If you have a 10 year term, but the amortization is 25 years, you’ll essentially have 15 years of loan principal due at the end. Now, the reason why it’s powerful: the longer the amortization, the less principal you are required to pay every month, so you are preserving cash flow.

What does a 25 year amortization mean?

When the amortization period of the loan is longer than the payment term, there is a loan balance left at maturity — sometimes referred to as a balloon payment. If you have a 10 year term, but the amortization is 25 years, you'll essentially have 15 years of loan principal due at the end. Click to see full answer.

How do you calculate an amortization schedule?

Use the concept of amortization to make smart choices about your finances.

- Whenever possible, make extra payments to reduce the principal amount of your loan faster. ...

- Consider the interest rate on the debts you have outstanding. ...

- You can find loan amortization calculators on the Internet. ...

- Use the $10,000 figure and calculate your amortization over the remaining term of the loan. ...

How to create an amortization schedule?

Method 1 Method 1 of 2: Creating an Amortization Schedule Manually

- Open a new spreadsheet in Microsoft Excel.

- Create labels in column A. Create labels for your data in the first column to keep things organized.

- Enter the information pertaining to your loan in column B. ...

- Calculate your payment in cell B4. ...

- Create column headers in row 7. ...

- Populate the Period column. ...

- Fill out the other entries in cells B8 through H8. ...

How to calculate loan payments in 3 Easy Steps?

Sample Calculator

- Method 1 Method 1 of 3: Using an Online Calculator Download Article. Open an online loan calculator. ...

- Method 2 Method 2 of 3: Calculating Loan Payments Manually Download Article. Write down the formula. ...

- Method 3 Method 3 of 3: Understanding How Loans Work Download Article. Understand fixed-rate versus adjustable-rate loans. ...

What does a 20 year amortization mean?

The amortization is the length of time it will take you to pay back the loan. In Canada, the most common amortization period is 25 years. You can amortize your loan for fewer years, which increases your monthly payments but reduces the overall interest you pay.

What does amortization period mean?

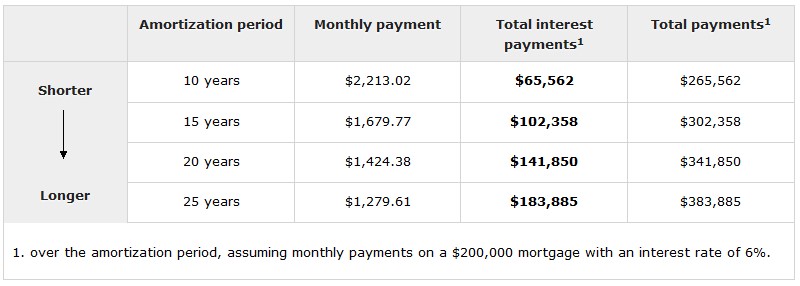

The amortization period is the length of time it would take to pay off a mortgage in full, based on regular payments at a certain interest rate. A longer amortization period means you will pay more interest than if you got the same loan with a shorter amortization period.

What does 5 year term with 25 year amortization mean?

For example, a loan could have a term of five years, but the payments could be based on a 25-year amortization schedule. For the borrower, this has the benefit of a lower monthly payment to minimize cash outlay, but it also means that there is a “balloon payment” at the end of the term.

What is the difference between 25 and 30-year amortization?

Improves purchasing power: A 30-year amortization improves purchasing power by approximately 16.6% versus a 25 year amortization. If it means getting into the right house, it could very well be worth it.

What is a 10 year term with 25-year amortization?

If you have a 10 year term, but the amortization is 25 years, you'll essentially have 15 years of loan principal due at the end.

What's the difference between loan term and amortization?

To put it simply — an amortization period is the total length of time it takes to repay your mortgage, and a mortgage term is the length of time you are locked into a mortgage contract.

How do you pay off an amortization table early?

One of the simplest ways to pay a mortgage off early is to use your amortization schedule as a guide and send you regular monthly payment, along with a check for the principal portion of the next month's payment. Using this method cuts the term of a 30-year mortgage in half.

What is the highest amortization you can have?

The maximum mortgage amortization period is 25 years for CMHC insured mortgages and 35 years for non-CMHC insured mortgages. A CMHC mortgage is generally one where the home purchaser has a down payment of less than 20% of the purchase price.

How do I calculate amortization?

How to Calculate Amortization of Loans. You'll need to divide your annual interest rate by 12. For example, if your annual interest rate is 3%, then your monthly interest rate will be 0.25% (0.03 annual interest rate ÷ 12 months). You'll also multiply the number of years in your loan term by 12.

