Reverse Mortgage Terms You Should Know (A-Z)

- Amortization Schedule The amortization schedule is an estimate given to each borrower that shows how interest and mortgage insurance is likely to accrue on your reverse mortgage loan over the life of the loan. ...

- Affidavit of Heirship ...

- Appraisal Management Company (AMC) ...

- Asset Dissipation ...

- Case Number ...

- Community Property ...

- Conditions (Underwriting) ...

- Condo Approval ...

Is a reverse mortgage better than a traditional mortgage?

The answer is that it depends on the situation. They have many similarities, but there are a few key differences that make reverse mortgages a better choice than a traditional mortgage. Or vice versa. This article breaks down the basics of these two types of home loans to give you a general idea of when to choose one over the other.

Is a reverse mortgage really worth it?

There are a few factors that can make a reverse mortgage worth it: Your home is increasing in value considerably. If you’re building up a lot of equity in your home, you may be able to take out a reverse mortgage and still have money left over for your estate. You plan to stay in your home for a long time.

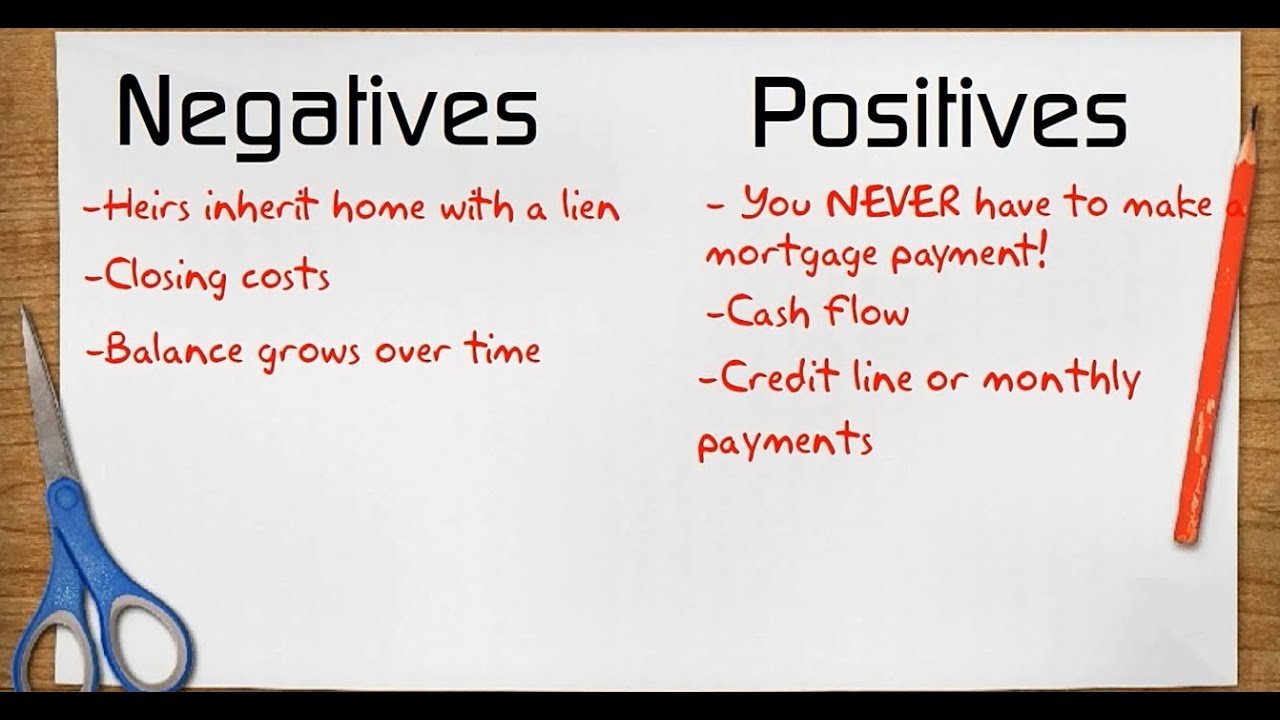

What are the bad things about reverse mortgage?

Why a Reverse Mortgage is a Bad Idea

- Putting Home Ownership at Risk. The fact that no payments must be made on a reverse mortgage as long as one homeowner remains living in the house is a major ...

- High Upfront Costs. The fees on a reverse mortgage can be expensive. ...

- Effects on Government Program Eligibility. ...

