What is a fixed ratio?

Fixed Ratio Schedule. Ratio schedules involve reinforcement after a certain number of responses have been emitted. The fixed ratio schedule involves using a constant number of responses. For example, if the rabbit is reinforced every time it pulls the lever exactly five times, it would be reinforced on an FR 5 schedule ...

What is example of fixed ratio?

An example of a fixed-ratio schedule would be a child being given a candy for every 3-10 pages of a book they read. For example, they are given a candy after reading 5 pages, then 3 pages, then 7 pages, then 8 pages, etc.

What does fixed ratio mean in psychology?

In operant conditioning, a fixed-ratio schedule is a schedule of reinforcement where a response is reinforced only after a specified number of responses. Essentially, the subject provides a set number of responses, then the trainer offers a reward.

What does fixed interval mean?

A Fixed Interval Schedule provides a reward at consistent times. Forexample a child may be rewarded once a week if their room is cleaned up. Aproblem with this type of reinforcement schedule is that individuals tend to wait until the time when reinforcement will occur and thenbegin their responses (Nye, 1992).

What is the difference between fixed and variable ratio?

The variable ratio schedule is unpredictable and yields high and steady response rates, with little if any pause after reinforcement (e.g., gambler). A fixed ratio schedule is predictable and produces a high response rate, with a short pause after reinforcement (e.g., eyeglass saleswoman).

Which is the best example of a fixed ratio schedule?

Fixed-Ratio Schedules This schedule produces a high, steady rate of responding with only a brief pause after the delivery of the reinforcer. An example of a fixed-ratio schedule would be delivering a food pellet to a rat after it presses a bar five times.

WHAT DOES IT MEAN TO ratio someone in real life?

On the social media platform Twitter, a ratio, or getting ratioed, is when replies to a tweet vastly outnumber likes or retweets. This means people are objecting to the tweet and considering its content bad.

What does ratio mean in real life?

Ratios allow us to measure and express quantities by making them easier to understand. Examples of ratios in life: The car was traveling 60 miles per hour, or 60 miles in 1 hour. You have a 1 in 28,000,000 chance of winning the lottery.

What is a ratio relationship example?

1 Understand the concept of a ratio and use ratio language to describe a ratio relationship between two quantities. For example, “The ratio of wings to beaks in the bird house at the zoo was 2:1, because for every 2 wings there was 1 beak.” “For every vote candidate A received, candidate C received nearly three votes.”

What is the difference between a fixed ratio and a fixed interval?

0:132:11Learning: Schedules of Reinforcement - YouTubeYouTubeStart of suggested clipEnd of suggested clipStart with fixed interval fixed interval requires that you wait a specified period of time afterMoreStart with fixed interval fixed interval requires that you wait a specified period of time after completing the correct response. Before you'll be reinforced an example of fixed interval is used by

Why is variable ratio the best?

In variable ratio schedules, the individual does not know how many responses he needs to engage in before receiving reinforcement; therefore, he will continue to engage in the target behavior, which creates highly stable rates and makes the behavior highly resistant to extinction.

What is a variable ratio?

In operant conditioning, a variable-ratio schedule is a partial schedule of reinforcement in which a response is reinforced after an unpredictable number of responses. 1 This schedule creates a steady, high rate of response. Gambling and lottery games are good examples of a reward based on a variable-ratio schedule.

What are some examples of a fixed interval schedule?

A fixed interval is a set amount of time between occurrences of something like a reward, result, or review. Some examples of a fixed interval schedule are a monthly review at work, a teacher giving a reward for good behavior each class, and a weekly paycheck.

What is an example of variable ratio?

Examples of ratio variables include: enzyme activity, dose amount, reaction rate, flow rate, concentration, pulse, weight, length, temperature in Kelvin (0.0 Kelvin really does mean “no heat”), survival time.

Is gambling an example of fixed ratio schedule?

