46 Vertical Integration Strategies

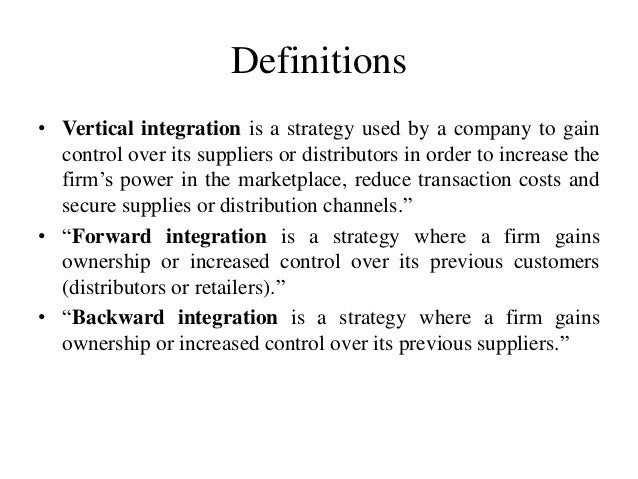

- Backward Vertical Integration. A backward vertical integration [2] strategy involves a firm moving back, or upstream, along the value chain and entering a supplier’s business.

- Forward Vertical Integration. A forward vertical integration [3] strategy involves a firm moving farther down the value chain to enter a buyer’s business.

- References. ...

What do companies use vertical integration?

What companies use forward integration?

- Forward Integration Explained.

- Amazon’s Acquisition of Whole Foods.

- The Whole Foods acquisition counts as forward integration because it gives Amazon the 460 brick-and-mortar Whole Foods outlets as places to sell its products or have customers pick them up.

What are the types of integration strategies?

- When the existing distributors of the organization are not reliable & are much expensive. ...

- When there is scarcity of the potential & qualified distributors.

- When there are competing organizations in the industry that is expected to rapidly grow.

- When the Business Organization has sufficient capital along with the human resource. ...

What are the drawbacks of vertical integration?

drawbacks to vertical integration include the following concerns: slow to embrace technological advances; less flexibility in accommodating shifting buyer preferences; may not enable a company to realize economies of scale; capacity-matching problems; and, calls for developing new types of resources and capabilities.

Should you expand through horizontal and vertical integration?

Should You Expand Through Horizontal and Vertical Integration? Examples of horizontal integration include when one large hotel chain buys another or when a major studio company purchases a small Vertical integration can also be the degree to which a firm owns its upstream suppliers (backward integration) and its downstream buyers (forward ...

What is vertical integration strategy example?

Vertical integration occurs when the chocolate manufacturer (e.g. Mondelez) purchases a cocoa bean processor that is buying its beans from. As a result, the manufacturer can pay exactly the marginal cost – rather than profiting the processor. In turn, consumers may see lower prices in a competitive market place.

What are the types of vertical integration?

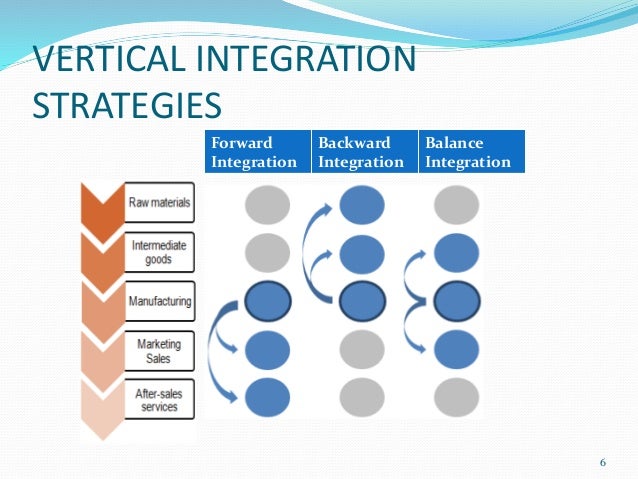

Three types of vertical integration There are three varieties of vertical integration: backward (upstream) vertical integration, forward (downstream) vertical integration, and balanced (both upstream and downstream) vertical integration.

What are the two methods of vertical integration?

Firms engage in two types of vertical integration. Forward integration is a method of vertical integration in which a firm will gain ownership of its distributors. Backward integration is a method of vertical integration in which a firm will gain ownership of its supplier.

What are the four steps of vertical integration?

The stages relative to vertical integration are materials, suppliers, manufacturing, and distribution. One example of a company that is vertically integrated is Target, which has its own store brands and manufacturing plants.