- Heirs Get a Problem Rather Than Inheritance. ...

What are the conditions of a reverse mortgage?

Reverse mortgages can use up the equity in your home, which means fewer assets for you and your heirs. Most reverse mortgages have something called a “non-recourse” clause. This means that you, or your estate, can’t owe more than the value of your home when the loan becomes due and the home is sold.

What is the downside to a reverse mortgage?

A big downside to reverse mortgages is the loss of home equity. Because you're not paying down your reverse mortgage balance, you'll make less profit when you sell, or limit your borrowing power if you need a new loan. You'll pay high upfront fees.

How long is the term on a reverse mortgage?

The number of years a reverse mortgage lasts can vary widely, and depends on your unique situation. For example, if you took out a reverse mortgage as soon as you were eligible at age 62 and lived an average life span staying comfortably in your home, you'd enjoy the benefits for about 16 years.

What are the terms of a typical reverse mortgage?

A reverse mortgage does not have to be repaid within a quantified term the way a traditional mortgage does. Rather, a reverse mortgage is repaid when the borrower dies, sells his house or otherwise moves out of the house for 12 months. A reverse mortgage can be taken out by a homeowner aged 62 or older.

What are the 3 types of reverse mortgages?

There are several kinds of reverse mortgage loans: (1) those insured by the Federal Housing Administration (FHA); (2) proprietary reverse mortgage loans that are not FHA-insured; and (3) single-purpose reverse mortgage loans offered by state and local governments.

What happens when you run out of equity in a reverse mortgage?

If you owe more than your home is worth, but sell your home for the appraised fair market value, the remaining balance will be paid by mortgage insurance. When the last remaining borrower passes away, the loan has to be repaid. Most heirs will repay the loan by selling the home.

Do you get all the money at once with a reverse mortgage?

You have three main options for receiving your money: through a line of credit, monthly payout, or lump sum payout. Your borrowing limit is called the "principal limit." It takes into account your age, the interest rate on your loan, and the value of your home.

What do you pay monthly on a reverse mortgage?

Do you make monthly payments on a reverse mortgage? No. Monthly mortgage payments on your reverse mortgage are optional.

What is the average rate of interest on a reverse mortgage?

50% Monthly MIP = 7.31% in total interest charges. Assumes $250,000 loan amount and includes . 50% Mortgage Insurance, standard 3rd party closing costs....HECM Reverse Mortgage Rates.Fixed RateAdjustable RateLending Limit7.06% (8.564% APR)7.365% (2.625 Margin)$970,8007.18% (8.700% APR)7.615% (2.875 Margin)$970,8002 more rows

Is the interest high on a reverse mortgage?

Reverse mortgages can have higher interest rates than traditional mortgage loans or home equity loans. The rate that you pay for a reverse mortgage can vary by lender, and you may have the option to choose a fixed or variable interest rate.

Who owns the house after a reverse mortgage?

No. When you take out a reverse mortgage loan, the title to your home remains with you. Most reverse mortgages are Home Equity Conversion Mortgages (HECMs).

Who benefits most from a reverse mortgage?

1. Helps Secure Your Retirement. Reverse mortgages are ideal for retirees who don't have a lot of cash savings or investments but do have a lot of wealth built up in their homes. A reverse mortgage allows you to turn an otherwise illiquid asset into cash that you can use to cover expenses in retirement.

Is a reverse mortgage a good idea for seniors?

The Takeaway If you're an older homeowner who plans to stay put, a reverse mortgage may be a sensible way to help fund your golden years. This is especially true for seniors whose spouses are also over age 62 and can be listed as co-borrowers on the loan.

What is the average age for a reverse mortgage?

62 and olderHome Equity Conversion Mortgages (HECMs), the most common type of reverse mortgage loan, are a special type of home loan available to homeowners who are 62 and older.

How is a reverse mortgage paid off?

A reverse mortgage is commonly paid back by using the proceeds from the sale of the home. If the loan comes due because you've passed away, your heirs will be responsible for handling the repayment and will have a few options for repaying the loan: Sell the home and use the proceeds to repay the loan.

Is it worth it to do a reverse mortgage?

They're a great fit for some homeowners, but a reverse mortgage can leave surviving family members with no equity, and sometimes no home. A reverse mortgage turns home equity into cash -- without requiring that you move out of your home. It can be a helpful financial tool for some retirees.

How does a reverse mortgage work in 2022?

