The first step in a judicial foreclosure is. acceleration of the loan. In a strict foreclosure, a lender takes title to the liened property directly. What is the order of payments in foreclosure? First, the costs and expenses of conducting the foreclosure sale are paid. Second, the lien that was foreclosed on is paid off.

- You get behind in your mortgage payments. ...

- The bank sends a letter notifying you of its intent to begin foreclosure. ...

- The bank files a lawsuit. ...

- The bank gives you notice of the lawsuit. ...

- You have a chance to respond.

What are the steps in the judicial foreclosure?

May 16, 2020 · The first step in a judicial foreclosure is. acceleration of the loan. In a strict foreclosure, a lender takes title to the liened property directly. What is the order of payments in foreclosure? First, the costs and expenses of conducting the foreclosure sale are paid. Second, the lien that was foreclosed on is paid off.

Which steps are included in the foreclosure process?

Jun 02, 2010 · In order for a foreclosure sale to be held in a judicial foreclosure, the actual lawsuit must be over, either through Summary Judgment or after trial, and all that remains are the final details of getting the property sold. Again the process and details vary by state, but all entail setting a date for sale.

How to start foreclosure proceedings?

Mar 21, 2022 · Judicial Foreclosure A judicial foreclosure requires the lienholder to file a civil lawsuit against the homeowner. They must obtain a judgment from the court before they are allowed to sell the property. This procedure is rare in Texas. See Rule 309 of the Texas Rules of Civil Procedure for the court rule governing judicial foreclosures.

What are the steps leading up to a foreclosure?

When the mortgage holder sends a “notice of intent” to the borrower, the foreclosure process begins. Yet the borrower can stop the foreclosure simply …

How many methods are used for the foreclosure process?

In addition to understanding their state's laws, homeowners should know that there are three common methods used to foreclose on a property.

What does a judicial foreclosure involve quizlet?

involves court-ordered transfer of the mortgaged property to the lender; available in a few states. Judicial foreclosure occurs in states that use a two-party mortgage document (borrower and lender) that does not contain a "power of sale" provision.

How long does a judicial foreclosure take in California?

It takes several months for a lender to foreclose on a California property. If everything goes according to schedule, the process typically takes approximately 120 days — about four months — but the process can take as long as 200 or more days to conclude.Feb 8, 2021

Which of the following describes judicial foreclosure?

Which of the following describes judicial foreclosure? The property is sold by court order after the mortgagee has given sufficient public notice.

What is foreclosure in basic terms?

A foreclosure is the legal process where your mortgage company obtains ownership of your home (i.e., repossess the property). A foreclosure occurs when the homeowner has failed to make payments and has defaulted or violated the terms of their mortgage loan.

What is foreclosure in basic terms quizlet?

What is foreclosure in basic terms? A borrower defaults on a loan, causing the lender to force the sale of the property to free up its investment.

Which is California's most common foreclosure process?

nonjudicial foreclosure processThe nonjudicial foreclosure process is used most commonly in our state. Nonjudicial foreclosure is the most common type of foreclosure in California.

What is the order of payments in foreclosure in California?

The proceeds of a trustee's (foreclosure) sale are distributed in the following order: First to the costs and expenses of the sale; next to the payment of obligations secured by the deed of trust which is being foreclosed on (i.e. to the foreclosing lender); third to junior lien holders in the order of their priority, ...Feb 15, 2018

How can a foreclosure process be temporarily stalled?

You can stop a foreclosure in its tracks, at least temporarily, by filing for bankruptcy. Chapter 7 bankruptcy. Filing for Chapter 7 bankruptcy will stall a foreclosure, but only temporarily. Once the bankruptcy case gets filed, a legal protection called the “automatic stay” goes into effect.6 days ago

What is the first step in judicial foreclosure?

Judicial Foreclosure: Complaint Filing a complaint or petition for foreclosure with the courts, Issuing summons to the borrower and all interested parties notifying them of the suit and stating the time period in which they must contest the foreclosure, and.Mar 9, 2017

How does a foreclosure work?

