What are the different instruments of fiscal policy?

- Consumer Credit Rationing

- Moral Persuasion

- Direct Action

What is fiscal policy, its objectives, tools and types?

What is Fiscal Policy, Its Objectives, Tools, and Types. Fiscal policy is an essential tool at the disposable of the government to influence a nation’s economic growth. The fiscal policy is used in coordination with the monetary policy, which a central bank uses to manage the money supply in a country. The meaning, types, objectives, and ...

What are the most important purposes of fiscal policy?

- is the policy to regulate and control money supply and credit in the economy.

- is carried out by the central bank of the country.

- makes use of tools such as bank rate, SLR, open market operations etc.

- functions include controlling financial institutions, influencing cost and availability of credit, controlling inflation and sale and purchase of paper

What is the meaning and objectives of fiscal policy?

Fiscal policy refers to how government receives and spends money. Fiscal policy can be seen from two perspectives – taxation and spending. There are six main objectives of fiscal policy – full employment, economic growth, control debt, control inflation, re-distribution, and polictical.

What are the 3 fiscal policy tools?

Expansionary fiscal policy tools include increasing government spending, decreasing taxes, or increasing government transfers. Doing any of these things will increase aggregate demand, leading to a higher output, higher employment, and a higher price level.

What are the primary tools of fiscal policy quizlet?

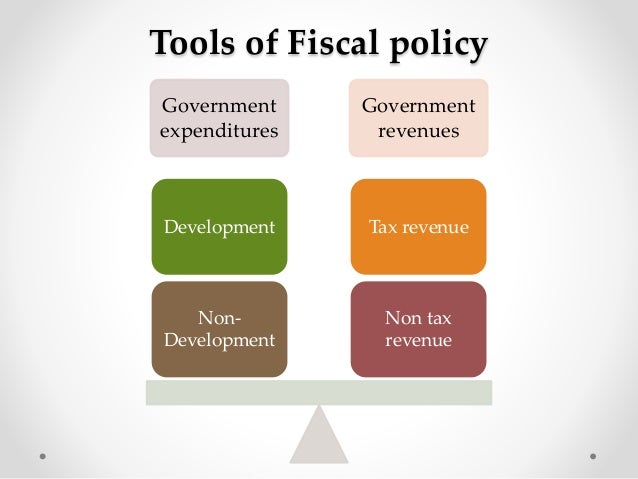

The primary tools of fiscal policy are: government expenditure and taxation.

What are the three tools of fiscal policy quizlet?

The three tools of monetary policy are: the reserve ratio, the discount rate and open market operations.

What are the tools of monetary policy quizlet?

open market operations, discount lending, and reserve requirements. The three tools of monetary policy used to control the money supply and interest rates.

What is fiscal policy quizlet?

Fiscal Policy. The government's use of taxes, spending, and transfer payments to promote economic growth and stability.

What is fiscal policy fiscal policy can be described as quizlet?

What is fiscal policy? Fiscal policy can be described as changes in government spending and taxes to achieve macroeconomic policy objectives.

What are some examples of fiscal policy?

The two major examples of expansionary fiscal policy are tax cuts and increased government spending. Both of these policies are intended to increase aggregate demand while contributing to deficits or drawing down budget surpluses.

What is fiscal policy fiscal policy can be described as?

Fiscal policy is the use of government spending and taxation to influence the economy. Governments typically use fiscal policy to promote strong and sustainable growth and reduce poverty.

What are the two fiscal tools?

The government possesses two major fiscal tools to influence the economy. These tools can be divided into spending tools and revenue tools. Spending tools refer to the overall government spending. On the other hand, revenue tools refer to taxes collected by the government.

How do taxes help a country?

Through taxes, a country can build infrastructure, thus improving service delivery to citizens; and

What is indirect tax?

Indirect taxes refer to taxes imposed on specific goods such as cigarettes, alcohol, fuel and services. VAT is an example of an indirect tax. Health and education can be excluded from indirect taxes.

What is the current government spending?

Current Government Spending. Current government spending includes goods and services, which it regularly provides and regularly. Such services include defense, health, and education. Consequently, this is aimed at improving the country’s labor productivity.

How long does it take to implement capital spending?

Capital spending strategies tend to take time. Formulation and implementation of capital spending may take several years; and

How does government expenditure affect unemployment?

An increase in government expenditure causes an increase in aggregate demand; and. It reduces the unemployment rate. An increase in government expenditure increases aggregate demand and the need for companies to employ more workers to meet the growing demand for goods and services.

Why is raising taxes important?

Raising taxes helps in discouraging alcoholism and drug abuse. This is made possible by increasing taxes on tobacco and alcoholic drinks; The government can achieve its fiscal needs through taxes; Spending tools such as defense are services that benefit everyone.

What is fiscal policy?

fiscal policy. federal government policy on taxes, spending, and borrowing that is designed to influence business fluctuations. two general categories of fiscal policy to fight a recession. government spends more money. government cuts taxes, giving people more money to spend.

Why is it difficult to time fiscal policy?

it can be difficult to time fiscal policy so that the AD curve shifts at just the right moments. the best case for fiscal policy. is when a recession is caused by a decrease in aggregate demand. but sometimes problem isn't that people aren't spending enough; the problem is that people don't have enough to spend.

What are the effects of tax cuts?

cuts tax rates as opposed to rebates have two expansionary effects, the spending effect and an additional incenvtive effect from the increased incentive to invest and work. temporary tax credit. can accelerate investments that would have happened anyway. a temporary reduction in the payroll tax or in teh sales tax can.

What does the government do to help people?

government cuts taxes, giving people more money to spend

When is bond financed expansionary policy most effective?

bond-financed expansionary policy is most effective when the private sector is

Can you increase spending without increasing taxes?

sell bonds, get cash on hand, can increase spending without increasing taxes

Does spending program affect economic conditions?

a spending program in contrast has a direct impact on economic conditions, at least once the money is put into the eonomy

What are the tools of fiscal policy?

The primary tools of fiscal policy are: government expenditure and taxation. If the economy is in a recession, the most appropriate fiscal policy would be to: increase government spending and cut taxes, thus running a higher budget deficit. An increase in government spending causes: the aggregate demand curve to shift to the right.

Can government action achieve those goals?

No government action can achieve those goals.

Why does fiscal policy fail to stabilize the economy?

fiscal policy fails to stabilize the economy because budget (deficits/surplus) are more attractive to voters

When the economy is operating at less than full employment, should the government run a budget?

when the economy is operating at less than full employment, the government should run a budget (surplus or deficit )

What is multiplier effect?

the multiplier effect refers to the fact that a change is spending (aggregate demand) will