- Single filers: $12,950

- Married filing jointly: $25,900

- Married filing separately: $12,950

- Heads of households: $19,400

What are federal income tax brackets?

For comparison purposes, however, your Federal tax bracket is the tax bracket in which your last earned dollar in any given tax period falls. You can think of the bracketed income tax as a flat amount for all of the money you earned up to your highest tax bracket, plus a marginal percentage of any amount you earned over that.

Are tax brackets for adjusted gross income?

Your tax bracket is based on your filing status and your adjusted gross income for the year. When you file your tax return, you will choose from one of five filing statuses : Your adjusted gross income is the gross income you made for the year, less any allowable deductions that you can take.

What is marginal tax brackets?

Your marginal tax rate is the tax rate you would pay on one more dollar of taxable income. This typically equates to your tax bracket. For example, if you're a single filer with $30,000 of taxable income, you would be in the 12% tax bracket. If your taxable income went up by $1, you would pay 12% on that extra dollar too.

What are IRS tax tables?

Tax tables are used to calculate the tax you owe based on your filing status and taxable income. They’re published by the Internal Revenue Service (IRS) and by each state that collects an income tax.

How do you know what tax bracket you're in?

You can calculate the tax bracket you fall into by dividing your income that will be taxed into each applicable bracket....How to Figure Out Your Tax BracketThe first $10,275 is taxed at 10%: $1,027.50.The next $31,500 (41,775-10,275) is taxed at 12%: $3,780.The last $33,225 (75,000-41,775) is taxed at 22% $7,309.50.More items...

What are the 2020 2021 tax brackets?

There are seven federal tax brackets for the 2021 tax year: 10%, 12%, 22%, 24%, 32%, 35% and 37%. Your bracket depends on your taxable income and filing status. These are the rates for taxes due in April 2022.

What are the 2022 IRS tax brackets?

There are still seven tax rates in effect for the 2022 tax year: 10%, 12%, 22%, 24%, 32%, 35% and 37%. However, as they are every year, the 2022 tax brackets were adjusted to account for inflation.

How much money do you have to make to not pay taxes 2021?

In 2021, for example, the minimum for single filing status if under age 65 is $12,550. If your income is below that threshold, you generally do not need to file a federal tax return.

How much taxes do you pay if you make $120000?

If you make $120,000 a year living in the region of California, USA, you will be taxed $38,515. That means that your net pay will be $81,485 per year, or $6,790 per month. Your average tax rate is 32.1% and your marginal tax rate is 43.0%.

What is the extra standard deduction for seniors over 65?

If you are age 65 or older, your standard deduction increases by $1,750 if you file as Single or Head of Household. If you are legally blind, your standard deduction increases by $1,750 as well. If you are Married Filing Jointly and you OR your spouse is 65 or older, your standard deduction increases by $1,400.

At what age is Social Security no longer taxed?

There is no age at which you will no longer be taxed on Social Security payments.

What is the standard deduction for seniors over 65?

If you're at least 65 years old or blind, you can claim an additional standard deduction of $1,350 in 2021 ($1,700 if you're claiming the single or head of household filing status). As with the 2022 standard deduction, the additional deduction amount is doubled if you're both 65 or older and blind.

What is the standard deduction for seniors over 65 in 2021?

For 2021, they get the normal standard deduction of $25,100 for a married couple filing jointly. They also both get an additional standard deduction of $1,350 for being over age 65.

What is the extra standard deduction for seniors over 65?

If you are age 65 or older, your standard deduction increases by $1,750 if you file as Single or Head of Household. If you are legally blind, your standard deduction increases by $1,750 as well. If you are Married Filing Jointly and you OR your spouse is 65 or older, your standard deduction increases by $1,400.

What is the standard deduction for senior citizens in 2021?

Increased Standard Deduction For the 2021 tax year, seniors get a tax deduction of $14,250 (this increases in 2022 to $14,700). Taking the standard deduction is often the best option and can eliminate the need to itemize.

How much federal tax do I pay on $80000?

