The Major Theories of FDI Explained Below:

- Theory of Monopolistic Advantage

- Oligopoly Theory of Advantage ADVERTISEMENTS:

- Product Life Cycle Model

- Eclectic theory

- Production Cycle Theory of Vernon. ...

- The Theory of Exchange Rates on Imperfect Capital Markets. ...

- The Internalisation Theory. ...

- The Eclectic Paradigm of Dunning.

What are the theories of foreign direct investment?

Theories of Foreign Direct Investment (FDI)

- Introduction. ...

- Literature Review

- 1.1 Hymer (1960) international operations of national firms. ...

- 1.2 Product Life-Cycle Theory. ...

- 1.3 Caves Theory. ...

- 1.4 Internalisation Theory. ...

- 1.5 The Eclectic Paradigm. ...

- 1.6 Strategic Motivations of Foreign Direct Investment. ...

- 1.7 Investment Development Path Theory. ...

- Japan Automotive Industry

What are pros and cons of FDI?

FDI has many advantages as well as ddisadvantages. PROS:-. Seed funding for various Startups and ventures which leads to manufacturing and launch in global market.Due to this the potential idea is turned into a finisu product.

Is FDI preferable to FII?

FDI is more preferred to the FII as they are considered to be the most beneficial kind of foreign investment for the whole economy. The Foreign Direct Investment is considered to be more stable than Foreign Institutional Investor.

How is FDI good for the economy?

PRESIDENTIAL aspirant Sen. Emmanuel "Manny" Pacquiao said foreign investments could flourish in the Philippines considering its strategic position in the Pacific region. "But it cannot reach its full potential because of systemic corruption, high taxes, inefficient but expensive utility supply, and slow internet connection," he pointed out.

What are the 4 types of foreign direct investment?

Types of FDIHorizontal FDI. The most common type of FDI is Horizontal FDI, which primarily revolves around investing funds in a foreign company belonging to the same industry as that owned or operated by the FDI investor. ... Vertical FDI. ... Vertical FDI. ... Conglomerate FDI. ... Conglomerate FDI.

What are the theories of investment?

The Flexible Accelerator Theory or Lags in Investment. The Profits Theory of Investment. Duesenberry's Accelerator Theory of Investment. The Financial Theory of Investment.

What are the international investment theories?

International investment theory explains the flow of investment capital into and out of a country by investors who want to maximize the return on their investments.

What is the meaning of foreign direct investment explain its types and theories?

A foreign direct investment (FDI) is where an individual or business from one nation, invests in another. This could be to start a new business or invest in an existing foreign owned business. Benefits Include: 1) Boost to International Trade. 2) Reduced Local Tensions.

How many trade theories are there?

There are 6 economic theories under International Trade Law which are classified in four: (I) Mercantilist Theory of trade (II) Classical Theory of trade (III) Modern Theory of trade (IV) New Theories of trade. Both of these categories, classical and modern, consist of several international theories.

What is Keynesian theory of investment?

Abstract. Keynes argued that profit expectations, and the degree of confidence or weight that managers place in their profit forecasts, determine investment. Previous attempts to test Keynes' theory have been plagued by the absence of any clear measure of entrepreneurs' expectations of future profits.

What is internalization theory of FDI?

Internalization theory suggests that gains from FDI morles of foreign expansion would be higher relative to non-FDI modes. The theory of inlernalization has come under increased criticism. on tile premise that there are agency costs to internalization that. may be higher than costs of non-equity forms of international.

What are the types of trade theories?

International Trade Theories | Definition and TypesMercantilism.Absolute Advantage.Comparative Advantage.Heckscher-Ohlin Theory.Product Life Cycle Theory.Global Strategic Rivalry Theory.National Competitive Advantage Theory.

What is mercantilism theory?

Mercantilism is an economic practice by which governments used their economies to augment state power at the expense of other countries. Governments sought to ensure that exports exceeded imports and to accumulate wealth in the form of bullion (mostly gold and silver).

How many types of FDI are there?

twoTypes and Examples of Foreign Direct Investment Typically, there are two main types of FDI: horizontal and vertical FDI. Horizontal: a business expands its domestic operations to a foreign country.

What is FDI and types of FDI?

There are mainly two types of FDI- Horizontal and Vertical, However, two other types of foreign direct investments have emerged- conglomerate and platform FDI. HORIZONTAL FDI: under this type of FDI, a business expands its inland operations to another country.

Which theory explain the growth of transnational companies and their motivation for achieving FDI?

The Internalisation Theory This theory tries to explain the growth of transnational companies and their motivations for achieving foreign direct investment. The theory was developed by Buckley and Casson, in 1976 and then by Hennart, in 1982 and Casson, in 1983.