Is it better to get a 25 or 30 year mortgage?

A 25-year amortization makes the most sense when you want to save on interest and get the most competitive interest rate. You'll save on interest with a 25-year amortization because you're paying off your mortgage in 25 years instead of 30 years.

Is it better to have a longer amortization?

The main benefit of choosing a mortgage with a longer amortization period is lower monthly mortgage payments. This can be a huge benefit if your income fluctuates month to month, if you are carrying a large mortgage, or if you are buying your first home.

What amortization period should I choose?

Shorter Amortization Periods Save You Money If you choose a shorter amortization period—for example, 15 years—you will have higher monthly payments, but you will also save considerably on interest over the life of the loan, and you will own your home sooner.

What does 10 year term 30 year amortization mean?

It provides you the security of an interest rate and a monthly payment that is fixed for the first 10 years; then, makes available the option of paying the outstanding balance in full or elect to amortize the remaining balance over the final 20 years at our current 30-year fixed rate, but no more than 3% above your ...

What does amortized over 30 years mean?

Amortization here means that you'll make a set payment each month. If you make these payments for 30 years, you'll have paid off your loan. The payments with a fixed-rate loan, a loan in which your interest rate doesn't change, will remain relatively constant.

What does amortized over 15 years mean?

Fixed-Rate Mortgages By making regular payments toward a mortgage, you reduce the balance of both principal and interest. A fixed-rate mortgage fully amortizes at the end of the term. In the case of a 15-year fixed-rate mortgage, the loan is paid in full at the end of 15 years.

How do you calculate amortization period?

To calculate amortization, start by dividing the loan's interest rate by 12 to find the monthly interest rate. Then, multiply the monthly interest rate by the principal amount to find the first month's interest. Next, subtract the first month's interest from the monthly payment to find the principal payment amount.

What Is Amortization?

The term “amortization” has two important meanings in finance. First, it can refer to the schedule of payments whereby a loan is paid off gradually over time , such as in the case of a mortgage or car loan. Second, it can refer to the practice of expensing the cost of an intangible asset over time .

How to calculate amortization?

To arrive at the amount of monthly payments, the interest payment is calculated by multiplying the interest rate by the outstanding loan balance and dividing by 12. The amount of principal due in a given month is the total monthly payment (a flat amount) minus the interest payment for that month.

Why Is Amortization Important?

Amortization is important because it helps businesses and investors understand and forecast their costs over time. In the context of loan repayment, amortization schedules provide clarity into what portion of a loan payment consists of interest versus principal. This can be useful for purposes such as deducting interest payments for tax purposes. Amortizing intangible assets is also important because it can reduce a business’ taxable income and therefore its tax liability, while giving investors a better understanding of the company’s true earnings.

What is the difference between amortization and depreciation?

The main difference between them, however, is that amortization refers to intangible assets, whereas depreciation refers to tangible assets. Examples of intangible assets include trademarks and patents; tangible assets include equipment, buildings, vehicles, and other assets subject to physical wear and tear.

What is amortization in accounting?

What Is Amortization? Amortization is an accounting technique used to periodically lower the book value of a loan or an intangible asset over a set period of time. In relation to a loan, amortization focuses on spreading out loan payments over time.

What is amortization schedule?

Amortization typically refers to the process of writing down the value of either a loan or an intangible asset. Amortization schedules are used by lenders, such as financial institutions, to present a loan repayment schedule based on a specific maturity date.

What is amortized over time?

Intangibles amortized (expensed) over time help tie the cost of the asset to the revenues generated by the asset in accordance with the matching principle of generally accepted accounting principles (GAAP).

What happens if you put 20% down on a home loan?

This insurance is rolled into the cost of the monthly home loan payments & helps insure the lender will be paid in the event of a borrower default. Typically about 35% of home buyers who use financing put at least 20% down.

How much down payment is required for a $250,000 home?

The above calculations presume a 20% down payment on a $250,000 home, any closing costs paid upfront, 1% homeowner's insurance & an annual property tax of 1.42%.

What is the most common mortgage in the US?

The most common home loan term in the US is the 30-year fixed rate mortgage . The following table shows current 30-year mortgage rates available in Redmond. You can use the menus to select other loan durations, alter the loan amount, or change your location.

What is the second most popular mortgage?

Of those people who finance a purchase, nearly 90% of them opt for a 30-year fixed rate loan. The 15-year fixed-rate mortgage is the second most popular home loan choice among Americans, with 6% of borrowers choosing a 15-year loan term. Loan Type.