Foreclosure is when the lender takes back property when the homeowner fails to make payments on a mortgage. Foreclosure processes differ by state. Typically, if you fall a few months behind on your mortgage payments, the. Don't wait for the foreclosure process to begin.Aug 28, 2017

What is judicial mortgage?

JUDICIAL MORTGAGE. In Louisiana, it is the lien resulting from judgments, whether these be rendered on contested cases, or by default, whether they be final or provisional, in favor of the person obtaining them.

What is foreclosure process?

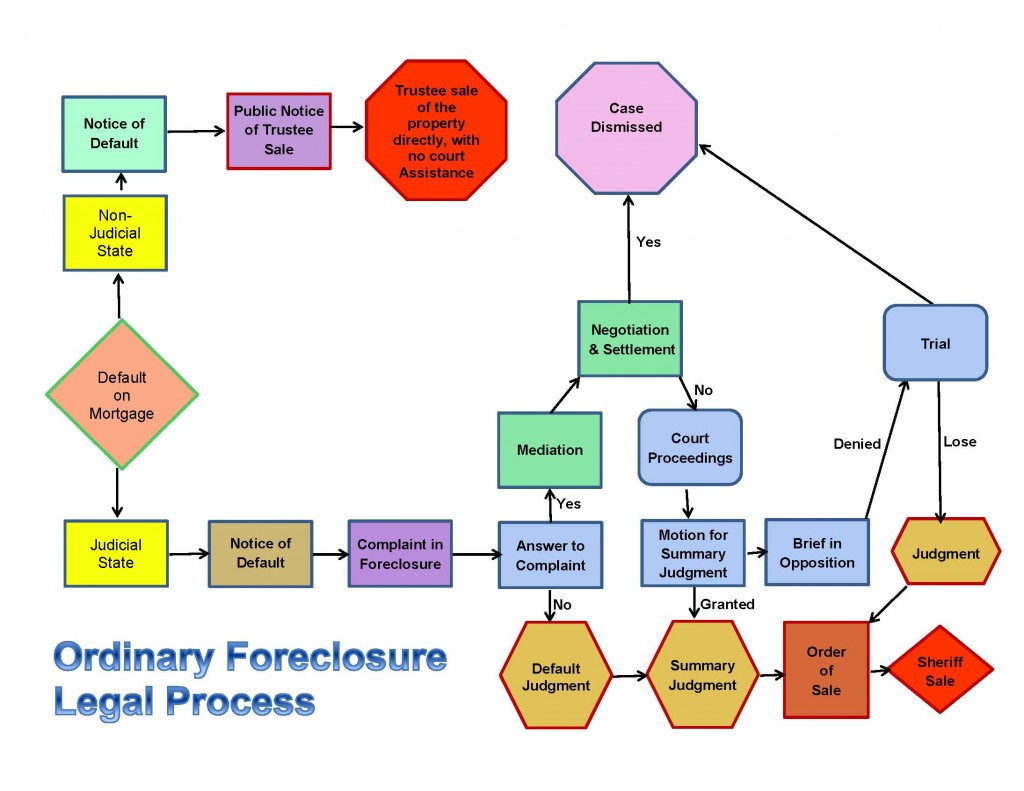

The Foreclosure Process#N#Foreclosure is the process by which the lender takes control of the property which was pledged as collateral for the mortgage debt and sells the property to raise money to pay on the debt created by the Note. The sale extinguishes the borrower's interest in the property although some states have redemption period after the sale. Other interests are also extinguished if the foreclosure is done properly, including the rights of other owners, spouses, junior mortgages, lienholders, and some taxes. The foreclosure process is very different depending on whether it is judicial or non-judicial.#N#In the US, approximately half of the states permit non-judicial foreclosure. The rest of the states require judicial foreclosure. A few states allow both.#N#However, the process is different in each state; accordingly the material here is intended as a general guide. It is for educational purposes only, and is not legal advice.

