What is a FICO score and how is it determined?

What is a FICO Score and How is it Determined?

- Payment History – 35%. Your payment history is the most important factor of your FICO score and has the most impact. ...

- Amount Owed – 30%. The amount that you currently owe to lenders. ...

- Length of Credit History – 15%. It’s as simple as it sounds – this is the length of time your credit accounts have been open. ...

- Credit Mix or Types of Credit Used – 10%. ...

What is a good FICO score?

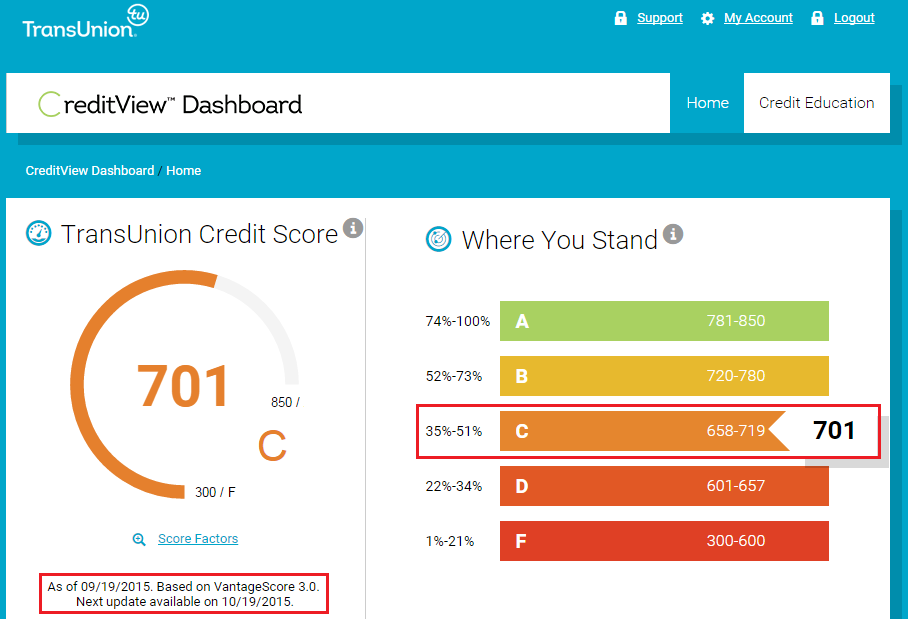

Those scores are broken down into five categories, though the breakdowns differ slightly. For FICO, a good credit score is 670 or higher; a score above 800 is considered exceptional. For VantageScore 3.0, a good score is 661 or higher, and a score of 781 to 850 is excellent.

What are the five categories of a FICO score?

What categories are considered when calculating my FICO Score?

- Payment history (35%)

- Amounts owed (30%)

- Length of credit history (15%)

- Credit mix (10%)

- New credit (10%)

How to check your FICO score?

Multiple services and tools are available, so take your pick:

- Order a free annual credit report. By law, you are entitled to a free credit report every 12 months from each of the three major credit bureaus. ...

- Sign up for an account on a free credit scoring website. ...

- Your credit card provider may already offer credit checks. ...

- You are legally entitled to a free credit report. ...

See more

What is a good FICO score 9?

FICO® Scores in the 740 to 799 range are deemed very good. Individuals with scores in this range may qualify for better interest rates from lenders. Good: 670 to 739. FICO® Scores in the range of 670 to 739 are rated good.

What's the difference between FICO score 8 and FICO score 9?

FICO 9 is similar to FICO 8 but differs when it comes to collections and rent payments. FICO 9 counts medical collections less harshly than other accounts in collections, so a surgery bill in collections will have less of an impact on your credit score than a credit card bill in collections.

Is FICO score 9 used for mortgage?

The FICO® Score versions used in mortgage lending and the more recently released versions, such as FICO® Score 9 and 10, have the same 300 to 850 range. VantageScore, a competing maker of credit scores, also uses that range for its latest VantageScore 3.0 and 4.0 model credit scores.

Is FICO score 9 being used?

FICO Score 9 is the second-latest version of the well-known credit scoring model, but it still isn't being used as widely as its predecessor, the FICO 8. All credit scores come from data in your credit reports, weighed according to proprietary formulas that calculate a score, typically on a 300-850 scale.

What FICO score is needed to buy a house?

620Generally speaking, you'll need a credit score of at least 620 in order to secure a loan to buy a house. That's the minimum credit score requirement most lenders have for a conventional loan. With that said, it's still possible to get a loan with a lower credit score, including a score in the 500s.

What is a good FICO score to buy a car?