A reverse mortgage is a type of loan that allows homeowners ages 62 and older, typically who've paid off their mortgage, to borrow part of their home's equity as tax-free income. Unlike a regular mortgage in which the homeowner makes payments to the lender, with a reverse mortgage, the lender pays the homeowner.

What is a Reverse Mortgage?

A reverse mortgage is a loan. It is not a government grant. You are not selling your home to the bank and you are still on title to the property. J...

Who Qualifies for a Reverse Mortgage?

Reverse mortgages are available to borrowers age 62 and over for the government insured Home Equity Conversion Mortgage (HECM) and some proprietary...

How are they Different from Home Equity Loans?

The reverse mortgage has greater flexibility than any other loan currently being offered such as equity loans or HELOC's. It also requires that bor...

How Much Can You Get From a Reverse Mortgage?

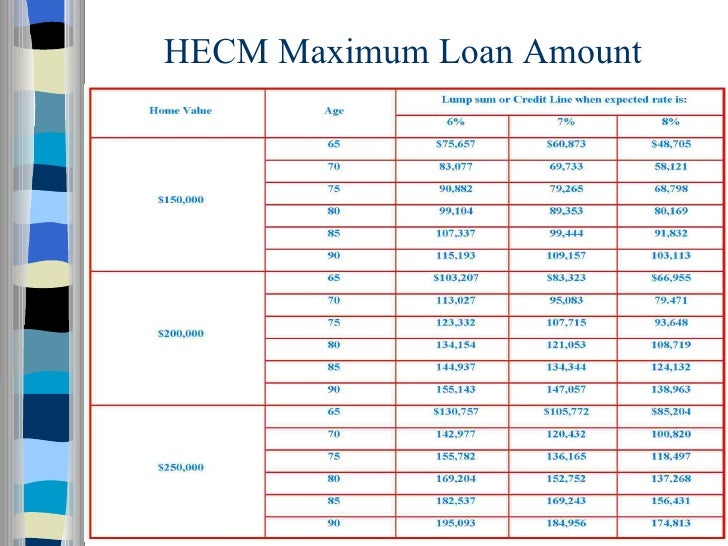

On a forward mortgage, you apply for a loan amount and the lender may approve that amount or a lower amount depending on your circumstances (income...

How is HUD Involved in Reverse Mortgages?

There are two parties involved in every mortgage transaction – a lender and a borrower. That is also true with a reverse mortgage. But in addition...

Was this answer helpful to you?

Please do not share any personally identifiable information (PII), including, but not limited to: your name, address, phone number, email address, Social Security number, account information, or any other information of a sensitive nature.

Why is reverse mortgage not free money?

This is because interest and fees are added to the loan balance each month. As your loan balance increases, your home equity decreases. A reverse mortgage loan is not free money. It is a loan where borrowed money + interest + fees each month = rising loan balance. The homeowners or their heirs will eventually have to pay back the loan, ...

What is reverse mortgage?

What is a reverse mortgage? A Home Equity Conversion Mortgage (HECM), the most common type of reverse mortgage, is a special type of home loan only for homeowners who are 62 and older. A reverse mortgage loan, like a traditional mortgage, allows homeowners to borrow money using their home as security for the loan.

How long do you have to cancel a reverse mortgage?

You have a three-day right to cancel a reverse mortgage. With most reverse mortgages, you have three business days after the loan closing to cancel the deal for any reason, without penalty. This is known as your right of “rescission.”. To cancel, you must notify the lender in writing.

When is a reverse mortgage repaid?

The loan is repaid when the borrower no longer lives in the home. Interest and fees are added to the loan balance each month and the balance grows. With a reverse mortgage loan, homeowners are required to pay property taxes and homeowners insurance, use the property as their principal residence, and keep their house in good condition.

How to cancel a loan with a lender?

To cancel, you must notify the lender in writing. Send your letter by certified mail, and ask for a return receipt so that you have documentation of when you sent and when the lender received your cancellation notice. Keep copies of any communications between you and your lender. After you cancel, the lender has 20 days to return any money you’ve ...

Do you have to pay monthly mortgage payments on a reverse mortgage?

However, unlike a traditional mortgage, with a reverse mortgage loan, borrowers don’t make monthly mortgage payments. The loan is repaid when the borrower no longer lives in the home. Interest and fees are added ...

What Is a Reverse Mortgage?

