments.

What was the Bretton Woods system?

The Bretton Woods system was the first example of a fully negotiated monetary order intended to govern monetary ...

How did interdependence affect the Bretton Woods era?

These new forms of monetary interdependence made large capital flows possible. During the Bretton Woods era, countries were reluctant to alter exchange rates formally even in cases of structural disequilibria. Because such changes had a direct impact on certain domestic economic groups, they came to be seen as political risks for leaders. As a result, official exchange rates often became unrealistic in market terms, providing a virtually risk-free temptation for speculators. They could move from a weak to a strong currency hoping to reap profits when a revaluation occurred. If, however, monetary authorities managed to avoid revaluation, they could return to other currencies with no loss. The combination of risk-free speculation with the availability of large sums was highly destabilizing.

What was the impact of the Bretton Woods Conference on the interwar period?

There was a high level of agreement among the powerful nations that failure to coordinate exchange rates during the interwar period had exacerbated political tensions. This facilitated the decisions reached by the Bretton Woods Conference. Furthermore, all the participating governments at Bretton Woods agreed that the monetary chaos of the interwar period had yielded several valuable lessons.

Where was the Bretton Woods Conference held?

Preparing to rebuild the international economic system while World War II was still being fought, 730 delegates from all 44 Allied nations gathered at the Mount Washington Hotel in Bretton Woods, New Hampshire, United States, for the United Nations Monetary and Financial Conference, also known as the Bretton Woods Conference.

How long did the Bretton Woods system last?

The Bretton Woods system lasted until 1971. By that time, inflation in the United States and a growing American trade deficit were undermining the value of the dollar. Americans urged Germany and Japan, both of which had favorable payments balances, to appreciate their currencies.

What was the role of the central banks in the Bretton Woods system?

Under the Bretton Woods system, central banks of countries other than the United States were given the task of maintaining fixed exchange rates between their currencies and the dollar. They did this by intervening in foreign exchange markets.

What was the idea of Bretton Woods?

The idea of the Bretton Woods was. Provide stable exchange rates to encourage investment and economic growth. Encourage countries to maintain low inflation / competitiveness – in order to maintain value of exchange rate.

What was the purpose of the Bretton Woods Conference?

The aim of the Bretton Woods conference was to provide greater global financial stability and enable the movement of capital to struggling economies.

Why was the Bretton Woods Conference held?

Bretton Woods is a ski resort chosen as a location for a conference in 1944 to decide on the new international monetary arrangements for after the end of the Second World War. It was attended by over 700 delegates from 44 allied countries.

When did Bretton Woods end?

There was a short period of a floating Bretton woods exchange rate, but it was effectively ended by 1971. Some of the structural changes which undermined the Bretton Woods system included: Growth of international currency markets with hedging and speculation causing fluctuations in the exchange rate.

What is the main feature of the Bretton Woods system?

The main feature of the Bretton Woods system is the obligation for each country to follow monetary policy rules to maintain the exchange rate of its currency at a fixed value of plus or minus one percent against gold and the IMF functions to bridge the temporary payment imbalance.

What is Bretton Woods system?

The Bretton Woods system is an agreement in 1944 for the global monetary system. Replace the gold standard with US dollars as an international currency standard. America is a superpower that has an important role in the Bretton Woods agreement. After signing the agreement, America, which is only one country that has the right to print dollars.

How many countries participated in the Bretton Woods agreement?

At the Bretton Woods conference, there were 44 countries involved in this agreement at the United Nations Monetary and Financial Conference held in Bretton Woods, New Hampshire. Under the Bretton Woods system agreement. Gold became the basis for the US dollar and other currencies were pegged to the value of the US dollar.

What happened before the Bretton Woods agreement?

Before the Bretton Woods agreement, most countries used gold as the standard of money, with each country guaranteeing their money with gold. So if at any time people will redeem money, it will follow the price of gold. After Bretton Woods, the gold standard does not apply, and the USD replaces gold as the currency standard.

What are the goals of Bretton Woods?

There are two main goals of the Bretton Woods conference, namely: 1 Encourage the reduction of tariffs and other obstacles in international trade. 2 Making a global economic order to minimize economic conflicts that occur between countries, and prevent World War II.

Why did the World Bank establish the Bretton Woods system?

Establishing The Bretton Woods system in order to resolve the battle between domestic autonomy and international stability.

What were the goals of the Bretton Woods Conference?

There are two main goals of the Bretton Woods conference, namely: Encourage the reduction of tariffs and other obstacles in international trade. Making a global economic order to minimize economic conflicts that occur between countries, and prevent World War II.

What is Bretton Woods system?

The Bretton Woods System is a set of unified rules and policies that provided the framework necessary to create fixed international currency exchange rates. Essentially, the agreement called for the newly created IMF to determine the fixed rate of exchange for currencies around the world.

What is the significance of the Bretton Woods Agreement?

