What are ADR transactions?

American Depositary Receipts (ADRs) are negotiable securities issued by a bank that represent shares in a non-U.S. company. These can trade in the U.S. both on national exchanges and in the Over-The-Counter (OTC) market, are listed in U.S. dollars, and generally represent a number of foreign shares to one ADR.

What is ADR example?

The most famous ADR methods are the following: mediation, arbitration, conciliation, negotiation, and transaction.

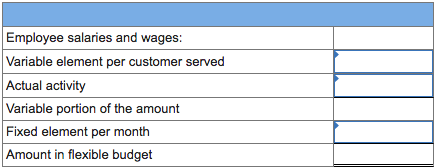

How is ADR calculated in finance?

ADR is calculated by dividing room revenue by rooms sold. The metric is of course applicable for any currency.

How does ADR price work?

If you own an ADR, you have the right to obtain the foreign stock it represents, but U.S. investors usually find it more convenient to own the ADR. The price of an ADR corresponds to the price of the foreign stock in its home market, adjusted to the ratio of the ADRs to foreign company shares.

What are the 4 types of ADR?

Arbitration, Conciliation, Mediation, Judicial Settlement, and Lok Adalat are the most commonly used ADR processes in civil proceedings....Methods of Alternative Dispute ResolutionsArbitration;Conciliation;Mediation;Judicial Settlement;Lok Adalat.

What are the 3 types of ADR?

The ADR techniques mainly include arbitration, conciliation, mediation, and negotiation. In India, Lok Adalat stands as another additional form of ADR mechanism, which combines different techniques like conciliation, mediation, and negotiation.

What is a good average ADR?

between 70 and 80What is a good ADR? It depends on the intensity of the match and the role you play in the team, but generally anything between 70 and 80 is considered good, but going over 80 is considered above average performance.

What is a good ADR ratio?

The most common ratio is 1:1 where each ADR represents one common share of the company. If an ADR is listed on an exchange, you can buy and sell it through your broker like any other share.

Is ADR a debt or equity?

ADRs are a form of equity security that was created specifically to simplify foreign investing for American investors. An ADR is issued by an American bank or broker. It represents one or more shares of foreign-company stock held by that bank in the home stock market of the foreign company.

Who pays the cost of ADR?

Each party in an alternative dispute resolution (ADR) process normally agrees to pay its own share of the costs of the ADR process itself (see 23), but the costs incurred in dealing with the dispute more generally will normally be allocated between the parties as part of any settlement achieved.

How is ADR taxed?

Any dividends paid by the ADR are generally taxable, just like dividends on U.S. shares. In addition, taxes may be withheld by the ADR company's local government. Depending on individual circumstances, foreign taxes withheld might be applied as a credit against U.S. taxes, or tax reclaim opportunities may be offered.

How often is ADR charged?

1 to 4 times per yearADR Fees are charged 1 to 4 times per year normally, the frequency might be higher under special circumstances. The charge amount will be split accordingly. For example, if annual ADR Fees is 2 cents and the charging frequency is 4 times a year, 0.5 cent will be charged each time.

What is ADR and GDR with example?

American Depository Receipt (ADR) is a depository receipt which is issued by a US depository bank against a certain number of shares of non-US company stock. Whereas Global Depository Receipt (GDR) is a depository receipt which is issued by the international depository bank, representing foreign company's stock.

What is the most popular ADR?

Agencies are not limited to using only one technique in their program; rather, they are encouraged to experiment with these techniques by using various methods in combination to reach effective resolutions. Mediation is presently the most popular form of ADR in use by agencies in employment-related disputes.

Is Adidas an ADR?

In the United States, adidas AG ADRs are traded on the OTCQX International Premier market, the highest over-the-counter market tier provided by OTC Markets Group, Inc....ADR Details:ADR Details:Exchange:OTCQXRatio (ADR:ORD):2:1Structure:Sponsored Level I ADR ProgramSymbol:ADDYY1 more row

What type of ADR is most common?

The most common forms of ADR for civil cases are mediation, arbitration, neutral evaluation, settlement conferences and community dispute resolution programs.

What does ADR mean in banking?

ADR means American Depository Receipt. ADR is a certificate issued by an American Bank which states that number of shares of another country firm can be traded in U.S. markets. JPMorgan a British departmental store created first ADR in 1927. According to Securities and Exchange Commission (SEC), instead of foreign stock, ADR is more convenient because they have more protection and transparency.

What is sponsored ADR?

Sponsored ADR − There will be a legal arrangement between bank and foreign company. In this, bank will handle investors and control of ADR and its cost by foreign company.