In general, lenders look for borrowers in the prime range or better, so you will need a score of 661 or higher to qualify for most conventional car loans.

What is the difference between a FICO score and a credit score?

Is "credit score" the same as "FICO® score"? Basically, "credit score" and "FICO® score" are all referring to the same thing. A FICO® score is a type of credit scoring model. While different reporting agencies may weigh factors slightly differently, they are all essentially measuring the same thing.

What is a FICO score vs credit score?

A credit score is a three-digit number that measures your financial health and how well you manage credit and debt. FICO scores are a specific type of score that lenders can use when making borrowing decisions.

Why is my FICO score higher than my credit score?

When the scores are significantly different across bureaus, it is likely the underlying data in the credit bureaus is different and thus driving that observed score difference.

What FICO score do mortgage lenders use 2022?

Most mortgage lenders accept FICO scores of 580 and above for an FHA loan. And you only need 3.5% down to buy a house with this program. Some lenders even allow credit scores of 500-579 under the FHA program, though you'll need a 10% down payment if your score is in that range.

Which FICO score do lenders use?

For other types of credit, such as personal loans, student loans and retail credit, you'll likely want to know your FICO® Score 8, which is the score most widely used by lenders.

Which credit score matters the most?

While there's no exact answer to which credit score matters most, lenders have a clear favorite: FICO® Scores are used in over 90% of lending decisions. While that can help you narrow down which credit score to check, you'll still have to consider the reason why you're checking your credit score.

Who uses FICO score 9?

The mortgage industry relies primarily on FICO scores 2, 4, and 5. Auto lenders use FICO Scores 2, 4, 5, 8, and 9. Credit card issuers use FICO Scores 2, 4, 5, 8, and 9.

Is an 8 FICO score good?

Consequently, when lenders check your FICO credit score, whether based on credit report data from Equifax, Experian, or TransUnion, they will likely use the FICO 8 scoring model. FICO 8 scores range between 300 and 850. A FICO score of at least 700 is considered a good score.

What is the FICO score 8 used for?

FICO Score 8 is a credit scoring model from the Fair Isaac Corporation (FICO) that is widely used by lenders to help determine the creditworthiness of potential borrowers and what interest rate they should be charged. This version of the company's base credit-scoring model was released in 2009.

What is a good FICO auto score 8?

What is a good FICO® Auto Score? While different lenders use different standards for rating credit scores, when it comes to base FICO® scores, many lenders consider a 700 or higher (on a scale of 300–850) to be a good credit score.

Where can I get FICO Score 9?

You can purchase it from FICO or possibly get it free from your credit card issuer, a lender or credit counselor through FICO’s Open Access program, which allows lenders and credit counselors to share scores used in lending decisions.

When did FICO 9 come out?

FICO Score 9 has been available to consumers since 2016. You can purchase it from FICO or possibly get it free from your credit card issuer, a lender or credit counselor through FICO’s Open Access program, which allows lenders and credit counselors to share scores used in lending decisions.

What are the two major credit score providers?

The two biggest providers of credit scores are FICO and VantageScore.

How to get a good credit score?

But the way to get a good score is the same no matter which scoring model is used: Pay bills on time, every time . Late payments hurt your score, and the later they are, the worse the damage. Use credit lightly. Lower credit utilization can make a big difference in your score. Check your credit reports.

Does your credit score affect your credit score?

Other credit score factors, including how recently you’ve applied for credit, the mix of your credit accounts and how long you’ve had credit also affect your score. But if you consistently pay your bills on time and keep balances low, you’re likely to have a good score no matter what model is used.

Is rent a part of credit score?

Rent payments. If rent payments are reported, they are part of the score calculations. Before now, rent payments were added to credit reports but weren't used to calculate a FICO credit score (they were, however, used for VantageScore 3.0).

What does FICO score 9 mean?

FICO® Score 9 looks at medical debt, paid collections and rental history differently than previous versions of the FICO® credit-scoring models. Here’s why your FICO® Score 9 credit scores could be different.

What is the FICO score?

The formula results in a three-digit number — ranging from 300 to 850 — that is known as a base FICO® credit score. There are three major consumer credit bureaus: Equifax, Experian and TransUnion. Consumers will probably see variations in their FICO® credit scores among bureaus.

What is the most widely used credit score?

According to a May 2015 CEB TowerGroup analyst report, FICO® scores were used in more than 90% of lending decisions in the U.S., indicating that it’s one of the most widely known credit scores.

What is the Fair Isaac credit risk formula?