What is judicial foreclosure?

Judicial Foreclosure#N#Judicial foreclosure is a lawsuit, similar to other kinds of lawsuits. It is formal and much more complex, and generally takes longer than non-judicial foreclosure, although this varies by jurisdiction. The point of a judicial foreclosure is for the lender to obtain from the court a judgment in foreclosure, and the right to hold a sale of the mortgaged property. The court is involved in the foreclosure process all the way through. So, if a borrower feels there is something wrong or improper occurring, he or she can raise those issues within the judicial foreclosure proceeding.

What is summary judgment in foreclosure?

If granted, that ends the case - it means the moving party wins. Summary judgment is the goal of foreclosure plaintiffs. Technically, it means that the court is convinced that there is no reason for a trial, that the pleadings and issues raised in the case by the parties demonstrate that the party requesting summary judgment does not have to do any more to prove its case. If a defendant does not raise issues which constitute defenses to foreclosure, and does not establish that there are issues that need to be sorted out at trial, the court is likely to grant summary judgment, since that removes one more case from the court's swollen caseload.

How long does it take to cure a foreclosure?

The cure period is typically between 20 and 60 days, depending on the mortgage document and state law.

How does a foreclosure sale work?

Notice of the date is given to all interested parties and in many states also provided publicly in the newspaper and often now by posting on the web sites of Courts, Clerks of Court or other similar locations. The foreclosure sale is handled by a judicial officer - in some states it is the Sheriff, in some states it is the Clerk of Courts, in some states a referral is made to a court-appointed master. The date is set, notice is given, and then the actual sale occurs. It is generally in the form of an auction.

What is a response to a foreclosure?

Response#N#If a borrower or other interested party has any reason to contest a foreclosure, he she or it needs to file a Response to the Complaint unless there is a defective process service issue (see above). There are many different kinds of responses, and it is critical that the right one be utilized at the right time.#N#Motions and other objections normally deal with preliminary matters of some kind, including technical defects in the Complaint, technical defects in service of process, etc. There are various kinds of preliminary motions. Most applicable usually to foreclosure, depending on the facts, are Motions to Quash Service, Motions to Dismiss, Motions to Strike, and often there are others, depending on the specific law and procedure of the state in question.

What is service of process?

Service of Process#N#Lawsuits are begun by service of process. All states have laws that govern exactly how this has to work to be valid. In most states, it means that the Summons and Complaint (see below) must be handed directly to you or to an adult member of your household. However, all states have laws to cover situations where you avoid service of process or cannot be served personally. Service of process must be done properly in accordance with the law of the state in question to be valid. These days we see many examples of improper service of process. If process is not served properly, this issue MUST be raised before any other defensive pleadings or it is waived.

What is foreclosure process?

The foreclosure process begins when a borrower defaults on its loan, whether by failing to make timely payments or meet its other obligations under the loan documents (e.g., failing to maintain property insurance). Evidence of the default is the linchpin of a lender being able to establish it has the right to foreclose.

How long does it take to get a foreclosure?

Time to Complete the Process. Depending on the state, foreclosures can occur as quickly as 30 days, and up to seven months (or longer). Right of Redemption.

What is a workout in a mortgage?

Common workouts include forbearance, loan modification, a repayment plan, deed in lieu of foreclosure or short sale. Acceleration Demand. If the borrower fails to cure the default before the period stated in the notice, the lender demands an acceleration of the loan.

What is a deficiency judgment?

The terms of the mortgage or deed of trust. Deficiency Judgments. Where the proceeds from the foreclosure sale aren’t enough to pay the borrower’s unpaid debt, the lender may be able to obtain a deficiency judgment against the borrower for the difference.

What happens when a borrower fails to meet its loan obligations?

