Employers NI / ERS NI - Employers also pay Employer's National Insurance contributions on their employees' earnings and benefits, which is summarised for reference on your payslip. TD or YTD (i.e. Tax TD) - This means "To Date" or "Year To Date".

Why is there a line for ERS pension on payslip?

So if there is a line for ers pension it will be the total employer's contributions to your pension, which is usually included on the payslip for information only (it does not form part of your salary which is going through your payslip with a gross to net analysis each month).

What does EE ni mean on a payslip?

Employee NI / EE NI - The amount being deducted for your National Insurance contribution. Employers NI / ERS NI - Employers also pay Employer's National Insurance contributions on their employees' earnings and benefits, which is summarised for reference on your payslip. TD or YTD (i.e. Tax TD) - This means "To Date" or "Year To Date".

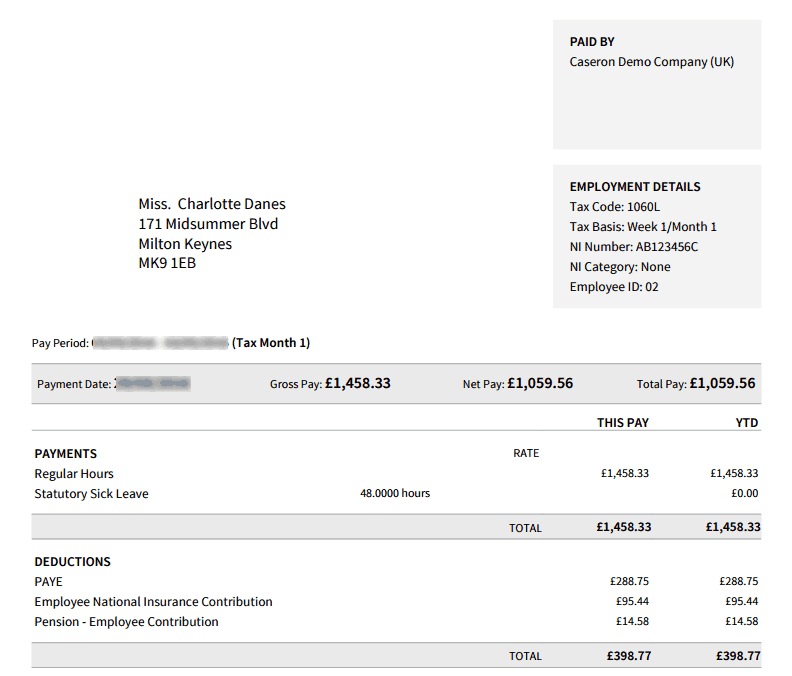

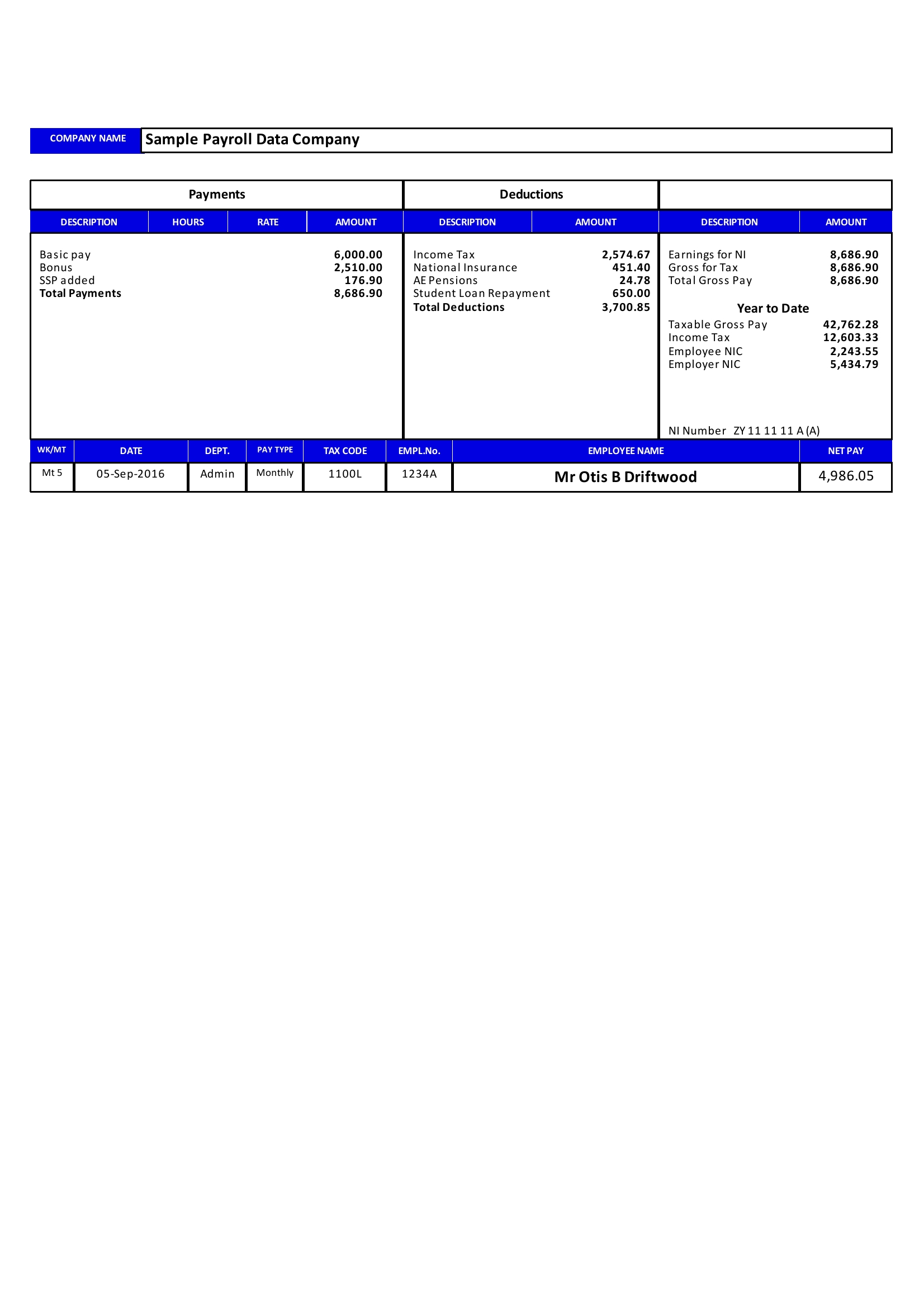

What are the amounts on my payslip?

Amounts and deductions on your payslip Employee NI / EE NI - The amount being deducted for your National Insurance contribution. Employers NI / ERS NI - Employers also pay Employer's National Insurance contributions on their employees' earnings and benefits, which is summarised for reference on your payslip.

What does TD mean on a payslip?

Employers NI / ERS NI - Employers also pay Employer's National Insurance contributions on their employees' earnings and benefits, which is summarised for reference on your payslip. TD or YTD (i.e. Tax TD) - This means "To Date" or "Year To Date".

What is the best interactive tool to help you understand more about your payslip?

What does TD mean on a payslip?

What is an ERN number?

What is an employee number?

What is gross pay?

What is tax code?

See 3 more

