What Can I Write Off on a Settlement Statement for Taxes?

- Finding Deductions. A HUD-1 is a form used in real estate closings to itemize the charges and adjustments paid by borrowers and sellers in purchasing property.

- Deductible Expenses. Several expenses at closing are deductible in the tax year in which they are incurred. ...

- Nondeductible Expenses. ...

- Capitalized Expenses. ...

Are settlement statements tax deductible?

Of course, your settlement statement is comprised of more than interest, points, and real estate taxes. Unfortunately, most of the other items are not tax deductible. These are standard fees you pay for a loan closing that you cannot deduct.

Can I deduct settlement or closing costs on my taxes?

The only settlement or closing costs you can deduct on your tax return for the year the home was purchased or built are Mortgage Interest and certain Real Estate (property) taxes. These can be deducted in the year you buy your home if you itemize your deductions. For additional tax information for homeowners, please see IRS Publication 530.

How do I list sales expenses on my settlement statement?

Select that to get to the general area. Sales expenses are listed in the sellers column of your settlement statement and include: Is the Sale of My Main Home Taxable?

Are refinance settlement statements tax deductible?

Homeowners who refinance are also given settlement statements. For homeowners, some of the costs for refinancing a mortgage loan are tax deductible. As with homebuyers, a refinanced mortgage's loan interest prepaid at closing is usually tax deductible.

What items on a settlement statement are tax deductible?

The seller of a business or investment property may deduct condo fees, fees paid out of escrow (for utility bills, insurance, etc.), fire/casualty insurance premiums, interest, and real estate taxes. They can also include the same selling expense items as the seller of a principal residence.

What is deductible on a settlement sheet?

Deductible Expenses Interest on your loan paid at closing is tax deductible. Any prorated property taxes allocated as your expenses are also deductible. You can deduct loan origination fees or points, which are the fees a bank charges you for making the loan.

What is deductible on closing statement?

Typically, the only closing costs that are tax deductible are payments toward mortgage interest, buying points or property taxes. Other closing costs are not. These include: Abstract fees.

Can you deduct settlement expenses?

Generally, if a claim arises from acts performed by a taxpayer in the ordinary course of its business operations, settlement payments and payments made pursuant to court judgments related to the claim are deductible under section 162.

How do you read a settlement statement for taxes?

0:367:31How To Read A Settlement Statement From Your Real Estate ClosingYouTubeStart of suggested clipEnd of suggested clipSo on page one of the closing disclosure you're going to see the parties identified at the top soMoreSo on page one of the closing disclosure you're going to see the parties identified at the top so seller and buyer the property. Address and the loan. Amount.

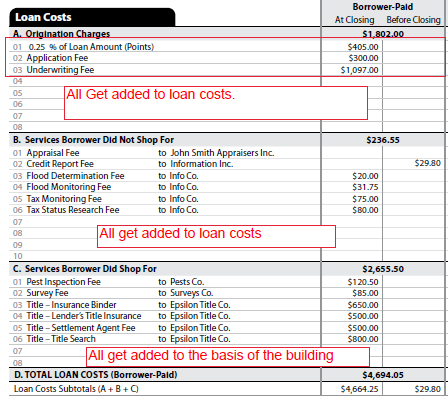

What closing costs can be added to basis?

The following are some of the settlement fees and closing costs that you can include in the original basis of your home.Abstract fees (abstract of title fees)Charges for installing utility services.Legal fees (including fees for the title search and preparation of the sales contract and deed)Recording fees.Surveys.More items...•

Can you write off home improvements?

Eligible expenses include painting, renovating rooms, replacing doors, windows, air conditioning electrical systems, and ventilation, as well as paving the yard and even landscaping, to name a few. This tax credit is worth 10.5% of eligible expenses, up to $2,100. The measure will end on December 31, 2022.

Are closing costs tax deductible in 2021?

You closing costs are not tax deductible if they are fees for services, like title insurance and appraisals. You can deduct these items considered mortgage interest: Mortgage insurance premiums — for contracts issued from 2016 to 2021 but paid in the tax year. Points — since they're considered prepaid interest.

Where do I find sales expenses on settlement statement?

Sales expenses are listed in the sellers column of your settlement statement and include: commissions. appraisal fees. broker's fees.

Can I write off settlement agreement?

Money you pay for legal fees or court costs is deductible, as long as the legal matter is business and not personal. If you agree to pay the plaintiff to settle a civil suit, that's also a legitimate business write-off. If the government took you to court, you can write off any remedial or compensatory damages you pay.

Do I have to claim a settlement on my taxes?

Generally speaking, any settlement or judgment amount you receive as compensation for lost income is subject to income tax. The reasoning is that your original income would have been taxable had you not suffered the income loss, so any compensation intended to replace that same lost income should be taxable as well.

Do I have to pay taxes on settlement money?

The tax treatment of settlements received for sickness or injury depends on how you handled your medical expenses. If you did not deduct any medical expenses related to your physical injury on previous tax returns, the settlement money you receive is not taxable. The IRS won't allow you to double-dip, however.

