What can I do if the IRS is holding my refund? In the case that the IRS hasn't sent your refund yet, you can ask them to stop the direct deposit. Call the IRS toll-free at (800) 829-1040, any weekday between 7 a.m. and 7 p.m.

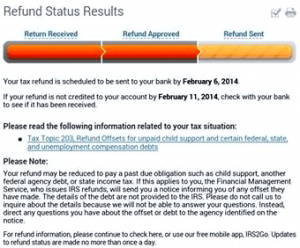

- IRS.gov “Where's My Refund?”

- The IRS2Go mobile app.

- IRS Refund Hotline – 800-829-1954. Wait at least 21 days after electronically filing and six weeks after mailing your return to contact the IRS by phone.

Can the IRS take or Hold my refund?

Yes. When the IRS takes or holds your refund, it’s a sign that you’re not in good standing with our nation’s tax collector. The IRS can take or hold your refund in any of these situations. 1. The IRS is questioning the accuracy of your tax return.

How long can the IRS Hold Your refund for review?

The IRS says people can start checking the status of their refund within 24 hours after an electronically filed return is received by the agency, or four weeks after a taxpayer mails a paper return.

Are IRS refunds delayed?

Refund delays also can be triggered if an e-filed or paper return has a mistake. Trouble spots include errors involving the recovery rebate credit and the child tax credit, missing information, and cases where the IRS suspects identity theft or fraud.

Is federal tax refund delayed?

There are many reasons your tax refund could be delayed. Perhaps your numbers and your employer’s numbers didn’t match. Or you accidentally skipped a line—or an entire form. Or maybe you claimed a credit that the IRS takes longer to check. This year, however, the mostly likely reason your tax refund is delayed is that you filed a paper return.

See more

How do I get the IRS to release my refund?

Request an expedited refund by calling the IRS at 800-829-1040 (TTY/TDD 800-829-4059).Explain your hardship situation; and.Request a manual refund expedited to you.

How long is the IRS allowed to hold your refund?

How long can the IRS hold your refund for review? The review process can take as long as 180 days. If the IRS requests more information or an amended return, it may take an extra 60 to 120 days to process the new information and issue a refund. Keep in mind that the IRS cannot issue a refund until February 15.

Why is the IRS still holding my refund?

Things that can delay a refund: The return has errors, is incomplete or is affected by identity theft or fraud. The return needs a correction to the child tax credit or recovery rebate credit amount.

Can I sue the IRS for holding my refund?

Generally, if you fully paid the tax and the IRS denies your tax refund claim, or if the IRS takes no action on the claim within six months, then you may file a refund suit. You can file a suit in a United States District Court or the United States Court of Federal Claims.

How do I know if my taxes are under review?

If the IRS decides that your return merits a second glance, you'll be issued a CP05 Notice. This notice lets you know that your return is being reviewed to verify any or all of the following: Your income. Your tax withholding.

Why would the IRS hold my refund for review?

There are many reasons why the IRS may be holding your refund. You have unfiled or missing tax returns for prior tax years. The check was held or returned due to a problem with the name or address. You elected to apply the refund toward your estimated tax liability for next year.

Is the IRS holding refunds for 2022?

Early Filers - You Will See A Delay In Your Refund Remember, Congress passed a law that requires the IRS to HOLD all tax refunds that include the Earned Income Tax Credit (EITC) and Additional Child Tax Credit (ACTC) until February 15, 2022, regardless of how early the tax return was filed.

Why is my 2022 refund taking so long?

What's Taking So Long to Receive Refunds? If you don't receive your refund in 21 days, your tax return might need further review. This may happen if your return was incomplete or incorrect. The IRS may send you instructions through the mail if it needs additional information in order to process your return.

Why is my refund taking longer than 21 days 2022?

It is also taking the IRS more than 21 days to issue refunds for some tax returns that require review including incorrect Recovery Rebate Credit amounts, or that used 2019 income to figure the Earned Income Tax Credit (EITC) and Additional Child Tax Credit (ACTC).

Can the IRS not give you your refund?

Key Takeaways. The IRS can seize some or all of your refund if you owe federal or state back taxes. It also can seize your refund if you default on child support or student loan debts. If you think a mistake has been made you can contact the IRS.

What happens if IRS never sends refund?

If you don't receive your deposit within five days after the 21 days have passed, you can request a refund trace. Paper check: If you don't receive your refund check within six weeks of mailing your tax return to the IRS, you can request a refund trace.

Can I file a complaint against the IRS?

If you wish to report a Section 1203 violation, you may do so by telephoning the Treasury Inspector General for Tax Administration (TIGTA). The toll free telephone number is 1-800-366-4484.

Why is the IRS holding my refund for 60 days?

