What are contra accounts in accounting?

What is a Contra Asset Account?

- Examples of Contra Assets. Accumulated Depreciation Accumulated depreciation is the total amount of depreciation expense allocated to a specific asset since the asset was put into use.

- Reasons to Show Contra Accounts on the Balance Sheet. ...

- Contra Asset – Accumulated Depreciation. ...

- Allowance for Doubtful Accounts. ...

- Related Readings. ...

Is accumulated depreciation a contra asset account?

An accumulated depreciation account is a type of contra asset account that is used for recording the amount of depreciation a fixed asset evolves through. For instance, a fixed asset such as machinery, a company building, office equipment, vehicles or even office furniture would be highlighted in an accumulated depreciation account.

What are the types of asset accounts?

Here are some examples of asset accounts:

- Cash

- Short-term Investments

- Accounts Receivable

- Allowance for Doubtful Accounts (a contra-asset account)

- Accrued Revenues/Receivables

- Prepaid Expenses

- Inventory

- Supplies

- Long-term Investments

- Land

Are distributions a contra account?

What is a contra account owner distribution? An owner’s or stockholders’ equity account with a debit balance instead of the normal credit balance. Examples include the owner’s drawing account, a dividend account, and the treasury stock account.

What is a contra asset classified as?

Normal asset accounts have a debit balance, while contra asset accounts are in a credit balance. Therefore, a contra asset can be regarded as a negative asset account. Offsetting the asset account with its respective contra asset account shows the net balance of that asset.

Is contra asset a current asset?

Accumulated depreciation is not a current asset account. Accumulated depreciation accounts are asset accounts with a credit balance (known as a contra asset account).

Is contra asset account a liability?

A contra asset account is not classified as an asset, since it does not represent long-term value, nor is it classified as a liability, since it does not represent a future obligation.

Where do contra assets go on a balance sheet?

Allowance for doubtful accounts is a common contra asset listed on a company's balance sheet under accounts receivable.

Why is a contra account an asset?

A contra asset account is an asset account where the account balance is a credit balance. It is described as "contra" because having a credit balance in an asset account is contrary to the normal or expected debit balance.

Which is a current asset?

Current assets include cash, cash equivalents, accounts receivable, stock inventory, marketable securities, pre-paid liabilities, and other liquid assets. Current assets are important to businesses because they can be used to fund day-to-day business operations and to pay for the ongoing operating expenses.

What accounts are contra accounts?

A contra account is a general ledger account with a balance that is opposite of the normal balance for that account classification. The use of a contra account allows a company to report the original amount and also report a reduction so that the net amount will also be reported.

What is a contra entry in accounting?

A contra entry is recorded when the debit and credit affect the same parent account and resulting in a net zero effect to the account. These are transactions that are recorded between cash and bank accounts.

What is a contra asset account?

A contra asset account is a type of asset account where the account balance may either be a negative or zero balance. This type of asset account is referred to as "contra" because normal asset accounts might include a debit, or positive, balance, and contra asset accounts can include a credit, or negative, balance. Because of the oppositional nature of these asset accounts, the contra account acts as a 'contrary' element to the debit balances of regular asset accounts. Furthermore, a contra asset account may also be regarded as a negative asset account because equalizing an asset account and contra asset account results in the asset's net, or total, balance.

What is contra asset?

The contra asset account has credited balances that can reduce the balance in its paired asset account. A company can choose to state this information as separate line items on its balance sheet so that any financial planners or analysts can determine the extent to which a paired asset might be reduced.

What are the different types of contra assets?

A company might use a combination of different types of asset accounts, and the following six types of contra asset accounts can be used in conjunction with these fixed and current asset accounts. Accumulated depreciation. Accumulated depletion. Obsolete inventory reserves. Allowance for doubtful accounts.

Why is it important to include contra assets on a balance sheet?

Financial advisors and planners can see the accumulation of assets an organization has. The amount of depreciation on an asset can be calculated using information from the balance sheet.

What is an ADA account?

