Standard IFRS Requirements

- Statement of Financial Position: This is the balance sheet. IFRS influences the ways in which the components of a balance sheet are reported.

- Statement of Comprehensive Income: This can take the form of one statement or be separated into a profit and loss statement and a statement of other income, including property and equipment.

Why does flying IFR require a rating?

Why IFR Training Is Important. When pilots use the term “your IFR ” or “the IFR,” they are referring to “ instrument rating requirements .”. In aviation, “IFR” stands for “Instrument Flight Rules.”. Having an IFR rating means that a pilot is authorized to fly in conditions of low visibility —specifically, with a ceiling below 1,000 feet above ground level, and/or visibility of one mile to less than three miles.

What are the minimum instruments required for an IFR flight?

No person may operate an airplane under IFR unless it has - (a) A vertical speed indicator; (b) A free-air temperature indicator; (c) A heated pitot tube for each airspeed indicator; (d) A power failure warning device or vacuum indicator to show the power available for gyroscopic instruments from each power source; (e) An alternate source of static pressure for the altimeter and the airspeed ...

When is IFR required?

In the United States, a flight operating under IFR is required to provide position reports unless ATC advises a pilot that the plane is in radar contact. The pilot must resume position reports after ATC advises that radar contact has been lost, or that radar services are terminated.

What are commercial pilot requirements?

- Important Facts About Commercial Airline Pilots

- Flight Time Requirement. The FAA requires pilots to have 1,500 hours of flight time to be eligible for an airline transport license.

- The Federal Aviation Administration Exam. ...

- Health Requirements. ...

- Educational Requirements. ...

What are the requirements for proper implementation of IFRS?

IFRS implementation involves four stages:Impact assessment.Planning & designing.Realization.Data conversion.

What are the general requirements for financial statements under IFRS?

A complete set of financial statements comprises:a statement of financial position as at the end of the period;a statement of profit and loss and other comprehensive income for the period. ... a statement of changes in equity for the period;a statement of cash flows for the period;More items...

What are the IFRS 17 requirements?

IFRS 17 requires a company to measure insurance contracts using updated estimates and assumptions that reflect the timing of cash flows and any uncertainty relating to insurance contracts. This requirement will provide transparent reporting about a company's financial position and risk.

What are the 4 principles of IFRS?

IFRS requires that financial statements be prepared using four basic principles: clarity, relevance, reliability, and comparability.

What are the requirements of IFRS 10?

IFRS 10:requires an entity (the parent) that controls one or more other entities (subsidiaries) to present consolidated financial statements;defines the principle of control, and establishes control as the basis for consolidation;More items...

Why are IFRS guidelines required?

IFRS Accounting Standards bring transparency by enhancing the international comparability and quality of financial information, enabling investors and other market participants to make informed economic decisions.

What do you mean by IFRS?

International Financial Reporting StandardsInternational Financial Reporting Standards (IFRS) are a set of accounting standards that govern how particular types of transactions and events should be reported in financial statements. They were developed and are maintained by the International Accounting Standards Board (IASB).

What are the key disclosure requirements under IFRS 16?

IFRS 16 contains both quantitative and qualitative disclosure requirements. The objective of the disclosure requirements is to give a basis for users of financial statements to assess the effect that leases have on the financial statements. Entities should focus on the disclosure objective, not on a fixed checklist.

What IFRS 16 compliance?

IFRS 16 introduces a single lessee accounting model and requires a lessee to recognise assets and liabilities for all leases with a term of more than 12 months, unless the underlying asset is of low value.

What is the main objectives of IFRS?

Its principal objectives are: to develop, in the public interest, a single set of high quality, understandable, enforceable and globally accepted international financial reporting standards (IFRS Standards) based upon clearly articulated principles.

What is IFRS principle based?

The international financial reporting standards (IFRS) system – the most common international accounting standard – is a principles-based approach, which states that a company's financial statements must be understandable, readable, comparable and relevant to current financial transactions.

What is IFRS and its benefits?

International Financial Reporting Standards (IFRS) is an accounting policy for the preparation of the financial reports. IFRS accounting standards lay down principles rather than rules, which leaves companies room for maneuver in their financial statement.

What are the requirements of financial statements?

Financial statements need to reflect certain basic features: fair presentation, going concern, accrual basis, materiality and aggregation, and no offsetting. Financial statements must be prepared at least annually, must include comparative information from the previous period, and must be consistent.

