What is price index?

What is interest rate?

What does it mean when the price level rises?

What is GDP in economics?

What does P mean in math?

See 2 more

About this website

What are the two types of price index?

The two most basic formulae used to calculate price indices are the Paasche index (after the economist Hermann Paasche [ˈpaːʃɛ]) and the Laspeyres index (after the economist Etienne Laspeyres [lasˈpejres]).

What are the three price indices?

These include the GDP Deflator, the Producer Price Index and the Employment Cost Index.

What is a price index?

The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services.

What is price index number and its types?

Price Index Number: It measures the general changes in prices of goods. It compares the level of prices between two different time periods. 2. Quantity Index Number: It measures changes in the level of output or physical volume of production in economy. E.g.: changes in agricultural and industrial production etc.

What is price index example?

A price index can be based on the prices of a single item or a selected group of items, called a market basket. For example, several hundred goods and services—such as rent, electricity, and automobiles—are used in calculating the consumer price index.

What is the most common price index?

the CPIAs the most widely used measure of inflation, the CPI is an indicator of the effectiveness of government policy. In addition, business executives, labor leaders and other private citizens use the index as a guide in making economic decisions. As a deflator of other economic series.

Why is price index used?

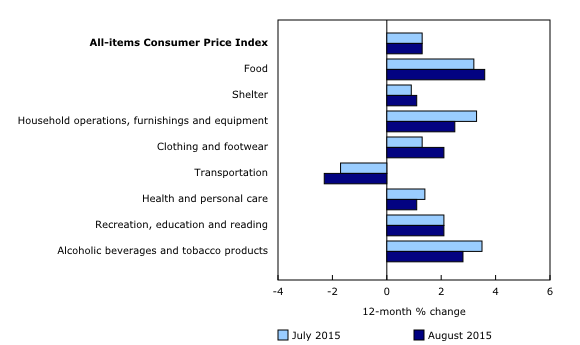

Consumer price inflation is estimated by using price indices. One way to understand a price index is to think of a very large shopping basket containing all the goods and services bought by households. The price index estimates changes to the total cost of this basket.

What is a price index used for?

It provides information about price changes in the Nation's economy to government, business, labor, and private citizens and is used by them as a guide to making economic decisions.

Why are there different price indices?

Various measures of prices and inflation have been constructed for different purposes and, therefore, reflect differing emphases. For example, the consumer price index (CPI) was designed to adjust pensions for World War I veterans.

What are the most commonly used price indexes?

Two common indexes of consumer prices are: The consumer price index, or CPI. Put out by the Bureau of Labor Statistics, this measures the average change over time in the prices that urban consumers pay for a market basket of goods and services. The price index for personal consumption expenditures, or PCE.

How many CPI indices are there?

two indexesConsumer inflation for all urban consumers is measured by two indexes, namely, the Consumer Price Index for All Urban Consumers (CPI-U) and the Chained Consumer Price Index for All Urban Consumers (C-CPI-U).

What are the two most important price indexes?

Two different price indexes are popular for measuring inflation: the consumer price index (CPI) from the Bureau of Labor Statistics and the personal consumption expenditures price index (PCE) from the Bureau of Economic Analysis.

How To Calculate CPI (Consumer Price Index) | Indeed.com

After adding your 2018 product prices, the total would be $6.75. The sum for 2020 products is $8.50. When you divide the current product price total by the past price total, your equation is 8.50 / 6.75 = 1.26.

Price index Definition & Meaning - Merriam-Webster

price index: [noun] an index number expressing the level of a group of commodity prices relative to the level of the prices of the same commodities during an arbitrarily chosen base period and used to indicate changes in the level of prices from one period to another.

What is wholesale price index?

They are: 1.The Wholesale Price Index (WPI): It includes prices of the goods sold in the wholesale market, i.e. the market where bulk transactions are made for further sale afterwards. 2. The Consumer Price Index (CPI): It includes prices of goods and services sold in the retail market, i.e. the final prices which the end consumers have to pay.

What is inflation indices?

Inflation indices which help in calculating inflation rates indicate how much prices have changed over a period of time. The indices themselves are a representation of the level of prices at a particular time.

What is the difference between WPI and PPI?

The PPI usually covers the industrial (manufacturing) sector as well as public utilities. Some countries also include agriculture, mining, transportation and business services. The WPI prices include taxes and transportation charges, whereas the producer prices do not.

What is PPI in manufacturing?