Why are the US 10-year Treasury rates falling?

US 10-year Treasury rates have recently fallen to all-time record lows due to the spread of coronavirus driving a risk off sentiment, with other financial rates falling in tandem. Homeowners who buy or refinance at today's low rates may benefit from recent rate volatility.

When interest rates are low, do home buyers have a preference for fixed rate mortgages?

When interest rates are low (as they were after the global recession was followed by many rounds of quantitative easing) home buyers have a strong preference for fixed-rate mortgages. When interest rates rise consumers tend to shift more toward using adjustable-rate mortgages to purchase homes.

Is a 25 year mortgage fixed rate?

Twenty-five year mortgages are common across many countries including the United Kingdom, Australia and Canada, however they are not particularly common across the United States. The above calculator is for fixed-rate mortgages. In many countries 25-year mortgages are structured as adjustable or variable rate loans which reset annually after a 2, 3, 5 or 10 year introductory period with a teaser rate.

How long is the average amortization period for a mortgage?

Despite that, theaverage amoritization lengths have been increasing, with 58% of mortgages having amortization periods of 25 years. The average amoritization period between 2015 and 2019 was 22 years, up from 21.4 years between 2010 and 2014, and up from 20.7 years before 1990.

How long can you amortize a mortgage with 20% down?

Therefore, if you are putting more than 20% down on your purchase, some lenders may accept an amortization period of greater than 30 years. Prior to this, on March 18th 2011, the maximum amortization on CMHC insured mortgages was reduced from 35 to 30 years.

Why do home buyers choose shorter amortization periods?

Many home buyers choose shorter amortization periods resulting in higher monthly payments if they can afford to do so, knowing that it promotes positive saving behaviour and reduces the total interest payable. For example, let us consider a $300,000 mortgage, and compare a 25-year versus 30-year amortization period.

How long is the maximum amortization period for CMHC?

As of March 2020, the maximum amortization period on all CMHC insured homes is 25 years. This became low in June 2012, when the federal government announced the maximum amortization period on CMHC insured homes would be reduced from 30 to 25 years. CMHC insurance is required on all home purchases with a down payment of 20% or less. Therefore, if you are putting more than 20% down on your purchase, some lenders may accept an amortization period of greater than 30 years.

How long does it take to pay off a mortgage in Canada?

Over the course of your amoritization period, you'll sign multiple mortgage contracts. Most maximum amortization periods in Canada are 25 years.

What is the difference between a mortgage and an amortization?

Here is a short answer: A mortgage term is the length of your current contract, at the end of which you'll need to renew; The amoritization period is the total life of your mortgage. A typical mortgage in Canada has a 5-year term with a 25-year amortization period.

What is a mortgage term?

The mortgage term is the length of time you commit to the mortgage rate, lender, and associated mortgage terms and conditions. The term you choose will have a direct effect on your mortgage rate, with short terms historically proven to be lower than long-term mortgage rates. The term acts like a 'reset' button on a mortgage.

How long is a loan amortization?

If you have a 10 year term, but the amortization is 25 years, you’ll essentially have 15 years of loan principal due at the end.

How long does a 10 year mortgage amortize?

Here’s a project to hold over a 10 year period, and both loan options are amortizing. But the “cheaper” loan (by interest rate) amortizes over 20 years, with the higher rate amortizing over 25 years. As expected, paying down the loan more quickly leads to more proceeds when you sell the property after 10 years.

Why is amortization important?

Now, the reason why it’s powerful: the longer the amortization, the less principal you are required to pay every month, so you are preserving cash flow.

What is stacksource loan?

StackSource is a tech-enabled commercial real estate loan platform. We connect investors who are developing or acquiring commercial properties with financing options like banks, insurance companies, and private lenders through an easy, transparent process. We’re taking the best of commercial mortgage brokerage and updating it for the 21st century. Learn more at StackSource.com.

Is it better to amortize a property or a longer amortization?

Will a longer amortization always be the right answer for every deal? No, of course not. But when looking at multiple loan options for your property investment, it’s a good idea to keep the amortization period top of mind. You may be surprised by how much it determines the optimal path for your deal.

What is amortization period?