Abstract and Figures

After the 1960s, and due to the emerging of globalization and trade liberalization policies, the expansion of foreign direct investment grew remarkably. These changes motivated many researchers to examine the issue of multinational corporations and international movement of capital.

References (28)

ResearchGate has not been able to resolve any citations for this publication.

What is FDI in modern times?

FDI rather than foreign trade, in modern times, is a major driving Force and an engine of growth of an economy under global setting. Short notes on the Army Mauryan Period. 10 Important Significance of FDI.

What is the oligopoly theory?

The oligopoly theory thus, explains defensive investment behaviour of a multinational firm. In short, monopolistic advantage theory explains first course of investment of a business firm in a foreign country. The oligopoly theory explain the defensive investment behaviour in terms of oligopolistic reaction to retain the monopoly power of the firm.

How does Vermon's Product Life Cycle Model explain trade?

By adding a time dimension to the theory of monopolistic advantage, the PLCM can explain a firm’s shift from exporting to FDI. Initially a firm when innovate a product, it produces at home enjoying its monopolistic advantage in the export market, thus, specialises and exports. Once the product becomes standardised in its growth product phase, the firm may tend to invest abroad and export from there to retain its monopoly power. The rivals from the home country may also follow to invest in the same foreign country’s oligopolistic market.

What is the eclectic theory?

Eclectic Theory: Eclectic theory, propounded by Dunning (1988), is a wholictic, analytic approach for FDI and organisational issues of the MNCs relating to foreign production. Eclectic paradigm considers the significance of three variables: 1. Country-specific. 2.

What is the purpose of a firm when it innovates a product?

Initially a firm when innovate a product, it produces at home enjoying its monopolistic advantage in the export market, thus, specialises and exports. Once the product becomes standardised in its growth product phase, the firm may tend to invest abroad and export from there to retain its monopoly power.

What is the monopolistic advantage of an investment firm?

The firm enjoys monopolistic advantage on two counts: 1. Superior knowledge and Advance Technology. 2. Economies of scale.

Abstract

Foreign direct investment has been of increasing importance in the world economy, yet there is still no completely satisfactory theory which can explain the phenomenon of world-wide foreign direct investment. Conventional trade theories are not very useful in explaining such a phenomenon.

Keywords

These keywords were added by machine and not by the authors. This process is experimental and the keywords may be updated as the learning algorithm improves.

Vintila Denisia

Foreign Direct Investment (FDI) acquired an important role in the international economy after the Second World War. Theoretical studies on FDI have led to a better understanding of the economic mechanism and the behavior of economic agents, both at micro and macro level allowing the opening of new areas of study in economic theory.

Abstract

Foreign Direct Investment (FDI) acquired an important role in the international economy after the Second World War. Theoretical studies on FDI have led to a better understanding of the economic mechanism and the behavior of economic agents, both at micro and macro level allowing the opening of new areas of study in economic theory.

Why is FDI important?

Theoretical studies on FDI have led to a better understanding of the economic mechanism andthe behavior of economic agents , bothat micro and macro level allowing the opening of new areas of studyin economic theory.

Who developed the production cycle theory?

Production cycle theory developed by Vernon in 1966 was usedto explain certain typesof foreign direct investment made by U.S. companies in Western Europe after the SecondWorld War in the manufacturing industry.

What is FDI in business?