The PPI usually covers the industrial (manufacturing) sector as well as public utilities. Some countries also include agriculture, mining, transportation and business services. The WPI prices include taxes and transportation charges, whereas the producer prices do not. 4.

What is cost of living index?

It includes prices of goods and services sold in the retail market, i.e. the final prices which the end consumers have to pay. It is hence also called the cost of living index. It is also used for indexing dearness allowance to employees for increase in prices. 3.

What are the two concepts of GDP?

From this we arrive at two concepts of GDP: the nominal GDP and the real GDP. The nominal GDP, when compared to the GDP of some previous year reflects the change in the total output produced by the economy as well as change in their prices.

Is all price included in the index?

Not all prices are included in the index, only a specified basket of good and services. The basket in the index is representative of the items which are relevant to a market or group. Thus there are different price indices for the prices faced by different groups. They are:

What is price index?

Price index, measure of relative price changes, consisting of a series of numbers arranged so that a comparison between ...

What is consumer price index?

consumer price index, measure of living costs based on changes in retail prices. Such indexes are generally based on a survey of a sample of the population in question to determine which goods and services compose the typical “market basket.” These goods and services are then priced periodically, and their…

Why are price indexes error?

Another possible source of error in price indexes is that they may be based on list prices rather than actual transactions prices. List prices probably are changed less frequently than the actual prices at which goods are sold; they may represent only an initial base of negotiation, a seller’s asking price rather than an actual price. One study has shown that actual prices paid by the purchasing departments of government agencies were lower and were characterized by more frequent and wider fluctuations than were the prices for the same products reported for the price index.

How to make price comparisons between two periods?

One way would be to make price comparisons between two periods solely in terms of goods that are identical in both periods. If one systematically deletes goods that change in quality, the price index will tend to be biased upward if quality is improving on the average and downward if it is deteriorating on the average.

When were wholesale price indexes published?

Wholesale price indexes for United States, Great Britain, Germany, and France, 1790–1940. Reprinted from A. Burns and W. Mitchell, Measuring Business Cycles; by permission of National Bureau of Economic Research.

What is the problem with price data collection?

The central problem of price-data collection is to gather a sample of prices representative of the various price quotations for each of the commodities under study. Sampling is almost always necessary. The larger and the more complex the universe of prices to be covered by the index, the more complex the sampling pattern will have to be. An index of prices paid by consumers in a large and geographically varied country, for example, ideally should be based on a sample representative of price changes in different cities and localities, in different types of outlets (supermarkets, department stores, neighbourhood shops, etc.), and for different commodities. The number of prices chosen to represent each type of city (or metropolitan area), type of outlet, and category of commodity would ideally be proportionate to its relative importance in the expenditures of the nation. Most price indexes are based on some approximation to such a sampling design.

What are indexes for?

Indexes are available for major groups of consumer expenditures (food and beverages, housing, apparel, transportation, medical care, recreation, education and communications, and other goods and services), for items within each group, and for special categories, such as services.

What is monthly index?

Monthly indexes are available for the U.S., the four Census regions, and some local areas. More detailed item indexes are available for the U.S. than for regions and local areas. Indexes are available for two population groups: a CPI for All Urban Consumers (CPI-U) which covers approximately 93 percent of the total population ...

What is CPI U?

The CPI-U includes expenditures by urban wage earners and clerical workers, professional, managerial, and technical workers, the self-employed, short-term workers, the unemployed, retirees and others not in the labor force. The CPI-W includes only expenditures by those in hourly wage earning or clerical jobs.

What is the purpose of CPI?

As a deflator of other economic series. The CPI and its components are used to adjust other economic series for price change and to translate these series into inflation-free dollars.

When did the City Average All Items Index start?

Some series, such as the U.S. City Average All items index, begin as early as 1913.

When was the CPI last modified?

Since 1985, the CPI has been used to adjust the Federal income tax structure to prevent inflation-induced increases in taxes. Last Modified Date: January 10, 2020.

What is the producer price index?

The Producer Price Index (PPI) is a family of indexes that measures the average change over time in selling prices received by domestic producers of goods and services. PPIs measure price change from the perspective of the seller. This contrasts with other measures, such as the Consumer Price Index ...

When are producer price indexes released?

Producer Price Indexes are usually made available during the second full week of the month following the reference date . Data is posted shortly after 8:30am on dates as announced in the online release calendar.

What is a PPI report?

The PPI Detailed Report is the most comprehensive publication on producer prices. It contains all aggregate industry level and detailed commodity level indexes as well as text, tables, notes, and special articles. The Detailed Report is made available at the same time as the news release on the PPI website.