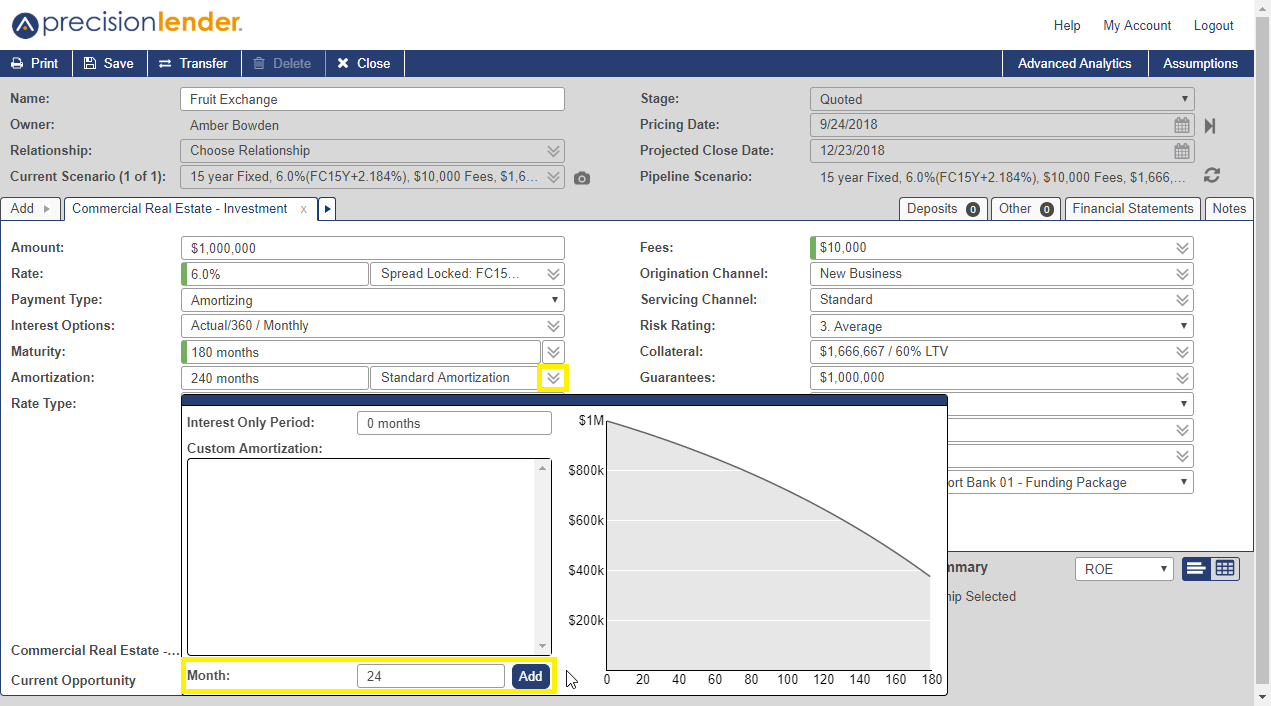

A loan’s amortization period is the amount of time over which a loan’s payments are calculated. In a commercial real estate transaction, it is common for a loan to have a “split amortization” meaning that the loan’s term and amortization periods are different. For example, a loan could have a term of five years, ...

What is amortization in real estate?

A loan’s amortization is the amount of time over which the loan’s payment is calculated. Nearly every commercial real estate transaction involves a loan and commercial real estate mortgages can be far more complicated than their residential counterparts.

What are the two inputs for amortization?

The other two are the loan amount and the interest rate. To illustrate how these work together, suppose an investor is seeking a loan for $1,000,000. It has a 5 year term, an amortization period of 20 years, and an interest rate of 6%.

How long does a commercial real estate loan last?

In general, a commercial real estate loan has a term that ranges from 5-30 years, but most tend to be in the 5-10 year range. This is a relatively short term commitment for a lender and it provides borrowers with enough time to execute their business plan for the property.

What is a Loan Term?

A loan’s “term” is the period of time that the borrower has to repay the principal balance. The term can vary from one loan to another and it is heavily influenced by two key factors:

How long does it take for a loan to be fully amortized?

The loan payment is calculated such that after 20 years of payments the loan will be paid in full hence the loan is fully amortized in 20 years. However, the bank doesn't want to wait 20 years so they require a balloon payment in 10 years. You as the borrower get a lower monthly payment based upon the 20yr amortization but have to payoff the loan balance at year 10. This is very basic stuff so find a good finance book or online resource to learn and understand the terms.

How long does a mortgage interest rate balloon?

The interest rate will be fixed for 10 years at which time it will balloon (balance of mortgage must be paid by either sale or refinance)---payments will be based upon a 20 year repayment schedule (also known as amortization schedule)...