What is ADR in rental?

The average daily rate (ADR) measures the average rental revenue earned for an occupied room per day.

What does rising ADR mean?

The higher the ADR, the better. A rising ADR suggests that a hotel is increasing the money it's making from renting out rooms. To increase the ADR, hotels should look into ways to boost price per room. Hotel operators seek to increase ADR by focusing on pricing strategies.

What Is the Average Daily Rate (ADR)?

The average daily rate (ADR) is a metric widely used in the hospitality industry to indicate the average revenue earned for an occupied room on a given day. The average daily rate is one of the key performance indicators (KPI) of the industry.

How to calculate revenue per available room?

Multiplying the ADR by the occupancy rate equals the revenue per available room.

What does RevPAR mean?

Meanwhile, RevPAR measures a lodging's ability to fill its available rooms at the average rate. If the occupancy rate is not at 100% and the RevPAR is below the ADR, a hotel operator knows that it can probably reduce the average price per room to help increase occupancy.

How much is ADR for hotel?

If a hotel has $50,000 in room revenue and 500 rooms sold, the ADR would be $100 ($50,000/$100). Rooms used for in-house use, such as those set aside for hotel employees and complimentary ones, are excluded from the calculation.

How to calculate average daily rate?

The average daily rate is calculated by taking the average revenue earned from rooms and dividing it by the number of rooms sold. It excludes complimentary rooms and rooms occupied by staff.

What is ADR deduction?

1. Buildings, equipment, vehicles, furniture, and machinery all can qualify for the deduction, as can patents and copyrights. The ADR method was used to assign upper and lower limits to the estimated useful lives of asset classes.

What is the ADR method?

The ADR method was used to assign upper and lower limits to the estimated useful lives of asset classes. It gave businesses considerable flexibility to determine the useful life of an asset. In fact, the asset depreciation range allowed the taxpayer a 20% leeway above and below the IRS's established useful life for each asset class.

What Is Asset Depreciation Range (ADR)?

Asset depreciation range was an accounting method established by the Internal Revenue Service (IRS) in 1971 to determine the useful economic life of specific classes of depreciable assets.

What is MACRS in accounting?

The modified accelerated cost recovery system (MACRS) is the current accounting method used by businesses claiming the deduction.

Why was ADR introduced?

ADR was introduced in an attempt to simplify calculations and provide some uniformity to tax deductions from depreciation. But the system was too complicated. It listed more than 100 classes of tangible assets based on the taxpayer's business and industry.

What form is used to claim depreciation deduction?

The form used to claim the depreciation deduction is IRS Form 4562. 4

What Is the ADR Formula?

ADR is the average realized room rental per day for hotels, resorts, and other properties within the lodging industry. It is a measure of how well a lodging property is generating revenue. Naturally, the higher the ADR, the better. However, if you set the ADR too high, you risk vacancy as customers will most probably seek alternative properties. Therefore, there is a delicate balance that you must observe between average day rate and total revenue. The key to revenue performance is to boost price per room without creating vacancies, well, at least not too many vacancies.

What does it mean when your ADR is falling?

Falling ADR, Rising or Steady RevPAR: This might indicate that you’ve made your rooms more price-competitive and thereby reduced vacancies. Perhaps you overpriced your rooms relative to the current market environment. For example, the economy might be tanking, or new competitors might have recently appeared.

Why use average daily rate?

You can use average daily rate to measure current versus historical performance. Additionally, you can compare ADRs among comparable hotels in the area. Specifically, you should compare ADRs for properties with similar location, size, and clientele. Your ADR relative to your competitors’ ADR indicates how your service and amenities rank. Clearly, nearby hotels with similar ADRs should offer similar value. Ultimately, your goal should be to have the best occupancy rate amongst all competitors with similar average daily rates.

How can online reputation help ADR?

Your online reputation can do much to help or hurt your ADR. By cultivating a good reputation, you can spark traveler interest in your property. Many travelers turn to OTAs for reviews. You need to monitor for mentions of your hotel on these sites and immediately respond to comments. Even if you can’t resolve a problem, you can at least show that you tried. You can gain insights into your hotel by evaluating customer reviews.

Does ADR account for vacant rooms?

Note that the ADR formula doesn’t account for vacant rooms. In other words, only rooms that you actually sell will figure into the ADR formula. Obviously, a high ADR might not be positive if a high vacancy rate accompanies it. However, if you run an exclusive boutique property, you might be willing to accept a low occupancy rate. Therefore, hoteliers look to revenue per available room (RevPAR) to place average day rate within context.