What are PPIs in the US economy?

economy— mining, manufacturing, agriculture, fishing, and forestry — as well as natural gas, electricity, construction, and goods competitive with those made in the producing sectors, such as waste and scrap materials. The PPI program covers approximately 72 percent of the service sector's output, as measured by revenue reported in the 2007 Economic Census. Data includes industries in the following sectors: wholesale and retail trade; transportation and warehousing; information; finance and insurance; real estate brokering, rental, and leasing; professional, scientific, and technical services; administrative, support, and waste management services; health care and social assistance; and accommodation.

How are establishments selected for the PPI survey?

Establishments are selected for the PPI survey via systematic sampling of a list of all firms in the industry.

What is PPI data?

Contract adjustment . PPI data are commonly used in adjusting purchase and sales contracts. These contracts typically specify dollar amounts to be paid at some point in the future. It is often desirable to include an adjustment clause that accounts for changes in input prices. For example, a long-term contract for bread may be adjusted for changes in wheat prices by applying the percent change in the PPI for wheat to the contracted price for bread. (See Price Adjustment Guide for Contracting Parties .)

What is a monthly PPI news release?

The monthly PPI News Release contains a text explanation of key aggregate index movements during the month and various supporting data tables for major components of the Final Demand-Inter mediate Demand indexes.

What is price index?

A price index is a measure of price changes using a percentage scale. A price index can be based on the prices of a single item or a selected group of items, called a market basket. For example, several hundred goods and services—such as rent, electricity, and automobiles—are used in calculating the consumer price index.

What are the price indices in India?

In India there are various price indices such as index of retail prices, index of wholesale prices, cost of living index of industrial workers, export prices, and so on. A separate index number can be calculated to measure changes in each price level. However, the method of construction is the same in each case.

Why are indexes important?

Rather, the indexes have an important impact on policymakers’ decisions and on the operation of the economy.

What is the most useful device for measuring change in the price level?

Meaning: Changes in the levels of prices are measured using a scale called a price index . This is the most useful device for measuring change in the price level. In most countries price indexes are used to measure inflation, each focusing on the prices of a collection of goods and services important to a particular segment of the economy.

What is index number?

An index number is a statistical device used to express price changes as a percentage of prices in a base year (or at a base date). (This base date is indicated by a phrase such as ‘1980= 100’.) In this case, movement in prices are expressed as percentage changes over the average level prevailing in 1980.

How to find index number?

An index number is simply compiled by selecting a group of commodities, noting their prices in a given year (the base year) and putting the number 100 to the total. If the prices of the selected commodities rise by, for example, 3% during the next year, the index number at the end of the year is 103. A fall in price of 1% would be shown by an index number of 99.

How to calculate year 2 index number?

year 2 index number – year 1 index number/year 1 index number x 100

What Is the Consumer Price Index (CPI)?

The Consumer Price Index (CPI) is a measure that examines the weighted average of prices of a basket of consumer goods and services, such as transportation, food, and medical care. It is calculated by taking price changes for each item in the predetermined basket of goods and averaging them. Changes in the CPI are used to assess price changes associated with the cost of living .

Who and What Are Covered in the CPI?

The CPI statistics cover professionals, self-employed and unemployed people, people whose incomes are below the federal poverty threshold, and retired people. People not included in the report are non-metro or rural populations, farm families, armed forces, people currently incarcerated, and those in mental hospitals. 5

How Is CPI Used?

CPI is an economic indicator. It is the most widely used measure of inflation and, by proxy, of the effectiveness of the government's economic policy. The CPI gives the government, businesses, and citizens an idea about price changes in the economy and can act as a guide in order to make informed decisions about the economy.

How Is the CPI Calculated?

The CPI is the weighted-average price of a broad cross-section of goods and services. This collection of items, often referred to as the CPI’s “basket” of goods, is intended to mimic the typical products and services purchased by American consumers. Over the years, as the prices of those products rise due to inflation, this gradual increase is reflected in a rising CPI. In the media, the CPI is commonly referred to in terms of its percentage year-over-year change.

What does CPI mean?

The rise in the general level of prices, often expressed as a percentage, means that a unit of currency effectively buys less than it did in prior periods. The CPI is what is used to measure these average changes in prices over time that consumers pay for goods and services. Essentially the index attempts to quantify the aggregate price level in an ...

What is inflation in economics?