What Are Seller Deductions?

Any prorated real estate taxes a home seller pays at closing are tax deductible. However, many of the closing costs listed on a settlement statement are deducted from sale proceeds. Lowered net proceeds reduce the capital gains the home seller may have garnered, thus reducing associated taxes. A capital gain is the improvement between a home's past purchase price and its later sale price, minus sale expenses.

What is a HUD-1 settlement statement?

The HUD-1 Settlement Statement is a breakdown of the expenses home sellers and homebuyers incur in a real estate sale. The settlement statement gives both parties a full picture of the expenses attached to the transaction. Some of the expenses assigned to home sellers and buyers on the HUD-1 form might be tax-deductible, and whether they are depends on the specifics of each transaction. Some of the more common examples of deductible expenses include loan origination fees, mortgage insurance premiums, and real estate tax payments.

Can you deduct mortgage insurance premiums?

Prepaid mortgage interest and mortgage insurance premiums are tax deductible, as are upfront real estate tax payments made from mortgage escrow funds.

Can you deduct points on a refinance?

However, on mortgage refinances, points paid are normally deducted as a prorated amount over the life of the loan.

Is a refinance loan deductible?

Homeowners who refinance are also given settlement statements. For homeowners, some of the costs for refinancing a mortgage loan are tax deductible. As with homebuyers, a refinanced mortgage's loan interest prepaid at closing is usually tax deductible. For property located in the San Francisco area, loan interest can become a significant expense and deduction. When you refinance your mortgage, points paid to lower your loan's interest rate can be deducted as well. However, on mortgage refinances, points paid are normally deducted as a prorated amount over the life of the loan.

Do home sellers pay closing costs?

Also, home sellers sometimes pay all or a portion of the buyer's closing costs. The closing costs sellers pay for buyers are deductible by buyers only, though the payment of such costs by sellers reduces those sellers' net capital gains and any taxes due.

Is mortgage interest deductible on HUD?

The mortgage interest paid for the remainder of the month in which the loan funds is also indicated on the HUD-1 statement and is tax deductible. Itemizing your taxes is the best way to take advantage of these deductions.

What is escrow payment?

Escrow Payments. Setting up an escrow often means paying real estate taxes upfront. It pays to know exactly how much you paid towards your real estate taxes at the closing. These funds are tax deductible, just like the real estate taxes you pay directly to the county.

How much is a discount point on a loan?

They are a percentage of your loan amount. One point equals one percent of your loan. On a $100,000 loan, one point equals $1,000. You can deduct these points on your tax returns. Again, you can deduct the full amount of the points on a purchase. If you refinanced, you’ll prorate the deduction over the life of the loan.

Can you deduct points on your tax return?

Whatever the case may be, you may be able to deduct those points on your tax return. Lenders look at points as prepaid interest. Since you get to deduct the interest you pay on your mortgage on an annual basis, it makes sense that you can deduct the points.

Can you deduct home insurance premiums?

You cannot, however, deduct the homeowner’s insurance premiums you pay upfront, so you’ll need to differentiate from the two. Make sure to ask your lender how much of the escrow account that you set up is comprised of real estate taxes. This way you know exactly how much you can claim on your taxes for deductions.

Can you deduct points on a mortgage?

If you purchased a home, you can deduct the full amount of the points during the year that you paid them. If you refinanced a mortgage, you must prorate the points over the term of the loan. For example, if you took out at 15-year loan, you’d write off a portion of the points every year for 15 years.

Can you deduct interest on a mortgage when closing?

Any interest you pay at the time of the closing can also be deducted. You prepay interest because you will not owe a mortgage payment the next month. Let’s say you close on November 15 th. You would not make a mortgage payment until January 1 st. This leaves all of the interest for the rest of November to be paid. The mortgage payment you make in January will cover December’s interest, though. If you close early in the month, you could pay a decent amount of money for interest that is worth deducting on your taxes.

Do you pay origination points on a mortgage?

Origination Points. It’s not unusual to pay origination points on a mortgage. Whether you have a less than perfect credit score or have a unique situation, lenders often charge points up front. Sometimes, those points are in place of itemized closing costs and other times they are in addition to the costs.

What are the expenses associated with buying a house?

Expenses include title insurance, your share of property taxes, interest, points, loan fees, escrow fees and recording fees, among others. While some of these expenses are not tax ...

What expenses are capitalized in closing?

When determining whether you owe taxes on the sale of the property, you will subtract the sale price from the property's cost basis to determine the taxable gain from the sale before applicable exclusions are applied. According to the IRS, expenses such as title insurance, transfer taxes, surveys, and legal fees may be capitalized.

Is interest on a loan at closing tax deductible?

Interest on your loan paid at closing is tax deductible. Any prorated property taxes allocated as your expenses are also deductible. You can deduct loan origination fees or points, which are the fees a bank charges you for making the loan.

Is closing expenses tax deductible?