In a variable ratio reinforcement schedule , the number of responses needed for a reward varies. This is the most powerful partial reinforcement schedule. An example of the variable ratio reinforcement schedule is gambling.

What is a good fixed cost ratio?

What's a Good Fixed Charge Coverage Ratio? As we mentioned above, a good fixed charge coverage ratio is equal to or greater than 1.25:1. A ratio that is 1:1 or lower is concerning, as it means your business is not making enough money to cover your fixed charges or is just scraping by.

What is fixed ratio punishment?

Fixed ratio punishment is used to limit a certain behavior using fixed ratio reinforcement schedules. For example, if a child fails 3 homework assi...

What is an example of a fixed ratio schedule?

An employee is trying to learn a new task, so their employer tells them that every time they successfully complete the task 3 times, the employer w...

What is a fixed ratio?

A fixed ratio is the number of times an action must be done in order to receive an award. For example, a child must do five chores before receiving...

What are fixed ratio schedules best used for?

Fixed ratio schedules are used in several ways. Some include increasing worker outputs and teaching someone a new skill or task.

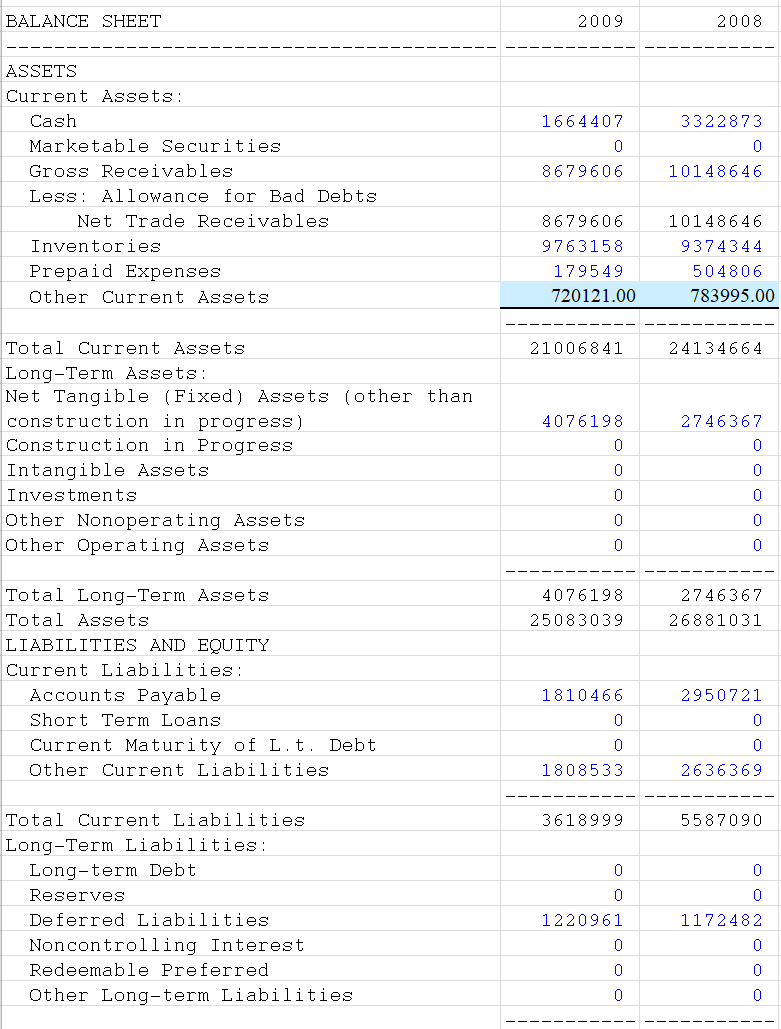

How to find fixed assets ratio?

Fixed Assets ratio is a type of solvency ratio (long-term solvency) which is found by dividing total fixed assets (net) of a company with its long-term funds. It shows the amount of fixed assets being financed by each unit of long-term funds.