What is integration strategy with example?

Definition “It is the process of acquiring or merging with competitors, leading to industry consolidation.” “Horizontal integration is a strategy where a company acquires, mergers or takes over another company in the same industry value chain.” For example, Disney merging with Pixar (movie production), 17.

What does vertical integration mean in business?

Vertical integration refers to an expansion strategy where one company takes control over one or more stages in the production or distribution of a product. Both of these strategies are undertaken by a company in order to consolidate its position among competitors.

What are some examples of horizontal and vertical integration?

The Heinz and Kraft Foods merger is an example of Horizontal Integration. ... Target, which has its store brands, is an example of vertical integration.

What are the different types of integration?

The different methods of integration include:Integration by Substitution.Integration by Parts.Integration Using Trigonometric Identities.Integration of Some particular function.Integration by Partial Fraction.

What are the advantages of vertical integration?

What Are the Advantages of Vertical Integration?Positive differentiation can be created. ... Asset investments can focus on specialization. ... It can increase a brand's local market share. ... Transaction costs are lower throughout the supply chain. ... Quality assurance can be built into the system. ... It opens new markets.More items...•

Why is vertical integration important?

This helps the company or firm increase efficiency by streamlining the process of obtaining supplies for its product, manufacturing it and selling it. In this manner, companies that vertically integrate often are more time efficient -- with shorter turnaround times.

What are the different types of integration?

The different methods of integration include:Integration by Substitution.Integration by Parts.Integration Using Trigonometric Identities.Integration of Some particular function.Integration by Partial Fraction.

What are the types of market integration?

There are five common types of business integration based on the buying company's position in the supply chain:Horizontal integration. ... Vertical integration. ... Forward integration. ... Backward integration. ... Conglomeration.

What is corporate strategy and types of vertical integration?

Vertical integration is a competitive strategy companies use to secure total control over the production and distribution of a product. For example, a company that buys their own supply of raw materials for a product along with the tools to make and transport that product would be employing vertical integration.

What are some examples of horizontal integration?

One of the most definitive examples of horizontal integration was the acquisition of Instagram by Facebook (now Meta) in 2012 for a reported $1 billion. ... Another notable example of a horizontal integration was Walt Disney Company's $7.4 billion acquisition of Pixar Animation Studios in 2006.More items...

What is financial modeling?

A financial analyst performing financial modeling#N#What is Financial Modeling Financial modeling is performed in Excel to forecast a company's financial performance. Overview of what is financial modeling, how & why to build a model.#N#and valuation of a business should incorporate the potential synergies#N#Types of Synergies M&A synergies can occur from cost savings or revenue upside. There are various types of synergies in mergers and acquisition. This guide provides examples. A synergy is any effect that increases the value of a merged firm above the combined value of the two separate firms. Synergies may arise in M&A transactions#N#(cost savings) that could arise from vertical integration. If the integration happens as part of a merger or acquisition#N#Mergers Acquisitions M&A Process This guide takes you through all the steps in the M&A process. Learn how mergers and acquisitions and deals are completed. In this guide, we'll outline the acquisition process from start to finish, the various types of acquirers (strategic vs. financial buys), the importance of synergies, and transaction costs#N#, the analyst will build an M&A model in Excel and factor in the cost savings that result.

What is vertical integration?

A vertical integration is when a firm extends its operations within its supply chain. It means that a vertically integrated company will bring in previously outsourced operations in-house. The direction of vertical integration can either be upstream (backward) or downstream (forward). This can be achieved either by internally developing an extended ...

What is synergy in M&A?

A synergy is any effect that increases the value of a merged firm above the combined value of the two separate firms. Synergies may arise in M&A transactions. (cost savings) that could arise from vertical integration. If the integration happens as part of a merger or acquisition.

Why is vertical integration important?

through vertical integration, whereas others instead opt to develop more efficient ways to manage their supply chain and input costs. It depends on the tradeoff of benefits and costs of integration.

What are tangible assets?

Tangible Assets Tangible assets are assets with a physical form and that hold value. Examples include property, plant, and equipment. Tangible assets are. , resources, and expertise needed to replicate the upstream or downstream member of the supply chain. 2. Quasi Vertical Integration.

What is McDonald's supply chain?