In a word, a reverse mortgage is a loan. A homeowner who is 62 or older and has considerable home equity can borrow against the value of their home and receive funds as a lump sum, fixed monthly payment, or line of credit. Unlike a forward mortgage—the type used to buy a home—a reverse mortgage doesn’t require the homeowner to make any loan payments.

What Are the Requirements for a Reverse Mortgage?

If you own a house, condominium, or townhouse, or a manufactured home built on or after June 15, 1976 , then you may be eligible for a reverse mortgage. Under FHA rules, cooperative housing owners cannot obtain reverse mortgages since they do not technically own the real estate in which they live but rather own shares of a corporation. In New York, where co-ops are common, state law further prohibits reverse mortgages in co-ops, allowing them only in one- to four-family residences and condos.

How Much Can You Borrow with a Reverse Mortgage?

For an HECM, the amount that you can borrow will be based on the youngest borrower’s age, the loan’s interest rate, and the lesser of your home’s appraised value or the FHA’s maximum claim amount, which is $822,375 as of Jan. 1, 2021.

Is a Reverse Mortgage Expensive?

Home equity conversion mortgages (HECMs), the most common type of reverse mortgage, bring a number of fees and costs. Some are one-time fees, and some are ongoing costs.

How Does a Reverse Mortgage Work When You Die?

Repaying the loan can get complicated, depending on how much equity you have in your house and whether you want the house to stay in your family after your death. 16

Can You Refinance a Reverse Mortgage?

Yes. You can refinance a reverse mortgage as long as it has been at least 18 months since you closed on the original reverse mortgage. Due to the exceptionally high origination fee and other fees, refinancing a reverse mortgage should be reserved for situations where a spouse needs to be added to the loan, more equity is needed, or the interest rate can be lowered substantially. 17

What happens to the proceeds of a reverse mortgage when a homeowner dies?

When the homeowner moves or dies, the proceeds from the home’s sale go to the lender to repay the reverse mortgage’s principal, interest, mortgage insurance, and fees. Any sale proceeds beyond what was borrowed go to the homeowner (if still living) or the homeowner’s estate (if the homeowner has died).

How are they Different from Home Equity Loans?

The reverse mortgage has greater flexibility than any other loan currently being offered such as equity loans or HELOC’s. It also requires that borrowers pay FHA (HUD) mortgage insurance on the HECM program. A HELOC or Home Equity Line of Credit is a bank product that is relatively inexpensive and quick to obtain. However, like most loans, there is a tougher standard to qualify for the loan underwriting and it is not as friendly for seniors on a fixed budget.

How is HUD Involved in Reverse Mortgages?

That is also true with a reverse mortgage. But in addition to a reverse mortgage lender, the government is involved in every transaction because HUD will insure the loan and so there are steps the lender must follow to be certain that the loan meets HUD requirements. To be a lender for a HECM loan, the lender must be approved by HUD.

How long can you take a HUD loan?

HUD limits the amount that any borrower can take in the first 12 months based on their mandatory obligations. If you are not repaying qualified existing liens on the property or using the loan to purchase the home, you are limited to 60% of the Principal Limit in the first 12 months and then you can receive the remaining 40% of your proceeds any time after 12 months. However, the fixed rate loan program is a single draw option.

What age can you reverse a mortgage?

Reverse mortgages are available to borrowers age 62 and over for the government insured Home Equity Conversion Mortgage ( HECM) and some proprietary or private programs will accept borrowers down to age 60. While eligible spouses under the age of 62 can be covered by the terms of the loan, they are not actually borrowers on the HECM reverse mortgage.

How long does it take to rescind a refinance?

All refinance transactions must follow the Federal law permitting a 3 day right to rescind (or cancel). Even after a borrower has signed their final loan documents the loan cannot fund until this mandated rescission period has elapsed. If a borrower rescinds during this 3-day period, the Lender must cancel the loan.

When does HUD assign case numbers?

HUD assigns a case number to each property when the borrower is beginning a new FHA loan. Lenders use the Case Number for several purposes and that number runs with the property even if the borrower chooses a new lender.

When are reverse mortgages due?

Reverse mortgages are due and payable when the last borrower on the loan passes or permanently leaves the property . In the case of eligible non-borrowing spouses though, they are given a deferral period if the borrower passes before the non-borrowing spouse and can remain in the home for as long as they live under the same terms as a borrower (must pay the taxes, insurance and any other property charges as due and must live in the home as their primary residence).