What does a low ratio mean?

Low – Ratio of less than 1 indicates long-term funds of the company are more than its net fixed assets It is desirable to some extent as it means that a company has sufficient long-term funds to cover its fixed assets.

What does a high ratio of more than 1 mean?

High – Ratio of more than 1 indicates net fixed assets of the company are more than its long-term funds which demonstrates that the company has bought some of its fixed assets with the help of short-term funds. This depicts operational inefficiency.

What Does the Fixed-Charge Coverage Ratio Tell You?

The fixed-charge ratio is used by lenders looking to analyze the amount of cash flow a company has available for debt repayment. A low ratio often reveals a lack of ability to make payments on fixed charges, a scenario lenders try to avoid since it increases the risk that they will not be paid back.

Why is the earnings ratio higher than the fixed costs?

That's because the company would only be able to pay the fixed charges twice with the earnings it has, increasing the risk that it cannot make future payments. The higher this ratio is, the better.

What does a high FCCR mean?

A high FCCR ratio result indicates that a company can adequately cover fixed charges based on its current earnings alone. 1:46.

Why do lenders use fixed charge coverage?

Lenders often use the fixed-charge coverage ratio to assess a company's overall creditworthiness.

Is FCCR better than TIE?

Like the TIE, the higher the FCCR ratio, the better.

Is a variable cost fixed?

As sales increase, so do the variable costs. Other costs are fixed and must be paid regardless of whether or not the business has activity.

What is fixed asset turnover ratio?

A higher fixed asset turnover ratio indicates that a company has effectively used investments in fixed assets to generate sales.

Why is the ratio used?

The ratio is commonly used as a metric in manufacturing industries that make substantial purchases of PP&E in order to increase output. When a company makes such significant purchases, wise investors closely monitor this ratio in subsequent years to see if the company's new fixed assets reward it with increased sales.

Why do companies with strong asset turnover ratios lose money?

Companies with strong asset turnover ratios can still lose money because the amount of sales generated by fixed assets speak nothing of the company's ability to generate solid profits or healthy cash flow.

What does a high FAT ratio mean?

A higher ratio implies that management is using its fixed assets more effectively. A high FAT ratio does not tell anything about a company's ability to generate solid profits or cash flows. 1:27.

What is the FAT ratio?

The FAT ratio, calculated annually, is constructed to reflect how efficiently a company, or more specifically, the company’s management team, has used these substantial assets to generate revenue for the firm.

Why is turnover ratio important?

For this reason, it is important for analysts and investors to compare a company’s most recent ratio to both its own historical ratios and ratio values from peer companies and/or average ratios for the company's industry as a whole .

What Is Operant Conditioning?

On some farms, workers are paid a certain amount of dollars for every basket they fill with fruit, vegetables, or flowers. If a farmworker fills one basket, they receive $20. If they fill ten baskets, that number jumps to $200. Every day, they leave with some amount of money - but that amount depends on how much work they did.

What is Fixed Ratio Reinforcement?

Fixed-ratio reinforcement is a schedule in which reinforcement is given out to a subject after a set number of responses. The “subject” is the person who is performing the behavior. Reinforcement may not be positive; they’re something added to a situation that encourages the subject to perform a behavior.

Examples of Fixed Ratio Reinforcement

Think back to the two examples I shared earlier. Which version of paying farmworkers is an example of a fixed-ratio reinforcement schedule? If you guessed the first example, where workers are paid per basket, you’re right! The response that employers are encouraging is picking fruits.

Other Schedules of Reinforcement

As you were listening to that last example, you might find yourself thinking of an alternative way to reinforce your behavior. You might put yourself on a different schedule: for example, if you packed your lunch three times that week, you get the big chocolate bar on Friday.

Does Fixed Ratio Reinforcement Work?