Alternatively, McDonald’s (NYSE: MCD) is known for its very dispersed supply chain due to its franchising business model . Instead of pursuing a vertical integration strategy, it uses a robust communication system between its managers and external suppliers. Part of this system is a crowdsourcing platform where various suppliers are able to share ideas and improve on individual processes and efficiency.

What is the Bullwhip effect?

It creates an effect that is known as the Bullwhip Effect, where information relating to the quantity demanded by the customer is amplified along the supply chain such that the manufacturer overreacts to the actual information.

What is vertical integration?

Vertical integration occurs when a firm gets involved in new portions of the value chain. By entering the domain of a supplier (backward vertical integration) or a buyer (forward vertical integration), executives can reduce or eliminate the leverage that the supplier or buyer has over the firm.

How does forward vertical integration work?

A forward vertical integration strategy involves a firm moving further down the value chain to enter a buyer’s business. Disney has pursued forward vertical integration by operating more than three hundred retail stores that sell merchandise based on Disney’s characters and movies. This allows Disney to capture profits that would otherwise be enjoyed by another store. Each time a Hannah Montana book bag is sold through a Disney store, the firm makes a little more profit than it would if the same book bag were sold by a retailer such as Target.

Which companies are involved in the value chain?

Firms such as ExxonMobil and ConocoPhillips can be involved in all stages of the value chain, including crude oil exploration, drilling for oil, shipping oil to refineries, refining crude oil into products such as gasoline, distributing fuel to gas stations, and operating gas stations.

Why is vertical integration important?

Vertical integration gives a company better economies of scale . Large companies employ economies of scale when they are able to cut costs while ramping up productions—they take advantage of their size. For example, a company could lower the per-unit cost by buying in bulk or by reassigning employees from failing ventures.

How does vertical integration affect a company?

They must then keep the plants running to maintain efficiency and profit margins . Vertical integration reduces a company's flexibility by forcing them to follow trends in the segments they integrated. Suppose a company acquired a retailer for their product ...

How does vertically integrated company benefit?

By controlling its own supply chain, it is more able to control and deal with any supply problems itself. A company benefits by avoiding suppliers with market power. These suppliers are able to dictate terms, pricing, and availability of materials and supplies.

What is vertical integration?

Businesses are always looking for methods to reduce costs and control the quality of the products and services they provide. A company is able to create a competitive advantage by integrating different stages of its production process and supply chain into their business. This is called vertical integration.

What are the disadvantages of vertical integration?

The biggest disadvantage of vertical integration is the expense. Companies must invest a great deal of capital to set up or buy factories. They must then keep the plants running to maintain efficiency and profit margins .

How many stages of supply chain?

Depending on the source of information, there are generally six accepted stages of a supply chain. The stages relative to vertical integration are materials, suppliers, manufacturing, and distribution. There are three types of integration, each with several shared advantages and disadvantages when merging two businesses in different stages ...

What are some examples of backward integration?

Examples include iron mining companies that own "downstream" activities such as steel factories. Backward integration takes place when businesses at the end of the supply chain take on activities that are "upstream" of its products or services.

What is forward integration strategy?

Engaging in sales or after-sales industries for a manufacturing company, it is a forward integration strategy. This strategy is used to achieve higher economies of scale and larger market share. Forward integration strategy is boosted by internet. Many companies have built their online stores and started selling their products directly to consumers, bypassing retailers.

What is vertical integration?

Vertical integration (VI) is used strategically to gain control over the industry’s value chain. The important issue to consider is, whether the company participates in one activity (one industry) or many activities (many industries). For example, a company may choose that it only manufactures its products or would get involved in retailing ...

What is backward integration?

If a manufacturing company starts creating intermediate goods for itself or buys its previous suppliers, it is a backward integration strategy. It is used to secure stable input of resources and become more efficient. Existing suppliers are unreliable, expensive or unable to provide the required inputs.

When must an organization integrate vertically?

Costs − An organization must integrate vertically when costs producing inside the company are less than the costs of availing that product in the market. Scope of the firm − It is necessary to think over the fact, whether moving into new industries would not dilute its current competencies.

What is horizontal integration strategy?

Horizontal integration strategy is when a business acquires a related business that occupies the same stage of the value chain and provides a similar type of value as the business. The acquired business does not have to be a direct competitor. It may produce a substitute product that serves a similar need for the customer or end-user.

What is vertical integration?

Vertical integration is generally separated into backward integration and forward integration. Backward integration involves restructuring to control the parts of the value chain supplying the business or moving backward toward the earliest stages of production or manufacturing. For example, a manufacturer might acquire the suppliers ...