Why the delay? While the delay could be simply due to IRS processing backlogs, the more likely reason is that your return got flagged for additional processing due to missing or incorrect information the IRS systems cannot automatically reconcile.

Who do I call if I haven't received my tax refund?

Whether you owe taxes or you're expecting a refund, you can find out your tax return's status by: Using the IRS Where's My Refund tool. Viewing your IRS account information. Calling the IRS at 1-800-829-1040 (Wait times to speak to a representative may be long.)

Is the IRS holding refunds for 2021?

Remember, Congress passed a law that requires the IRS to HOLD all tax refunds that include the Earned Income Tax Credit (EITC) and Additional Child Tax Credit (ACTC) until February 15, 2022, regardless of how early the tax return was filed.

Will I get my refund after 60 day review?

After 60 days, you'd need to file an amended return to reverse any errors and get your refund back. If the IRS thinks you claimed erroneous deductions or credits, the IRS can hold your refund. In this case, the IRS will audit you to figure out whether your return is accurate.

Why is my tax refund being held?

There are two big “tax account” reasons the IRS will hold your refund: The IRS suspects you’ve been the victim of tax identity theft. This may mean you’ll need to contact the IRS and prove your identity before you’ll get your refund. There’s a discrepancy related to your dependent.

How long does it take for the IRS to release your refund?

Once you’ve cleared up your account issue, the IRS will usually release your refund within a few weeks. 5. You owe other debts, like student loans, back child support, outstanding unemployment compensation repayments, or state taxes. The IRS collects some other types of debts by taking your refund.

What happens if you claim erroneous deductions?

If the IRS thinks you claimed erroneous deductions or credits, the IRS can hold your refund. In this case, the IRS will audit you to figure out whether your return is accurate. If you prove to the IRS that you correctly took the deductions and/or credits, the IRS will issue your refund or corrected refund. The IRS can freeze your refund ...

What happens if you don't pay your taxes?

2. You owe back taxes. If you owe back taxes, the IRS will take all your refunds to pay your tax bill, until it’s paid off. The IRS will take your refund even if you’re in a payment plan (called an installment agreement). But if you can’t pay your taxes right away, it’s always best to get into an IRS payment agreement to minimize penalties ...

How long do you have to file an amended tax return?

In that case, if you don’t think the change was correct, you have 60 days to prove your case to the IRS and ask for a reversal. After 60 days , you’d need to file an amended return to reverse any errors and get your refund back. If the IRS thinks you claimed erroneous deductions or credits, the IRS can hold your refund.

What is the phone number for the Bureau of Financial Services?

If you’re not sure what to do, call the Bureau of Financial Services Treasury Offset Program at (800) 304-3107.

Can the IRS take my refund?

Can the IRS Take or Hold My Refund? Yes. | H&R Block

What is the number to call to check on my tax refund?

If you still aren’t sure what happened with your refund, contact an IRS representative at IRS Tax Help Line for Individuals – 800-829-1040 (TTY/TDD 800-829-4059).

What to do if you don't get a refund from a credit union?

The IRS will contact the institution and try to help, but the IRS can’t require the bank or credit union return the funds.

Was your refund supposed to go directly to your bank account?

The bank account information you put on your tax return was incorrect.

Is the IRS holding on to your refund?

The IRS may not issue a credit or refund to you before February 15th, if you claim the Earned Income Tax Credit (EITC) or Additional Child Tax Credit (ACTC) on your tax return.

Did the IRS change my tax return?

The IRS may have changed an amount on your tax return during processing, but for some reason you didn’t get a notice, or maybe your tax return wasn’t received by the IRS. A transcript of your account will have information about the receipt and processing of your return.

Can TAS release refunds?

Neither TAS, nor the IRS, can release any part of your refund before that date, even if you’re experiencing a financial hardship.

Can you be injured if your spouse is responsible for your debt?

If you believe you are entitled to all or part of the refund because your spouse is solely responsible for the debt, you may be an Injured Spouse.

Why is my tax return being held off?

There might be many reasons why the Internal Revenue service might review and hold off your refund. The general norm is to file for your income tax return via electronic means through a computerized system where the system scans and reviews your return application. In most cases, if the return is free of errors, the IRS will accept it. However, there might be a chance of your return containing errors or it might include deductions or credits that are out of the ordinary. In such scenarios, a representative from the Internal Revenue Service will review your return physically.

Why does the IRS review my tax return?

IRS reviews can also be triggered by incomplete returns which could hold up your refund for a longer period of time. For instance, if your return was filed on paper and you forgot to fill in critical information such as your Social Security Number or misspell your address or date of birth, or did not sign your tax form, the Internal Revenue Service cannot process your tax return unless the above information is corrected and checked off.

Why is my tax refund delayed?