What Is Hotel ADR?

A hotel’s ADR, Average Daily Rate, is the measure of the average rate paid per room that’s occupied at the property. Ultimately, it’s a KPI that helps hoteliers identify their room rates from a day-to-day perspective. ADR is calculated to have an understanding of a hotel’s profits and performance.

Why is ADR So Important for Hotels?

ADR is a key way of helping hoteliers keep track of their hotel’s financial performance. Your average daily rate is an indicator of the value travelers receive at your property for a night’s stay. Understanding how your ADR compares to other properties in your local market can indicate the relative quality of service and amenities at your property. Often, you can identify your closest competitors by determining which hotels in your area are in the same ADR range as your property. Your marketing goal should be to obtain the highest market share (or occupancy rate) for hotels within that same price range.

How do you Calculate Hotel ADR?

First, you must know your hotel’s room revenue and the number of rooms sold to calculate your property’s ADR. Next, insert those numbers into the following formula:

How can Hotels Increase ADR?

A hotelier will find their hotel’s success through the lens of giving a little to get a little. To start, consider revamping your hotel’s social media presence. Consistently posting about your hotel’s amenities, your staff, and local events nearby are important. They’re what’s going to make your hotel appealing to travelers.

Why is the ADR number lower than the ARR?

You can calculate both with the same formula, however, the ADR number will typically be lower because it refers to a day and not a longer period of time. ARR calculations typically include time periods of higher rates and occupancy, like weekends and holidays, which may increase the average rate.

What is ARR in room rates?

While ADR measures the Average Daily Rate, ARR is the Average Room Rate calculation, which tracks room rates over a longer period of time than daily. ARR can be used to measure the average rate from a weekly or monthly standpoint. You can calculate both with the same formula, however, the ADR number will typically be lower because it refers to a day and not a longer period of time. ARR calculations typically include time periods of higher rates and occupancy, like weekends and holidays, which may increase the average rate.

What Is the Average Daily Rate (AD?

- The average daily rate (ADR) is a metric widely used in the hospitality industry to indicate the av…

Another KPI metric is the occupancy rate, which when combined with the ADR, comprises revenue per available room (RevPAR), all of which are used to measure the operating performance of a lodging unit such as a hotel or motel. - The average daily rate (ADR) measures the average rental revenue earned for an occupied room …

The operating performance of a hotel or other lodging business can be determined by using the ADR.

Understanding the Average Daily Rate (AD

- The average daily rate (ADR) shows how much revenue is made per room on average. The highe…

Hotel operators seek to increase ADR by focusing on pricing strategies. This includes upselling, cross-sale promotions, and complimentary offers such as free shuttle service to the local airport. The overall economy is a big factor in setting prices, with hotels and motels seeking to adjust ro…

Calculating the Average Daily Rate (AD

- The average daily rate is calculated by taking the average revenue earned from rooms and dividi…

\text {Average Daily Rate} = \frac {\text {Rooms Revenue Earned}} {\text {Number of Rooms Sold}} Average Daily Rate = Number of Rooms SoldRooms Revenue Earned

Example of the Average Daily Rate (AD

- If a hotel has $50,000 in room revenue and 500 rooms sold, the ADR would be $100 ($50,000/500). Rooms used for in-house use, such as those set aside for hotel employees and complimentary ones, are excluded from the calculation.

Real World Example

- Consider Marriott International ( MAR ), a major publicly traded hotelier that reports ADR along with occupancy rate and RevPAR. For 2019, Marriott's ADR increased by 2.1% from 2018 to $202.75 in North America. The occupancy rate was fairly static at 75.8%. Taking the ADR and multiplying it by the occupancy rate yields the RevPAR. In Marriott's case, $202.75 times 75.8% e…

The Difference Between the Average Daily Rate (AD and Revenue Per Available Room (RevPA

- The average daily rate (ADR) is needed to calculate the revenue per available room (RevPAR). The average daily rate tells a lodging company how much they make per room on average in a given day. Meanwhile, RevPAR measures a lodging's ability to fill its available rooms at the average rate. If the occupancy rate is not at 100% and the RevPAR is below the ADR, a hotel operator knows th…

Limitations of Using the Average Daily Rate (AD

- The ADR does not tell the complete story about a hotel’s revenue. For instance, it does not include the charges a lodging company may charge if a guest does not show up. The figure also does not subtract items such as commissions and rebates offered to customers if there is a problem. A property’s ADR may increase as a result of price increases, however, this provides limited inform…