When a borrower fails to meet its loan obligations, the lender may try to foreclose on the property securing the loan. “Foreclosure” is just the series of steps a lender has to take in order to force the sale of such property and use the sale proceeds to recover its unpaid debt. This is simple enough in theory.

What is a judgment of foreclosure?

As noted above, lenders typically ask for a judgment of foreclosure (money judgment for principal, pre-judgment interest, reasonable expenses, and costs of the action), an order for sale of the property, and in some cases a deficiency judgment.

How to set aside a foreclosure sale?

In a judicial foreclosure, other than the methods listed above to object to the sale, the only ways to set aside the sale is by either appealing the court’s decision, filing a motion to reopen the case, or filing a new lawsuit to overturn the sale.

What is judicial foreclosure in Texas?

A judicial foreclosure requires the lienholder to file a civil lawsuit against the homeowner. They must obtain a judgment from the court before they are allowed to sell the property. This procedure is rare in Texas.

What is non judicial foreclosure?

A non-judicial foreclosure (also referred to as a "power of sale" foreclosure) allows the lienholder to sell the property without having to file a civil lawsuit against the homeowner. In order to qualify for a non-judicial foreclosure, the lienholder must have a deed of trust with a "power of sale" clause, giving them the authority to sell ...

Can you apply for a quasi judicial foreclosure in Texas?

However, under Rules 735 and 736 of the Texas Rules of Civil Procedure [PDF], certain lienholders can apply for what is known as an "expedited foreclosure" (also referred to as a quasi-judicial foreclosure) which, if granted, allows the process to move forward similar to a non-judicial foreclosure.

What is judicial foreclosure?

By Trinise L. Castro. A judicial foreclosure requires the lender to first file and win a lawsuit for the right to foreclose. As such, the judicial foreclosure process lasts much longer than a non-judicial foreclosure, which does not require a court proceeding.

How long does it take to get a foreclosure?

A judicial foreclosure can take several months to a year. When a mortgage payor defaults on the loan, the lender can file court proceedings to seek a judgment for money due. The judgment allows the property to be sold in a foreclosure sale.

What happens when a mortgage holder sends a notice of intent?

Notice of Intent. When the mortgage holder sends a “notice of intent” to the borrower , the foreclosure process begin s. Yet the borrower can stop the foreclosure simply by paying the past-due payments, late fees and interest added. If the borrower does not do so, then the lender can file a lawsuit to gain possession of the property ...

What happens if a borrower doesn't file a lawsuit?

If the borrower does not do so, then the lender can file a lawsuit to gain possession of the property and recover money owed. However, the borrower can still save the property from foreclosure by making arrangements to bring the defaulted loan current.

What is foreclosure auction?

Foreclosure Auction. The property is offered up for sale at a foreclosure auction . A foreclosed property is typically set to be sold at the minimum price equal to the balance owed to the lender. However, the property may not be not priced low enough to appeal to an auction bidder.

How long does it take to respond to a notice of intent to sell?

After the judge issues a judgment, the lender typically sends the borrower a notice of intent to sell the property. The borrower has 10 days to respond to the notice. The borrower can avoid the foreclosure sale if he pays off the entire balance of the mortgage. However, he also has to pay the related foreclosure costs and attorney’s fees. The borrower may seek a loan modification, short sale or bankruptcy protection in an attempt to save his property from foreclosure.

How long does it take to respond to a summons and complaint?

The “summons and complaint” states the time frame in which the borrower must respond to contest or dispute the lawsuit. The time frame is usually 15 to 30 days. The borrower has the right to explain to the judge why he should be able to keep the property. However, the borrower is not required to file a response.

How many phases of foreclosure are there?

If you (or a loved one) are facing foreclosure, make sure you understand the process. While there is variation from state to state, there are normally six phases of a foreclosure procedure.

How long does it take to get a house foreclosed on?

There are typically six phases in the foreclosure process and the exact steps vary state by state. Before a home is foreclosed on, owners are given 30 days to fulfill their mortgage obligations. Most lenders would actually prefer to avoid foreclosing on a property.