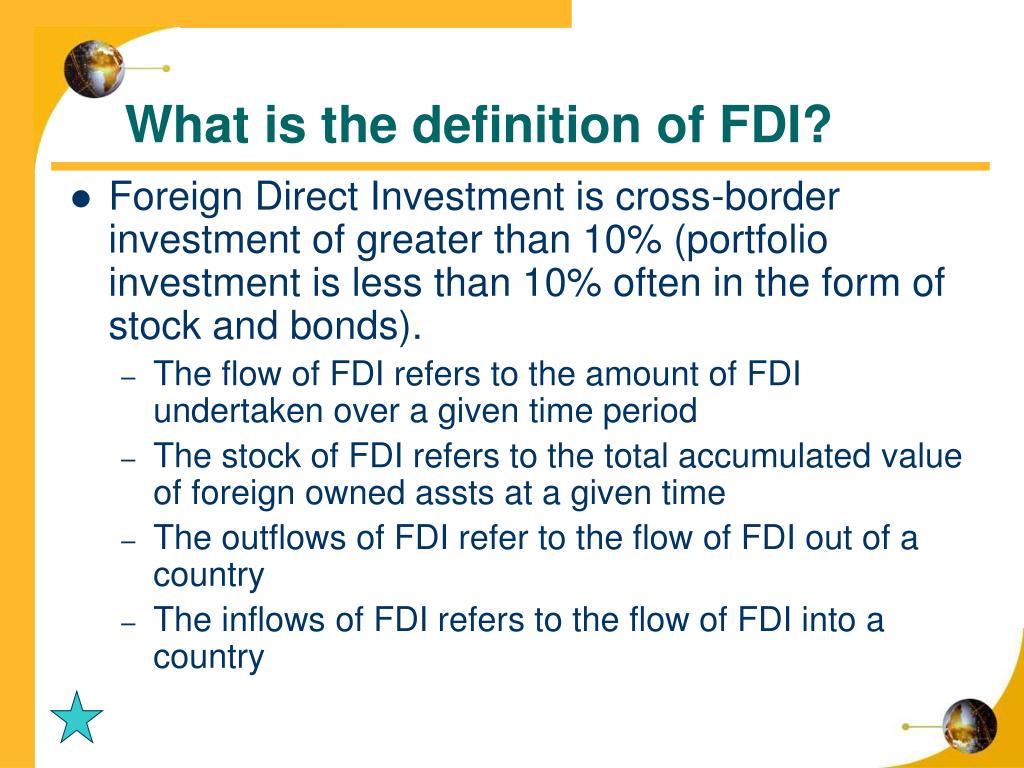

FDI was defined by the United Nations Conference on Trade and Development (UNCTAD, 2017: P3) "as an investment in a long term relationship and reflecting a lasting interest and control by a resident entity in one country (foreign direct investor or parent enterprise) in an enterprise resident in another country other than that of the foreign direct investor". Bajrami and Nazmi (2019) further buttressed that it involves the injection of foreign capital into enterprises operating in a different country other than the investor's country. ...

What is FDI in Africa?

Foreign direct investment (FDI) is regarded as a critical determinant in the concept of development for Africa. However, institutional quality in the recipient countries is considered an essential factor that can be used to drive FDI flows inward.

How does FDI affect Africa?

Foreign direct investment (FDI) is regarded as a critical determinant in the concept of development for Africa. However, institutional quality in the recipient countries is considered an essential factor that can be used to drive FDI flows inward. The study aims to establish the effect of institutions' challenges on the FDI inflow and how it impacts on economic development for host selected countries in sub-Saharan Africa (SSA). The study employed pooled data for 30 SSA countries for the period within the years 2000 and 2018. The analysis method used was the fixed and random effect regression model utilized to estimate the effect of foreign capital on economic development with considerations for the quality of institutions for developing SSA sub-region of Africa. This study reveals that foreign capital inflow is crucial for economic development in the SSA sub-region of Africa. Quality of institutions as determining factors also affected the level of inflow of FDI to the host SSA sub-region, which resulted in the underutilization of domestic resources and hence abnormal development of domestic sector investment. The study recommends that the government of host SSA sub-region needs to consider the degree of institutional quality to encourage further FDI inflows. To afford the maximal benefit of FDI in the development of the host domestic sector and to guard the industry that foreign investment flows into carefully. It is expedient, thereby, that the domestic investment is enhanced to ensure that dependence on foreign capital inflow continues to decline as income increases. Until domestic investments are sufficient to generate advancement in technology and desired economic development for the selected countries, in the SSA sub-region.

Introduction

The Main FDI Theories

- In spite of numerous studies explaining the phenomenon of FDI, there is no unified theoretical explanation. However, most of these studies concur that FDI would not exist in a perfectly competitive market. In a perfectly competitive world, international trade is the only means of contributing to the global market (Denisia, 2010, p. 105). Theories explaining FDI include product…

Costs and Benefits of FDI to Developing Economies: Case Study of India

- Generally, FDI refers to the net inflow of investment in an economy, which includes long and short term capital. FDI can be an inward investment or outward investment, hence the term net inflow. Net inflow is the balance between inward FDI and outward FDI (Cywiński & Harasym, 2012, P. 37). The benefits of FDI to developing economies can be grouped as follows: resource transfer effec…

Conclusion

- FDI is a significant component of a country’s economy. The inspiration behind FDI has been explained by a number of theories. These theories include production succession hypothesis, theory of conversion scale on the blemished capital market, theory of internal and external advantages and O-L-I theories. Despite the fact that there is no common the...

References

- Banerji, S 2013, Effects of FDI in the Indian Economy, Indian Statistical Institute, Kolkata, West Bengal. Buckley, PJ & Casson, M C 1976, The Future of the Multinational Enterprise, Homes and Meier, London. Cushman, D 1985, ‘Real Exchange Rate Risk, Expectations and the Level of Direct Investment’, Review of Economics and Statistics, vol. 67, no. 2, pp. 297-308. Cywiński, L & Haras…