$80000 Annual Salary - Payment Periods OverviewYearly%1Federal Income Tax10,368.0012.96%Adjusted Federal Income Tax10,368.0012.96%Social Security4,960.006.20%Medicare1,160.001.45%4 more rows

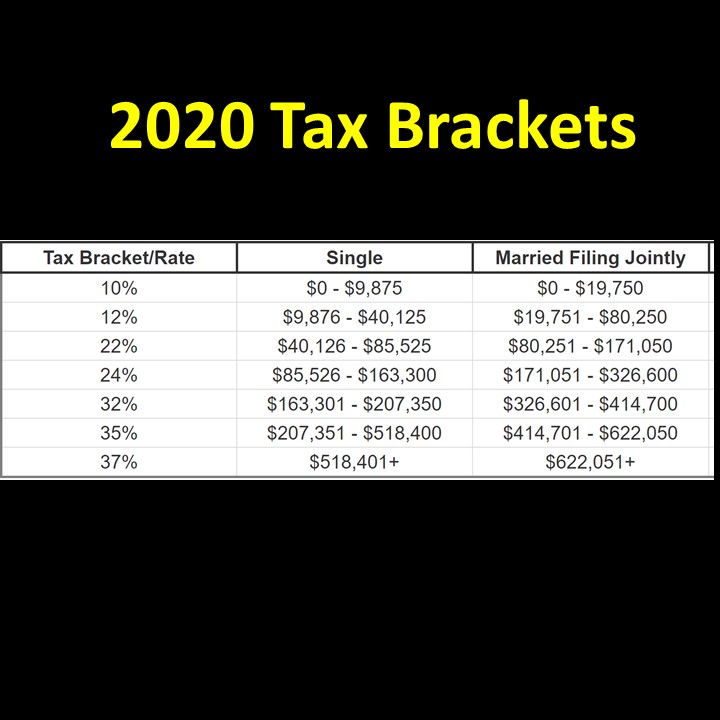

What is the tax rate for 2020?

In 2020, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (Table 1). The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of $518,400 and higher for single filers and $622,050 and higher for married couples filing jointly.

How much is exempt from tax in 2020?

In 2020, the first $15,000 of gifts to any person is excluded from tax. The exclusion is increased to $157,000 for gifts to spouses who are not citizens of the United States.

What is standard deduction?

The standard deduction reduces a taxpayer’s taxable income by a set amount determined by the government. It was nearly doubled for all classes of filers by the 2017 Tax Cuts and Jobs Act as an incentive for taxpayers not to itemize deductions when filing their federal income taxes.

What is the AMT tax rate?

However, this exemption phases out for high-income taxpayers. The AMT is levied at two rates: 26 percent and 28 percent.

How many tax provisions does the IRS have?

On a yearly basis the IRS adjusts more than 40 tax provisions for inflation. This is done to prevent what is called “ bracket creep ,” when people are pushed into higher income tax bracket s or have reduced value from credits and deductions due to inflation, instead of any increase in real income.

Why was the Alternative Minimum Tax created?

The Alternative Minimum Tax (AMT) was created in the 1960s to prevent high-income taxpayers from avoiding the individual income tax. This parallel tax income system requires high-income taxpayers to calculate their tax bill twice: once under the ordinary income tax system and again under the AMT.

What is a tax bracket?

A tax bracket is the range of incomes taxed at given rates, which typically differ depending on filing status. In a progressive individual or corporate income tax system, rates rise as income increases. There are seven federal individual income tax brackets; the federal corporate income tax system is flat.

What is the tax rate for 2020?from taxfoundation.org

In 2020, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (Table 1). The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of $518,400 and higher for single filers and $622,050 and higher for married couples filing jointly.

How much is exempt from tax in 2020?from taxfoundation.org

In 2020, the first $15,000 of gifts to any person is excluded from tax. The exclusion is increased to $157,000 for gifts to spouses who are not citizens of the United States.

What is standard deduction?from taxfoundation.org

The standard deduction reduces a taxpayer’s taxable income by a set amount determined by the government. It was nearly doubled for all classes of filers by the 2017 Tax Cuts and Jobs Act as an incentive for taxpayers not to itemize deductions when filing their federal income taxes.

What is the AMT tax rate?from taxfoundation.org

However, this exemption phases out for high-income taxpayers. The AMT is levied at two rates: 26 percent and 28 percent.

How many tax provisions does the IRS have?from taxfoundation.org

On a yearly basis the IRS adjusts more than 40 tax provisions for inflation. This is done to prevent what is called “ bracket creep ,” when people are pushed into higher income tax bracket s or have reduced value from credits and deductions due to inflation, instead of any increase in real income.

What is taxable income?from taxfoundation.org

Taxable income is the amount of income subject to tax, after deductions and exemptions. For both individuals and corporations, taxable income differs from—and is less than—gross income.

