The ongoing costs

- Mortgage payments. Your mortgage payment will almost certainly be your biggest recurring house expense. ...

- Property taxes. In most places, your city or county government requires you to pay property taxes on your home for as long as you own it.

- Homeowners and mortgage insurance. ...

- HOA fees. ...

- Home maintenance, repairs and utilities. ...

Full Answer

What is the minimum income to buy a house?

What are the requirements to buy a house?

- Credit score

- Income and employment

- Savings

- Existing debt

- Required documents

- Mortgage pre–approval

How much cash do I need to buy a house?

A WOMAN who bought a house at 22 has claimed young people don't want to make sacrifices to become a homeowner. Georgina Carson, 25, added: "If you want something that much you would ... they can or look to buy up north to make money from it.

How much house can I afford with my salary?

How much house can I afford on 120k salary? If you make $50,000 a year, your total yearly housing costs should ideally be no more than $14,000, or $1,167 a month. If you make $120,000 a year, you can go up to $ 33,600 a year , or $2,800 a month—as long as your other debts don't push you beyond the 36 percent mark.

Is it ever OK to overpay on a house?

When life gives Disney lemons, the House of Mouse invents a new lemonade recipe ... Then, buy these stocks at reasonable prices. It's OK to overpay a bit if you have to. Quality doesn't always come cheap. Then, stick those shares under your proverbial ...

What do I pay after I buy a house?

There are many variables that go into determining how much you'll pay for closing costs, but it's usually smart to prepare for 3 – 6% of the home value. This means that if you're buying a home worth $200,000, you might pay $6,000 – $12,000 in closing costs.

When you buy a house what do you pay monthly?

What we call a monthly mortgage payment isn't just paying off your mortgage. Instead, think of a monthly mortgage payment as the four horsemen: Principal, Interest, Property Tax, and Homeowner's Insurance (called PITI—like pity, because, you know, it increases your payment).

How much money should I save before buying a house?

How Much to Save for a Down Payment When Buying a Home. You may find as you start shopping for financing that many mortgage companies recommend you put at least 20 percent down.

How much house can I afford making $70000 a year?

On a $70,000 income, you'll likely be able to afford a home that costs $280,000–380,000. The exact amount will depend on how much debt you have and where you live — as well as the type of home loan you get.

How much is a mortgage application?

A mortgage application is used by some lenders to try to get home buyers committed to them through a $400 to $500 fee. Investopedia calls it an excessive fee and should be avoided.

How much does a mortgage lender charge for a credit report?

Mortgage lenders have to run a credit report on you if you’re buying a home and sometimes they’ll try to charge you between $30 to $50 per report. Find out why hiring a home inspector is worth it.

What is the escrow fee?

Escrow Fee. The closing fee is paid to the title company, escrow company or attorney conducting the closing. Some states require a real estate attorney be present at every closing. This is a fee that is separate from the escrow deposit, which requires up to two months of property tax and mortgage insurance payments.

How much does a flood determination assessment cost?

A flood determination assessment is something that comes up and is usually around $10 to $20 but it’s used by lenders to find out if a property is in a flood zone. Lenders have to get a flood determination assessment to determine if the home has the proper amount of insurance.

What is origination fee?

An origination fee is usually collected after a loan is approved and as part of the closing costs. It is between .5 and 1 percent of the sale price. The origination fee typically covers the cost of paperwork, verifications and calculations to figure out the mortgage. Find out what to know about down payments. 8 / 13.

Plan to pay more upfront costs than down payment money when you buy a house

Please answer a few questions to help us match you with attorneys in your area.

Question

I'm about to be a first-time homebuyer, and am on a tight budget. I have a pretty good idea of how much down payment money I'll need, and how much I can afford to pay in monthly mortgage payments. But I'm not as clear about other expenses I'll need to pay up front. Any tips on this?

Answer

Smart thinking to plan ahead for buying a house. Many buyers will have to spend some serious cash before they even move into their new home.