About this website

What does ers mean in payroll?

Gifts and awards of shares in companies, often known as employment related securities ( ERS ) are commonly used by employers to reward, retain or provide incentives to employees. They can be tax advantaged or non-tax advantaged.

What does ERS pension mean?

Employees' Retirement SystemA pension plan, governed and administered by the Employees' Retirement System (ERS), in which participants may receive a specific monthly benefit upon retirement age, based on years of service and salary history.

What gets deducted from my paycheck?

Pre-tax deductions: Medical and dental benefits, 401(k) retirement plans (for federal and most state income taxes) and group-term life insurance. Mandatory deductions: Federal and state income tax, FICA taxes, and wage garnishments. Post-tax deductions: Garnishments, Roth IRA retirement plans and charitable donations.

What does R mean on my payslip?

DEDUCTIONS (R INDICATES REFUND)

How do you calculate ers?

You can calculate this by adding up your highest 36, 48 or 60 months of salary and dividing that number by 36, 48 or 60.

What does EE and ER mean on payslip?

If you've got a workplace pension, you'll probably see 'ER pension' on your payslip. That's the money that your employer is contribution to your pension pot. Similarly, 'EE pension' on your payslip is the money that you're contributing to your pension pot from your wages.

How much do I pay in taxes if I make 1000 a week?

If you earn $1,000 per week in gross pay, you'll pay $1,000 X . 765, or $76.50 per week toward FICA.

Why do I get taxed so much on my paycheck 2022?

The IRS has announced higher federal income tax brackets for 2022 amid rising inflation. And the standard deduction is increasing to $25,900 for married couples filing together and $12,950 for single taxpayers.

How much of your paycheck is taxed?