In 1958, Fair Isaac Corporation created a mathematical formula designed to analyze consumer credit risk based on a number of factors. Today, those credit factors generally include payment history, credit usage, length of credit history, credit types and recent credit inquiries — each carrying a different weight when considered in the formula.

Does FICO score 9 include rental history?

With FICO® Score 9, rental history is now factored into these credit scores when landlords directly report the payments to one or all of the credit bureaus. Before this newest version, rental history was simply not factored into your FICO® credit scores. This change may be most beneficial to consumers who have just started to establish their credit history.

Do different credit scoring models have the same factors?

Although differing credit-scoring models can produce slightly different credit scores, they generally use similar factors . FICO® credit-scoring models have undergone numerous revisions over the past three decades. With trends of consumers and needs of lenders continually evolving, FICO has adapted its models to keep up.

Does unpaid medical bills affect FICO?

Unpaid medical bills in collections have less negative impact on FICO® Score 9 credit scores than with previous FICO® scoring models. Also, unpaid medical bills sent to collections agencies will have less impact on FICO® Score 9 credit scores than nonmedical debt.

What Is FICO 9?

FICO 9 is a credit scoring model introduced by FICO (formerly the Fair Isaac Corporation) to lenders in 2014 and consumers in 2016. 1 2 FICO 9 differs from previous versions of the FICO credit score primarily in its treatment of medical and other collection accounts. Though the FICO 9 credit score is accessible to both lenders and consumers, as of the end of 2020, it still isn’t as widely used as FICO 8. 3

Why is FICO 9 important?

This change with FICO 9 could be helpful to people with thin credit files who are just beginning to establish and build credit. Having a positive rental payment history reported to the credit bureaus could work in their favor because payment history accounts for 35% of FICO credit scores.

What does it mean when your FICO score is negative?

FICO scores also view collection accounts in a negative light. A collection account means that your account has gone unpaid for an extended period of time and the original creditor has either assigned or sold the debt to a collection agency .

What does FICO score tell you?

In general, credit scores tell lenders and banks how much of a credit risk someone is based on their credit history. Specifically, FICO scores look at five different weighted factors: 4. Of the five, payment history carries the most weight.

What credit score do mortgage lenders use?

Mortgage lenders may use entirely different versions, such as FICO 2, FICO 4, or FICO 5. Car loan issuers can use the same versions or FICO 8. 3 .

Why did FICO change to 9?

FICO opted to make changes to its credit scoring model with FICO 9 in an attempt to make scoring more accurate and predictive. 2. There’s also a third change ...

When was FICO 9 introduced?

FICO 9 is an updated FICO credit scoring model that was introduced to lenders in 2014 and consumers in 2016.

When was the FICO score 9 introduced?

FICO Score 9 is a credit scoring model introduced to lenders in 2014 and consumers in 2016. It’s the second-latest FICO credit scoring model, as 10 was introduced in early 2020. What makes FICO Score 9 particularly interesting, though, are the changes when it comes to paid collection accounts, unpaid medical accounts, and home rental payments:

What is FICO Score 9—and how does it differ from FICO’s previous credit scoring models?

But let’s try to explain things as plainly as possible: there’s no one uniform FICO credit scoring model that’s used to calculate scores—there are, as of writing, 10 FICO credit scoring models in total. They are known—and written—as “FICO Score 2,” “FICO Score 4,” etc, or simply just as “FICO 2,” “FICO 4,” and so on.

What is the FICO score for home loans?

To elaborate further, each FICO credit scoring model determines credit scores slightly differently, and it’s been stated by CNBC that FICO Score 2, 4, and 5 are commonly used by banks when it comes to home mortgages. But for auto loans and card lending for instance, FICO Score 8 is the wider used model according to ValuePenguin —at least for now it is.

What is a FICO score?

As briefly touched on in the above paragraph, a FICO credit score is a specific number that reflects your credit-related actions based off of your credit reports. It’s this that the majority of lenders scrutinize when you apply for credit—like a student loan to cover university fees which you’ll pay back when you land a job, or a home mortgage to help you buy a place from a real estate company when you don’t have all the funds to cover an outright purchase.

Why is FICO used?

FICO scores are still used to this day by lenders, helping them to see whether applicants are essentially trustworthy or not. In fact, it’s claimed that FICO credit scores are used in 90% of credit-related decision-making in the U.S.

When did FICO 9 come out?

Earlier, it was mentioned in this post that FICO Score 9 was “introduced to lenders in 2014 and consumers in 2016”—let’s elaborate on the latter part. In 2016, consumers at large were allowed to access and view their credit scores that the FICO 9 credit scoring model had calculated.

When was FICO created?