How long does it take for a reverse mortgage to be paid off?

1 At that time, the estate has approximately 6 months to repay the balance of the reverse mortgage or sell the home to pay off the balance. All remaining equity is inherited by the estate.

How is reverse mortgage determined?

With a reverse mortgage, the amount that can be borrowed is determined by an FHA formula that considers the age of the youngest borrower, the current interest rate, and the appraised value of the home.

How to get a reverse mortgage?

There are several ways to receive the proceeds from a reverse mortgage: 1 Lump sum – a lump sum of cash at closing. (only available for fixed-rate loans) 2 Tenure – equal monthly payments as long as the homeowner lives in the home. 3 Term – equal monthly payments for a fixed period of time. 4 Line of Credit – draw any amount at any time until the line of credit is exhausted. 5 Any combination of those listed above

What happens to the equity in a home when the owner dies?

If the equity in the home is higher than the balance of the loan, the remaining equity belongs to the estate.

How to receive proceeds from reverse mortgage?

There are several ways to receive the proceeds from a reverse mortgage: Lump sum – a lump sum of cash at closing. (only available for fixed-rate loans) Tenure – equal monthly payments as long as the homeowner lives in the home. Term – equal monthly payments for a fixed period of time. Line of Credit – draw any amount at any time until the line ...

What happens if you sell your house and it is not enough to pay off the reverse mortgage?

If the sale of the home is not enough to pay off the reverse mortgage, the lender (not the borrower) must take a loss and request reimbursement from the FHA. No other assets are affected by a reverse mortgage. For example, investments, second homes, cars, and other valuable possessions cannot be taken from the estate to pay off the reverse mortgage.

What happens if you don't meet the requirements for a mortgage?

For example, you must live in the home as your primary residence, continue to pay required property taxes, homeowners insurance, and maintain the home according to Federal Housing Administration requirements. Failure to meet these requirements can trigger a loan default that may result in foreclosure.

Why refinance a reverse mortgage?

Popular reasons for refinancing include taking advantage of a lower interest rate, adding a spouse to the mortgage, or accessing more cash when the equity in the home rises due to an increase in the home’s value.

What is an adjustable rate mortgage?

Adjustable-Rate Mortgage: A mortgage loan with an interest rate that varies or adjusts periodically throughout the life of the loan. Age-in-Place: The ability to live in one’s own home and community safely, independently and comfortably, regardless of age, income, or ability level.

What happens if you don't take steps to remedy the default?

If steps aren’t taken to remedy the default, the lender may start foreclosure proceedings. Expected Interest Rate (EIR): The Expected Interest Rate is what the lender estimates the average rate will be over the life of the reverse mortgage.

How long can you live in a home with a term plan?

Term Plan -In this payout plan, you choose to receive equal monthly payments over a finite period, such as 10 or 20 years. Although your payments will stop at some point, you can continue living in the home as your principal residence until a maturity event occurs, such as selling, moving out, passing away or otherwise failing to live up to your loan terms, such as paying your property taxes and homeowners insurance.

How long does it take to cancel a reverse mortgage?

Right of Rescission: A borrower’s right to cancel a reverse mortgage loan within three business days of closing.

How long do you have to keep your property line open?

You are charged interest only on the portion of the line you use. So, you could simply keep your line open for 10, 20 or 30 years, saving it for a rainy day, and never be charged a penny of interest.

What is the CFPB?

Consumer Financial Protection Bureau (CFPB): The Consumer Financial Protection Bureau is an agency of the United States government responsible for consumer protection in the financial sector.

What is HECM in FHA?

Under the HECM program, a fee charged to borrowers that is equal to a small percentage of the maximum claim amount, plus an annual premium thereafter on the loan balance. The MIP guarantees that if the lender goes out of business, FHA will step in and ensure the borrower has continued access to his or her loan funds. The MIP further guarantees that when the property is sold to pay back the reverse mortgage, the borrower will never owe more than the value of the home.

How much does a lender charge for HECM?

A lender can charge the greater of $2,500 or 2% of the first $200,000 of your home’s value plus 1% of the amount over $200,000. HECM origination fees are capped at $6,000. Some lenders waive or reduce the origination fees on certain products.

What is counseling for reverse mortgage?

Counseling: A service provided by an independent third-party, typically approved by the U.S. Department of Housing and Urban Development, to make sure the borrower fully understands the reverse mortgage and reviews alternative options, prior to application.