Some expenses you incur at closing are not deductible. The insurance premium for your home insurance is not tax deductible and neither is your title insurance premium. Remember that private mortgage insurance may or may not be deductible, in whole or in part, depending upon your income level.

How much gain can you exclude from your income?

For the sale of a residence, up to $250,000 ($500,000 on a joint return where you both lived in the residence) of gain can be excluded from income if you lived in and owned the house for two of the last five years.

What tab to look for when selling a home?

Look under the wages and income tab for less common income, then sale of home.

Is a settlement statement tax deductible?

What items on the sale of home "Settlement Statement" are income tax deductible for the seller? Almost no closing costs incurred on a sale of a residence are deductible. An exception is any mortgage interest or real estate taxes charged at closing to bring them up to the closing date.

Where are sales expenses listed on a settlement statement?

Sales expenses are listed in the sellers column of your settlement statement and include:

Do you include prorated taxes on a 1098?

Yes, you would include the prorated taxes. Any interest would already be on your Form 1098 from your mortgage company. Also, perhaps the following will help -

What is settlement statement?

Today, the settlement statement has a new name – it’s the Closing Disclosure. Either way, the statement itemizes the cost of closing on your loan. It includes all charges from the lender, third parties, and all prepaid expenses, such as interest, taxes, and insurance.

How much can you deduct on closing disclosure?

Today, taxpayers can deduct $12,200 for single filers and $24,400 for married filing joint filers. If you don’t have itemized deductions that exceed this amount, itemizing your deductions doesn’t make sense. If you don’t itemize your deductions, you can’t deduct any of the items on your Closing Disclosure.

How long after closing can you deduct prepaid interest?

Prepaid interest covers the interest on the loan from the closing date through the end of the month. Your first mortgage payment won’t occur until approximately 45 days after closing.

Can you write off closing costs on a closing disclosure?

If you don’t itemize your deductions, you can’t deduct any of the items on your Closing Disclosure. In order to write off the closing costs you paid, you must itemize the deductions. So start there. If you think you have more deductions than $12,200 or $24,400, then read on to see what you can deduct.

Can closing costs be deducted from taxes?

Closing Costs Sellers Can Deduct. If you are the seller, you may be able to deduct a few expenses on your taxes. Just like buyers, you can deduct any property y taxes that you pay. You’ll likely pay a prorated amount since the buyer will be in the home and owe a portion of the year’s taxes.

Is closing tax deductible?

Any real estate taxes you paid at the closing are also tax deductible. This includes taxes you paid for the upcoming bill or money you put into an escrow account to hold for tax payments. The Closing Disclosure will break down the amount you pay for the taxes, which you can write off accordingly.

Can you deduct closing costs?

You can deduct the amount stated on the Closing Disclosure. Sellers also benefit from closing costs that come off the bottom line. The less money sellers make at the closing, the lower his or her capital gains are. This helps reduce the cost of the taxes because the profits are lower.

What closing costs are tax deductible when purchasing a home?

What closing costs are tax-deductible when purchasing a home? Congratulations on the purchase of your new home! When you purchased your home, you may have paid what is called "settlement" or "closing costs" in addition to the contract price.

Can you deduct closing costs on taxes?

The only settlement or closing costs you can deduct on your tax return for the year the home was purchased or built are Mortgage Interest and certain Real Estate (property) taxes. These can be deducted in the year you buy your home if you itemize your deductions.

What is the standard deduction for 2021?

First, you should know the current standard deduction amounts. For 2020 tax returns filed in 2021, the standard deduction is $12,400 for individuals, $18,650 for heads of household and $24,800 for married couples filing jointly and surviving spouses. Your itemized deductions need to exceed these amounts to benefit from closing cost tax deductions.

Do you have to pay taxes on the first $250,000 you sell your home?

If you’ve lived in your home two of the last five years, you don’t have to pay taxes on the first $250,000 of profit from selling your home if you’re single, or $500,000 if you’re married. These amounts are exemptions, which give you much greater tax savings than deductions.

Can you deduct mortgage origination fees?

The IRS classifies mortgage origination fees as points. You can deduct your loan origination fees, even if the seller pays them. These are the fees that lenders charge for underwriting and processing your mortgage.

Is a loan point deductible?

The type of loan point you’re probably most familiar with is the type you pay to reduce your interest rate. The IRS considers these “discount points” to be prepaid interest, which generally makes them tax deductible in the year you pay them if you meet these conditions: The mortgage is secured by your main home.

Can you deduct property taxes?

State and local real estate taxes (property taxes) are deductible in the year you pay them. You can only deduct property taxes that are levied at a similar rate on all the real estate in your area to benefit the general welfare.

Can you deduct mortgage interest on property taxes?

Only mortgage interest and property taxes are potential deductions. That means the following fees are not tax deductible:

Do you have to deduct points when selling a house?

However, when you sell your home, you’ll have to remember to reduce the value of the purchase price by any points the seller paid. You will probably achieve the greatest tax savings by deducting all your points in the year you pay them, if you’re eligible to do so.