Why was the Alternative Minimum Tax created?from taxfoundation.org

The Alternative Minimum Tax (AMT) was created in the 1960s to prevent high-income taxpayers from avoiding the individual income tax. This parallel tax income system requires high-income taxpayers to calculate their tax bill twice: once under the ordinary income tax system and again under the AMT.

When is the 2022 efile tax season?

The 2022 eFile Tax Season for 2021 Returns starts in January 2022. Start and sign up now and be part of the eFile.com Tax Win Zone.

Is efile.com less than TurboTax?

Did You Know that eFile.com is up to 60% less than TurboTax?

How The Brackets Work

In the American tax system, income tax rates are graduated, so you pay different rates on different amounts of taxable income, called tax brackets. There are seven tax brackets in all. The more you make, the more you pay.

A New Top Tax Rate For The Future

Will the top income tax rate go up in the near future? It will if President Biden gets his way. Last year, as part of his American Families Plan, the president proposed increasing the highest tax rate from 37% to 39.6%, which is where it was before the Tax Cuts and Jobs Act of 2017. He was not able to get that change passed last year.

Tax Brackets & The Tax Cuts And Jobs Act Of 2017

The Tax Cuts and Jobs Act of 2017 guides current tax policy. Among its notable achievements:

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site.

Tax Brackets For : What Is My Tax Bracket

We may receive a commission if you sign up or purchase through links on this page. Here’s more information.

How Do Tax Brackets Work In Ontario

In Ontario, tax brackets are based on net income for income tax purposes. There are 5 tax brackets:

How Federal Tax Brackets Work

The most important thing to understand about Canadas federal income tax brackets is that the rates apply only to the earnings that fall within each tiersort of like a ladder.

When is the federal tax bracket due for 2019?

Federal Income Tax Bracket for 2019 (filing deadline: July 15, 2020) In rare cases, such as when one spouse is subject to tax refund garnishing because of unpaid debts to the state or federal government, opting for the “Married filing separately” tax status can be advantageous.

What is the federal tax bracket?

The Federal Income Tax Brackets. The U.S. currently has seven federal income tax brackets, with rates of 10%, 12%, 22%, 24%, 32%, 35% and 37%. If you’re one of the lucky few to earn enough to fall into the 37% bracket, that doesn’t mean that the entirety of your taxable income will be subject to a 37% tax. Instead, 37% is your top marginal tax rate.

How many brackets did Trump lower the tax rate?

The tax reform passed by President Trump and Congressional Republicans lowered the top rate for five of the seven brackets. It also increased the standard deduction to nearly twice its 2017 amount.

What is the federal income tax rate for 2019?

Federal Income Tax Brackets for Tax Years 2019 and 2020. The federal income tax rates remain unchanged for the 2019 and 2020 tax years: 10%, 12%, 22%, 24%, 32%, 35% and 37%. The income brackets, though, are adjusted slightly for inflation. Read on for more about the federal income tax brackets for Tax Year 2019 ( due July 15, ...

How long do you have to file taxes in 2019?

If you need even more time than July 15 to file your 2019 taxes, you can use Form 4868 to get another three months (to October 15.) But remember, this extension does not apply to payments. So if you owe taxes, you should estimate what you owe and pay what you can to avoid a penalty and interest.

What is marginal tax rate?

With a marginal tax rate, you pay that rate only on the amount of your income that falls into a certain range. To understand how marginal rates work, consider the bottom tax rate of 10%. For single filers, all income between $0 and $9,700 is subject to a 10% tax rate.

How much is the tax rate for dividends in 2020?

Youngsters with accounts that earn more than $1,100 in dividends and interest in 2020 will be liable for taxes according to the rates applied to trusts and estates — quickly escalating brackets that range from 10% (up to $2,600) to 37% (more than $12,950).

When is the 2020 tax deadline?

Note: This can get a bit confusing. The filing deadline for the 2020 tax year is April 15, 2021. (Or October 15, 2021 if you apply for an automatic filing — but not paying — extension.) Which means you account for your 2020 tax bill in 2021.

What determines your tax bracket?

As mentioned above, determining your tax bracket hinges on two things: filing status and taxable income. Here are some useful details:

How to calculate effective tax rate?

To calculate your effective tax rate, take the total amount of tax you paid and divide that number by your taxable income. Your effective tax rate will be much lower than the rate from your tax bracket, which claims against only your top-end earnings.