What are the requirements in preparation of financial statements?

How to Prepare Financial StatementsStep 1: Verify Receipt of Supplier Invoices. ... Step 2: Verify Issuance of Customer Invoices. ... Step 3: Accrue Unpaid Wages. ... Step 4: Calculate Depreciation. ... Step 5: Value Inventory. ... Step 6: Reconcile Bank Accounts. ... Step 7: Post Account Balances. ... Step 8: Review Accounts.More items...•

What are the four requirements on financial statements?

They are: (1) balance sheets; (2) income statements; (3) cash flow statements; and (4) statements of shareholders' equity.

What are the 4 required financial statements?

4 Types of Financial Statements That Every Business NeedsBalance Sheet. Also known as a statement of financial position, or a statement of net worth, the balance sheet is one of the four important financial statements every business needs. ... Income Statement. ... Cash Flow Statement. ... Statement of Owner's Equity.

What is IFRS standard?

What are IFRS Standards? IFRS standards are International Financial Reporting Standards ( IFRS) that consist of a set of accounting rules that determine how transactions and other accounting events are required to be reported in financial statements. They are designed to maintain credibility and transparency in the financial world, ...

Where are IFRS standards used?

IFRS are the standard in over 100 countries, including the EU and many parts of Asia and South America. The United States, however, has not yet adopted them and the SEC is still deciding whether or not they should move toward them as the official standard of accounting.

Why are IFRS standards important?

They are designed to maintain credibility and transparency in the financial world, which enables investors and business operators to make informed financial decisions. IFRS standards are issued and maintained by the International Accounting Standards Board and were created to establish a common language so that financial statements can easily be ...

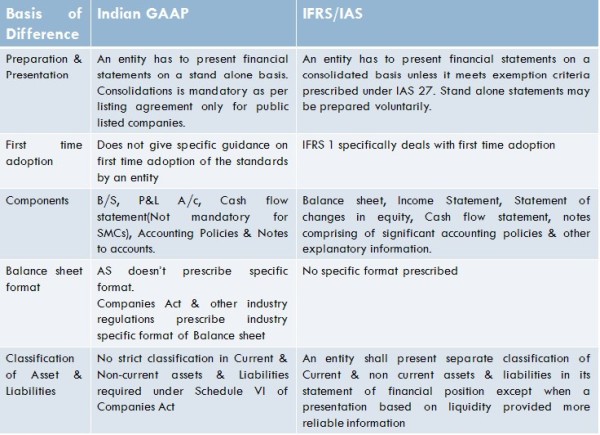

What is the difference between IFRS and GAAP?

The largest difference between the US GAAP (Generally Accepted Accounting Principles) and IFRS is that IFRS is principle-based while GAAP is rule-based. Rule-based frameworks are more rigid and allow less room for interpretation, while a principle-based framework allows for more flexibility.

What is an IFRS note?

Notes comprising a summary of the significant accounting policies and other explanatory notes which disclose information required by IFRS and information which will help with understanding the financial statements. A company that applies IFRS must explicitly state in these notes that it complies with the standards.

What is financial reporting quality?

Financial reporting quality relates to the quality of the information that is contained... Read More

What is the purpose of IAS 1?

1 stipulates that a complete set of financial statements should include: Notes comprising a summary of the significant accounting policies and other explanatory notes which disclose information required by IFRS and information which will help with understanding the financial statements.

What is IAS 1?

IAS No. 1 also specifies several general features which should underlie the preparation of financial statements. These features include:

What is the IAS number 1?

1, Presentation of Financial Statements.

What is a classified statement of financial position?

Classified Statement of Financial Position: the balance sheet should distinguish between current and non-current assets, and current and non-current liabilities unless a liquidity-based presentation is deemed to be more relevant;

When should accrual accounting be used?

Accrual basis: Accrual accounting should be used when preparing financial statements , except where cash flow information is involved. Materiality and Aggregation: Material items are items that can influence the economic decision-making of users of financial statements.

What are the requirements of IFRS?

According to the IFRS, business entities in Dubai must have the following statements in their financial reports to meet the standards as specified by the global accounting rules and regulations –

Role of IFRS

The role of International Financial Reporting Standards for businesses in Dubai is extremely crucial. Following points will intimate you regarding the importance of the IFRS for businesses in Dubai: –

Benefits of IFRS

Here are some of the major benefits that can be availed by businesses in the UAE through the implementation of the IFRS: –