How long do fixed monthly advances last?

Fixed monthly loan advances for as long as a borrower lives in a home.

What is a loan servicer fee?

A fee charged by the loan servicer for administering a loan after closing, such as disbursing loan funds, maintaining loan records and sending statements

What is a lock in principal?

A feature that allows borrowers to lock-in the principal limit for a specific period of time.

What is margin in finance?

Margin: An amount added to the Index (CMT) to determine both the Expected and Actual interest rates. The margin is determined by the loan investor.

What happens to a home loan after the borrower leaves?

It is generally the home's sale, after the borrower leaves that repays the loan. The loan term, then, bears a relationship to the minimum age requirement but not the repayment requirements.

What do you need to get a reverse mortgage?

A reverse mortgage borrower does not need income, employment or good credit. He only needs to own a house, to live there and to have reached at least 62 years of age. The dearth of requirements arises from the fact that the loan value comes not from the borrower's earning ability but the value of the house and the fact that the loan does not have to be repaid until the borrower dies, sells the home or moves out for 12 months. It is generally the home's sale, after the borrower leaves that repays the loan. The loan term, then, bears a relationship to the minimum age requirement but not the repayment requirements.

How long do you have to pay monthly mortgage payments?

The monthly payments may be taken out for a set term or for as long as the borrower remains living in the house. The payment term, however, should not be confused with the loan term. If a borrower chooses to receive monthly payments for 10 years, the loan does not come due when the payments stop.

How long does a loan have to be repaid?

The dearth of requirements arises from the fact that the loan value comes not from the borrower's earning ability but the value of the house and the fact that the loan does not have to be repaid until the borrower dies, sells the home or moves out for 12 months. It is generally the home's sale, after the borrower leaves that repays the loan.

How long does a reverse mortgage last?

According to Forbes Magazine, the average term ends up being about seven years.

What is the life expectancy of a child born in 2011?

U.S. life expectancy for a child born in 2011 was 78 years and 8 months with women living almost eight years more than men. When a married couple takes out a reverse mortgage, the loan term extends until the last of the two borrowers leaves the house. As mortality rates fall, as they have tended to over the last several decades, the average reverse mortgage term would be expected to increase, absent other factors. But factors such as how much debt the borrower shoulders going into the loan, his cost of living and healthcare needs during the loan term and the amount of equity in the home and borrower's age at the start of the loan all influence the loan term.

Does a reverse mortgage have to be repaid?

Mortgage. By Mary Gallagher. A reverse mortgage does not have to be repaid within a quantified term the way a traditional mortgage does. Rather, a reverse mortgage is repaid when the borrower dies, sells his house or otherwise moves out of the house for 12 months.

What Is a Reverse Mortgage?

- In a word, a reverse mortgage is a loan. A homeowner who is 62 or older and has considerable h…

Instead, the entire loan balance, up to a limit, becomes due and payable when the borrower dies, moves out permanently, or sells the home. Federal regulations require lenders to structure the transaction so that the loan amount won't exceed the home’s value. Even if it does, through a dr… - A reverse mortgage is a type of home loan for seniors ages 62 and older. 1

Reverse mortgage loans allow homeowners to convert their home equity into cash income with no monthly mortgage payments.

Cash in Equity

- Reverse mortgages can provide much-needed cash for seniors whose net worth is mostly tied u…

According to the National Reverse Mortgage Lenders Association, homeowners ages 62 and older held $10.19 trillion in home equity in the third quarter (Q3) of 2021. The number marks an all-time high since measurement began in 2000, underscoring how large a source of wealth home equit…

How a Reverse Mortgage Works

- With a reverse mortgage, instead of the homeowner making payments to the lender, the lender …

As with a forward mortgage, the home is the collateral for a reverse mortgage. When the homeowner moves or dies, the proceeds from the home’s sale go to the lender to repay the reverse mortgage’s principal, interest, mortgage insurance, and fees. Any sale proceeds beyond …

Types of Reverse Mortgages

- There are three types of reverse mortgages. The most common is the home equity conversion …

If your home is worth more, however, you can look into a jumbo reverse mortgage, also called a proprietary reverse mortgage. 4 - When you take out a reverse mortgage, you can choose to receive the proceeds in one of six wa…

Lump sum: Get all the proceeds at once when your loan closes. This is the only option that comes with a fixed interest rate. The other five have adjustable interest rates.

Would You Benefit from a Reverse Mortgage?