Sometimes your refund could also get delayed if it gets lost in the mail which never reaches you. There could also be a possibility of having your refund stolen from the mailbox which could be another delaying cause. Additionally, government shutdowns like the incident that occurred from December 22, 2018 until January 25, 2019 can also lead to longer wait times because the federal bodies need to be up and running in order to process refunds quickly. You can always contact the local IRS office for additional help in case the “Where’s My Refund” tool is not working or does not provide you with the information you are looking for. Contacting the IRS office will help them trace your refund in order to find the root cause and issue a replacement if necessary, in genuine cases.

How long does it take to get your tax refund after you amend your tax return?

It can take up to three weeks for amended returns adjusted by you to display in the IRS system and an extended four month or sixteen weeks to get processed implying that you will have to end up standing by for several months to receive your refund.

What happens if you interchange two digits on your tax return?

For instance, if there was a situation where you interchanged two digits, the IRS will align the error made mathematically but this revision will lead to extra processing time and as a result, your refund which is due will get delayed as well.

What happens when someone files a fraudulent tax return?

Tax-related identity theft can happen when someone else files a fraudulent tax return using your personal information and claims a refund in your name. The statistics for the tax-filing season of 2019 pointed to a rough estimate of $15.8 million in falsified refund claims with greater than 3,800 unauthorized returns related to identity theft. Anybody who suspects having been unlawfully cheated by tax-related identity theft is encouraged to report fraud to the Federal Trade Commission and contact the Internal Revenue Service reporting the same.

Can you hold off your tax return for a long time?

There can be situations where your tax return has mistakes or numerical errors wherein your refund might be held off for a long time . Upon the detection of an error in your return, it is designated for physical review implying that an employee from IRS must investigate it to detect the mistake.

How to get your tax refund faster?

Join the eight in 10 taxpayers who get their refunds faster by using e-file and direct deposit. It's always been the safest, fastest way to receive your refund, but is even more so in these uncertain times. It is also easy to use. Just select it as your refund method through your tax software and type in the account number and routing number. Or, tell your tax preparer you want direct deposit. You can even use direct deposit if you are one of the few people still filing by paper. Be sure to double check your entry to avoid errors.

How long does it take to get a tax refund?

The IRS issues more than 9 out of 10 refunds in less than 21 days. However, it’s possible your tax return may require additional review and take longer.

How long does it take to get a refund from a 1042?

If you requested a refund of tax withheld on a Form 1042-S by filing a Form 1040NR, we will need additional time to process the return. Please allow up to 6 months from the original due date of the 1040NR return or the date you actually filed the 1040NR, whichever is later to receive any refund due.

How long does it take for IRS to process a tax return?

Thank you for your patience. The IRS issues more than 9 out of 10 refunds in less than 21 days. However, it’s possible your tax return may require additional review and take longer.

Where is my routing number on my check?

Be sure to double check your entry to avoid errors. Your routing and account number can be found on the bottom of your checks, through your online banking application or by contacting your financial institution directly. Do not enter the number on your bank card.

What to do if you haven't received your tax refund?

In the case that the IRS hasn’t sent your refund yet, you can ask them to stop the direct deposit. Call the IRS toll-free at (800) 829-1040, any weekday between 7 a.m. and 7 p.m.

How long does it take to get a tax refund if you file a paper return?

The IRS estimates the processing time for amended returns as somewhere between eight and 12 weeks.

Why does the IRS keep processing time?

To combat the threat, the IRS maintains strict security standards. Some security measures will cause the IRS to increase processing time for returns (and refunds). If the IRS suspects that someone has attempted to steal your identity (by filing a fake return), this could hold up your return.

What happens if IRS garnishes your tax return?

In the event that the IRS garnishes your refund, you will receive a notice explaining why it did so. If you don’t think you owed that debt, you will need to dispute it with the agency to whom the money was paid. The Takeaway. There are a number of reasons why you could experience a tax refund delay.

Why is my tax refund delayed?

Reason for Tax Refund Delay: You Have Outstanding Debt. For certain types of debts, the IRS has the authority to garnish your tax refund. (Wage garnishment is the act of withholding money from you in order to put it toward something else.) Common reasons that the IRS will garnish your refund include.

How long does it take to get a tax refund for 2020?

For 2020 tax returns, the IRS said it planned to issue more than 90% of refunds within 21 days of e-filing. Some refunds could take as little as 14 days. This, of course, was before the coronavirus pandemic hit and health directives closed offices, including at the IRS.

Why is the IRS making changes to their processes?

One reason for this is because the IRS may still be making changes to their processes. That could include updated security measures or process tweaks due to changes in the tax code. And if the IRS needs to update or make changes, it probably won’t make them until just before tax time.