Allowance for doubtful accounts, or ADA for short, is a type of contra asset account that is used to create an allowance for clients that purchase goods or services, and then fail to pay the amount owed for their purchases.

What is trade accounts receivable?

Trade accounts receivable refer to an amount that a company bills to its clients when delivering goods or services. These billings may usually be documented on invoices, which are then summarized in an aging report for all the business's accounts receivable.

What is obsolete inventory?

Obsolete inventory refers to a company's products or goods that have become obsolete, or unusable, during routine use and operations. This type of contra asset account may generally be debited expenses, followed by a credit to the company's contra asset account for recording unusable inventory.

Definition of Contra Asset Account

A contra asset account is an asset account where the account balance is a credit balance. It is described as "contra" because having a credit balance in an asset account is contrary to the normal or expected debit balance. (A debit balance in a contra asset account will violate the cost principle .)

Examples of Contra Asset Accounts

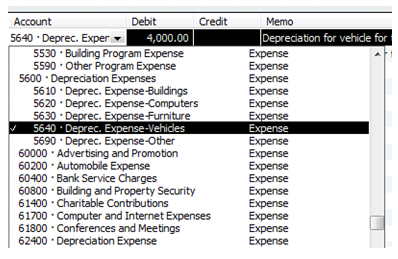

The most common contra asset account is Accumulated Depreciation. Accumulated Depreciation is associated with property, plant and equipment (plant assets). Accumulated Depreciation will be credited when Depreciation Expense is recorded.

What is a Contra Asset Account?

This is when a contra asset account comes in. What is a contra asset account? In simple words, this is an account with a credit balance that is assigned to a particular asset account with a goal to be used to offset the balance of the last one.

Why is it important to show the details of a contra account?

It is important to show these details instead of just recording a net amount because a company can better analyze its financial activity and make changes accordingly. For example, a contra account is set up with an asset account to hold the accumulated depreciation over the years the asset is held. This account is known as Accumulated depreciation. A similar account can be found in the bookkeeping records if the business sells its products or provides services on a credit. Allowance for doubtful accounts allows management to account for a portion of the debt they assume will be uncollectible in their analysis and business plans.

Why is double entry accounting important?

Double-entry accounting plays an important role in the way bookkeepers record each and every transaction. Based on this equation, each account in the general ledger has a debit or a credit normal balance, which is used to identify whether an account should be debited or credited to increase its balance.

Why are contra assets called contra?

Contra asset accounts get their name “contra” because they include a credit balance. These go against the normal asset accounts, which have a debit balance. In essence, contra asset accounts have a negative balance while other asset accounts have a positive balance. Both of these accounts offset each other to represent a net balance on a company’s balance sheet.

What is the importance of Contra Asset Accounts?

Contra asset accounts are necessary for companies for various reasons. The most prominent of these include allowing companies to present a more accurate picture of their assets. Contra asset accounts help companies to record any reductions to their non-current and current assets. By doing so, they can bring their asset accounts to a more accurate position.

What is a Contra Account?

A contra account is an account that companies use to reduce the value of a related account. It usually nets off against related accounts and provides an opposite effect to the balance. Therefore, contra accounts are the reverse accounts that decrease a specific account’s balance. For example, if an account has a debit balance, a contra account will have a credit balance. Thus, netting off both will result in the final amount for the account.

What are the three types of financial accounts?

A company’s financial accounts will usually have three types of items. These include assets, liabilities, and equity. Assets are debit balances that include resources with expected positive future economic benefits. In contrast, liabilities are credit balances that contain obligations that can result in negative cash flows. Lastly, equity is the residual amount after deducting a company’s assets from its liabilities.

What is obsolete inventory?

Companies that hold inventories for a long time may face accumulating obsolete inventory. It refers to any items that are no longer relevant or usable. Therefore, these companies must maintain an obsolete inventory reserve account to net off any unusable stock from the account. This requirement also comes from the accounting standard for inventories.

Do contra assets have credit balances?

Although contra asset accounts have credit balances, they do not appear in liabilities or equity. Usually, credit balances include items from one of those two nature. Therefore, contra asset accounts differ from other accounts that have a credit balance. Contra asset accounts are negative assets in essence. However, accounting standards refer to them as contra accounts.