Why do people buy houses with cash?

Maybe you came into a large inheritance, or you’re just really good at saving. Either way, paying the price of the home in full means you won’t have to worry about making mortgage payments. Plus, sellers love a cash offer because it means they won’t have to wait for mortgage lenders ...

How much does a home warranty cost?

Shur recommends considering a home warranty, which costs about $450 a year and provides coverage on a wide variety of elements such as plumbing, electrical, heating/air conditioning, and appliances.

How much does a HOA cost?

These fees will be based on the size of your home and the amenities in your community, but for a typical single-family home, HOA fees can cost around $200 to $300 a month.

Does home insurance add up?

Homeowners insurance adds up. The cost of the policy will depend on the size and value of your home, your location, your deductible, and your coverage. Talk to your current insurer about the home and area you’ll be moving to to get an accurate picture of your new insurance costs.

Do you have to pay property taxes if you pay off your house?

And it’s true! Even if your entire house is paid off, you’ll still have to pay property taxes each month.

Do you have to pay HOA fees when buying a house?

If you’re buying a house with cash in a community with a homeowners association, you might have to budget for monthly or annual HOA fees. These mandatory fees are paid by everyone who owns in the community and go toward maintaining the common areas .

How much can you deduct on your property taxes?

Beginning with the 2018 tax year, you may be able to deduct up to $10,000 ($5,000 if you ’re married filing separately) of your property taxes, plus state and local income taxes combined. Or, you could choose to use sales tax instead of income tax. This is known as the SALT deduction.

When is the best time to buy a home?

Warm-weather months can be a great time to buy a home. But before you take the plunge for the first time, here are some things you should know about taxes and buying a home. Credit Karma Tax® — Always free Learn More.

What is stamp tax?

Many states that charge these taxes base the tax amount on a percentage of the purchase price of the property. Each state and its taxing body have different rules for how their real estate transfer taxes work.

How much tax is on a $500,000 home in Delaware?

And Delaware state law says the tax will be divided between buyers and sellers equally. So in Delaware, your $500,000 home could come with transfer taxes of $15,000 (if you buy in a city without its own transfer tax) or up to $20,000 in state and local taxes .

What is the conveyance tax rate in Hawaii?

For example, Hawaii’s state conveyance tax increases as the property value increases, with the tax rate starting at 0.1% for properties valued at less than $600,000. New Jersey has multiple fees on top of the state and county fees, including additional fees for properties over a certain dollar amount.

Do cities charge sales tax on homes?

Additionally, counties and cities may charge their own sales taxes. With so many types of purchases subject to sales tax, it may be surprising to learn that when you’re buying a house, some states don’t apply their sales tax to home purchases. However, states can have idiosyncrasies in their tax law.

Does California charge sales tax on mobile homes?

However, states can have idiosyncrasies in their tax law. For example, California may charge sales and use tax if you buy a mobile home. So make sure to check your state and local sales taxes to get a better idea of the taxes you may be responsible for.

Who is responsible for paying for the fees for a home sale?

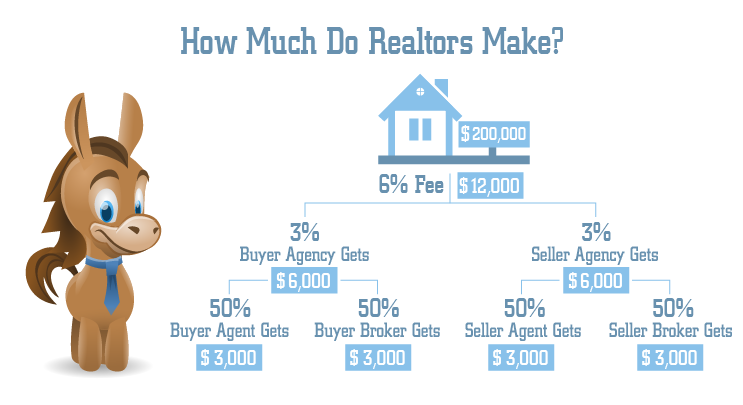

Buyers and sellers are responsible for paying for different fees, so it’s important to know best practices for a typical home sale. Here’s what you need to know about real estate agent commission and how much cash you can expect to contribute.