What is strategic strategy?

Strategy is a firm's orientation, objectives, and tactics employed in pursuit of its objectives or goals. A strategic plan is how these attributes are organized or aligned. Strategies can be applied generally to the firm's value proposition or to any objective or goal within the firm. Porter's Generic Strategies identify how strategy is applied ...

What is core competency?

Assuming control of a part of the value chain in which the company does not have extensive knowledge or ability (a core competency) can result in poorer quality of materials, parts, or goods (particularly when competition does not force maintained quality).

How difficult is it to integrate two companies?

The process of integrating two companies can also be very difficult. It requires a combination of physical, human, and technological resources. Finally, the ability to control a single stage of the value stage may be limited by antitrust law.

Why is vertical integration important?

But companies sometimes integrate because a company in an adjacent stage of the industry chain has more market power. If one stage of an industry chain exerts market power over another and thereby achieves abnormally high returns, it may be attractive for participants in the dominated industry to enter the dominating industry. In other words, the industry is attractive in its own right and might attract prospective entrants from both within the industry chain and outside it.

Why don't you vertically integrate?

The primary message: don't vertically integrate unless it is absolutely necessary to create or protect value. Vertical integration can be a highly important strategy, but it is notoriously difficult to implement successfully and—when it turns out to be the wrong strategy—costly to fix.

Why is it difficult for nonintegrated players to enter the market?

Potential entrants may have to enter all stages to compete. This increases capital costs and the minimum efficient scale of operations, thus raising barriers to entry.

What is the most critical variable in determining VMF?

Buyers and sellers. The number of buyers and sellers in a market is the most critical—although the least permanent—variable determining VMF. Problems arise when the market has only one buyer and one seller (bilateral monopoly) or only a few buyers and a few sellers (bilateral oligopoly).

What were the forces of vertical disintegration in the 1990s?

Three forces seem to favor a general trend toward vertical disintegration during the 1990s. First, many companies integrated in the past for spu rious reasons and should now, even in the absence of structural change, disintegrate. Second, the emergence of a powerful market for corporate control is increasing pressure on overintegrated companies to restructure themselves—either voluntarily or at the hands of corporate raiders. And third, worldwide structural changes are occurring in many industries that increase the advantages and reduce the risks of trading. The first two reasons are self-explanatory, but the third reason needs elaboration.

Why do companies forward integrate?

The early manufacturers of fiberglass and plastic, too, found that forward integration was essential to creating the perception that these products were superior to traditional materials. 5#N#5. See E. R. Corey, The Development of Markets for New Materials, Cambridge, MA, Harvard University Press, 1956.

What are the characteristics of a failed vertical market?

The typical features of a failed vertical market are (1) a small number of buyers and sellers; (2) high asset specificity, durability, and intensity; and (3) frequent transactions.

Understanding Vertical Integration

- Netflix, Inc. is a prime example of vertical integration. The company started as a DVD rental business before moving into online streaming of films and movies licensed from major studios. Then, Netflix executives realized they could improve their margins by producing some of their o…

Advantages and Disadvantages of Vertical Integration

- Vertical integration can help a company reduce costs and improve efficiency. But the company's efforts can backfire.

Real-World Examples of Vertical Integration

- The fossil fuel industry is a case study in vertical integration. British Petroleum, ExxonMobil, and Shell all have exploration divisions that seek new sources of oil and subsidiaries that are devoted to extracting and refining it. Their transportation divisions transport the finished product. Their retail divisions operate the gas stations that deliver their product. The merger of Live Nation an…

What Is Vertical Integration?

- A vertically integrated company is one that owns and controls every facet of the supply chain and production, all the way down to the customer-facing aspect of the business. A company that pursues vertical integration is one that does not have to depend on outside businesses, contracts, or suppliers.The company controls it all, meaning they don’t h...

Types of Vertical Integration

- Vertical integration can come in different forms. Unlike horizontal integration, which is a strategy where a business acquires other companies at the same level, vertical integration focuses on controlling every level. The following are the different types to consider when implementing a vertical integration strategy.

The Pros and Cons of Vertical Integration

- While vertical integration has many advantages, that doesn’t mean it will work for just any company. For some businesses, vertical integration makes all the sense in the world. For others, it might not make as much sense and they’ll want to look further into horizontal integration. To make a decision on if it’s best for you and your company, check out the following pros and cons…

How Does Vertical Integration Work in Action?