FICO (formerly known as Fair, Isaac and Company) is a data analytics company that was founded in 1956. In 1958, the company created their first credit scoring system, which they began distributing to a selection (around ~50) of U.S.-based lenders.

What is the FICO score 9?

FICO Score 9 (also known as FICO 9 and FICO 9.0) is the latest edition of the widely regarded credit scoring models.

What is FICO 9?

Fair Isaacs is continually updating its FICO score products. Every few years they come out with a new version, and FICO 9 is the latest.

What credit score do auto lenders use?

Auto lenders use FICO Scores 2, 4, 5 and 8, while credit card issuers use FICO Scores 2, 3, 4, 5, and 8. In addition, some lenders also make use of in-house credit scoring models based on their own specific credit experience. This may also help to explain the reluctance to adopt FICO’s latest credit scoring model.

Why does FICO charge a fee?

FICO charges a fee in order for an institution to use their actual credit scores. In general, when you see an offer of free credit scores, they aren’t the real deal.

What are the changes to FICO 9.0?

But it does have three major changes, and they’re mostly good for consumers. 1. Medical collections. Open medical collections have less impact in FICO 9.0 than they do in previous versions. 2. Third-party collections. These have no negative impact on your credit score if the collections have been paid. 3.

What percentage of lenders use proprietary credit scores?

While there are a variety of proprietary credit scores in existence, this scoring family is used by about 90% of all lenders. Lenders use credit scores to predict borrower loan performance, which is done by calculating numeric scores based on previous credit experience.

Where does FICO come from?

Like all credit scoring models, FICO scores are developed from the information contained in your credit report.

What Is FICO 9?

FICO 9 was introduced in 2016 and is available to both lenders and consumers. While not as widely used as FICO 8, this scoring model has some features that could help certain consumers improve their credit scores.

What is the best FICO score?

FICO scores range from 300 to 850, with 850 considered a perfect score. The higher your score, the better your odds of being approved for loans and lines of credit at the most favorable interest rates. FICO scores are based on these five factors: 3. Payment history (35%)

What Are FICO 10 and FICO 10T?

FICO 10 and FICO 10T are new credit scoring models announced in 2020. FICO says the FICO Credit Score 10 Suite is designed to be its most predictive scoring model yet, giving lenders a more precise picture of someone’s credit risk. FICO 10 and FICO 10T still follow the same basic FICO algorithm that focuses on payment history, credit utilization, credit age, credit mix, and credit inquiries. What makes FICO 10T different is the use of trended data. 6

What Is a Good Credit Score?

FICO rates its scores as exceptional, very good, good, fair, and poor. The table shows which scores are associated with which rating.

What is the most recent vantage score?

As with FICO scores, there are several different VantageScores, the most recent being VantageScore 4.0. 14 Some credit card issuers, such as American Express, and other companies that offer free credit scores to their customers provide VantageScores rather than FICO scores. 15.

What is the most recognizable name in credit score?

Other Credit Scores. FICO is perhaps the most recognizable name in credit scores. The Fair Isaac Corporation (now called FICO), which developed the FICO credit scoring algorithm, says its scores are used by 90% of top U.S. lenders in more than 90% of lending decisions. 1 There are currently several types of FICO scores available.

What are the rules for maintaining a good credit score?

These include paying bills on time, maintaining a low credit utilization ratio, and applying for new credit sparingly.

What is a good FICO Score?

Every lender determines for themselves what is a good FICO Score and how they will use a FICO Score and other information within the loan approval process.

Why are there different FICO Scores?

We use credit a lot differently than we did 30 years ago. FICO Scores have periodically been updated to stay more current.

What is the difference between a FICO Score and other credit scores?

Only FICO Scores are created by the Fair Isaac Corporation and are used by over 90% of top lenders when making lending decisions .

How does FICO score work?

A FICO Score is a three-digit number based on the information in your credit reports. It helps lenders determine how likely you are to repay a loan. This, in turn, affects how much you can borrow, how many months you have to repay, and how much it will cost (the interest rate). When you apply for credit, lenders need a fast ...

Why do lenders use FICO scores?

Not only does a FICO Score help lenders make smarter, quicker decisions about who they loan money to, it also helps people like you get fair and fast access to credit when you need it.

What does it mean when your credit score is below the average?

Your score is well below the average score of U.S. consumers and demonstrates to lenders that you are a risky borrower.

Why is it important to have a fair credit score?

And overall, fair, quick, consistent and predictive scores help keep the cost of credit lower for the entire population as a whole . The more accessible credit is, the more lenders can loan and the more efficient they can be in their processes to drive costs down and pass savings on to the borrowers.