How does fixed ratio reinforcement stack up to other types of reinforcement? Psychologists have found that although this schedule does encourage behaviors, there is a lag in motivation once the reinforcement is distributed. Think about it this way.

What Is The Fixed-Charge Coverage Ratio?

- The fixed-charge coverage ratio (FCCR) measures a firm's ability to cover its fixed charges, such as debt payments, interest expense, and equipment lease expense. It shows how well a company's earnings can cover its fixed expenses. Banks will often look at this ratio when evaluating whether to lend money to a business.

The Formula For The Fixed-Charge Coverage Ratio Is

- FCCR=EBIT+FCBTFCBT+iwhere:EBIT=earnings before interest and taxesFCBT=fixed charges be…

How to Calculate The Fixed-Charge Coverage Ratio

- The calculation for determining a company's ability to cover its fixed charges starts with earnings before interest and taxes(EBIT) from the company's income statement and then adds back interest expense, lease expense, and other fixed charges. Next, the adjusted EBIT is divided by the amount of fixed charges plus interest. A ratio result of 1.5, for example, shows that a company c…

What Does The Fixed-Charge Coverage Ratio Tell You?

- The fixed-charge ratio is used by lenders looking to analyze the amount of cash flow a company has available for debt repayment. A low ratio often reveals a lack of ability to make payments on fixed charges, a scenario lenders try to avoid since it increases the risk that they will not be paid back. To avoid this risk, many lenders use coverage ratios, including the times-interest-earned ra…

Example of The Fixed-Charge Coverage Ratio in Use

- The goal of computing the fixed-charge coverage ratio is to see how well earnings can cover fixed charges. This ratio is a lot like the TIE ratio, but it is a more conservative measure, taking additional fixed charges, including lease expenses, into consideration. The fixed-charge coverage ratio is slightly different from the TIE, though the same interpretation can be applied. The fixed-c…

Limitations of The Fixed-Charge Coverage Ratio

- The FCCR doesn't consider rapid changes in the amount of capital for new and growing companies. The formula also doesn't consider the effects of funds taken out of earnings to pay an owner's draw or pay dividends to investors. These events affect the ratio inputs and can give a misleading conclusion unless other metrics are also considered. For this reason, when banks ev…

What Is the Fixed Asset Turnover Ratio?

- The fixed asset turnover ratio (FAT) is, in general, used by analysts to measure operating perfor…

The fixed asset balance is used as a net of accumulated depreciation. A higher fixed asset turnover ratio indicates that a company has effectively used investments in fixed assets to generate sales. - The fixed asset turnover ratio reveals how efficient a company is at generating sales from its exi…

A higher ratio implies that management is using its fixed assets more effectively.

Understanding the Fixed Asset Turnover Ratio

- \begin {aligned} &\text {FAT} = \frac { \text {Net Sales} } { \text {Average Fixed Assets} } \\ &\text…

The ratio is commonly used as a metric in manufacturing industries that make substantial purchases of PP&E in order to increase output. When a company makes such significant purchases, wise investors closely monitor this ratio in subsequent years to see if the company's …

Interpreting the Fixed Asset Turnover Ratio

- A higher turnover ratio is indicative of greater efficiency in managing fixed-asset investments, bu…

Though the FAT ratio is of significant importance in certain industries, an investor or analyst must determine whether the company under study is in the appropriate sector or industry for the ratio to be calculated before attaching much weight to it.

Difference Between the Fixed Asset Turnover Ratio and the Asset Turnover Ratio

- The asset turnover ratio uses total assets instead of focusing only on fixed assets as done in the FAT ratio. Using total assets acts as an indicator of a number of management’s decisions on capital expenditures and other assets.

Limitations of Using the Fixed Asset Ratio

- Companies with cyclical sales may have worse ratios in slow periods, so the ratio should be loo…

Companies with strong asset turnover ratios can still lose money because the amount of sales generated by fixed assets speak nothing of the company's ability to generate solid profits or healthy cash flow.