- Most businesses start at one point in the supply chain. Perhaps a company is a retail outlet selling products to the customer. Or maybe the company manufactures an item. While horizontal integration would mean expanding along the same level in that supply chain (such as acquiring more retail outlets if you are one yourself), vertical integration means expanding to different leve…

Vertical Integration Examples

- Elon Musk is known for being a strong proponent of vertical integration. His company SpaceX has made headlines for cutting down on the costs of constructing a rocket ship. That’s because SpaceX manufactures most of the components for the rockets themselves. Musk has extended this idea to his other famous company, Tesla. Thanks to strategies such as building the Tesla Gi…

Alternatives to Vertical Integration

- Unless you’re already a large company with vast resources, vertical integration might not be feasible for you. As discussed, one alternative to this strategy is horizontal integration. With horizontal integration, you can still expand as a company, but you don’t necessarily add on more complexity. Horizontal integration can also act as a stepping stone before becoming a vertically …

Vertical Integration: A Centuries-Old Way to Successfully Scale A Business

- The concept behind vertical integration has been around for decades. It all started with Andrew Carnegie, who introduced the idea on a large scale thanks to Carnegie Steel. Other businessmen like John D. Rockefeller followed suit, forming huge companies that controlled all aspects of the supply chain. It’s not different from what today’s billionaires like Jeff Bezos and Elon Musk have …

The Four Degrees of Vertical Integration

- 1. Full Vertical Integration

Obtaining all the assets, resources, and expertise needed to replicate the upstream or downstream member of the supply chain. - 2. Quasi Vertical Integration

Obtaining some stake in a supplier in the form of specialized investments or an equity staketo obtain agency benefits by increasing the ownership interest in the outcome.

Advantages of Vertical Integration

- The direct benefits of pursuing vertical integration are greater control over the supply chain and lower variable production costs.

Disadvantages of Vertical Integration

- One of the primary disadvantages of vertically integrating is the increase in managerial complexity. This is because entering a new line of work requires a new set of expertise to complement the existing business. A clear result of this is the increase in divestitures to return a company to its core competency. One instance of increased managerial complexity being a disi…

Applications of Vertical Integration

- Some companies are able to gain a competitive advantagethrough vertical integration, whereas others instead opt to develop more efficient ways to manage their supply chain and input costs. It depends on the tradeoff of benefits and costs of integration.

Synergies in Financial Modeling

- A financial analyst performing financial modeling and valuation of a business should incorporate the potential synergies (cost savings) that could arise from vertical integration. If the integration happens as part of a merger or acquisition, the analyst will build an M&A modelin Excel and factor in the cost savings that result.

Video Explanation of Vertical Integration

- Watch this short video to quickly understand the main concepts covered in this guide, including what vertical integration is, the types of vertical integration, as well as the pros and cons of performing vertical integration.

Additional Resources

- Thank you for reading this article on Vertical Integration. To learn more about corporate-level strategies, enroll now in CFI’s Corporate & Business Strategy Courseto deepen your knowledge! Continue learning more by reading the following CFI resources: 1. Horizontal Merger 2. M&A Considerations and Implications 3. Conglomerate Merger 4. M&A Synergies

Definition and Examples of Vertical Integration

Types of Vertical Integration

- There are more than a few types of vertical integration. All types involve a merger with another company in at least one of the four relevant stages of the supply chain. The difference depends on where the company falls in the order of the supply chain. When a company at the beginning of the supply chain controls stages farther down the chain, it is referred to as being integrated forw…

Pros and Cons of Vertical Integration

- Pros Explained

There are five noteworthy benefits of vertical integration that give a company a competitive advantageover non-integrated competitors. A vertically integrated company can avoid supply disruption. By controlling its own supply chain, it is more able to control and deal with any suppl… - Cons Explained

The biggest disadvantage of vertical integration is the expense. Companies must invest a great deal of capital to set up or buy factories. They must then keep the plants running to maintain efficiency and profit margins. Vertical integration reduces a company's flexibilityby forcing them …

Vertical Integration vs. Horizontal Integration

- Vertical integration involves acquiring or developing one or more important parts of a company’s production process or supply chain. For example, Netflix’s shift from licensing shows and movies from major studios to producing its own original content is an example of vertical integration. In contrast, horizontal integration involves acquiring a competitor or other related business with th…

Frequently Asked Questions

- Want to read more content like this? Sign upfor The Balance’s newsletter for daily insights, analysis, and financial tips, all delivered straight to your inbox every morning!