Overview of California TaxesGross Paycheck$3,146Federal Income15.22%$479State Income4.99%$157Local Income3.50%$110FICA and State Insurance Taxes7.80%$24623 more rows

What is ers NI?

EMPLOYERS NI / ERS NI Employers also pay Employer's National Insurance contributions on their employees' earnings and benefits, which is summarised for reference on your payslip. EARNINGS FOR TAX / EARNINGS FOR NI This is the amount of your earnings that are subject to tax or national insurance deductions.

Is 1257L an emergency tax code?

Tax code 1257L 1257L is an emergency tax code only if followed by 'W1', 'M1' or 'X'. Emergency codes can be used if a new employee does not have a P45.

What does the R mean on my P60?

received a tax refund7. What Does R Mean on a P60? R indicates that you have received a tax refund that your employer has passed onto you. If there is no R then you have paid tax.

Is ERS the same as 401k?

Personal savings, like an individual retirement account or 401(k), are important for members to supplement their State of Texas Retirement and Social Security. ERS offers the Texa$aver 401(k) / 457 Program℠, a voluntary retirement savings program with lots of investment opportunities and lower-than-average fees.

How does the Texas ERS retirement work?

The state retirement plan is a defined benefit plan. That means, when you choose to retire after reaching eligibility, you will get a monthly payment (or annuity) for the rest of your life – no matter how long you live.

Who is eligible for ERS in Texas?

You must have at least 10 years of eligible service credit to be eligible for retiree insurance benefits. If you began work before September 1, 2001, at least three of those years must have been with a state agency in the Texas Employees Group Benefits Program (GBP).

Is ERS the same as TRS?

Unlike ERS service credit, which is based on months, TRS service credit is based on years. At least 90 working days in one fiscal year counts as one year of TRS service credit. When it transfers to ERS, it's counted as 12 months. More than likely, you didn't work at TRS and ERS employers at the same time.

EE NI and ER NI -Tax Forum :: Free Tax Advice

EE NIC is employee NIC, also called the primary contribution. It is calculated on income above a certain level, is the liability of the employee and is deducted from that income to arrive at net pay.

What does "ers pens" mean on a payslip — MoneySavingExpert Forum

On payslips you get ers and ees: Employer's and Employee's So if there is a line for ers pension it will be the total employer's contributions to your pension, which is usually included on the payslip for information only (it does not form part of your salary which is going through your payslip with a gross to net analysis each month).

Ers NI on the payslip — AAT Discussion forums

I would really appreciate some advice please. Thanks for all the responses I don't think there is a legal requirement to show it as I have previously worked for a firm of chartered accountants where it was not shown on the payslips as AK002 has pointed out, however this is a new client of mine and I am wondering what he hopes to gain by not showing it.

What is the best interactive tool to help you understand more about your payslip?

For a great interactive tool to help you understand more about your payslip we recommend you check out the CIPP payslip template

What does TD mean on a payslip?

TD or YTD (i.e. Tax TD) - This means "To Date" or "Year To Date". As well as showing earnings and deductions for that specific pay period, your payslip should also show you a combined total for that tax year to date.

What is an ERN number?

Employers PAYE Reference / ERN - An ERN is given to every business that registers with HM Revenue and Customs as an employer. You may need this number when applying for tax credits, applying for Student Loans, or a range of other tasks, so your employer will sometimes put it on your payslip.

What is an employee number?

Employee number - This is given to you by your employer and serves as a unique identifier for you while you work there. When you have a payroll query, you may need to quote this number. You won't keep this number if you move company, and it’s worth noting that not all employers will issue one.

What is gross pay?

Gross Pay - This is the total amount that you have earned, before deductions have been applied. It may include earnings for overtime, bonuses, shift work, and holiday pay, etc.

What is tax code?

Tax code - This tells your employer how they should apply tax on your earnings. Your tax code is given to your employer by HMRC and will usually change each financial year. Again, this should appear on every payslip.

Acronyms & Abbreviations

Get instant explanation for any acronym or abbreviation that hits you anywhere on the web!

A Member Of The STANDS4 Network

Get instant explanation for any acronym or abbreviation that hits you anywhere on the web!

How often do you need a payslip?

Section 8 of the emmployment rights act 1996 says gross pay, itemised deductions and net pay with an easement which allows you to group the deductions into a single sum as long as they do not change and you can provide a statement once every 12 months, and that's it!

Why is class 1 primary evident on a payslip?

as long as the Class 1, primary is evident on the payslip the employee is entitled to consider that the statutory function has been performed, it is HMRC's responsibility to make sure the money is paid over, not the employees.