Inflation is the decline of purchasing power of a given currency over time; or, alternatively, a general rise in prices. A quantitative estimate of the rate at which the decline in purchasing power occurs can be reflected in the increase of an average price level of a basket of selected goods and services in an economy over some period of time. The rise in the general level of prices, often expressed as a percentage, means that a unit of currency effectively buys less than it did in prior periods.

Does the Consumer Price Index include savings?

While it does measure the variation in price for retail goods and other items paid by consumers, the Consumer Price Index does not include things like savings and investments, and can often exclude spending by foreign visitors.

What Is the Producer Price Index (PPI)?

The producer price index (PPI), published by the Bureau of Labor Statistics (BLS), is a group of indexes that calculates and represents the average movement in selling prices from domestic production over time.

What is the difference between a PPI and a consumer price index?

The PPI measures price movements from the seller's point of view. Conversely, the consumer price index (CPI) measures cost changes from the viewpoint of the consumer. In other words, this index tracks changes to the cost of production. There are three areas of PPI classification that use the same pool of data from the Bureau of Labor Statistics: industry, commodity, and commodity-based final and intermediate demand (FD-ID). 1

How many product price indexes does BLS produce?

BLS produces thousands of product price indexes each month. An analyst can review information broken into three large categories and then further drill down to specific products or services. 1

How is PPI different from CPI?

The PPI is different from the CPI in that it measures costs from the viewpoint of industries that make the products, whereas the CPI measure prices from the perspective of consumers.

What is the second category of classification?

The second category is the commodity classification . This publication ignores the industry of production and combines goods and services by similarity and product make-up. More than 3,700 indexes cover produced goods and about 800 cover services. The indexes are arranged by end-use, product, and service.

What is price index?

A price index (PI) is a measure of how prices change over a period of time, or in other words, it is a way to measure inflation. Inflation Inflation is an economic concept that refers to increases in the price level of goods over a set period of time. The rise in the price level signifies that the currency in a given economy loses purchasing power ...

What is interest rate?

Interest Rate An interest rate refers to the amount charged by a lender to a borrower for any form of debt given, generally expressed as a percentage of the principal. . The general formula for the price index is the following:

What does it mean when the price level rises?

The rise in the price level signifies that the currency in a given economy loses purchasing power (i.e., less can be bought with the same amount of money). . There are multiple methods on how to calculate inflation (or deflation. Deflation Deflation is a decrease in the general price level of goods and services.

What is GDP in economics?

Gross Domestic Product (GDP) Gross domestic product (GDP) is a standard measure of a country’s economic health and an indicator of its standard of living. Also, GDP can be used to compare the productivity levels between different countries. in the base period.

What does P mean in math?

P 1: Price of goods in period 1. P 2: Price of goods in period 2. X: Weights (the weights are used in conjunction with the prices) f: General function.

Data Available

- There are two important price indexes related to a sale transaction or a contract: 1. The list price index: the ratio between the pocket revenue generated (after all discounts and rebates) and the “list revenue” that would have been generated if all products and services had been sold at their list price (undiscounted) as defined in the applicable ...

Coverage

Sources of Data

Forms of Publication

- Price indexes are available for the U.S., the four Census regions, nine Census divisions, two size of city classes, eight cross-classifications of regions and size-classes, and for 23 local areas....

- Monthly indexes are available for the U.S., the four Census regions, and some local areas. More detailed item indexes are available for the U.S. than for regions and local areas.

- Price indexes are available for the U.S., the four Census regions, nine Census divisions, two size of city classes, eight cross-classifications of regions and size-classes, and for 23 local areas....

- Monthly indexes are available for the U.S., the four Census regions, and some local areas. More detailed item indexes are available for the U.S. than for regions and local areas.

- Indexes are available for two population groups: a CPI for All Urban Consumers (CPI-U) which covers approximately 93 percent of the total population and a CPI for Urban Wage Earners and Clerical Wo...

- Some series, such as the U.S. City Average All items index, begin as early as 1913.

Uses

- The CPI represents changes in prices of all goods and services purchased for consumption by urban households. User fees (such as water and sewer service) and sales and excise taxes paid by the cons...

- The CPI-U includes expenditures by urban wage earners and clerical workers, professional, managerial, and technical workers, the self-employed, short-term workers, the unemployed, r…

- The CPI represents changes in prices of all goods and services purchased for consumption by urban households. User fees (such as water and sewer service) and sales and excise taxes paid by the cons...

- The CPI-U includes expenditures by urban wage earners and clerical workers, professional, managerial, and technical workers, the self-employed, short-term workers, the unemployed, retirees and othe...