Despite falling apart, the Bretton Woods summit and agreement are responsible for a number of notably important aspects in the financial world. First and foremost is the creation of the IMF and the World Bank. Both institutions remain vital to the global economy to this day.

What was the purpose of the 1944 Bretton Woods summit?

The summit was also looking for policies and regulations that would maximize the potential benefits and profits that could be derived from the global trading system. What resulted from the conference were the Bretton Woods Agreement and the Bretton Woods System.

Where was the Bretton Woods Agreement reached?

The Bretton Woods Agreement was reached in a 1944 summit held in New Hampshire, USA on a site by the same name. The agreement was reached by 730 delegates, who were the representatives of the 44 allied nations that attended the summit. The delegates, within the agreement, used the gold standard.

What were the features of the Bretton Woods System?

One of the primary features of the Bretton Woods System was a set conversion between currencies and the U.S. dollar and the U.S. dollar and gold. The value of the dollar was set at 1/35th of an ounce. The values of other currencies were pegged to the U.S. dollar. Those who held other currencies covered by the agreement always knew how many dollars they could receive for their British pounds or French francs.

What was the Bretton Woods Agreement and System?

The Bretton Woods Agreement was the result of a series of negotiations among the Allied powers near the end of World War II. In 1944, the nations agreed on how to set up the world’s financial system after the war. The agreement takes its name from Bretton Woods, New Hampshire, where the negotiators met to discuss the plan.

Who signed the Bretton Woods agreement?

Forty-four countries sent delegations to the Bretton Woods conference to negotiate the Bretton Woods System. Each of those 44 countries later signed the agreement.

What were the benefits of Bretton Woods currency pegging?

Stability and predictability were the benefits of currency pegging under Bretton Woods.

What institutions did the Bretton Woods Agreement create?

The Bretton Woods Agreement established two major world institutions: the International Monetary Fund and the World Bank.

How did Bretton Woods change the world?

The Bretton Woods system modified this somewhat, establishing the U.S. Dollar as the world’s reserve currency and setting its value equal to 1/35th of an ounce of gold. The U.S. maintained gold reserves in the Treasury and other nations pegged the costs of their money to the U.S. dollar. The goal was to make it easy to convert from any currency to the dollar, which had a known value in gold. This helped facilitate the exchange of currencies.

What is Robinhood Learn?

Robinhood Learn. Democratize finance for all. Our writers’ work has appeared in The Wall Street Journal, Forbes, the Chicago Tribune, Quartz, the San Francisco Chronicle, and more. Definition: The Bretton Woods Agreement was a financial agreement negotiated in 1944 in Bretton Woods, New Hampshire, that set the value of the U.S.

Overview

Origins

The political basis for the Bretton Woods system was in the confluence of two key conditions: the shared experiences of two World Wars, with the sense that failure to deal with economic problems after the first war had led to the second; and the concentration of power in a small number of states.

There was a high level of agreement among the powerful nations that failure t…

Design of the financial system

Free trade relied on the free convertibility of currencies. Negotiators at the Bretton Woods conference, fresh from what they perceived as a disastrous experience with floating rates in the 1930s, concluded that major monetary fluctuations could stall the free flow of trade.

The new economic system required an accepted vehicle for investment, trade, …

Readjustment

The Bretton Woods arrangements were largely adhered to and ratified by the participating governments. It was expected that national monetary reserves, supplemented with necessary IMF credits, would finance any temporary balance of payments disequilibria. But this did not prove sufficient to get Europe out of its conundrum.

Postwar world capitalism suffered from a dollar shortage. The United States was running large b…

Late application

After the end of World War II, the U.S. held $26 billion in gold reserves, of an estimated total of $40 billion (approx 65%). As world trade increased rapidly through the 1950s, the size of the gold base increased by only a few percentage points. In 1950, the U.S. balance of payments swung negative. The first U.S. response to the crisis was in the late 1950s when the Eisenhower administration placed …

The Bretton Woods system in the 21st century

In the wake of the Global financial crisis of 2008, some policymakers, such as Chace and others have called for a new international monetary system that some of them also dub Bretton Woods II. On the other side, this crisis has revived the debate about Bretton Woods II.

On 26 September 2008, French President Nicolas Sarkozy said, "we must rethink the financial system from scratch, as at Bretton Woods."

See also

• Bretton Woods Committee

• General Agreement on Tariffs and Trade

• Monetary hegemony and Dedollarisation

• Neoliberalism

Further reading

• Allen, Larry (2009). The Encyclopedia of Money (2nd ed.). Santa Barbara, CA: ABC-CLIO. pp. 50–51. ISBN 978-1598842517.

• Van Dormael, A.; Bretton Woods : birth of a monetary system; London MacMillan 1978

• Michael D. Bordo and Barry Eichengreen; A Retrospective on the Bretton Woods System: Lessons for International Monetary Reform; 1993