Is Ers NIC relevant?

The comment about the relevance of Ers NIC is absolutely right, it has nothing to do with the employee and I think you will find that an employer is perfectly justified in asking for it to be removed. All payroll systems must be able to amend its payslips to client requirements.

What does "earning" mean on a pay stub?

Earning abbreviations show where your money is coming from. This includes not just regular pay, but possibly also vacation pay or even administrative leave. Every kind of pay will have an abbreviation on your pay stub.

What does ST stand for in tax?

St Tax/SWT/SIT/SITW - These abbreviations are used for the “state tax withholding.”

What do you see on a pay stub?

But, when you are trying to decipher it all, it can look pretty intimidating. On your pay stub, you’ll see some common payroll abbreviations and some that aren’t so common.

What information does an employer include on a payslip?

Your employer might include extra information on your payslip which they don’t have to provide. For example, your: tax code. National Insurance number. pay rate (annual or hourly) extra payments, such as overtime, tips or bonuses. These must be included in your gross pay figure. Back to top.

Why do employers put space on payslips?

Some employers use a space on the payslip for important messages . These might give you extra information about your pay or other information they want to share .

What is an emergency tax code?

Sometimes your tax code isn’t right for your circumstances and you might be given an emergency code.

What information must be on a payslip?

What information your payslip must contain. Remember to check your payslip regularly and that it shows the same tax code as your latest tax code notice. Your payslip must show the information below. Gross pay. Your full pay before any tax or National Insurance has been taken off.

How to make sure you are on the right tax code?

To make sure you’re on the right tax code, check your code matches the Personal Allowance you should be getting

How long is sick pay on a payslip?

Your employer is liable to pay you Statutory Sick Pay if you’re off work sick for four days or more in a row, and you meet certain conditions.

Why do companies use payroll numbers?

Some companies use payroll numbers to identify individuals on the payroll.

What does L mean on a payslip?

According to HMRC, this essentially means that you are entitled to the basic personal allowance and your income tax will be deducted at the basic, higher or additional rates, depending on exactly how much you earn.

What is tax code on payslip?

All employees will have a tax code on their payslips. This is given to you by the taxman, HM Revenue & Customs (HMRC), and outlines how much tax you should be paying. There will be a number and then a letter. The number points towards what your personal allowance is.

What is your tax code?

All employees will have a tax code on their payslips. This is given to you by the taxman, HM Revenue & Customs (HMRC), and outlines how much tax you should be paying.

What is the number on a tax letter?

There will be a number and then a letter. The number points towards what your personal allowance is. This is how much you can earn before having to pay any income tax.

What happens if you receive additional income from your employer?

So for example, if you receive some form of additional income from your employer on top of your main salary - for example a company car - that needs to be taken into account, and will be deducted from your personal allowance. If those deductions are worth more than your personal allowance, then you'll be given a K code.

How many different codes are there for additional jobs?

There are three different codes used to cover additional jobs (or pensions).

What does BR mean in tax?

BR means that all of your income from this job will be taxed at the basic rate, D0 means that all of the income will be taxed at the higher rate and D1 means it will be taxed at the additional rate of income tax. The danger here is that if you see a D, when it's not your second job, you could well be losing more than £2,000 a year ...

What is the best interactive tool to help you understand more about your payslip?

For a great interactive tool to help you understand more about your payslip we recommend you check out the CIPP payslip template

What does TD mean on a payslip?

TD or YTD (i.e. Tax TD) - This means "To Date" or "Year To Date". As well as showing earnings and deductions for that specific pay period, your payslip should also show you a combined total for that tax year to date.

What is an ERN number?

Employers PAYE Reference / ERN - An ERN is given to every business that registers with HM Revenue and Customs as an employer. You may need this number when applying for tax credits, applying for Student Loans, or a range of other tasks, so your employer will sometimes put it on your payslip.

What is an employee number?

Employee number - This is given to you by your employer and serves as a unique identifier for you while you work there. When you have a payroll query, you may need to quote this number. You won't keep this number if you move company, and it’s worth noting that not all employers will issue one.

What is gross pay?

Gross Pay - This is the total amount that you have earned, before deductions have been applied. It may include earnings for overtime, bonuses, shift work, and holiday pay, etc.

What is tax code?

Tax code - This tells your employer how they should apply tax on your earnings. Your tax code is given to your employer by HMRC and will usually change each financial year. Again, this should appear on every payslip.