How much is long term capital gains taxed?

economy, long-term capital gains — gains from securities sold after having been held for at least a year — are taxed at rates lower than comparable ordinary income. Tax brackets for long-term capital gains (investments held for more than one year) are 15% and 20%. An additional 3.8% bump applies to filers with higher modified adjusted gross incomes (MAGI).

Why do married couples file separate taxes?

Married Filing Separately – A married couple files separate tax returns to keep an individual income lower. This is beneficial in certain situations like repaying student loans under an income-driven repayment plan.

What is marginal tax rate?

Marginal Tax Rates. Marginal tax rates refer to the rate you pay at each level (bracket) of income. Increments of your income are taxed at different rates, and the rate rises as you reach each of the seven “marginal” levels in the current system. This means you may have several tax rates that determine how much you owe the IRS.

How many tax brackets are there?

There are seven federal income tax brackets. Here's what they are, how they work and how they affect you.

What is the tax bracket for a single person with 30,000?

For example, if you're a single filer with $30,000 of taxable income, you would be in the 12% tax bracket. If your taxable income went up by $1, you would pay 12% on that extra dollar too.

How much does TaxAct save?

TaxAct is a solid budget pick, and NerdWallet users can save 25% on federal and state filing costs.

What is marginal tax rate?

What is a marginal tax rate? Your marginal tax rate is the tax rate you would pay on one more dollar of taxable income. This typically equates to your tax bracket. For example, if you're a single filer with $30,000 of taxable income, you would be in the 12% tax bracket.

What does it mean to take all the deductions?

In other words: Take all the tax deductions you can claim — they can reduce your taxable income and could kick you to a lower bracket, which means you pay a lower tax rate .

How do tax credits affect your tax bracket?

Tax credits directly reduce the amount of tax you owe; they don't affect what bracket you're in. Tax deductions, on the other hand, reduce how much of your income is subject to taxes. Generally, deductions lower your taxable income by the percentage of your highest federal income tax bracket.

What does it mean to be in a progressive tax bracket?

Being "in" a tax bracket doesn't mean you pay that federal income tax rate on everything you make. The progressive tax system means that people with higher taxable incomes are subject to higher federal income tax rates, and people with lower taxable incomes are subject to lower federal income tax rates. The government decides how much tax you owe ...

How to qualify for lower tax bracket?

To legally qualify for a lower tax bracket, you need to reduce your taxable income. The way to do this is to claim every tax deduction and credit you possibly can. The tax deductions you’re eligible for depends on whether you’re self-employed or a salaried employee.

How much is the standard deduction for 2018?

For 2018, single filers and married filers filing separately were entitled to take a $12,000 standard deduction. Married filers deciding to file jointly were entitled to $24,000. Heads of household could claim $18,000.

What if I Choose to Itemize?

There are a few common deductions you might decide to take if you’re itemizing. But you need to make sure you qualify for them, so speak to a professional before you add them to your tax return. The last thing you want is to get audited.

Why are tax credits important?

Tax credits are the holy grail of the tax code because they reduce your income tax liability, rather than reducing your taxable income. Everything is refunded on a dollar-for-dollar basis. There are both State and Federal tax credits you should consider, including: Earned income tax credit.

How many deductions does H&R Block have?

When you file with H&R Block Online they will search over 350 tax deductions and credits to find every tax break you qualify for so you get your maximum refund, guaranteed.

Does the tax bracket change every year?

Every year, the Federal tax brackets chart tends to change. With the new changes to the tax code, under the Tax Cuts and Jobs Act (TCJA), it’s more important than ever to determine which Federal tax bracket you fall into. It could influence how much you pay by thousands of dollars. Table of Contents [ show]

What are the current tax brackets for 2020?

There are seven tax brackets for most ordinary income for the 2020 tax year: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent and 37 percent.

Did federal taxes change in 2020?

Although the tax rates didn't change, the income tax brackets for 2021 are slightly wider than for 2020. The difference is due to inflation during the 12-month period from September 2019 to August 2020, which is used to figure the adjustments.

Are tax laws changing for 2021?

The income taxes assessed in 2021 are no different. Income tax brackets, eligibility for certain tax deductions and credits, and the standard deduction will all adjust to reflect inflation. For most married couples filing jointly their standard deduction will rise to $25,100, up $300 from the prior year.