What is the true rate of inflation?

The TRUE inflation rate is ~13%, if using the Bureau for Labor Statistics’ original calculation method. – Investment Watch The TRUE inflation rate is ~13%, if using the Bureau for Labor Statistics’ original calculation method.

What country has the highest inflation rate?

Only Sudan, Ethiopia and Angola with 155%, 43%, and 38% year-on-year food inflation rates respectively had the higher rates than East Africa’s largest economy between February last year and February 2022.

What is a normal or healthy rate of inflation?

What is an acceptable level of inflation? The Federal Reserve has not established a formal inflation target, but policymakers generally believe that an acceptable inflation rate is around 2 percent or a bit below.

What is the average percentage of inflation per year?

The annual inflation rate for the United States is 5.3% for the 12 months ended August 2021, following two straight 5.4% increases, according to U.S. Labor Department data published September 14. The next inflation update is scheduled for release on October 13 at 8:30 a.m. ET.

What does 5% inflation mean?

An inflation rate of 5% per year means that if your shopping costs you $100 today, it would have cost you about only $95 a year ago. If inflation stays at 5%, the same basket of shopping will cost you $105 in a year's time. If inflation stays at 5% for ten years, this same shopping will cost you $163.

What is a good inflation rate percentage?

around 2 percentThe Federal Reserve has not established a formal inflation target, but policymakers generally believe that an acceptable inflation rate is around 2 percent or a bit below.

Is 3% a good inflation rate?

If inflation is greater than 2%, it becomes dangerous. Walking inflation is when prices rise between 3% to 10% in a year. It can drive too much economic growth. At that level, inflation robs you of your hard-earned dollars.

What does it mean if inflation is 2%?

A common calculation is the percentage change from a year ago. For instance, if a price index is 2 percent higher than a year ago, that would indicate an inflation rate of 2 percent. One index that economists and policymakers like to look at is the price index for personal consumption expenditures (PCE).

What is the real inflation rate in 2022?

US Inflation Rate Below Forecasts at 8.5% The annual inflation rate in the US slowed more than expected to 8.5% in July of 2022 from an over 40-year high of 9.1% hit in June, and below market forecasts of 8.7%.

Who benefits from inflation?

1. Anybody on a Fixed Salary or Fixed Income.

Who wins from inflation?

Inflation allows borrowers to pay lenders back with money worth less than when it was originally borrowed, which benefits borrowers. When inflation causes higher prices, the demand for credit increases, raising interest rates, which benefits lenders.

What is causing inflation right now?

What causes inflation? It can be the result of rising consumer demand. But inflation can also rise and fall based on developments that have little to do with economic conditions, such as limited oil production and supply chain problems.

What is US inflation rate now?

The annual inflation rate for the United States is 8.5% for the 12 months ended July 2022 after rising 9.1% previously — the most since November 1981, according to U.S. Labor Department data published Aug. 10.

Is zero percent inflation a good thing?

Therefore, zero inflation would involve large real costs to the American economy. The reason that zero inflation creates such large costs to the economy is that firms are reluctant to cut wages. In both good times and bad, some firms and industries do better than others.

How does inflation rate affect me?

Over the long term, inflation erodes the purchasing power of your income and wealth. This means that even as you save and invest, your accumulated wealth buys less and less, just with the mere passage of time. And those who put off saving and investing impacted even more.

What happens if inflation rate is high?

If inflation stays elevated for too long, it can lead to something economists call hyperinflation. This is when expectations that prices will be keep rising fuels more inflation, which reduces the real value of every dollar in your pocket.

What is the inflation rate for the last 10 years?

Value of $1 from 2010 to 2022 The dollar had an average inflation rate of 2.59% per year between 2010 and today, producing a cumulative price increase of 35.87%. This means that today's prices are 1.36 times higher than average prices since 2010, according to the Bureau of Labor Statistics consumer price index.

What is high inflation rate?

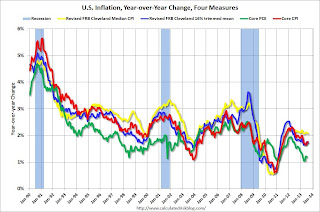

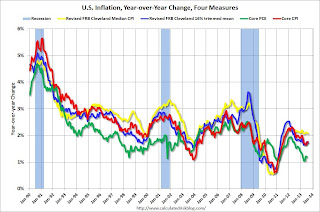

Year-over-year inflation rates give a clearer picture of price changes than annual average inflation. The Federal Reserve uses monetary policy to achieve its target rate of 2% inflation. In 2022 in the wake of the COVID-19 pandemic, inflation reached 8.5%, its highest rate since 1982.

Why does inflation happen?

As a floating currency is becomes more abundant, it’s value starts to decline. This makes sense because it isn’t as scarce as it once was.

What is devaluation in the CPI?

This is devaluation is evident in the fact that the consumer price index (CPI) increases during this period. In other words, it’s a rate at which the currency is being devalued causing the general prices of consumer goods it increase relative to change in currency value.