What is phase 1 of mortgage?

Phase 1: Payment Default. A payment default occurs when a borrower has missed at least one mortgage payment. The lender will send a missed payment notice indicating that it has not yet received that month’s payment.

What happens if a property is not sold at a public auction?

If the property is not sold during the public auction, the lender will become the owner and attempt to sell the property through a broker or with the assistance of a real estate owned (REO) asset manager. 8 These properties are often referred to as “bank owned,” and the lender may remove some of the liens and other expenses in an attempt to make the property more attractive.

What happens when you buy a foreclosed home?

When a foreclosed property is purchased, it is up to the buyer to say how long the previous owners may stay in their former home. Once the highest bidder has been confirmed and the sale is completed, a trustee’s deed upon sale will be provided to the winning bidder.

When are mortgage payments due?

Typically, mortgage payments are due on the first day of each month, and many lenders offer a grace period until the 15th of the month. After that, the lender may charge a late payment fee and send the missed payment notice. 2 . After two payments are missed, the lender will often follow up with a demand letter.

When is a notice of trustee sale recorded?

If the loan has not been made up to date within the 90 days following the notice of default, then a notice of trustee sale will be recorded in the county where the property is located.

How long does a foreclosure take?

Steps in a Judicial Foreclosure. Judicial foreclosures usually take longer than nonjudicial foreclosures, generally lasting from a few months to several years, depending on the state. Below are the steps in a typical judicial foreclosure.

What happens after a judgment is issued on a foreclosure?

At the foreclosure sale, if a third party makes the highest bid on the home, that person or entity will then become the new owner of the property. But in most cases, the foreclosing party will be the high bidder. At the foreclosure sale, the foreclosing party typically bids on the property using a "credit bid." A credit bid means that the bank bids the debt that the borrower owes.

What is the difference between foreclosure and foreclosure?

When a house is sold at a foreclosure sale for less than the outstanding mortgage debt, the difference between the debt and the foreclosure sale price is called the deficiency. In many states, the foreclosing party can get a personal judgment, called a "deficiency judgment," against the borrower for the deficiency as part of a judicial foreclosure or by filing a suit thereafter. (Learn how lenders collect deficiency judgments .)

What is foreclosure in the US?

Foreclosure is the process where a home is sold to pay off an unpaid, secured debt. In some states, foreclosures are always judicial, which means they go through the court system. In other states, foreclosures are typically nonjudicial (out of court), although these states permit judicial foreclosures as well.

What is a credit bid in foreclosure?

A credit bid means that the bank bids the debt that the borrower owes. Sometimes, the court must confirm the sale afterward.

What is a breach letter for a mortgage?

Most mortgages and deeds of trust contain a provision that requires the foreclosing party to send you a notice, commonly called a breach letter, letting you know that you are in default on the loan before it can accelerate the loan and proceed with foreclosure.

What is redemption period?

A redemption period is an amount of time when the foreclosed homeowner may redeem (repurchase) the home after the foreclosure.

Why do we need judicial foreclosure?

1 . Many states require judicial foreclosure to protect the equity that debtors may still have in the property. Judicial foreclosure also serves to prevent strategic disclosures by unscrupulous lenders.

What is a foreclosing party?

The foreclosing party next files a lawsuit in the county where the property is located and requests the court to allow the home to be sold to pay the debt. As part of the lawsuit, the foreclosing party includes a petition for foreclosure that explains why a judge should issue a foreclosure judgment. In most cases, the court will do so, ...

How long does a foreclosure last?

Judicial foreclosures can last anywhere from six months to around three years , depending on the state. To begin the foreclosure process, the mortgage servicer, or the company to which mortgage services are paid, must wait until the borrower is delinquent on payments for 120 days. 4 .

What is the difference between foreclosure and debt?