What should be included in a real estate agent fee?

Generally, things like photography, the cost of listing the property, and the cost of any printed materials or signs are included in the fee, ...

Who pays the broker fee?

It’s up to the landlord and the tenant to decide who pays the rental agent’s fee. Broker fees for finding you a rental generally fall between one month’s rent and 15% of the annual rent of the property. In some situations, the landlord pays the broker to help him find a desirable tenant.

Do landlords pay broker fees?

In some situations, the landlord pays the broker to help him find a desirable tenant. But in other areas, like big cities with large rental populations, the renter will be required to pay the broker fee, even if the landlord hired the broker. Customs vary widely by location, so always make sure you clarify who is going to pay for what, ...

Do buyers pay closing costs?

In fact, even though the buyer usually pays most of the closing costs, they are up for negotiation, too. That’s one of the many things a good agent will do for a buyer—make sure you get the sweetest deal possible.

Can a seller negotiate with a buyer?

A seller can negotiate the terms of the listing agreement—which contains the real estate agent fees—with the brokerage or agent. If a buyer is in a tough seller’s market or bidding war, offering to pay some or all of the real estate agent’s fees can be a way to stand out from other offers. In fact, even though the buyer usually pays most ...

What happens if you appraise a house for less than the price?

If a home appraises for less than the price, the lender may expect the borrower to come up with cash equal to the difference between the appraised value and the price — in essence, a bigger down payment. If the borrower doesn't have enough cash on hand, the deal will fall through unless the seller reduces the price.

Why is it so hard to qualify for a mortgage?

Sometimes it's difficult to qualify for a mortgage because of issues with the property, and sometimes it's difficult because of issues with the buyer. Mortgage lenders "typically won't finance a house that is in disrepair," Kurokawa says — so you might pay cash for a home that needs work before it's habitable.

What to do after offer accepted?

After your offer is accepted, you'll make an earnest money deposit, make sure a title search is done, conduct a final walk-through and go to a closing, where you'll sign documents to transfer the property. You might conduct a home inspection and even hire an appraiser.

Is cash handy?

Cash is handy when these things happen. "You'll probably exhaust your cash for emergencies, repair and important purchases if you spend all your cash on buying the home," Tal Shelef, a real estate agent and co-founder of CondoWizard, in Toronto, said by email.

Can you finance a house that is in disrepair?

Mortgage lenders "typically won't finance a house that is in disrepair," Kurokawa says — so you might pay cash for a home that needs work before it's habitable. However, various renovation loan programs allow you to buy a fixer-upper and include renovation costs in the loan.

What is a good real estate agent?

A good real estate agent can serve as a guide, pointing you in the right direction, giving you a heads-up when bumps are on the road ahead, and , if something comes up that is beyond the agent's scope of knowledge, helping you find a specialized guide to solve that problem.

Does hiring a seller's agent save you money?

Hiring the Seller's Agent Probably Won't Save You Any Money. One of the biggest misconceptions that buyers have is that they'll save on agent commissions by having the seller's agent—commonly, the one you meet at an open house, or talk to if you call the number on the "For Sale" sign—handle the entire transaction.

How are property taxes calculated?

The property taxes are calculated based on the county assessment of tax value. It is important to keep in mind the county tax assessment of value is just that, an "assessment" for the purpose of calculating taxes. The county assessment is not an "appraisal". Both these agents are correct.

Can you use a realtor to appraise a home?

You can utilize a realtor or an appraiser to assist you when the values are reassessed by the appraisal district. I would make sure that you check with your realtor or an appraiser before purchasing a home the county has assessed for considerably less than you are paying.