- A reverse mortgage might sound a lot like a home equity loan or a home equity line of credit (HE…

A reverse mortgage is the only way to access home equity without selling the home for seniors in situations like these: - don’t want the responsibility of making a monthly loan payment

can't afford a monthly loan payment

What Is Required for a Reverse Mortgage?

- If you own a house, condominium, or townhouse, or a manufactured home built on or after June …

While reverse mortgages don’t have income or credit score requirements, they still have rules about who qualifies. You must be at least 62 years old, and you must either own your home free and clear or have a substantial amount of equity (at least 50%). Borrowers must pay an originati…

What Are the Costs of a Reverse Mortgage?

- HUD adjusted insurance premiums for reverse mortgages in October 2017. Since lenders can’t a…

One change was an increase in the up-front premium, from 0.5% to 2.0%, for three out of four borrowers and a decrease in the up-front premium, from 2.5% to 2.0%, for the other one out of four borrowers. The up-front premium used to be tied to how much borrowers took out in the first ye…

Reverse Mortgage Interest Rates

- Only the lump sum (single disbursement) reverse mortgage, which gives you all of the proceeds …

In addition to one of the base rates, the lender adds a margin of one to three percentage points. So if the index rate is 2.5% and the lender’s margin is 2%, then your reverse mortgage interest rate will be 4.5%. As of January 2022, lenders’ margins ranged from 1.5% to 2.5%. Interest compound…

How Much Can You Borrow with a Reverse Mortgage?

- The proceeds that you’ll receive from a reverse mortgage will depend on the lender and your pay…

However, you can’t borrow 100% of what your home is worth, or anywhere close to it. Part of your home equity must be used to pay the loan’s expenses, including mortgage premiums and interest. Here are a few other things that you need to know about how much you can borrow: - The loan proceeds are based on the age of the youngest borrower or, if the borrower is married, …

The lower the mortgage rate, the more you can borrow.

Avoiding Reverse Mortgage Scams

- With a product as potentially lucrative as a reverse mortgage and a vulnerable population of borr…

Relatives, caregivers, and financial advisors have also taken advantage of seniors either by using a power of attorney to reverse mortgage the home, then stealing the proceeds, or by convincing them to buy a financial product, such as an annuity or whole life insurance policy, that the senio…

Do This to Avoid Foreclosure From a Reverse Mortgage

- Another danger associated with a reverse mortgage is the possibility of foreclosure. Even thoug…

As a reverse mortgage borrower, you are required to live in the home and maintain it. If the home falls into disrepair, it won’t be worth fair market value when it’s time to sell, and the lender won’t be able to recoup the full amount that it has extended to the borrower. - Reverse mortgage borrowers are also required to stay current on property taxes and homeowner…

About one in five reverse mortgage foreclosures from 2009 through 2017 was caused by the borrower’s failure to pay property taxes or insurance, according to an analysis by Reverse Mortgage Insight. 14

Is a Reverse Mortgage Expensive?

- Home equity conversion mortgages (HECMs), the most common type of reverse mortgage, bring a number of one-time fees and ongoing costs. The most significant of these are origination fees, closing costs, and mortgage insurance premiums, along with the interest the borrow accumulates on the loan balance. 8

When Do You Have to Repay a Reverse Mortgage?

- The lender will require the borrower to repay the reverse mortgage if the borrower does any of th…

resides outside the home for more than a year - fail to maintain the property

stops paying your homeowners insurance premiums or property taxes

Can You Owe More Than the Home Is Worth with a Reverse Mortgage?

- Your loan balance could grow higher than your home's value, but lenders can’t go after borrowers or their heirs if the home turns out to be underwater when the loan is due. The mortgage insurance premiums that borrowers pay go into a fund that covers lenders losses when this happens.

Can You Refinance a Reverse Mortgage?

- Yes, you can refinance a reverse mortgage. Because of the origination fee, upfront mortgage insurance premium, and other closing costs, refinancing a reverse mortgage should be reserved for situations where a spouse needs to be added to the loan, more equity is needed, or the interest rate can be lowered substantially. 15

The Bottom Line

- A reverse mortgage can be a helpful financial tool for senior homeowners who understand how t…

Even when a reverse mortgage is issued by the most reputable of lenders, it’s still a complicated product. Borrowers must take the time to educate themselves about it to be sure that they’re making the best choice about how to use their home equity. Further, they should shop around an…