Do companies need to maintain contra assets?

Contra asset accounts have several types. It is not mandatory for companies to maintain all these accounts. Instead, the existence of contra asset accounts for companies will differ based on a company’s requirements. However, there are some prevalent contra asset accounts that may exist for all companies. Some of these include the following.

What is a Contra Asset Account?

What is Contra Asset Account? Contra asset account is an asset account having credit balance which is related to one of the assets with debit balance and when we add the balances of two of these assets together, it will show us the net book value or carrying value of the assets having the debit balance.

What is annual report?

The annual reports Annual Reports An annual report is a document that a corporation publishes for its internal and external stakeholders to describe the company's performance, financial information, and disclosures related to its operations. Over time, these reports have become legal and regulatory requirements. read more are prepared for various parties; some of them might not be accounting versed; they help them in identifying the reduction in total value.

Is it prudent to show reduction or reserve in separate account?

It is only prudent to show the reduction or reserve in a separate account, and at any point, it gives us the netbook value explaining what the actual cost was and how much of that has been depreciated. It also helps in creating reserves, and later any change in the expected number can be adjusted through allowances and reserves.

Do assets have a debit balance?

We know that assets have a debit balance#N#Debit Balance In a General Ledger, when the total credit entries are less than the total number of debit entries, it refers to a debit balance. A debit balance is a net amount often calculated as debit minus credit in the General Ledger after recording every transaction. read more#N#; however, the contra assets account has credit balances. It means that this account shows the balance, which is a reduction in the value of assets. Let’s say we expect 2% of our total receivable of $100,000 has gone bad. So we show $2,000 ($100,000*2%) as provision for doubtful debts, which is a reduction from debtors value and means that only $98,000 is expected to be received from debtors.

What Is A Contra Asset Account? Definition, Types, Example, And More

Home » Bookkeeping » What Is A Contra Asset Account? Definition, Types, Example, And More

Credit Cards: Payments & Purchases

A debit to one account can be balanced by more than one credit to other accounts, and vice versa. For all transactions, the total debits must be equal to the total credits and therefore balance.

Allowance For Doubtful Accounts And Bad Debt Expenses

Put simply, contra accounts are used to reduce the normal accounts on the balance sheet. If the related account has a debit as the natural balance, then the contra account will record a credit. Notes receivables are promissory notes that include a promise from a borrower to repay a lender.

Why Are Contra Accounts Important?

When financial statements are prepared, an estimation of the uncollectible amounts is made and an adjusting entry recorded. Thus, the expense, the allowance account, and the accounts receivable are all presented properly according to U.S.

Accountingtools

The proper size of a contra asset account can be the subject of considerable discussion between a company controller and the company’s auditors. The auditors want to ensure that reserves are adequate, while the controller is more inclined to keep reserves low in order to increase the reported profit level.

Contra Accounts Definition

Units should consider using an allowance for doubtful accounts when they are regularly providing goods or services “on credit” and have experience with the collectability of those accounts. The following entry should be done in accordance with your revenue and reporting cycles , but at a minimum, annually.

Examples of Contra Assets

Reasons to Show Contra Accounts on The Balance Sheet

- By reporting contra asset accounts on the balance sheet, users of financial statements can learn more about the assets of a company. For example, if a company just reported equipment at its net amount, users would not be able to observe the purchase price, the amount of depreciation attributed to that equipment, and the remaining useful life. Contra asset accounts allow users to …

Allowance For Doubtful Accounts

- Allowance for doubtful accounts (ADA) is a contra asset account used to create an allowance for customers that are not expected to pay the money owed for purchased goods or services. The allowance for doubtful accounts appears on the balance sheet and reduces the amount of receivables.

Related Readings

- Thank you for reading CFI’s guide to Contra Asset. To keep advancing your career, the additional CFI resources below will be useful: 1. Three Financial Statements 2. PP&E (Property, Plant & Equipment) 3. Straight-Line Depreciation Method 4. Credit Sales