What is inflation in economics?

Inflation is the rate at which the value of a currency is falling and, consequently, the general level of prices for goods and services is rising. Inflation is sometimes classified into three types: Demand-Pull inflation, Cost-Push inflation, and Built-In inflation. The most commonly used inflation indexes are the Consumer Price Index (CPI) ...

What Causes Inflation?

There are three main causes of inflation: demand-pull inflation, cost-push inflation, and built-in inflation. Demand-pul l inflation refers to situations where there are not enough products or services being produced to keep up with demand, causing their prices to increase.

What is the rate at which the value of a currency is falling?

Inflation is the rate at which the value of a currency is falling and, consequently, the general level of prices for goods and services is rising.

What is the most commonly used inflation index?

The most commonly used inflation indexes are the Consumer Price Index (CPI) and the Wholesale Price Index (WPI).

Why does the Federal Reserve have long term inflation goals?

The Federal Reserve clearly communicates long-term inflation goals in order to keep a steady long-term rate of inflation, which is thought to be beneficial to the economy . Price stability—or a relatively constant level of inflation—allows businesses to plan for the future since they know what to expect.

Why is inflation optimum?

An optimum level of inflation is often promoted to encourage spending to a certain extent instead of saving. If the purchasing power of money falls over time, then there may be a greater incentive to spend now instead of saving and spending later.

How does the expansion of the money supply affect the price of oil?

For instance, when the expansion of the money supply creates a speculative boom in oil prices the cost of energy of all sorts of uses can rise and contribute to rising consumer prices, which is reflected in various measures of inflation.

A driver destroyed my parked car and their insurance has been giving the runaround for weeks - what do I do?

A driver destroyed my parked car and their insurance has been giving the runaround for weeks - what do I do?

Wife got new job, new company's independence clause is making me sell some of my stocks, anyway to get around this?

As the title states, she got a new job with a rather large company that has an independence clause requiring us to divest in certain stocks that are on a restricted list.

Mortgage payment surprise!

I just got off the phone with our mortgage company regarding an almost $200 increase to our monthly mortgage cost. My husband and I are set up for automatic payments, so I normally just let the system do it’s thing.

Wells Fargo denied my fraud claim, my life savings are gone, what can I do?

I got a letter from Wells Fargo last week saying that they've denied my fraud claim and I don't know what to do.

Using Emergency Fund

Hi All! I live with my girlfriend and we are financially stable had a nice emergency fund built up. We just had to spend $780 to fix my car and probably about the same to fix my girlfriend's car this week. There is still income coming in.

I got a job offer and I need to know if they are low balling me or if I am delusional

Quick back story on me I am a graduate of the Culinary Institute of America,I worked in NYC for years, and I even studied and worked abroad in some of the best restaurants. I am a level three sommelier, and I even teach classes now. I also have competed nationally and internationally in cooking and cocktail competitions.

What does 2.5% inflation mean?

For example, a 2.5% inflation rate means that something that cost $100 last year now costs $102.50. It also means that you need a 2.5% raise just to stay even.

What Is the Inflation Target?

The core inflation rate —which excludes the impact of volatile oil and food prices and is often tracked on a year-over-year basis—was up by 6% annually and 0.6% in January. That is higher than the 2% target that the Federal Reserve says is needed to maintain a healthy economy, but it is in line with the current monetary policy target of reaching an average of 2% inflation over time.

When does cost-push inflation occur?

Cost-push inflation occurs when supplier costs increase. If commodity costs or wages rise, then suppliers pass those cost increases on to customers, which increases prices throughout the economy. Cost-push is one of the two primary types of inflation alongside demand-pull. Demand-pull inflation occurs when consumer demand increases, like when strong economic performance encourages consumers to spend money rather than save.

What is the inflation rate for 2021?

The U.S. inflation rate as of May 2021 was 5.0% compared to a year earlier. That means consumer prices increased by more than 5% over the course of a year—the sharpest such increase since August 2008. The inflation rate is an important economic indicator, because it tells you how quickly prices are changing. It's measured by the Consumer Price ...

Why is deflation worse than inflation?

Deflation is worse than inflation, because it signals falling demand. As long as businesses and people feel less wealthy, they spend less, reducing demand further. They don't care if interest rates are 0%, because they aren't borrowing anyway. There's too much liquidity, but it does no good.

Why is inflation important?

The inflation rate is an important economic indicator, because it tells you how quickly prices are changing. It's measured by the Consumer Price Index (CPI), which is reported by the Bureau of Labor Statistics (BLS) each month. 1. The increase was driven by a 7.3% increase in the price of used cars and trucks.

What happens to the economy during a recession?

With a recession come declining wages, job losses, and big hits to most investment portfolios. As a recession worsens, so does deflation. Businesses offer ever-lower prices in desperate attempts to get consumers to buy their products and services. The Federal Reserve combats deflation with expansionary monetary policy.