To enroll with Zelle at USAA, you must be at least 18 years old and have:

- A valid U.S. mobile number or email address. See note 1

- An active USAA FSB checking or savings account open for at least 10 days.

- Accounts that are in good standing.

- Location services for the USAA Mobile App enabled in your phone settings.

- The latest version of the USAA Mobile App and the ability to use Quick Logon.

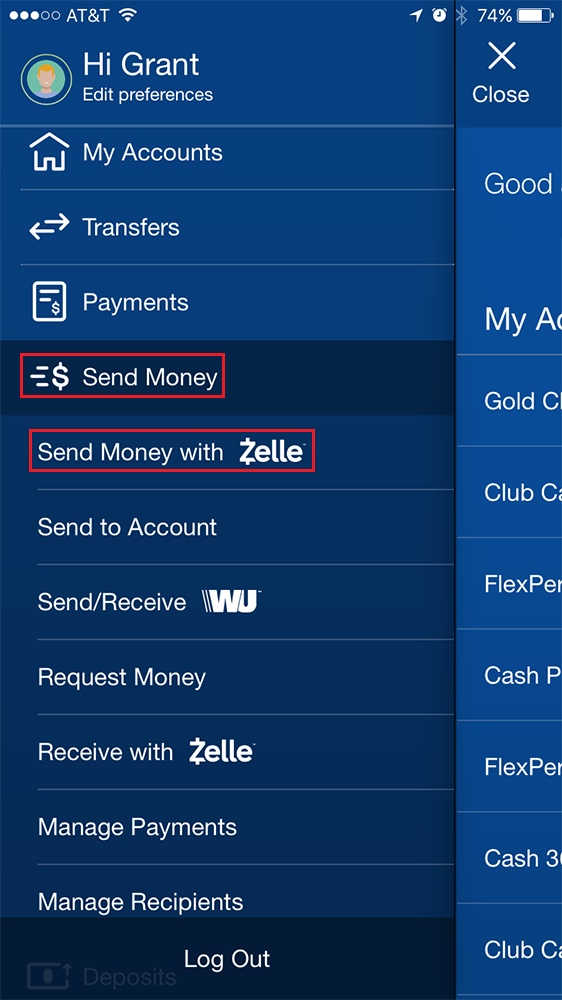

How do I send someone money with Zelle?

Steps Download Article

- Zelle is a free, money-transfering app that you can use to send money to other people who use Zelle.

- This app icon looks like a "Z" with a line through it, like a cash symbol ($), that you'll find on one of your Home screens, in the app ...

- You should see this near the top of your screen. ...

- Tap a contact you want to send money to. ...

How to get money sent through Zelle?

What to Know

- Once you've set up a Zelle account, you'll get a text or email notification when someone sends you money.

- If your bank supports Zelle, you can choose an account to deposit the funds. Otherwise, it goes on your connected debit card.

- Request money: Select Request on the main screen. Choose a contact > Enter an amount > Review > Request.

How much can you send through Zelle?

Your weekly send limit is $500. And Zelle points out that you cannot request to increase or even decrease your send limit. Therefore, if your enrollment with Zelle is only with a debit card, this is, for now, something you can’t change. What Can You Do? A $500 Zelle weekly send limit might not be enough for you.

How to get set up with Zelle?

Here’s how to get started:

- Sign in to the Chase Mobile ® app and tap "Pay and Transfer"

- Tap "Send Money with Zelle ® "

- Tap "Get started" (you may need to agree to terms and conditions)

- Choose your account and add an email or U.S. ...

- Enter your U.S. ...

- Note: You can also add up to 5 email address

- Enter the code sent to your phone and Tap "Next"

- Tap "Done" or "Send or request money"

See more

How do I receive money through Zelle?

Information menuClick on the link provided in the payment notification.Select your bank or credit union.Follow the instructions provided on the page to enroll and receive your payment.

Can I use Zelle without a bank account?

Although the service is seamlessly integrated as a money transfer service provider into many big-name financial institutions, if you use a more obscure bank or credit union, fret not — all you need is an email address or mobile phone number to take advantage of Zelle, regardless of who you bank with.

Do you need a debit card for Zelle?

Zelle is compatible with nearly all major banks, and most even have the service integrated into their mobile banking app. Consumers who download Zelle's standalone app must provide a phone number or email and debit card information to be able to receive and send funds.

Which banks work with Zelle?

If you already have Zelle® in your banking app, GREAT!...Amoco Federal Credit Union.Anchor Bank.Anderson Brothers Bank.Andrew Johnson Bank.Andrews Federal Credit Union.Anstaff Bank.APCU/Center Parc.APL FCU.More items...

Can I use Zelle with cash App?

Cash App cards and Zelle are incompatible, so you cannot link them together. So, when you try to enter your Cash App card information, Zelle will not let you do so and give you an error message.

Can I use Zelle with PayPal?

There's no way to transfer money between PayPal and Zelle as the two platforms don't support each other. However, you can send money to a connected bank account and then forward it.

Can I use my Chime card with Zelle?

Yes, Zelle mobile transfer works with Chime bank. This means there is an established ground for users to undertake financial transactions between Zelle and Chime. Anyone who uses Zelle can use Chime.

What debit cards work with Zelle?

To enroll with the Zelle® app, enter your basic contact information, an email address and U.S. mobile number, and a Visa® or Mastercard® debit card with a U.S. based account. We do not accept debit cards associated with international deposit accounts or any credit cards.

How can I find out if my bank or credit union uses Zelle?

Check with your financial institution. Search their website or mobile app, or look under the Transfers menu, to see if Zelle is available at your b...

Can I use Zelle if I don’t have a smartphone?

If your bank or credit union offers Zelle, you can use its online banking website to send or receive Zelle payments, even if you do not have a smar...

Can I get paid via Zelle?

Yes. Zelle isn’t just for sending money, you can also use it to receive disbursements from companies, universities, government agencies or any othe...

Can I use Zelle for my small business, or to pay a small business?

Yes. Zelle can be a great way to get paid as a small business owner, because it’s fast and there are no fees. If your customers’ payment amounts ar...

What is Zelle and how does it work?

Zelle allows enrolled users to send quick and easy payments to friends and family. The money is typically received in minutes, and you only need to know the US phone number or email address for your recipient to get started.¹

What do you need to know about using Zelle

Zelle is a convenient way to make payments to people you trust, but there are a few limitations to the service. Here’s what you need to know.

Zelle fees

Zelle does not charge users to send or receive money.¹⁴ You’ll need to confirm that your own bank or credit union doesn’t add a fee - but most banks offer Zelle payments without any additional charges.

How to send, request and receive money via Zelle

To make a Zelle payment, you’ll need to log into your online banking service, or the Zelle app. Simply enter your recipient’s US phone number or email address, and the amount you want to send. Once you confirm the payment it will be processed instantly.

Wise is the smart, new way to send money abroad

Want to use Fidelity for international wires? Wish you knew Fidelity's wire transfer fees or how to get started? We've done the research, so you don't have to.