The difference between the debt and the foreclosure sale price is the deficiency. In most states, the foreclosing party can get a personal judgment against the borrower for the deficiency. 3 . Mortgage lending discrimination is illegal.

How long does it take for a servicer to cure a default?

In most cases, the debtor then has 30 days to cure the default, and if they are not able to, the servicer will move forward with foreclosure proceedings.

Is foreclosure judicial or nonjudicial?

2 Many states require foreclosures to be judicial, but in some states, foreclosures can be either nonjudicial or judicial. 1 .

Can a deficiency judgment be used on a foreclosure?

Depending on the state, the foreclosing party may also be entitled to a deficiency judgment. A deficiency judgment allows the house to be sold at a foreclosure sale for less than the outstanding mortgage debt. The difference between the debt and the foreclosure sale price is the deficiency. In most states, the foreclosing party can get ...

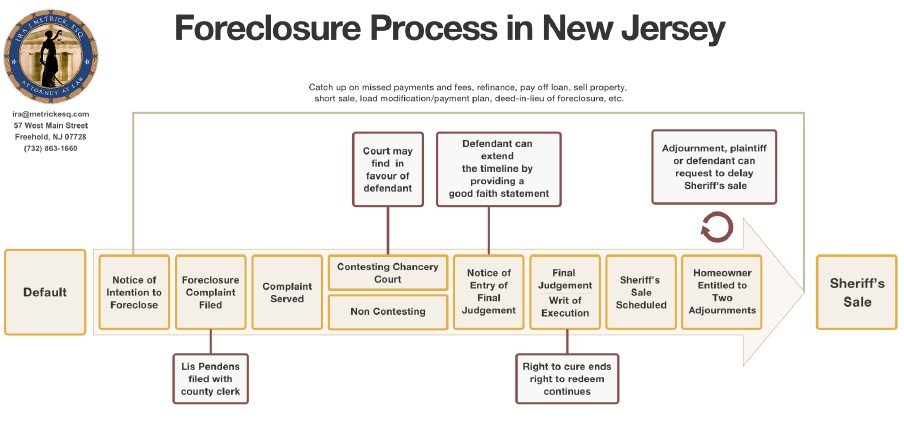

How long does it take for a bank to foreclose on a property in Texas?

It takes approximately 60 days for a bank to foreclose on a property in Texas. There is a chance the foreclosure process will be delayed if the borrower decides to contest the action before a judge or files for bankruptcy. Foreclosure can also be delayed if the borrower seeks adjournments and delays of sales. Go to top.

What is foreclosure in mortgage?

Foreclosure is when a lender takes possession of a mortgaged property using legal measures. When a foreclosure occurs, a lender attempts to recover the loan balance from an individual, or borrower, who has failed to make payments. YouTube. ehowfinance.

What is pre foreclosure?

Pre-foreclosure is the beginning of the foreclosure process. During pre-foreclosure, the lender files a non-payment notice on the property. This notice lets the borrower know the lender will take legal action against them if the debt is not repaid.

How long does a mortgage lender have to give a notice of default in Texas?

The notice of default grants the homeowner at least 20 days to make their payments before a notice of sale can be given.

What is the difference between judicial and non-judicial foreclosure?

There are two types of foreclosure, judicial and non-judicial. A judicial foreclosure process in Texas requires the lender to appear in court before they can get a mandate to auction off the property legally. Non-Judicial foreclosure in Texas is simpler and easier than the traditional foreclosure process. Non-judicial foreclosure allows the lender ...

How long does a foreclosure notice have to be sent?

Once the cure period expires and at least 21 days before the foreclosure sale, the lender sends the notice of sale through certified mail to the borrowers named in the mortgage. The lender also files the Notice of Sale with the county clerk (in the property’s county) and posts it at the local courthouse.

How much notice do you need to give to sell your home?

Before a lender can sell your home at auction, the borrower must have at least 21 days’ notice in writing. In addition to a 21-day notice, the lender must file paperwork with the clerk of courts in the property’s county.